Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

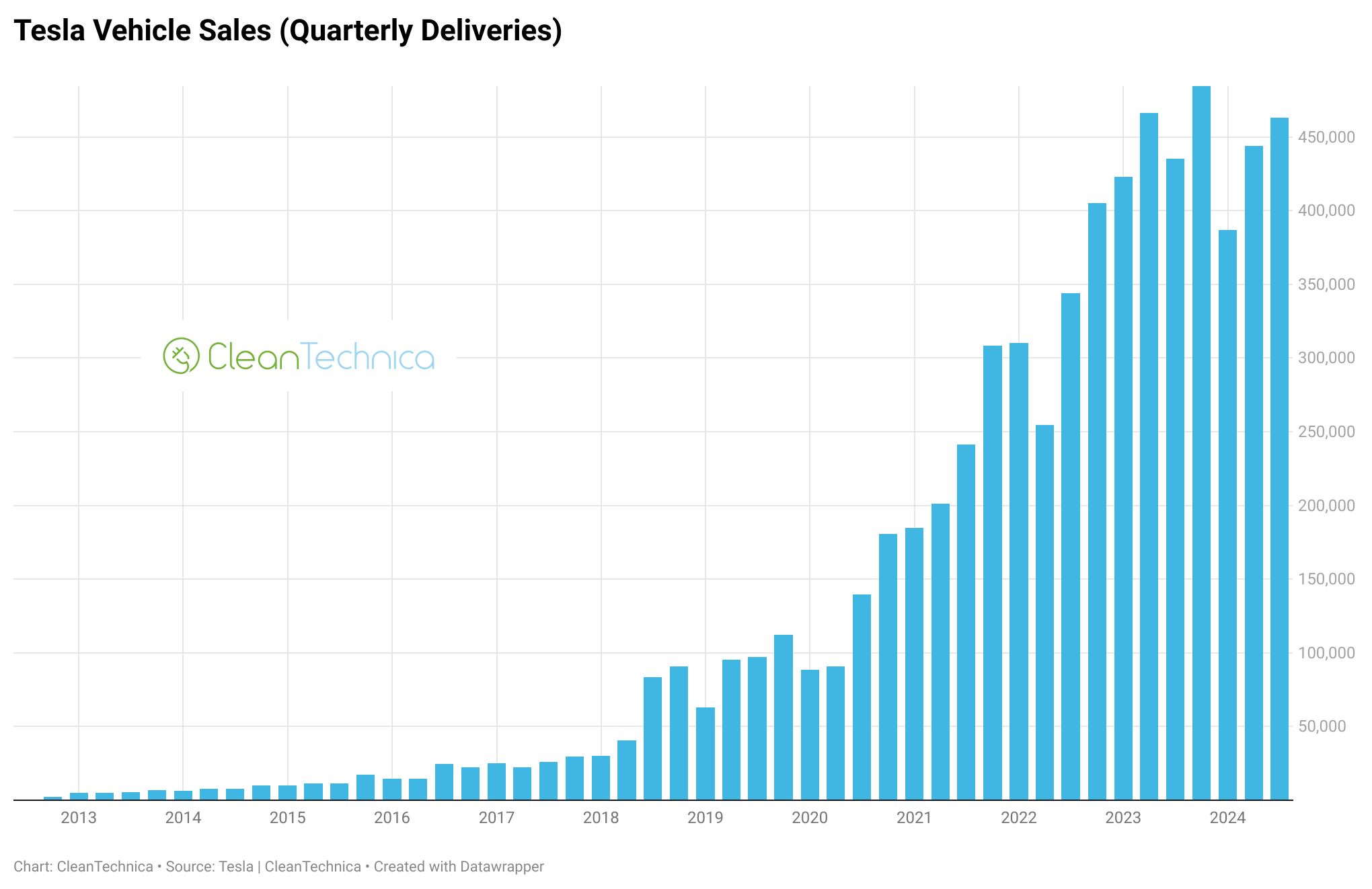

Tesla has released its 3rd quarter production and delivery (aka sales) numbers. On the back of two straight quarters of dropping sales (year over year), there was much anticipation to see how much Tesla could bounce back and see sales growth in the third quarter. The result: Tesla deliveries in Q3 2024 totaled 462,890, a 6.4% increase over the 435,059 deliveries of Q3 2023.

Going back to the 1st quarter and 2nd quarter, Tesla’s year-over-year sales drops were 8.5% and 4.8%. So, this 3rd quarter bounce got things back on track, but the company will still need a strong 4th quarter in order to log sales growth in 2024 — which CEO Elon Musk said earlier this year would be the case. Will it achieve that to prove Musk right, or will Tesla have its first full year-over-year drop in sales in its history? We’ll discuss that further as we get closer and get a better sense of what will happen in the 4th quarter.

Aside from overall sales, there are some other narratives to pull out.

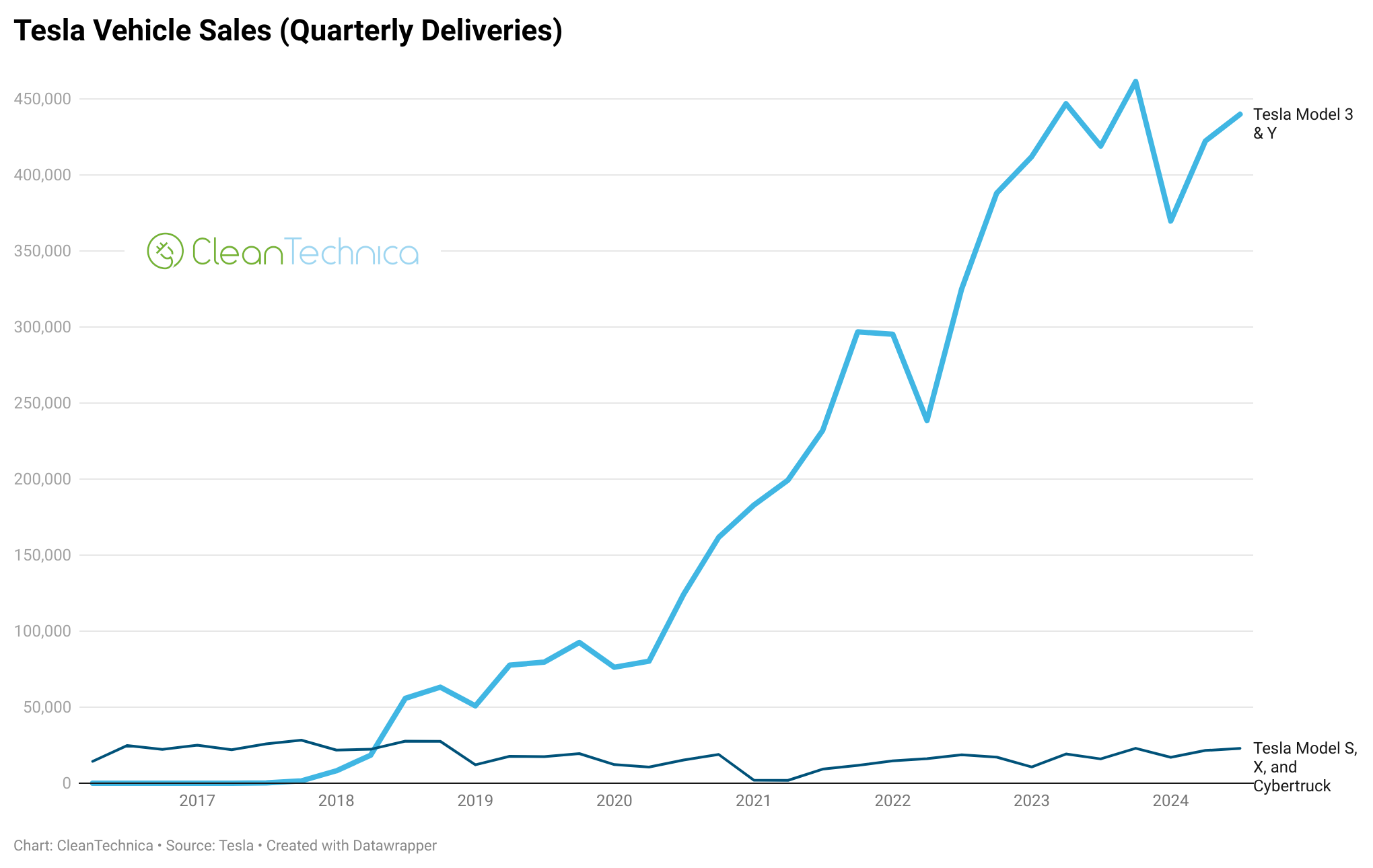

Looking at the big dogs — the Model 3 and Model Y — their sales grew 4.99%. Yes, I could have just said 5%, but the 4.99% jumped out to me as a kind of popular interest rate figure or whatnot and made me chuckle. The more important point here, though, is that the Model 3 and Model Y grew less than Tesla sales overall. But, if you really think about it, it’s a little surprising this figure was as high as it was, because …

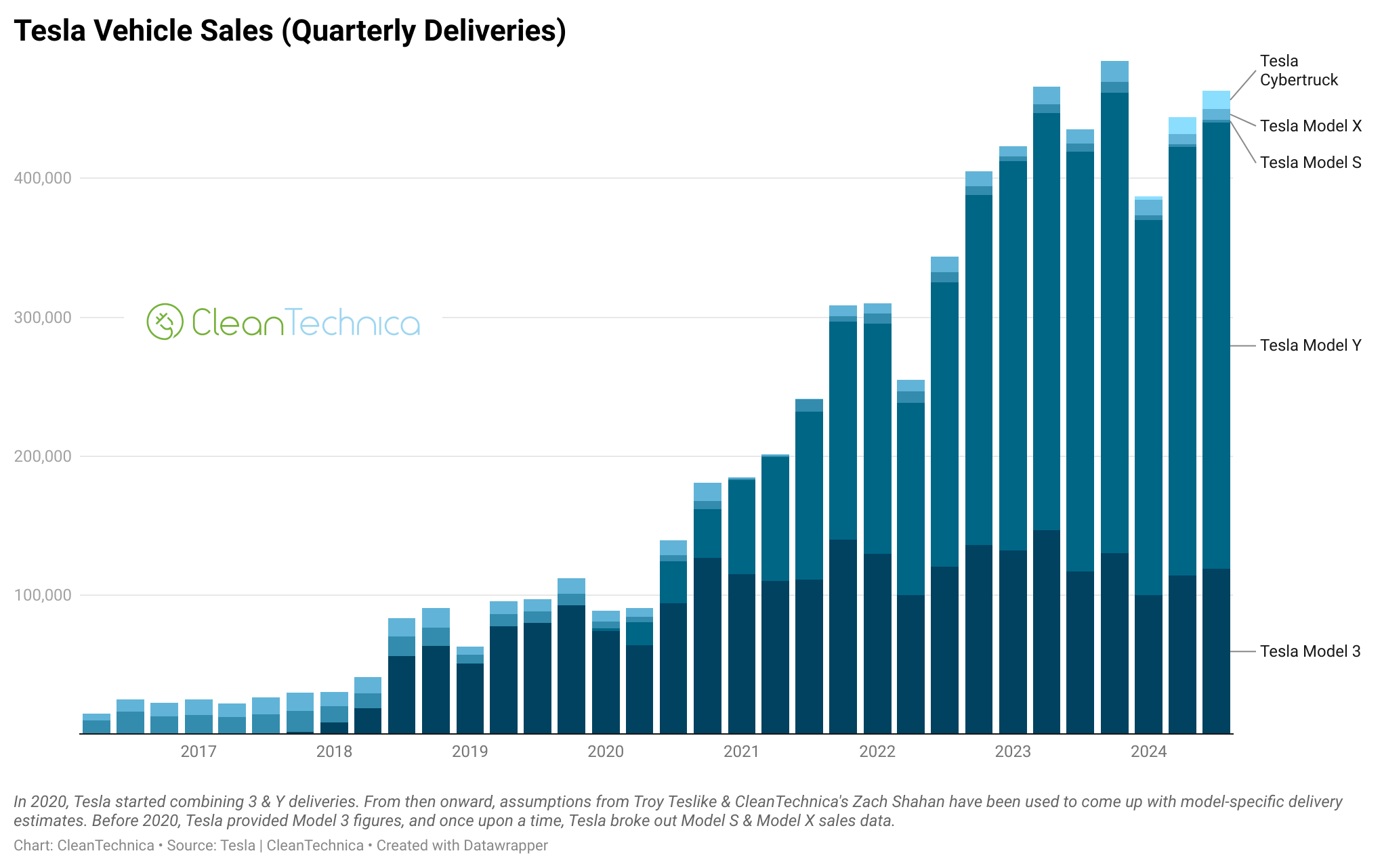

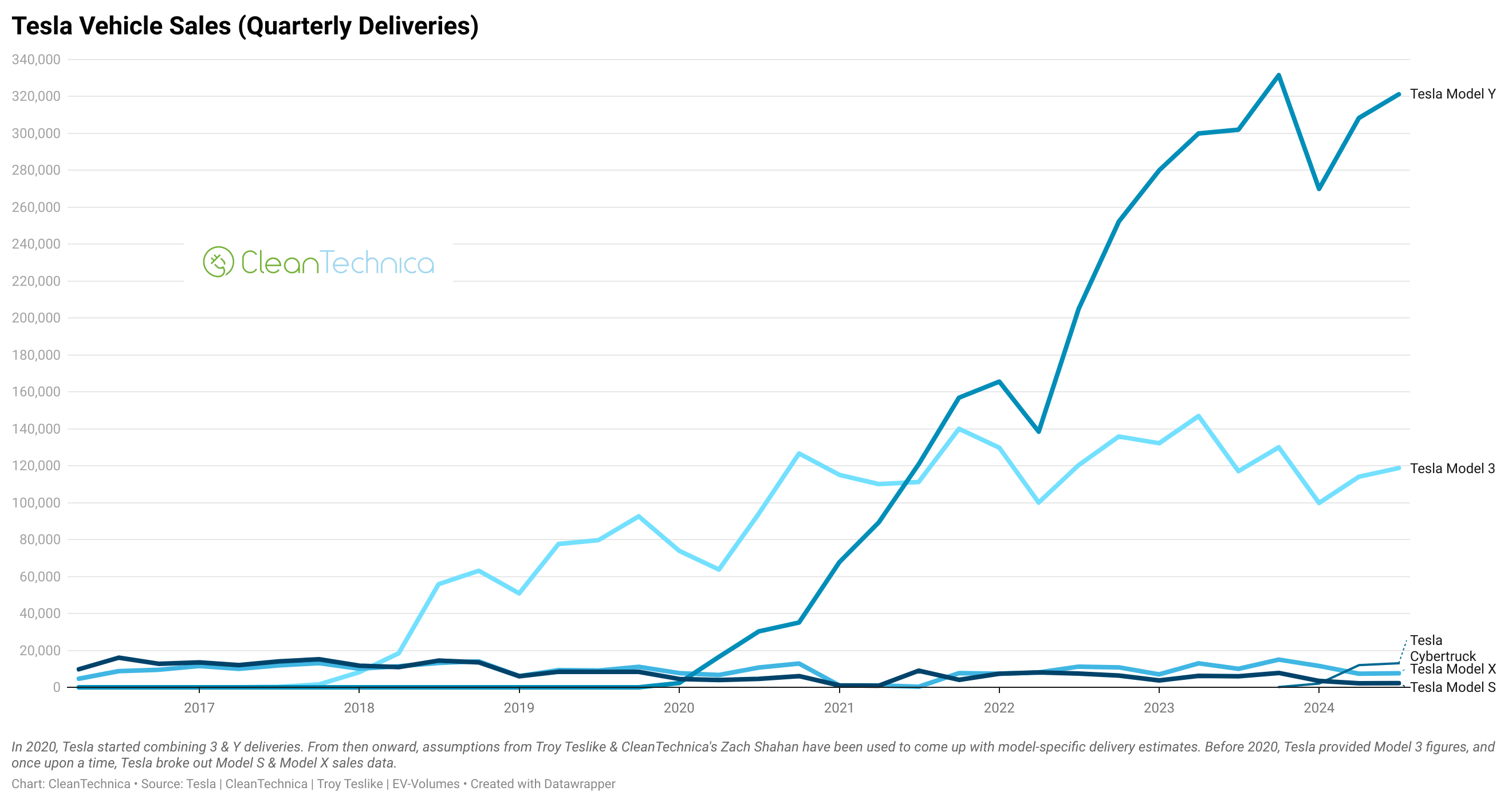

That means the Tesla Cybertruck didn’t ramp up as much as many probably expected it would (and many others didn’t). Tesla doesn’t report Cybertruck sales separately, but lumped in with the Model S and Model X, those three “large Tesla” models had just 22,915 deliveries. Yes, that’s 43.35% growth for the “large Tesla” group since Q3 2023, but it’s really not a significant number for the Cybertruck even if 22,000 of those deliveries were Cybertrucks (which is obviously not the case). For comparison, 21,551 Cybertrucks plus Model Ss plus Model Xs were delivered in the second quarter. So, there was almost no difference from Q2 to Q3. That seems concerning to me. Though, it also means there’s more potential in coming quarters if Tesla can ramp up Cybertruck production and deliveries, and it means Model 3 and Model Y sales were, at least, still up 5%.

Those are the official numbers. In order to try to look at the trends in more detail, I’ve done my usual split of the model groups based on a variety of historical data and trends, including numbers from specific markets like China, Europe, and the US. The following are a chart, a graph, and a brief discussion taking those estimates into account. (Note: Interactive versions of the chart and graph are available on the bottom of the article, along with one more chart. Though, they may not display well on some phones — better to view on a computer.)

What this chart and graph emphasize to me, as usual, is just how big of a factor the Model Y and Model 3 are for the company. It’s all about those two models. If their sales drop, the company crashes, but at the moment, we’re basically seeing their sales plateau. They’re not growing like they used to, but they’re not crashing either. How long is this going to be the case?

Also, there’s potential for the Cybertruck to rise up and become a mass-market model. Or not. Maybe. We’ll see. At the moment, it is struggling to separate itself from Model S and Model X territory. But the key point is that it’s really hard to know just how much potential the model has. Will it remain down in that territory forever? Or can it compete with the country’s popular pickup trucks once the production ramp-up is complete?

Naturally, Tesla’s narrative is all about robotaxis, robotics, and AI these days. Some see it as a deflection from stagnating and even drooping sales. Others see it as a key area of the future where Tesla is leading and could live up to its massive market cap and hype. I can see both arguments, but I don’t know which is going to end up being more true. We’ll see. In the meantime, what I’m most eager to see in the rest of 2024 is how well Tesla can do in the 4th quarter. Can it really get its sales growth mojo back? Will it just keep cruising at about the same level? Or could its sales even slide down as people get bored with Tesla’s models, get turned off by Elon Musk’s political sideshow, or find other options they prefer?

From my perspective, 4th quarter sales can’t come soon enough! I’m super eager to find out how this abnormal year turns out for Tesla.

Here are interactive versions of all of the charts and graphs above, as well as one more chart where you can switch between models:

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Videos

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy