Tesla continues to be the best selling brand in Europe, but Volkswagen is recovering

Some 234,000 plugin vehicles were registered in July in Europe — which is +48% year over year (YoY), the market’s highest growth since August 2021. Unfortunately, the overall market also grew fast, +17%, as it is finally recovering from a couple of bad years.

Last month’s plugin vehicle share of the overall European auto market was 23% (15% full electrics/BEVs). That result kept the 2023 plugin vehicle share at 22% (15% for BEVs alone).

BEVs kept gaining momentum in July, growing 68% YoY, its biggest growth rate since February ’22. Meanwhile, PHEVs (+22%, their highest growth rate this year) also had a surprisingly positive result, which means that both technologies are accelerating their adoption rate.

With these two powertrains rising, others must come down, and one of them is diesel, which now has only 14% of the European passenger car market, a far cry from the 50% share it had in 2015 or the 55% average it experienced before that. At this rate, in this category, diesel will be dead by 2027, well before the 2035 ICE ban….

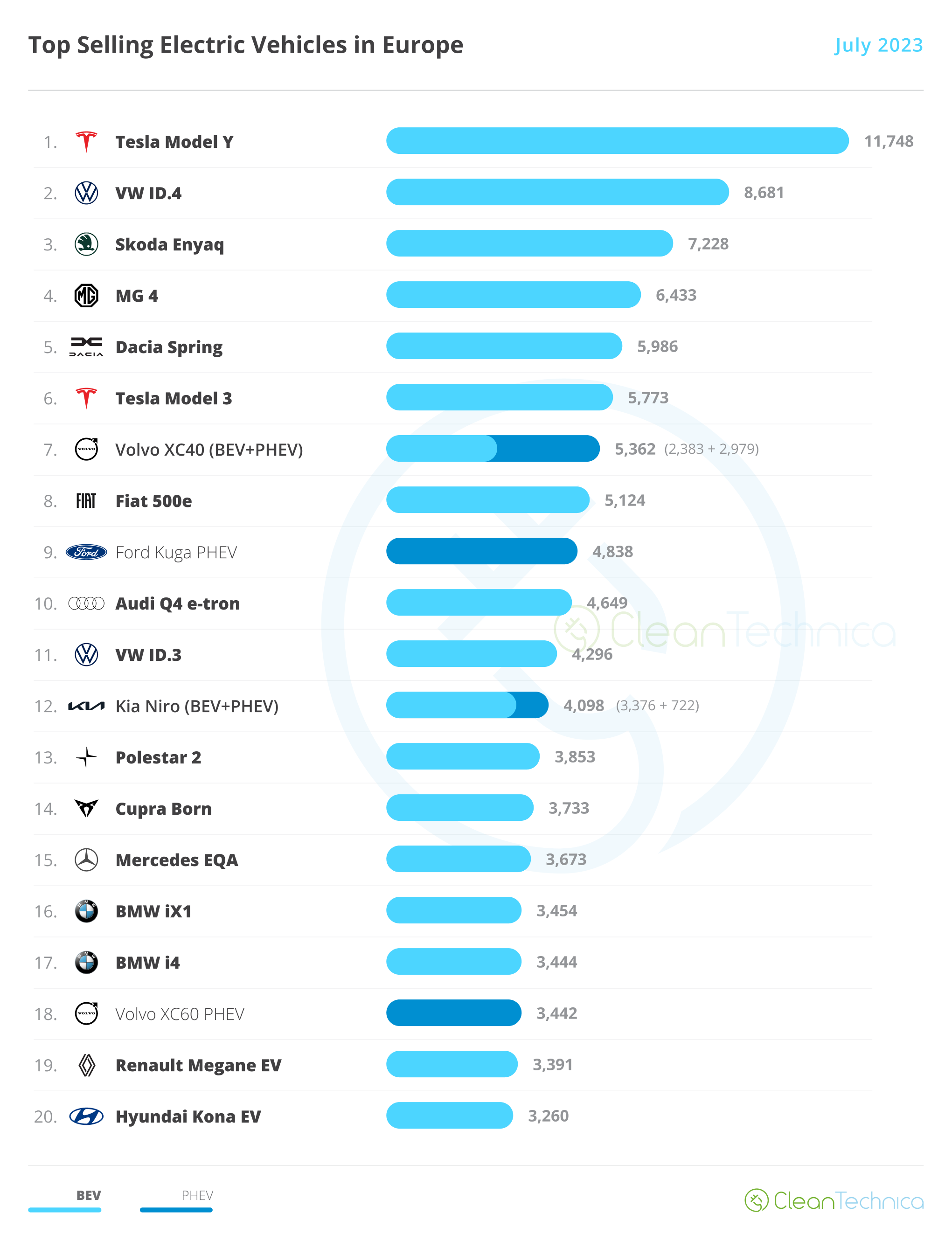

The highlight of the month was the Skoda Enyaq jumping into the 3rd spot. But let’s look closer at July’s plugin top 5:

#1 Tesla Model Y — For the 9th month in a row, Tesla’s crossover was the best selling EV in Europe. In July, the midsizer had 11,748 registrations. This year could be considered “Peak Model Y” in Europe. The midsized crossover should continue to post similar results in the coming quarters in Europe — but do not expect sales to increase significantly over current volumes, as I am confident the Model Y has already reached the market’s natural limits. Also limiting its growth will be the refreshed Tesla Model 3, which might steal some sales from it, even if Europeans aren’t really into sedans these days. Regarding last month’s performance, the Model Y’s biggest European markets included the UK (2,280 units), Germany (2,067 units), and France (1,631 units), with these countries being the ones posting four-digit results.

#2 VW ID.4 — The Volkswagen crossover won another podium position in July thanks to 8,681 registrations. With increased production availability, the ID.4 now has enough firepower to compete for the #2 spot in 2023, looking to improve on the #3 spot it scored last year. But, will the crossover get there? There have been rumors that demand is dropping, so even if VW now has enough production capability to go after the #2 Tesla Model 3, slow demand could prevent it from doing so. Regarding the ID.4’s July performance, its main market was its home market of Germany (2,941 registrations), followed at a distance by the UK (1,050 registrations), and Norway (975 units).

#3 Skoda Enyaq — The Czech crossover is a sure value in the EV arena, and although the VW ID.4 is now the MEB-platform biggest seller, the good looking crossover has managed to end July in a podium position, and with a record performance to boot. The model had 7,228 sales, an amazing performance for the Skoda EV, especially when we consider that July is a holiday month and most of its competitors are taking a vacation and enjoying some piña coladas…. With this in mind, expect sales to continue strong in the coming months, now that the production constraints seem to have (finally!) ended. Regarding the Enyaq’s July results, the distribution of deliveries between markets was pretty balanced, with the bigger market being Germany (1,896 units), followed by the Netherlands (742 units), Norway (724), and the UK (696)

#4 MG4 — The compact hatchback is fulfilling MG’s best expectations, proving right its dragon-slayer nickname and earning another top 5 presence in July thanks to 6,433 registrations. With original looks, good handling, and good enough interior materials, the Sino-British hatchback is sort of the electric Ford Focus that the US brand has refused to make. With Dearborn’s European arm now little more than an extension of the US marketing team (SUVs = Freedom & Americana), there is a hole in the B and C segments for mainstream hatchbacks with a focus on good handling and smart design. With the MG4 now filling the role of the electric Ford Focus, who will fill the role of the electric Ford Fiesta? But I digress. Back to the MG4’s July performance. Its main markets were its adopted home market of the UK (1,850 registrations), Germany (1,193 registrations), and France (1,083 registrations), which incidentally are three big markets for hatchbacks. The remaining markets ended at some distance behind, with the 4th best score happening in Ireland, 565 units. This could mean that production is still not enough to satisfy demand and SAIC is still starving secondary markets.

#5 Dacia Spring — Although it didn’t reach record sales levels, the little Sino-Romanian had a positive month, allowing it to beat its Fiat 500e arch rival and win the city car category in July. With 5,986 sales, a new year best, the popular city car is currently Renault’s cash cow in the EV arena. The only Renault showing up on the table was the Megane EV, in #19, selling almost half of what the Dacia EV had. Looking at July’s performance, France (2,127 registrations) and Germany (1,818 registrations) were the biggest markets by far, followed at a distance by its home market of Romania (828 registrations).

Looking at the rest of the July table, the highlights are all in the second half of the table. The #15 spot of the Mercedes EQA was celebrated with a year-best performance from the German model, 3,673 registrations, ending the month above its arch rival, the BMW iX1, which was #16 with 3,454 registrations, again beating the i4 as the highest placed BMW on the table.

The second half of the table also witnessed record performances, like the BMW iX1 scoring its second record result in a row, this time 4,158 registrations. That put it in 16th.

It is interesting to see that the best selling models from the “Three Marys” (BMW, Mercedes, and Audi) are their compact crossovers (BMW iX1, Mercedes EQA, and Audi Q4 e-tron), which says a lot about current market trends. But it also says a lot about the black hole effect that Teslas are making in the midsize market, stealing sales left and right from the premium German automakers. Will this be just a phase, followed by a bounce back from the Three Marys in a few years, or have they lost their customer base for good? I guess the IAA might start providing some answers….

Below the top 20, we had several models with positive performances, like the VW ID.5 reaching 2,477 registrations. In the full size category, the Audi Q8 e-tron continued to remain in charge, thanks to July’s 2,523 registrations. There was also good news in the Hyundai–Kia stable, with the Hyundai Ioniq 5 (2,801 units) and Kia EV6 (3,240) helping their respective makes with solid results. The BYD Atto 3 (export spec BYD Yuan Plus) had its best score this year, 1,643 registrations. Has BYD finally started to deliver in European markets with relevant volumes?

Finally, in the Stellantis stable, despite weak results from its best sellers — the Fiat 500e was only 8th, while the Peugeot e-208 didn’t even make the top 20 — the Stellantis highlight this month came from Jeep, with the little Avenger EV scoring 1,455 deliveries in only its third month on the market. Expect for the Polish-made American model to start knocking at the door of the top 20 in a few months.

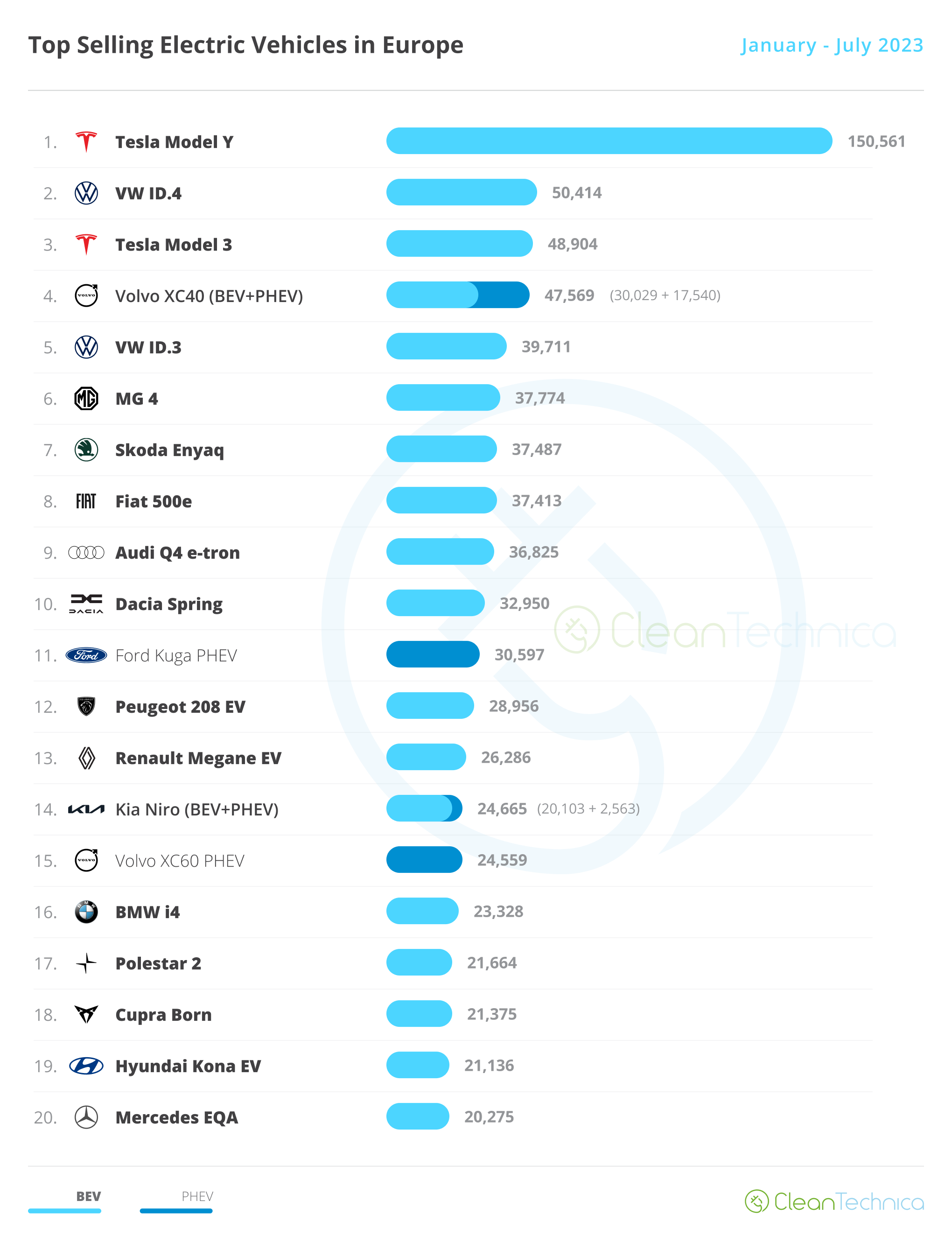

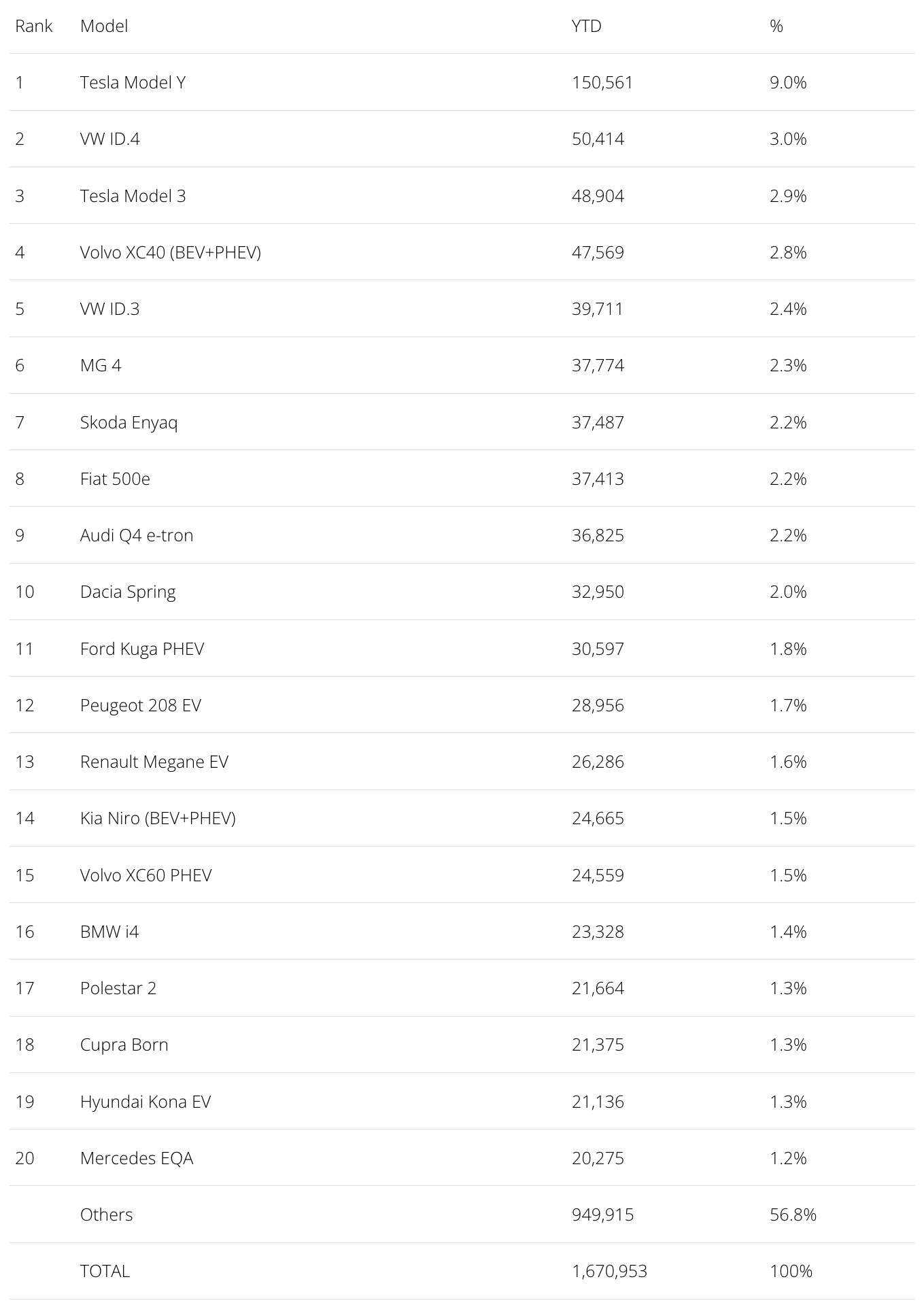

Looking at the 2023 ranking, with the Tesla Model Y having three times as many deliveries as the new runner-up VW ID.4, the attention is now focused on the remaining podium positions.

On that topic, the VW ID.4 jumped two positions in July, to 2nd place, removing the Model 3 from the silver medal spot. If the upcoming refresh of the Tesla sedan is as disruptive as rumors say it will be, namely price-wise, then the German crossover will have a hard time holding onto silver.

Speaking about the #4 Volvo XC40, it is probably already suffering from the comparison with Volvo’s newborn EX30, of which its 7th position in July could be an early sign of fatigue and future cannibalization.

Elsewhere, let’s look at the remaining position changes. The MG4 continues to climb up the table, having risen two positions in July to #6, immediately followed by another value-for-money champ, the Skoda Enyaq, which jumped from 9th in June to 7th now. (And what do you know — apparently there is a market for EVs that focus on value for money. Well, color me amazed!)

The Ford Kuga PHEV was up one position, to #11, while its direct competitor, the Kia Niro, also climbed up the table — in this case, to #14.

In the last positions of the table, the highlight is the rise of the Polestar 2, which was up to #17 and now has its sights set on the #16 BMW i4. So, not only us the i4 having its derrière kicked by the Tesla Model 3, but now it is seeing the Polestar 2 coming closer and closer. And let’s not forget that the Kia EV6 (#21) and Hyundai Ioniq 5 (#25) aren’t that far behind either….

(Well, at least BMW is trying, even if the i4 is just a placeholder model. Mercedes will only come to play next year — with the new CLA — while Audi is only bringing the A4 e-tron to market … in 2026.)

Still in the top 20, the Cupra Born was up to #18. We can also celebrate the arrival of the Mercedes EQA onto the table, in #20, but the three-pointed-star model cannot rest on its laurels, because the arch rival BMW iX1 (in #22) is also rising and could surpass it soon.

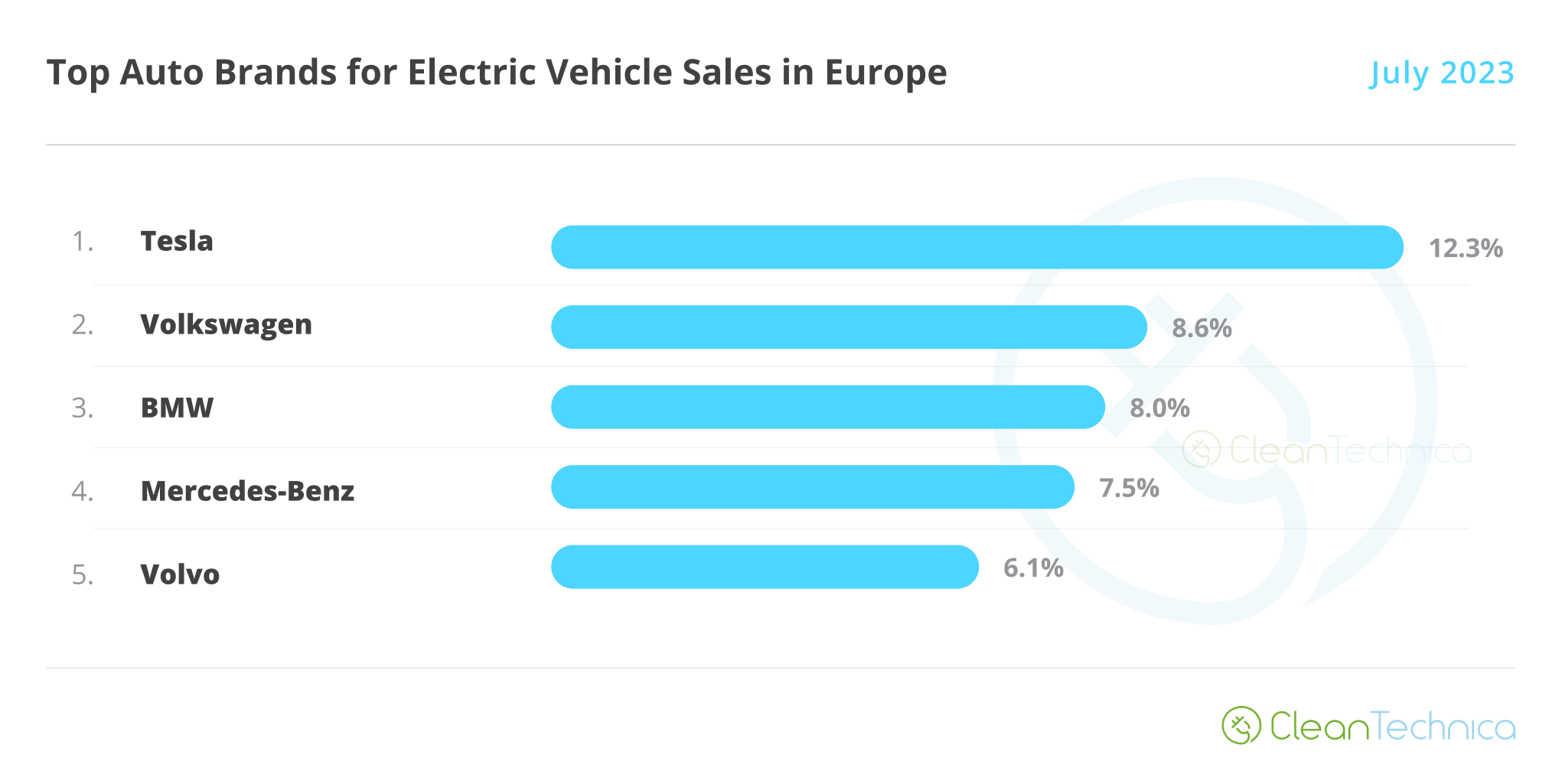

In the auto brand ranking, Tesla is leading with a comfortable 12.31% share of the plugin market, down 0.8% compared to its peak in June. Volkswagen is in the runner-up position with 8.6%, up 0.1% compared to the previous month.

3rd placed BMW (8%, up from 7.9%) has kept its lead over Mercedes (7.5%, up from 7.4%), but with only 0.5% share separating the two, a lot can still happen between them.

Finally, Volvo (6.1%, down from 6.2%) is still comfortable in 5th but is losing share by the day. So, we might see #6 Audi (5.4%, up from 5.3% in June) surpass it sometime in the future.

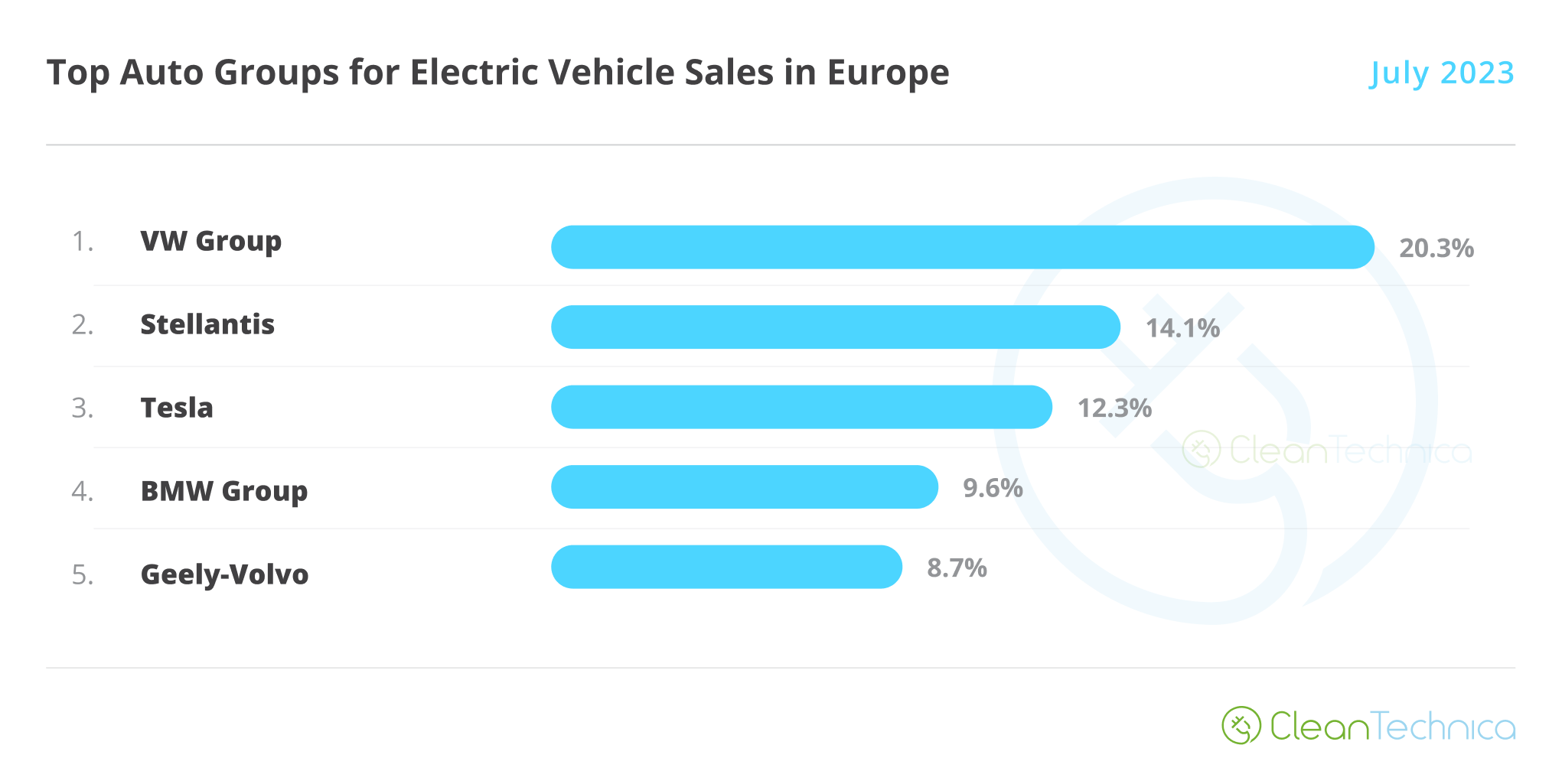

Arranging things by automotive group, Volkswagen Group was up to 20.3%, from 19.9% in June, keeping a comfortable lead over runner-up Stellantis (14.1%, down 0.2% from the previous month).

Off-peak Tesla dropped from 13.1% to 12.3%, but expect the US automaker to try and go after the #2 position in September, looking to profit from Stellantis’ apparent weakness.

Off the podium, #4 BMW Group was up to 9.6%, while #5 Geely–Volvo suffered from the poor performance from Volvo and dropped 0.1% share, to 8.7%.

With #6 Mercedes-Benz Group (8.4%, up from 8.3%) and #7 Hyundai–Kia (8.3%, up 0.1%) on the rise, Geely might be ousted from its 5th spot in the next few months.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …