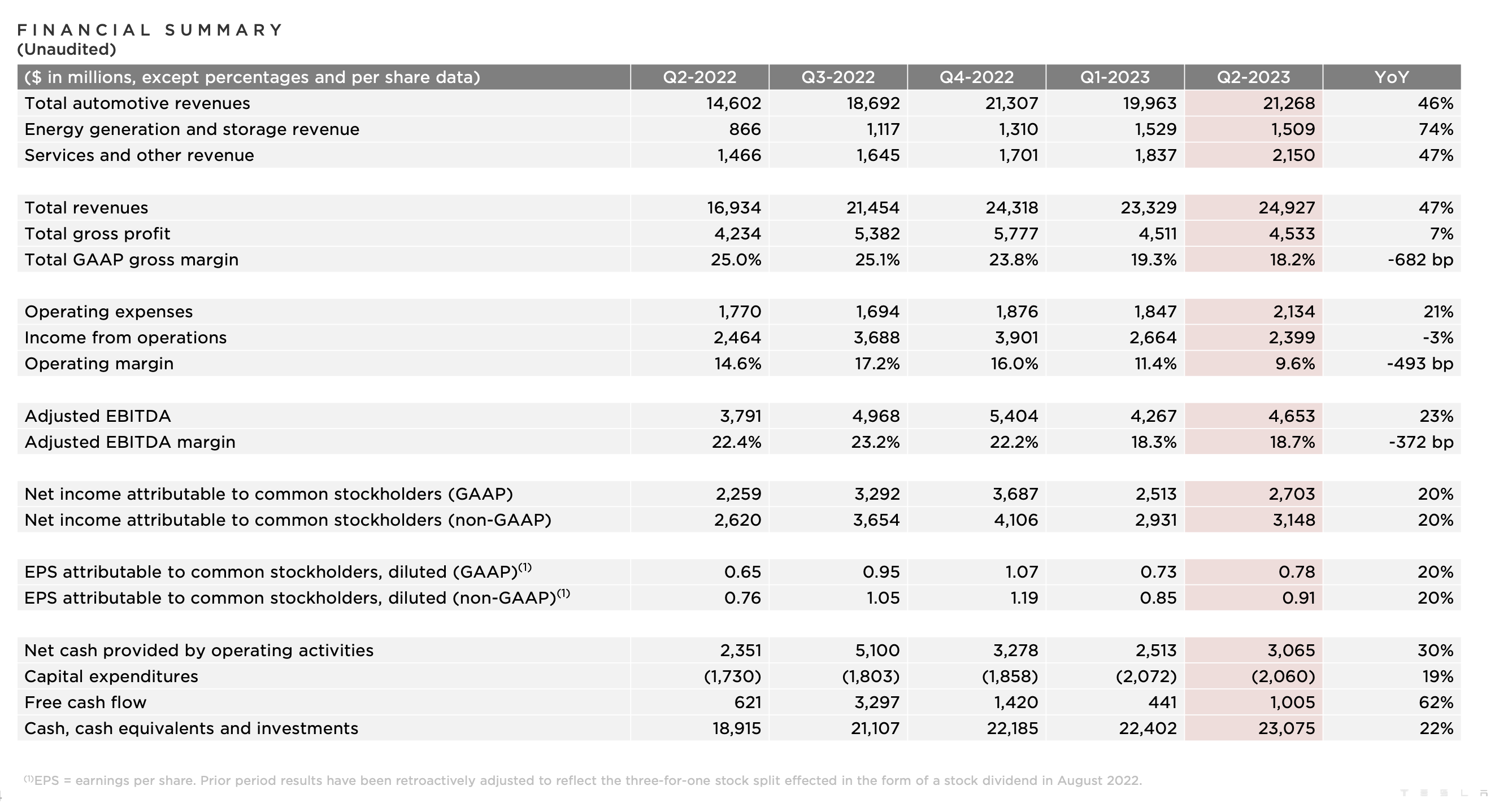

Tesla continued to rake in the cash in the second quarter of 2023, on the back of record global deliveries. The company brought in nearly $25 billion in revenue in the second quarter (Q2), which was 47% more than in Q2 2022. But let’s look a little more closely at these and other numbers.

Tesla Gross Profit & Gross Margin

Total gross profit was a bit more than $4.5, up 7% compared to Tesla’s gross profit in Q2 2022.

A third key overarching financial figure is gross margin (using GAAP accounting). While Tesla was still at a very healthy 18.2% on this metric, that was down considerably from the 22.4% of Q2 2022 — as you may have already figured out when seeing revenues up 47% but gross profits up only 7%. (And if you did the math in your head, extra credit or bonus points for you.)

Looking by segment, Tesla’s automotive revenue was up 46% to $21.27 billion, its energy generation and storage revenue was up 74% to $1.51 billion, and its “services and other” revenue was up 47% to $2.15 billion.

Tesla Cash

Let’s just look at straight cash matters now.

“Net cash provided by operating activities” was up to $3.065 billion, 30% more than the $2.351 billion of Q2 2022.

Meanwhile, capital expenditures were $2.060 billion, up 19% from the $1.730 billion of Q2 2022.

Free cash flow, thus, was $1.005 billion, 62% more than the $621 million of Q2 2022.

Cash, cash equivalents, and investments were a record $23.075 billion, 22% higher than a year before.

If you like looking at a table full of numbers, here’s another way to look at the figures above and more from Tesla:

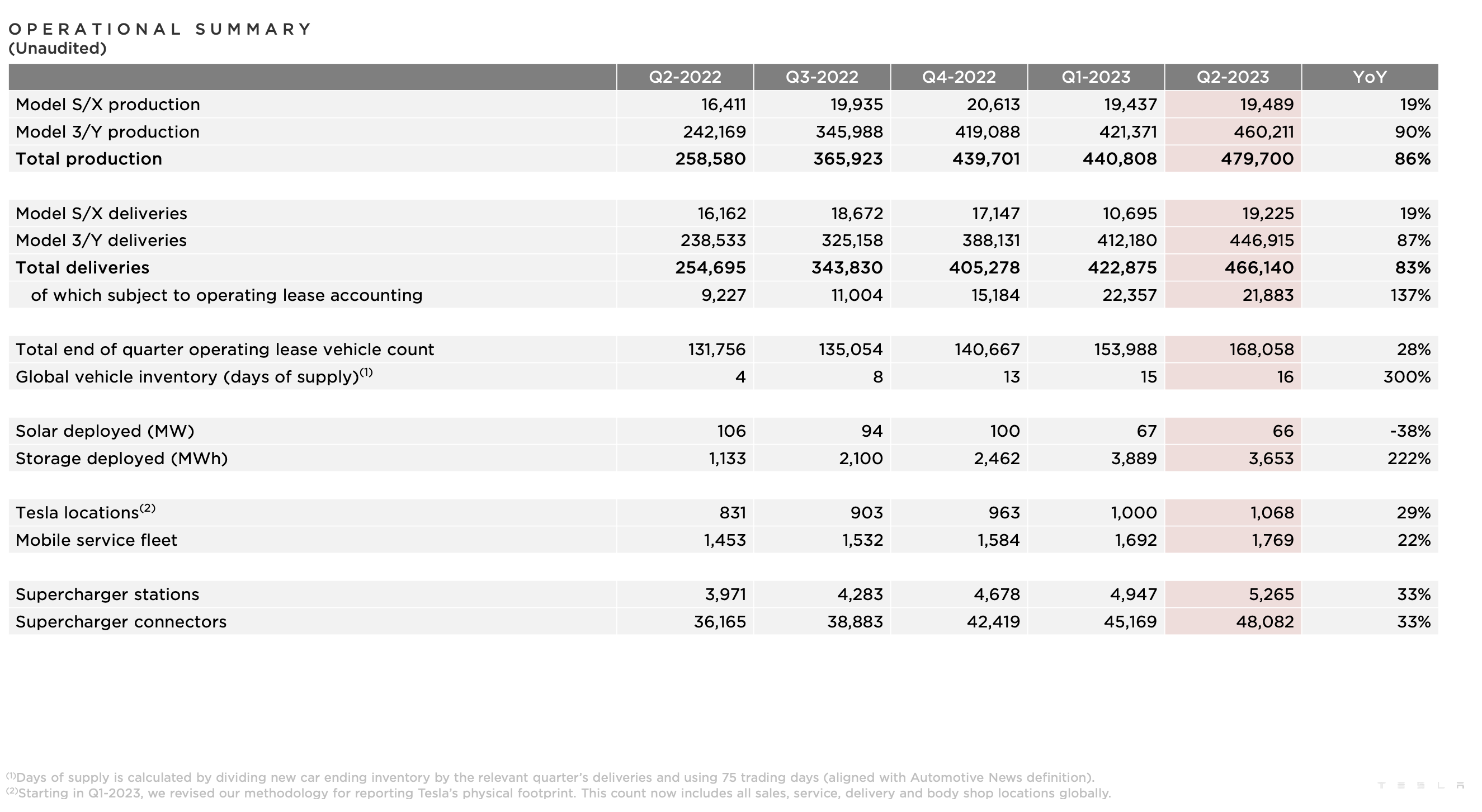

We’ve already covered Tesla vehicle production and deliveries (aka sales) for Q2, but here’s a table showing those as well as solar, energy storage, Tesla location, mobile service fleet, Supercharger station, and Supercharger connector growth:

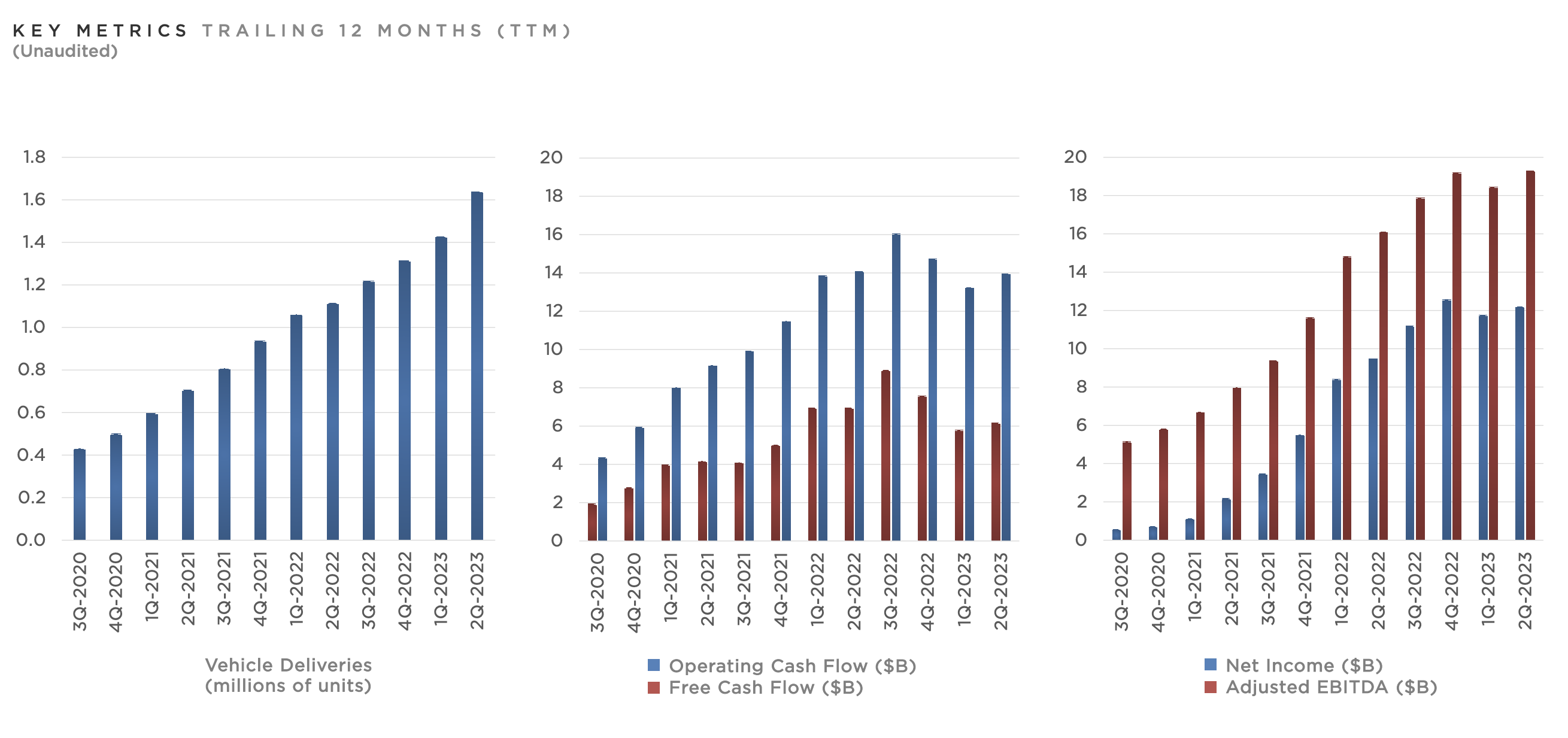

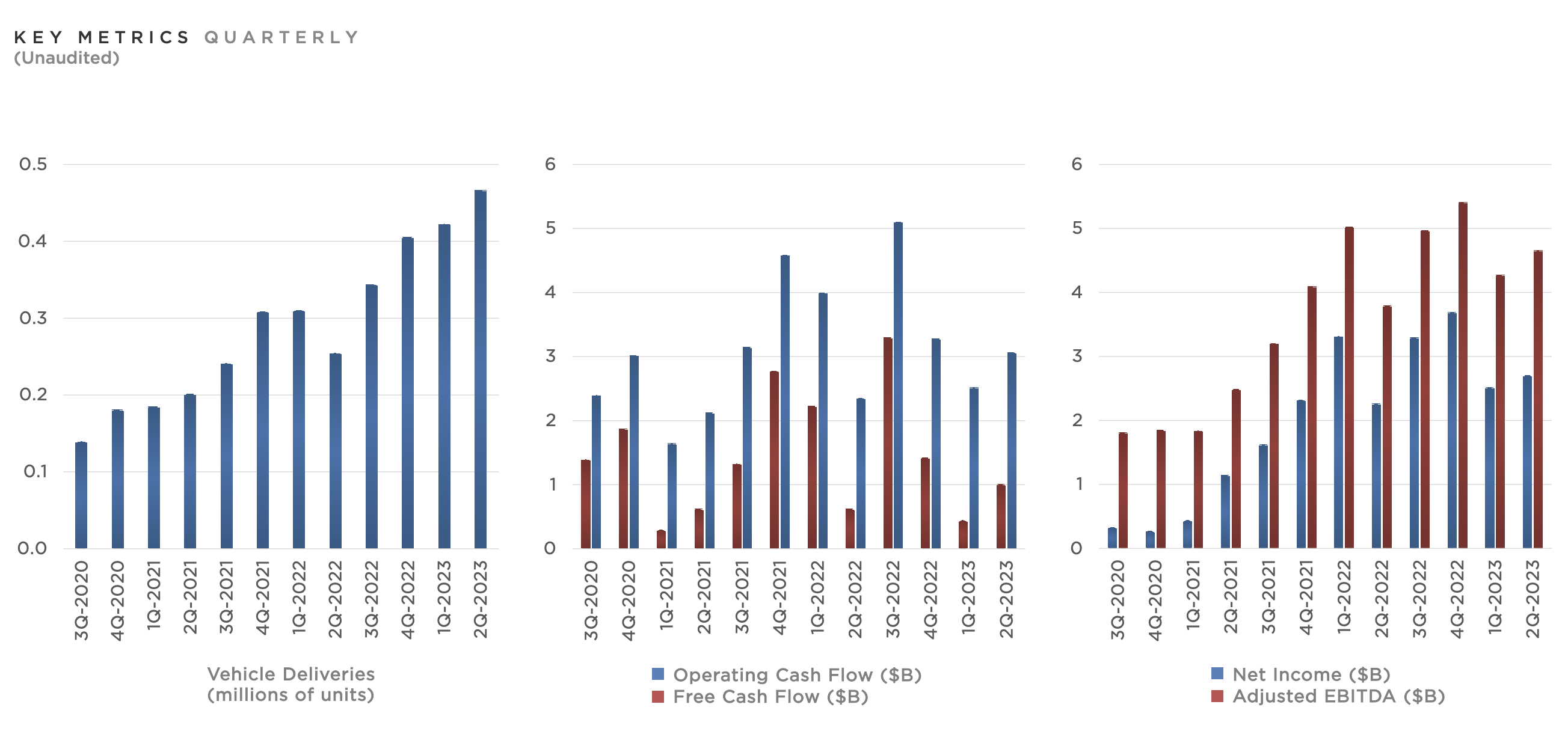

So, yes, vehicle production jumped 86% and vehicle deliveries jumped 83% in Q2 2023 compared to Q2 2022, and leasing jumped 137% but is still a very small portion of Tesla’s vehicle business.

Vehicle inventory (days of supply) is an interesting metric for a number of reasons. First of all, it was up 300% in Q2 2023. Inventory being higher was something we highlighted before the production and sales numbers came out a couple weeks ago — both looking at order backlog and inventory itself. Just looking at how that changed year over year (up 300%) could be a bit concerning — and maybe it remains a bit concerning for some of you. However, when you look at the number of days of supply, those concerns can also dissolve quickly. Last year, Tesla had just 4 days or supply (inventory) at the end of Q2. This year, that had risen to 16 days of supply, but 16 days of supply is still better than the industry average and quite small. Some have said that this increase in inventory is largely due to Tesla “unwinding the wave” of its historically complicated globally delivery process.

The number of Tesla locations (sales, service, delivery, and body shop locations) had risen 29% from 831 in Q2 2022 to 1,068 in Q2 2023. Meanwhile, its mobile service fleet rose 22% from 1,453 vehicles to 1,769 vehicles.

On the charging front, Supercharger stations grew 33% from 3,971 to 5,265, and individual Superchargers connectors grew 33% from 36,165 to 48,082. That’s astounding charging infrastructure growth, and it’s something we’ll probably come back to in another article.

The vehicle business is certainly the bulk of Tesla’s business, but let’s also look at those other interesting energy industry metrics. Deployed Tesla solar power declined year over year, from 106 MW to 66 MW. That’s a bit surprising since the Inflation Reduction Act has encouraged solar power adoption. On the other hand, deployed energy storage products grew 222%, from 1,133 MWh to 3,653 MWh.

We’ll come back to other highlights in future articles, but the quarterly Tesla conference call is now live, so I’m going to focus on listening to that.

All images courtesy of Tesla.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Have a tip for CleanTechnica, want to advertise, or want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Former Tesla Battery Expert Leading Lyten Into New Lithium-Sulfur Battery Era:

CleanTechnica uses affiliate links. See our policy here.