Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Remember when the Tesla Model Y outsold every other electric car, anywhere in the world, all the time? That was then; this is now. According to Yahoo Finance, registration data from Germany’s Motor Transport Authority (KBA) shows the Volkswagen brand has delivered 49,200 electric cars in that country through the end of October. BMW has delivered 33,167. Tesla is in third place with 31,461 delivered. A skip and a hop away, Cars Guide says MG has taken the EV sales lead in the UK.

While Volkswagen may be leading the EV pack in Germany, its sales of its battery-electric cars have declined since a year ago at this time, when it delivered 9,400 more EVs than it did in the same period of this year. Tesla sales are down by 23,300 cars compared to their performance in 2023. BMW, on the other hand, is seeing a solid increase in sales of its electric cars. It sales are up by 6,600 cars compared to a year ago at this time.

Sales, of course, are a moving target. Germany cancelled or significantly reduced its EV purchase incentives at the end of last year, which hurt Volkswagen and Tesla. Why BMW is bucking that trend is a matter of conjecture. It may be that its electric car offerings are more appealing to its customers or that BMW owners are wealthier as a group and are willing to pay more in order to have that iconic BMW roundel on the hood. Volkswagen’s electric cars are finding tough sledding in the new car market, largely because of software issues that the company seems unable to address successfully. The Volkswagen brand is experiencing a reduction in sales of its conventional cars as well, which has led to tensions with its union members as it contemplates closing two or more factories in Germany — something that has never happened before in the company’s history.

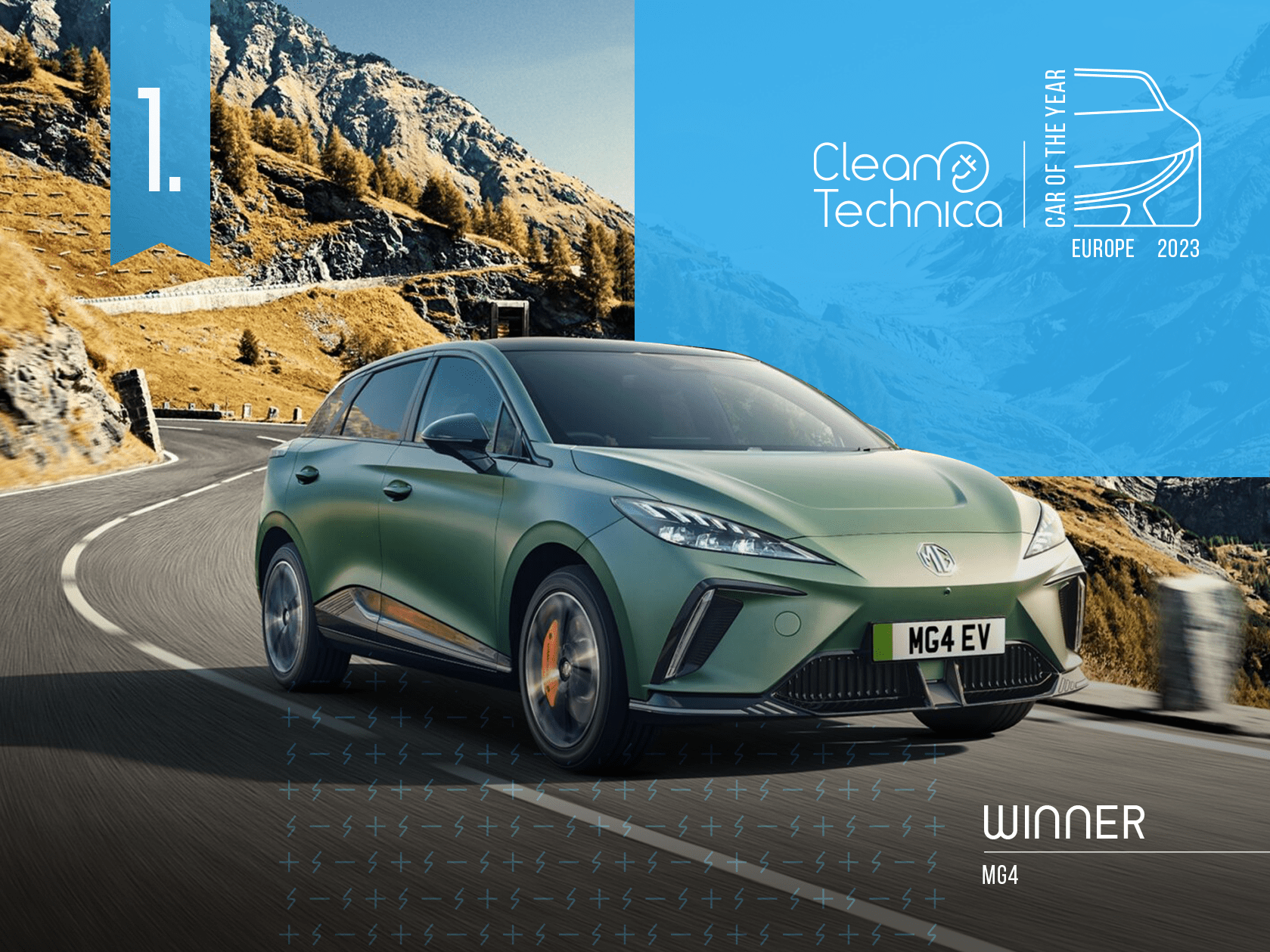

MG4 Leads EV Sales In The UK

Across the Channel in the UK, the MG4 battery electric hatchback is outselling the Tesla Model Y, the Tesla Model 3, and the Toyota Camry. In fact, it is close to catching the Toyota Corolla, one of the best selling cars in the UK. According to Cars Guide, the secret to the success of the MG4 is simple. The MG 4 Excite out-the-door price is just $32,990 with a 52 kWh battery and 350 kilometers of range (WLTP). Not only is that cheaper than the GWM Ora at $35,990 drive-away price and the BYD Dolphin at $38,990 before on-road costs, it is also about $3,000 less than a Toyota Corolla Ascent Sport hybrid. The MG4 Essence with a 64 kWh battery and 450 kilometers of range is priced at $46,990 drive-away, which seems like a pretty hefty increase for an extra 12 kWh in the battery pack and a few more doodads on the dashboard.

In October 2024, Tesla sold a total of 1,464 cars in the UK — 1,042 Model Y SUVs and 422 Model 3 sedans. During the same period, MG delivered 1,486 MG4 hatchbacks. For context, in the small car segment, that puts the MG4 behind the Toyota Corolla, with 1751 cars delivered and ahead of all others, including the Hyundai i30, Kia Cerato, and Mazda 3. The GMW Ora sold a paltry 154 cars, while the BYD Dolphin saw just 67 deliveries. MG4 deliveries have grown significantly since the company trimmed the price of the car substantially in September, reinforcing the notion that that three most important words in car sales are the price, the price, and the price.

The Price Factor

Price has been one of the biggest factors affecting EV popularity. Tesla was selling about 1,500 Model Y vehicles a month up until April of this year. In May, it slashed prices and saw a huge increase in June when it sold 2,906 Model Y and 1,777 Model 3 vehicles. In the same month, Nissan, Peugeot, and Ford dramatically discounted their electric cars and saw an immediate increase in sales. If MG manages to keep such a sharp price point on the MG4 while covering its operating costs, rivals like the Dolphin, Ora, and other new rivals are unlikely to catch up by the end of the year. There will be a bigger challenge next year when more low-price rivals such as the Kia EV3 and Hyundai Inster, not to mention fresh rivals such as Aion’s new hatchback sedan, begin selling in the UK.

MG chief commercial officer Giles Belcher made note of other reasons for MG4’s success last month. “At MG we believe we have a winning formula when it comes to buying a new car, and this includes EVs. We have award winning products backed up by an industry leading 10 year warranty and at a price point that represents great value,” said Belcher. Before the price of the base MG4 was cut, its sales were less than a quarter of what they have been in recent weeks. Because cars can be manufactured so cheaply in China, manufacturers have a lot of room to reduce prices to attract more sales — or raise them to generate more profits.

UK Avoids Import Tariffs For Now

Unlike the EU, the UK has not elected to impose additional tariffs on electric cars imported from China. Reuters reported recently that Britain does not plan to follow the European Union in imposing tariffs on imports of electric vehicles from China because UK businesses have not raised a complaint to be investigated, according to British trade minister Jonathan Reynolds.

He said there had not been any complaints from local industry to Britain’s Trade Remedies Authority (TRA), and so he would not seek to follow the lead of the EU on tariffs. He added that his “primary concern” was promoting a thriving and open export markets for British producers. “I do have the power as the Secretary of State to make that referral. We keep it under close analysis, but I think it’s important our industry is different, and as of yet industry itself hasn’t asked for that referral to the TRA,” Reynolds said. He also suggested it was in the UK’s best interests to build trade relations with China, having failed to do so previously, and that engagement was a good thing for the nation.

What Reynolds did not say is that, unlike Germany, France, and several other EU countries, the UK does not have a large domestic auto industry that needs to be protected from foreign competition. In fact, it depends on imports for much of its new car sales, so the Chinese models are just adding to the supply already coming from Japanese, Korean, and EU manufacturers.

The Takeaway

Sales is a long-term game. Sometimes companies sell at a loss in hopes of driving out rivals so they can raise prices and generate profits in the future. Sometimes companies slash prices to get a toehold in new markets. But, eventually, somebody has to make money playing the game or the whole thing falls apart. The question now is who is making and who is losing money in the EV sales game. Many CleanTechnica readers are rooting for electric cars to become the majority of new car sales in many countries, but for that to happen, they will need to be profitable. The coming year could be a pivotal for the EV revolution.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy