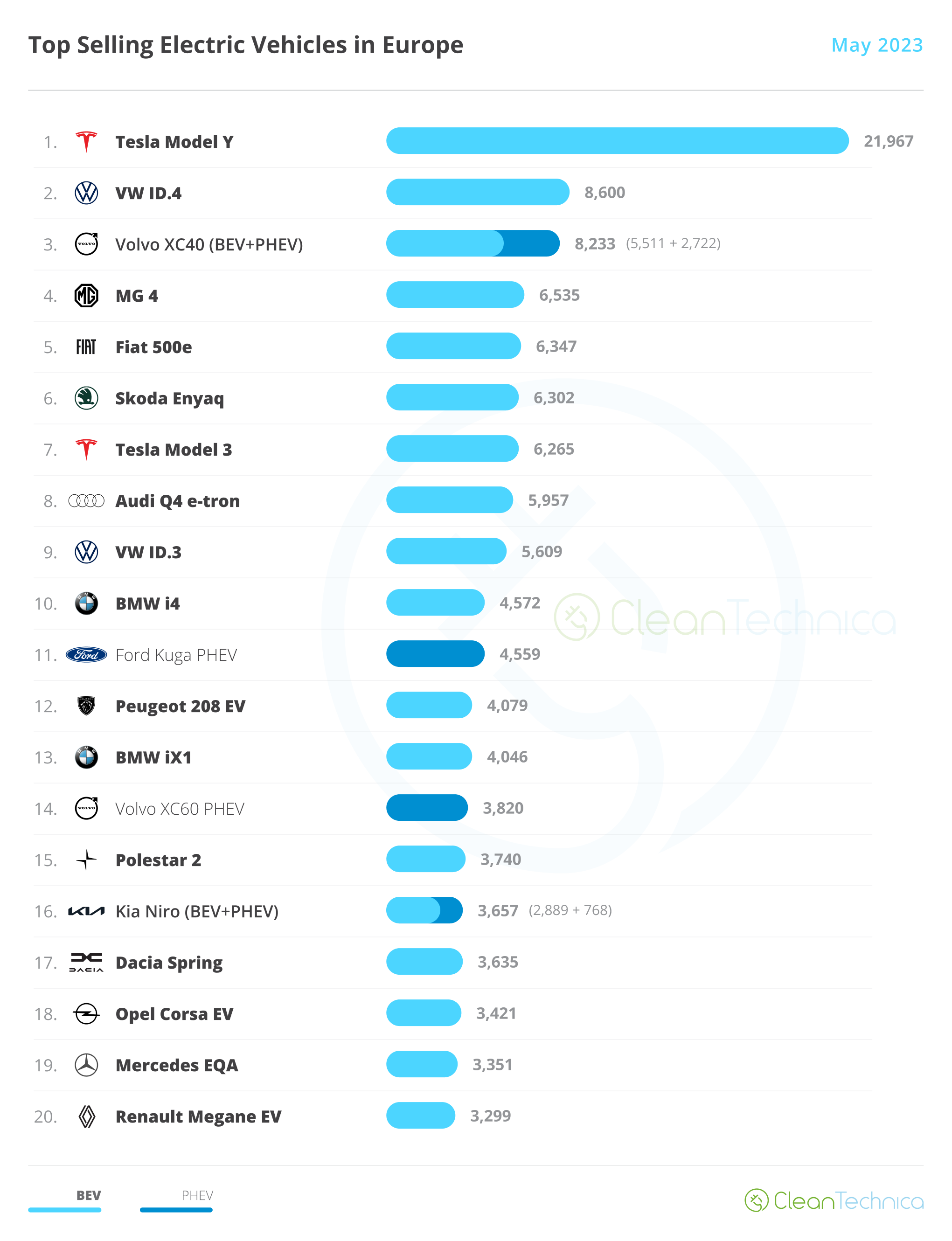

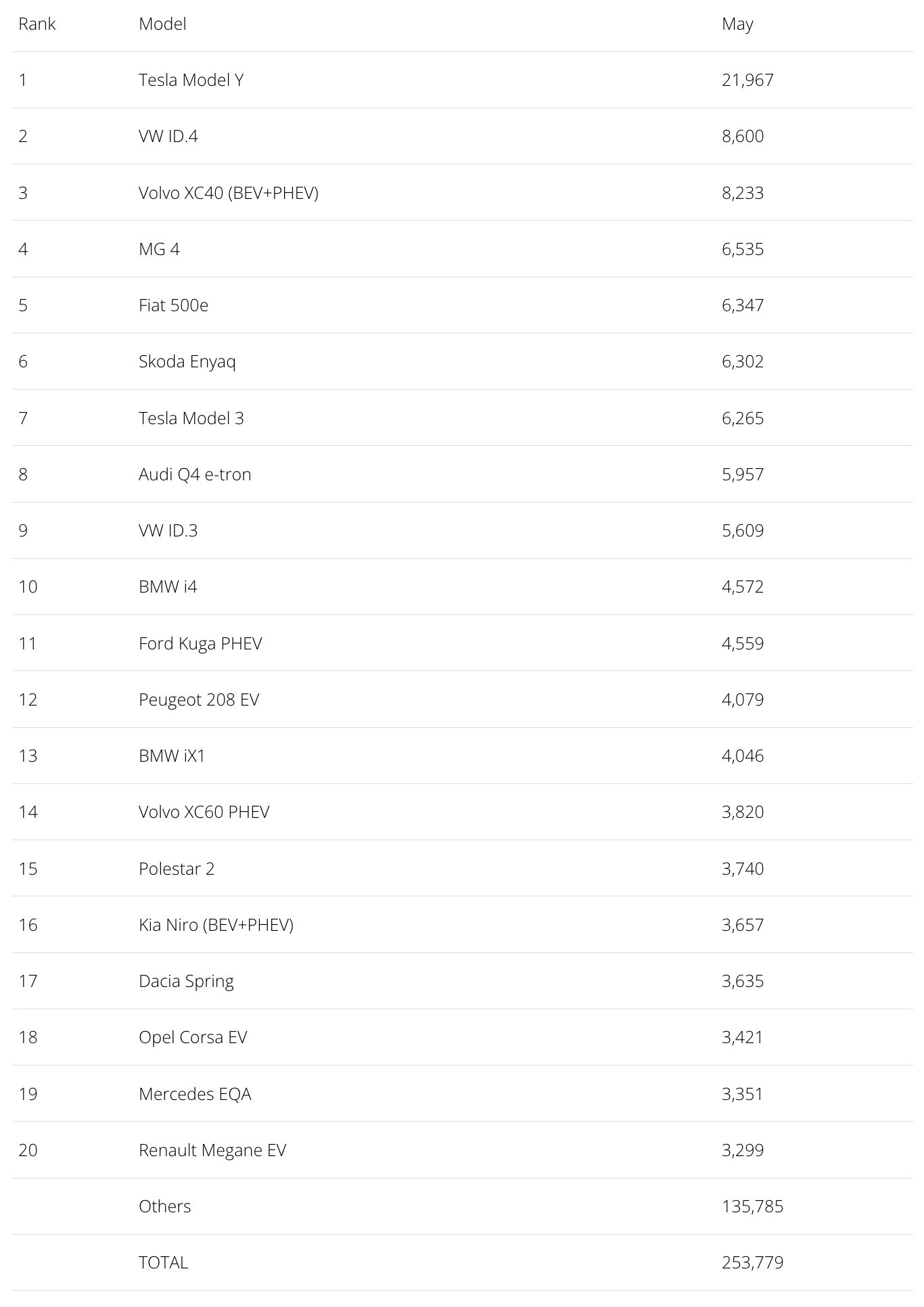

Tesla continues to be the best selling brand in Europe, but Volkswagen is recovering

Some 253,000 plugin vehicles were registered in May in Europe — which is +38% year over year (YoY). Unfortunately, the overall market also grew fast, +18%, surpassing 1 million sales. It is finally recovering from a couple of bad years.

Last month’s plugin vehicle share of the overall European auto market was 23% (15% full electrics/BEVs). That result kept the 2023 plugin vehicle share at 21% (14% for BEVs alone).

BEVs kept gaining momentum in May, with last month’s growth rate (+67% YoY) being the highest in over a year. Meanwhile, PHEVs (+1%) remained stable. These performances allowed pure electrics to represent 68% of plugin registrations last month, pulling the YTD share to 66%.

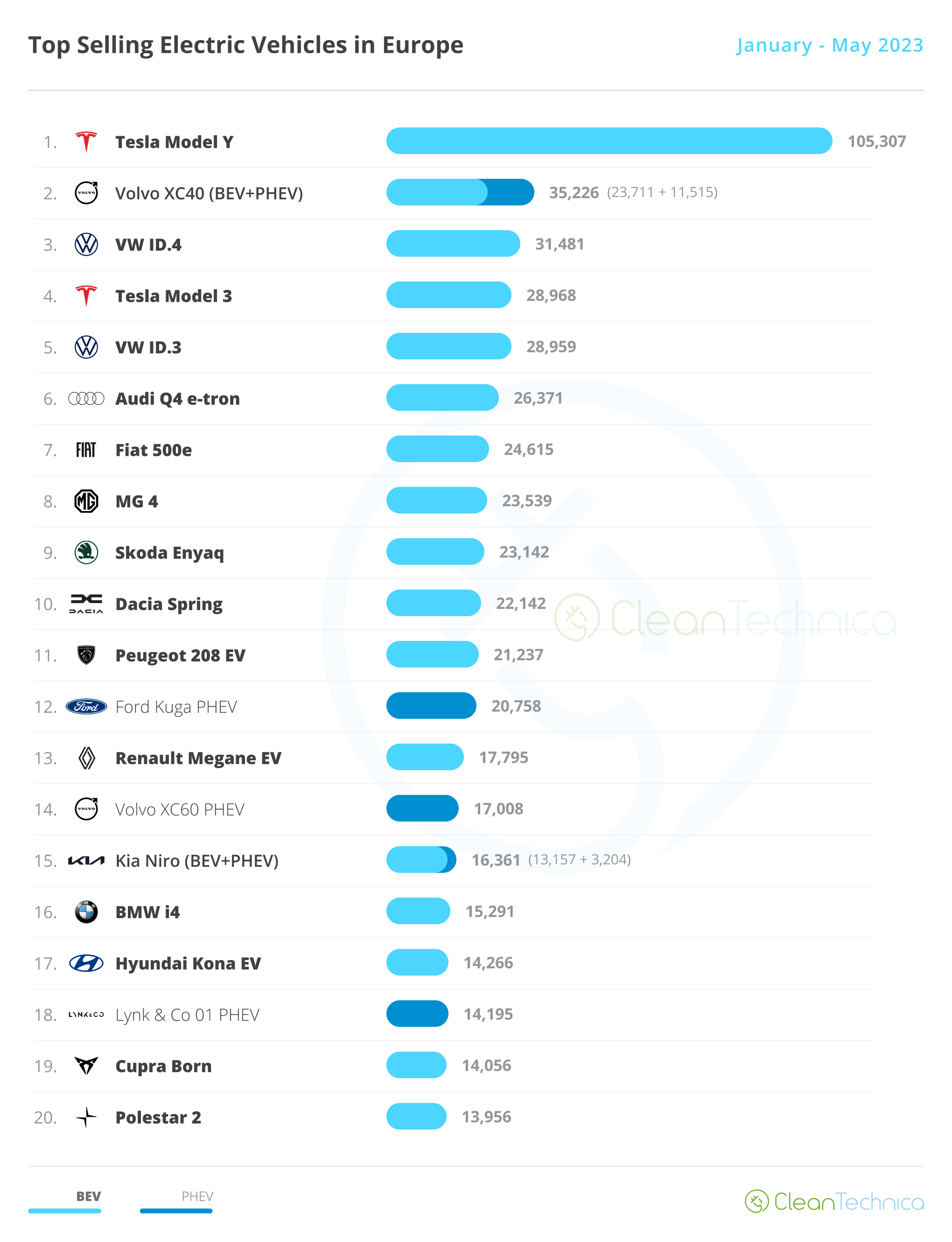

The highlight of the month was the Tesla Model Y once again dominating the table, more than doubling the sales of the runner-up VW ID.4, but let’s look closer at May’s plugin top 5:

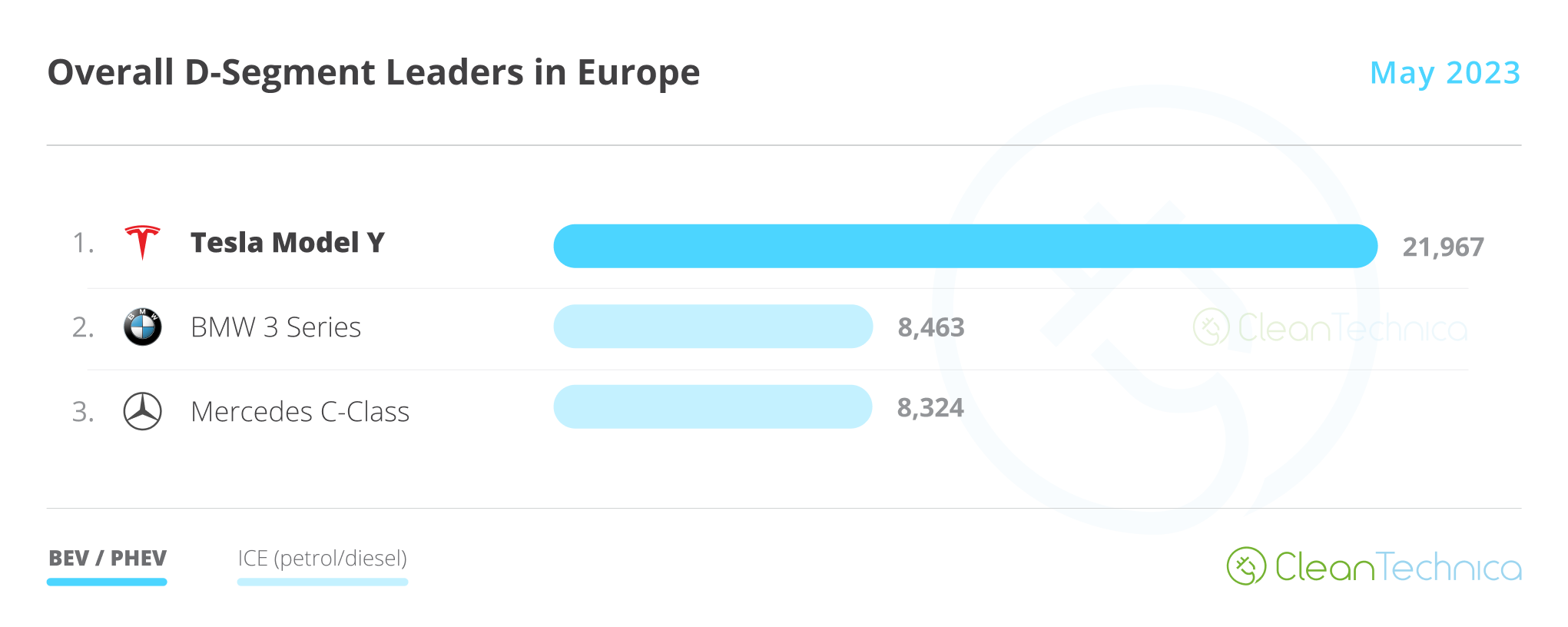

#1 Tesla Model Y — For the 7th month in a row, Tesla’s crossover was the best selling EV in Europe. In May, the midsizer had 21,967 registrations, an amazing result for an off-peak month — that no doubt benefited from the recent price cuts and also from the fact that the Model Y is one of the few EVs that has a balanced supply-and-demand ratio, allowing for quick delivery for anyone interested in buying one. This year could be considered “Peak Model Y” in Europe. The midsize crossover should continue to post similar results in the coming quarters in Europe — but do not expect sales to increase significantly over current volumes, as I am confident the Model Y has already reached the market’s natural limits*. Regarding last month’s performance, the Model Y’s biggest European markets included Germany (4,240 units), France (2,709), Norway (2,691), the UK (2,502 units), Sweden (1,903 units), Denmark (1,164), and the Netherlands (1,048 units).

(* The point where no matter how compelling the vehicle is, because there are already several in the neighborhood, people just go for something else. Some people have called this in the past the “Toyota Camry effect.” Adding to this, we are walking into a maturing market, where people are spoiled with different choices. Even if the alternatives are more expensive and/or consumers have to wait, some people go elsewhere because they have different needs or just want something more exclusive.)

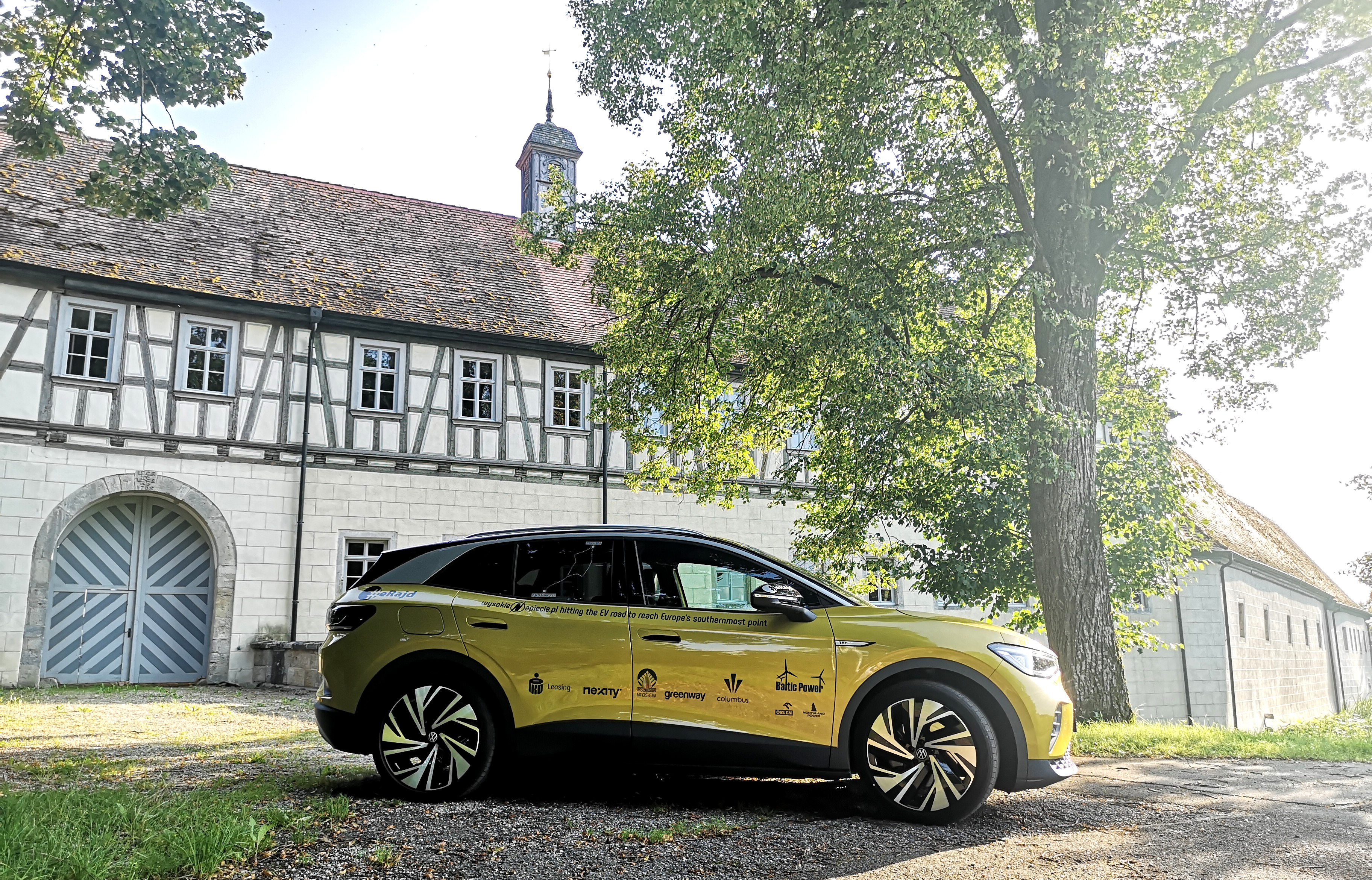

#2 VW ID.4 — The Volkswagen crossover jumped into the runner-up spot in May thanks to 8,600 registrations. With increased production availability, thanks to local USA production and the start of production in Emden, the ID.4 now has enough firepower to compete for the #2 spot in 2023, looking to improve on the #3 spot it scored last year. Will the crossover get there? One thing is certain: last year’s runner-up, the Tesla Model 3, no longer seems unbeatable. Regarding the ID.4’s May performance, its main market was its home market of Germany (2,721 registrations), followed from a distance by Sweden (837), the UK (815 registrations), Norway (738 registrations), and the Netherlands (713 registrations).

#3 Volvo XC40 (BEV+PHEV) — The compact Swede is a sure value in the EV arena, and with the BEV version being the main driver of growth (5,511 registrations), Volvo’s popular SUV ended the month on the podium. The XC40 doesn’t really stand out on any item in particular, but it also doesn’t have weak points, making it a no-nonsense option that contributes to its current success. Having said that, the Belgian-built Volvo might start to be affected by the cannibalization effect from the recently introduced EX30, a slightly smaller crossover that has competitive specs and pricing. The EX30 will no doubt steal a lot of sales from its older sibling (and the remaining competition). Regarding the XC40’s May results again, though, it had 8,233 registrations, with the XC40 sales distribution being even across several medium-sized markets, like Sweden (1,352 registrations) and the Netherlands (1,039 registrations). The UK was also a big receptor of sales (1,005 registrations).

#4 MG4 — The compact hatchback is fulfilling MG’s best expectations, earning another top 5 presence in May thanks to 6,535 registrations, thus making it one of Europe’s favorite hatchbacks. With a purposeful look, good handling and good enough interior materials, the Sino-British hatchback is a sort of the electric Ford Focus that the US brand has refused to make. With the Dearborn’s European arm now little more than an extension of the US marketing team (SUVs = Freedom & Americana), there is a hole in the B and C segments for mainstream hatchbacks with a focus on good handling and smart design. With the MG4 now filling the role of the electric Ford Focus, who will fill the role of electric Ford Fiesta? But I digress. Back to the MG4’s May performance. Its main markets were its (adopted) home market of the UK (1,965 registrations) and France (1,593 registrations), which incidentally is another big market for hatchbacks. The remaining markets ended at some distance behind, like the cases of Germany (941 registrations) and Spain (439 registrations).

#5 Fiat 500e — Without reaching the sales levels of previous months, the little Italian was nevertheless the Surprise of Month. With 6,347 sales, the best selling city car is currently recovering after a slow start to the year. France was its largest market, with 2,601 registrations, followed by Germany (1,594 units) and its home of Italy (516). This last result might seem a little low, given the Italians’ love for domestic brands and small cars, but the explanation probably has more to do with the fact that Italy is below the curve when it comes to EV adoption than anything else.

Looking at the rest of the May table, let’s look at a few highlights. The #10 spot of the BMW i4 was one such highlight, with the striking fastback looking to become the default choice in the category for those wanting for an alternative to the Tesla models. Additionally, the recent BMW iX1 joined the table, in #13, with a record 4,046 registrations, highlighting a strong May for the Bavarian company. The Polestar 2 also had a good month, with 3,740 registrations, while the Opel Corsa EV re-joined the table in #18 thanks to 3,421 units.

Below the top 20, we had several models with positive performances, like the Kia EV6, with 2,928 registrations, and the Mini Cooper EV, which had 2,935 registrations.

Finally, besides having its Corsa EV in the top 20, Opel was close to placing another model in the table, as the stylish Mokka EV (3,077 registrations) ended just some 200 units below the #20 Renault Megane EV. Still, with Stellantis placing three models in the table, coming from three different brands (Fiat 500e, Peugeot 208 EV, and Opel Corsa EV), the multinational conglomerate can’t really complain. Only Volkswagen Group managed to do better (4 models).

Looking at the overall category leaders, in the midsize segment, we can see that the Tesla Model Y continues to rule supreme, even in an off-peak month. It had 21,967 registrations. The Model Y was followed by the BMW 3 Series (8,463 registrations) and the Mercedes C-Class (8,324 registrations).

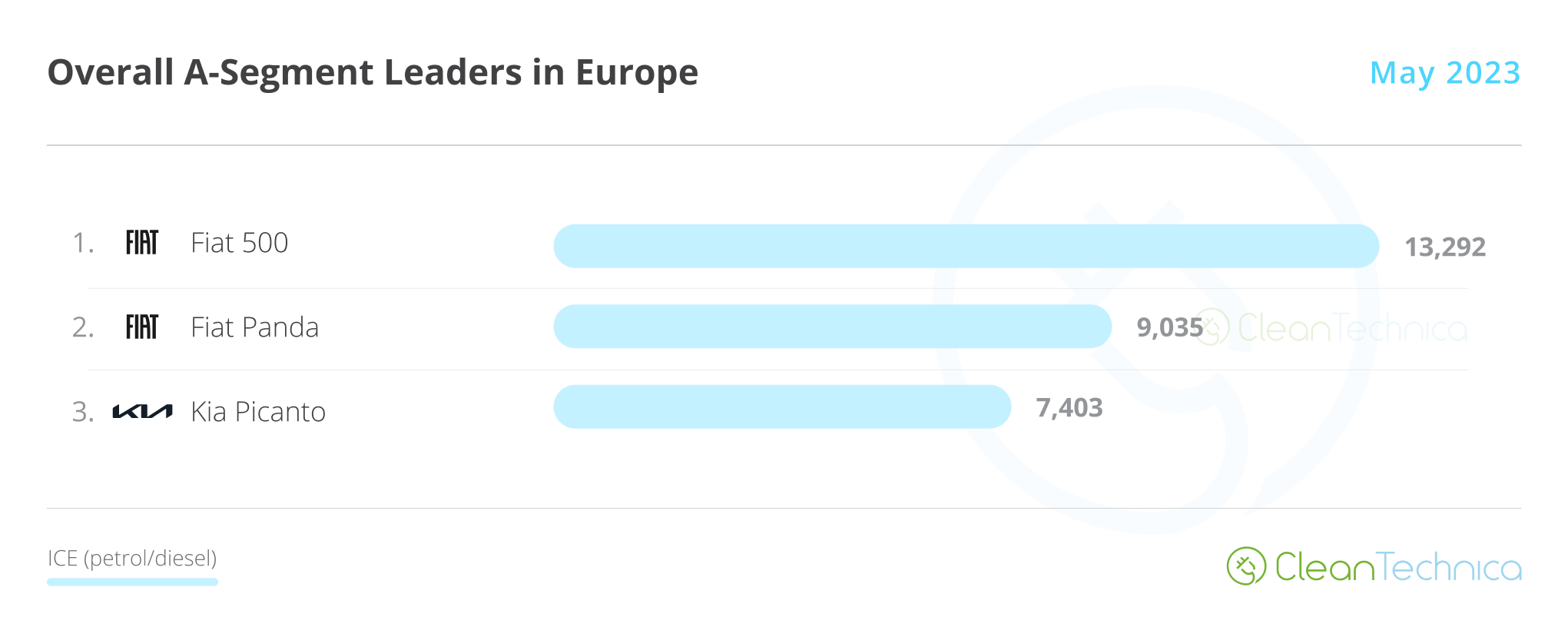

As for city cars, with the longtime leader Fiat 500 now getting 48% of all of its sales (6,347 units) from the EV version, and the next city EV selling well below (Dacia Spring, 3,635 units), Fiat seems to be transitioning its star model into the new era quite nicely. However, the true test will be when the first competitive Chinese city EVs (ahem, see: BYD Seagull…) land in Europe.

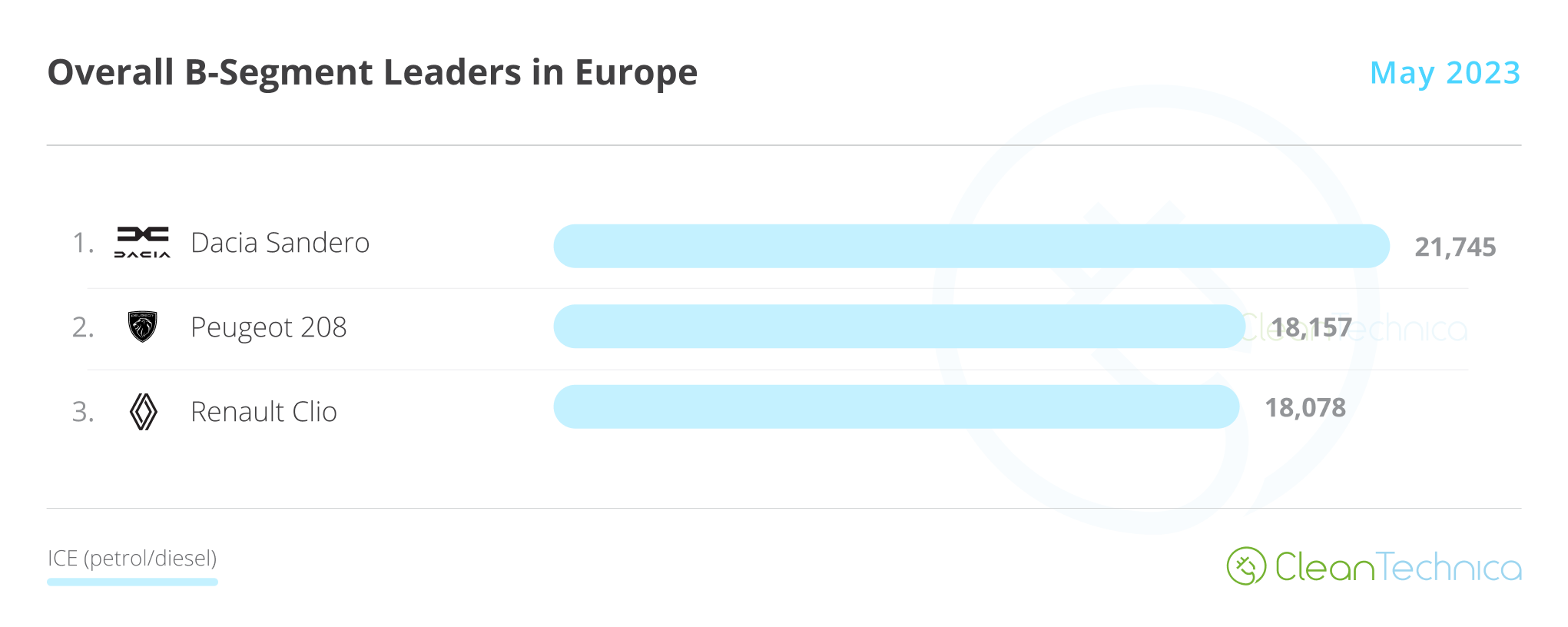

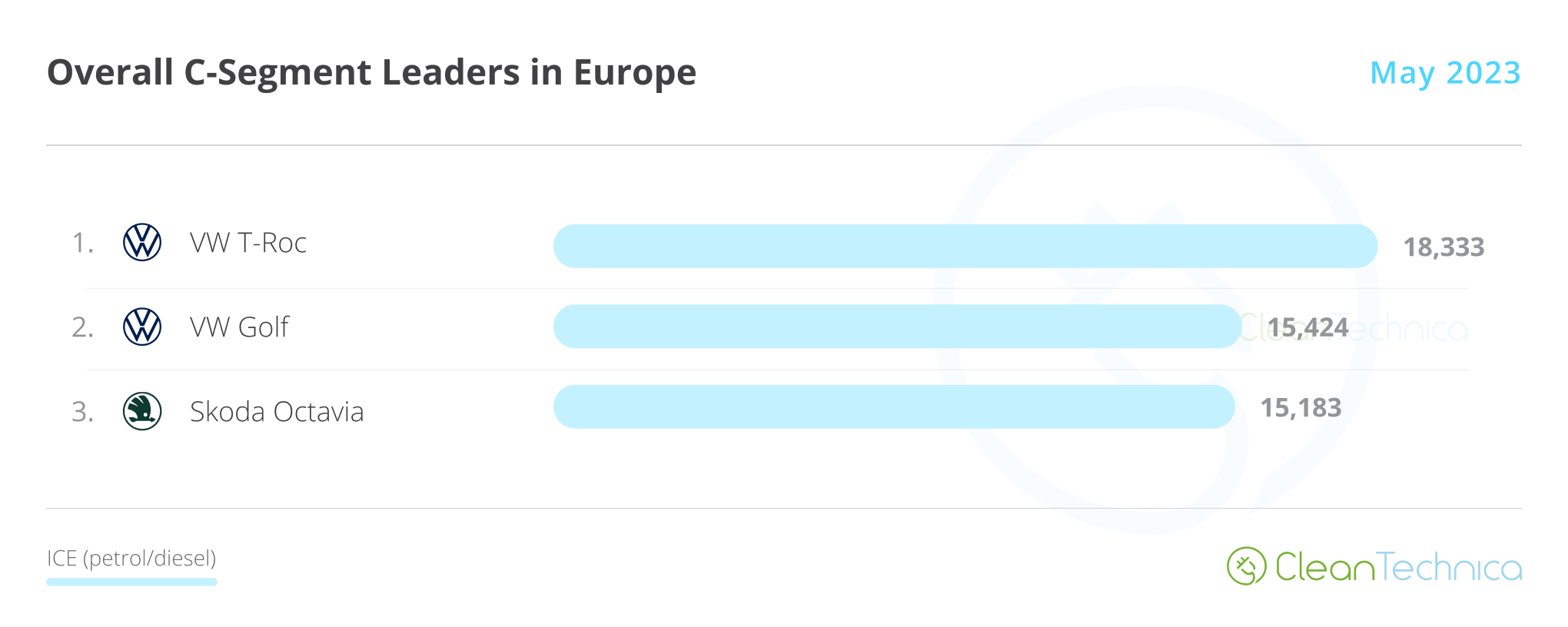

Looking at the remaining categories, Volkswagen Group won the PEV best seller title in the full-size category with the Audi Q8 e-tron (2,135 units) and also won in the C-segment (VW ID.4 in the PEV category, VW T-Roc in the overall ranking), while in the B-segment, Dacia won overall, with the respective PEV category prize going to the Peugeot 208 EV.

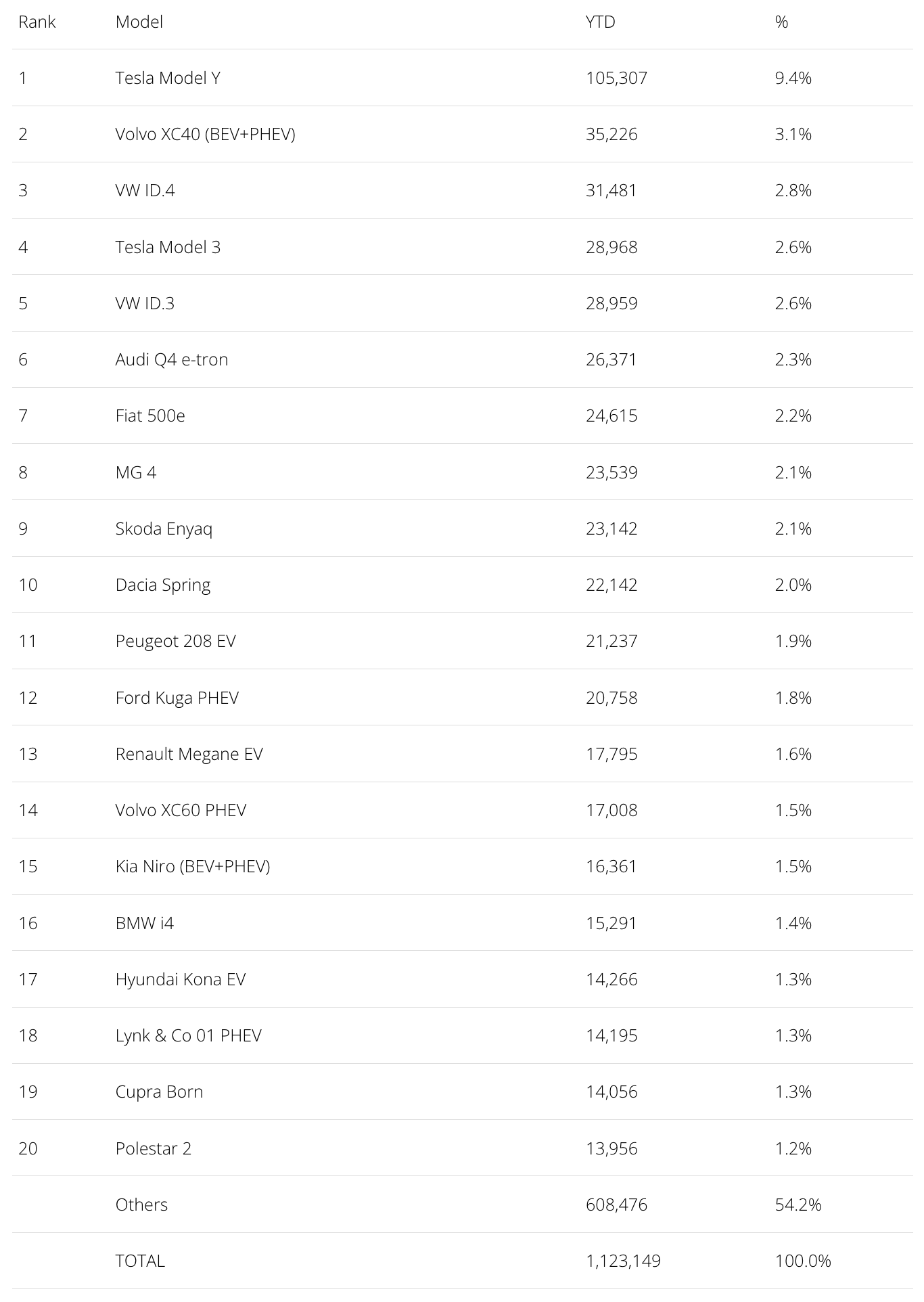

Looking at the 2023 ranking, with the Tesla Model Y having three times as many deliveries as the runner-up Volvo XC40, the attention is now focused on the remaining podium positions.

The second placed Volvo XC40 managed to hold onto silver, but the same can’t be said about the VW ID.3, which dropped from 3rd to 5th in May to the benefit of its sibling VW ID.4 and the Tesla Model 3, which climbed one position each.

In June, expect the Model 3 to surpass the German crossover, but it will be harder to reach the #2 Volvo XC40, as the difference, some 6,000 units, is more significant.

Elsewhere, let’s look at the remaining position changes. The Fiat 500e rose to #7, gaining important ground over the #10 Dacia Spring, its most direct competitor in the city car category. With Renault’s Twingo EV and Zoe showing their age, the Megane EV suffering at the hands of the competition (and needing a price cut?), and the Nissan Ariya selling below expectations, cruising under 1,000 units/month, the Renault–Nissan Alliance is in real need of a sales champion to avoid an over reliance on the Dacia Spring’s performances (aka the Wuling Mini EV effect).

Speaking of SAIC, the MG4 jumped two positions, to 8th, proving to be a well suited model for European tastes. (See text above about the MG4.) Another model with a strong value-for-money proposal is the Skoda Enyaq, which was up to #9, thus becoming the 4th MEB-platform model in Europe’s top 10.

In the second half of the table, the highlight is the three-position jump of the BMW i4, which was up to #16 and is looking to reach the #14 Volvo XC60 PHEV soon. Still in the midsize category, the Polestar 2 rejoined the table, in #20, replacing the Hyundai Ioniq 5, which experienced a slow month.

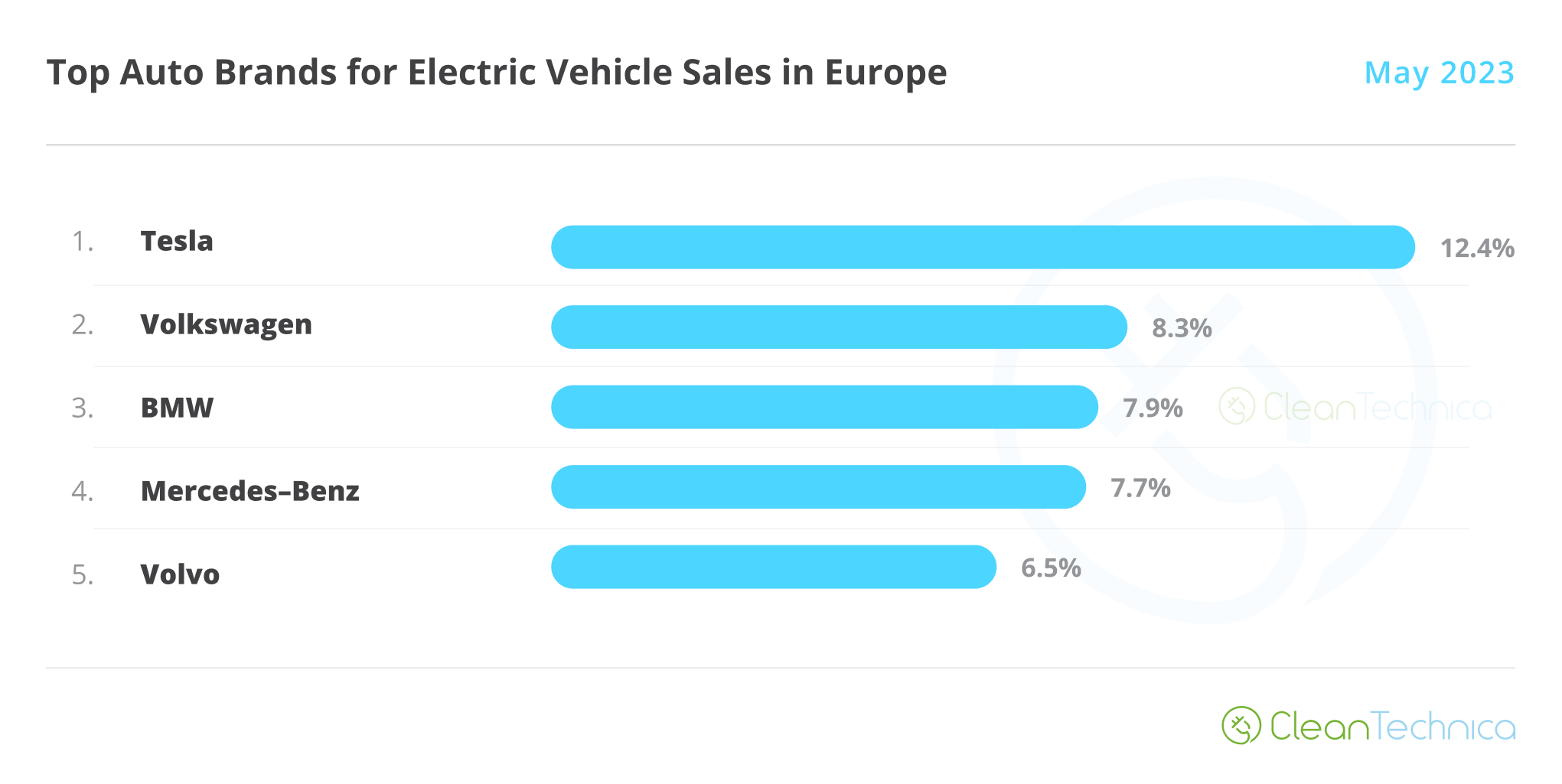

In the automaker ranking, Tesla is leading with a comfortable 12.4% share, with Volkswagen in the runner-up position with 8.3%, up 0.1% compared to the previous month.

3rd placed BMW (7.9%, up from 7.7%) gained precious advantage over Mercedes (7.7%), but with only 0.2% share separating the two, a lot can still happen between them.

Finally, Volvo (6.5%) is comfortable in 5th, with #6 Audi (5.3%, down 0.1%), and #7 Peugeot (4.7%) at some distance.

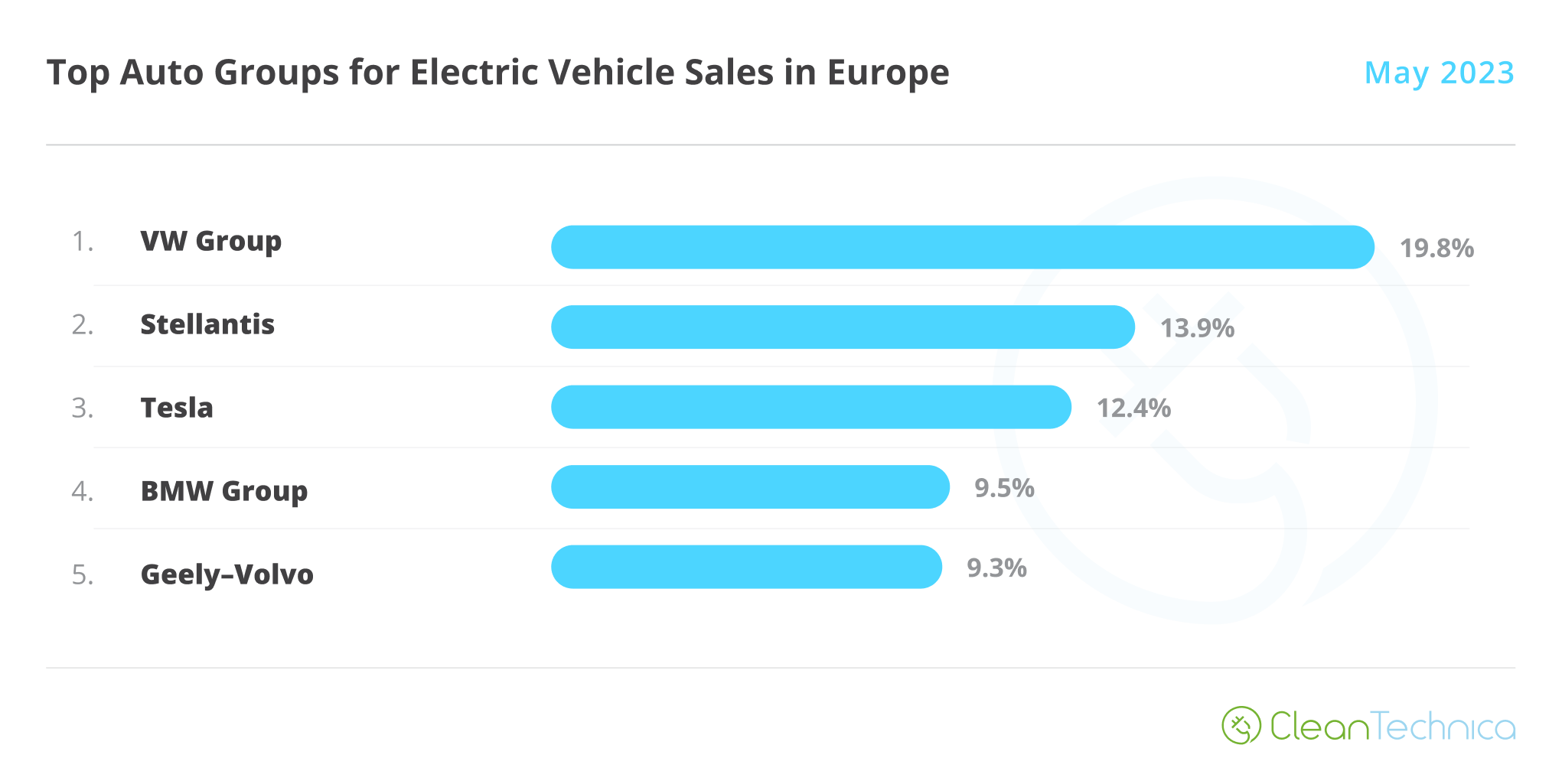

Arranging things by automotive group, Volkswagen Group was up to 19.8%, keeping a comfortable lead over new runner-up Stellantis (13.9%).

Off-peak Tesla dropped slightly from 12.6% to 12.4%, but expect the US automaker to go after the #2 position in June thanks to its end-of-quarter peak.

The remaining competition recovered market share, with #4 BMW Group going up to 9.5% and #5 Geely–Volvo up to 9.3%.

With #6 Mercedes-Benz Group at some distance (8.6%), Geely can still focus on looking ahead and try to recapture the #4 position from BMW Group next month.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …