Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

The following is a Tesla leasing analysis, as well as a look at how leasing offers many advantages but also has significant drawbacks. First, though, Tesla boosts sales with many different incentives, so let’s list some of the others for a broader perspective.

Tesla seems to be pulling out all the stops to sell its cars around the globe, including the following in the US:

- Doubling the Referral Credit. Here is mine if you need one.

- Might be the last chance to get the $7,500 federal EV tax credit since Trump might repeal it.

- Leasing discounts as low as $299 a month on the Model 3 & Model Y.

- 3 to 6 months of free Supercharging and Full Self Driving (Supervised).

- 0% financing for up to 72 months.

- Inventory discounts of up to $8,000 in selected locations.

- The subject of today’s article, the ability to buyout a leased vehicle.

Below is a video from my friend Dennis that talks about some of the details of the leasing and some things to think about. I then summarize those points, in addition to mentioning some others below.

Some Great Advantages Of Leasing

- You don’t have to worry about selling the car at the end of the lease or taking what the dealer will give you.

- The down payment and monthly payment are frequently a lot lower than financing the same car. They vary widely, but are about half the monthly payment for many vehicles right now.

- You get the federal tax credit even if your income is more than $150,000 (single) or $300,000 (married).

- You get the tax credit even if the vehicle isn’t otherwise eligible. For example, the Cybertruck isn’t eligible yet. The Model S is above the $55,000 limit for sedans and the Plaid Model X is for SUVs.

- You can buy out the car after a week if you don’t like the terms of the lease (but you still get the tax credit you might not have been eligible for).

- You have the option, but not the obligation, to buy the car at the end of the lease. This is a valuable option. A lot can change in the 2 or 3 years of the lease. Affordable electric cars could come out from Tesla or others at $25,000 that would likely tank the value of your car. On the other hand, the Tesla might solve Full Self Driving and your car could double in value, since it can be used by people to make money. Federal and state tax credits could likewise go up or down, and that would also affect the value of your used Tesla greatly.

Some Bad Things I Don’t Like About Leases

- They have a fixed term and I might want to keep the car a longer or shorter period of time.

- If you heavily customize the car, they are a bad deal, since the company wants the car back stock and you either need to reverse all your customizations or accept a lower value for the car.

- If you curb your wheels and get a lot of small dents on your car, the company will likely charge you a big fee to fix all these things. If you own the car, the person buying it may or may not take that much off of the price.

- You don’t build up any equity, so you can feel like a hamster on a treadmill, never getting ahead.

- Leasing isn’t available in all states; 6 states are excluded (KY, NE, NH, OK, SC & WI).

- Looking at the residual values of the Tesla leases, they seem like they assume very low depreciation. For example, a Long Range Rear-Wheel Drive Model 3 has a net cash price after federal tax credit of $34,990 and the lease buyout price of $31,594 after 2 years. That is assuming only 9.7% depreciation over 2 years vs. 30% to 35% for the average car over 2 years (according to Grok). That means the chance that the buyout is a great deal in 2 or 3 years is lower than if the buyout price was much lower.

- The implicit interest rate is not the same on all the cars. According to Dennis, on some cars it is about 1% and on some as high as 13%. If it is high and you are buying just to get the tax credit, you would be wise to buy it out after a week and just finance it. If it is low, you might just keep the lease and enjoy the option to buy it at the end of the term. Dennis suggests you go to the Tesla sales center in your city to find out the money factor (which is the finance term for interest rate) for each model of each car.

Two Very Different Deals

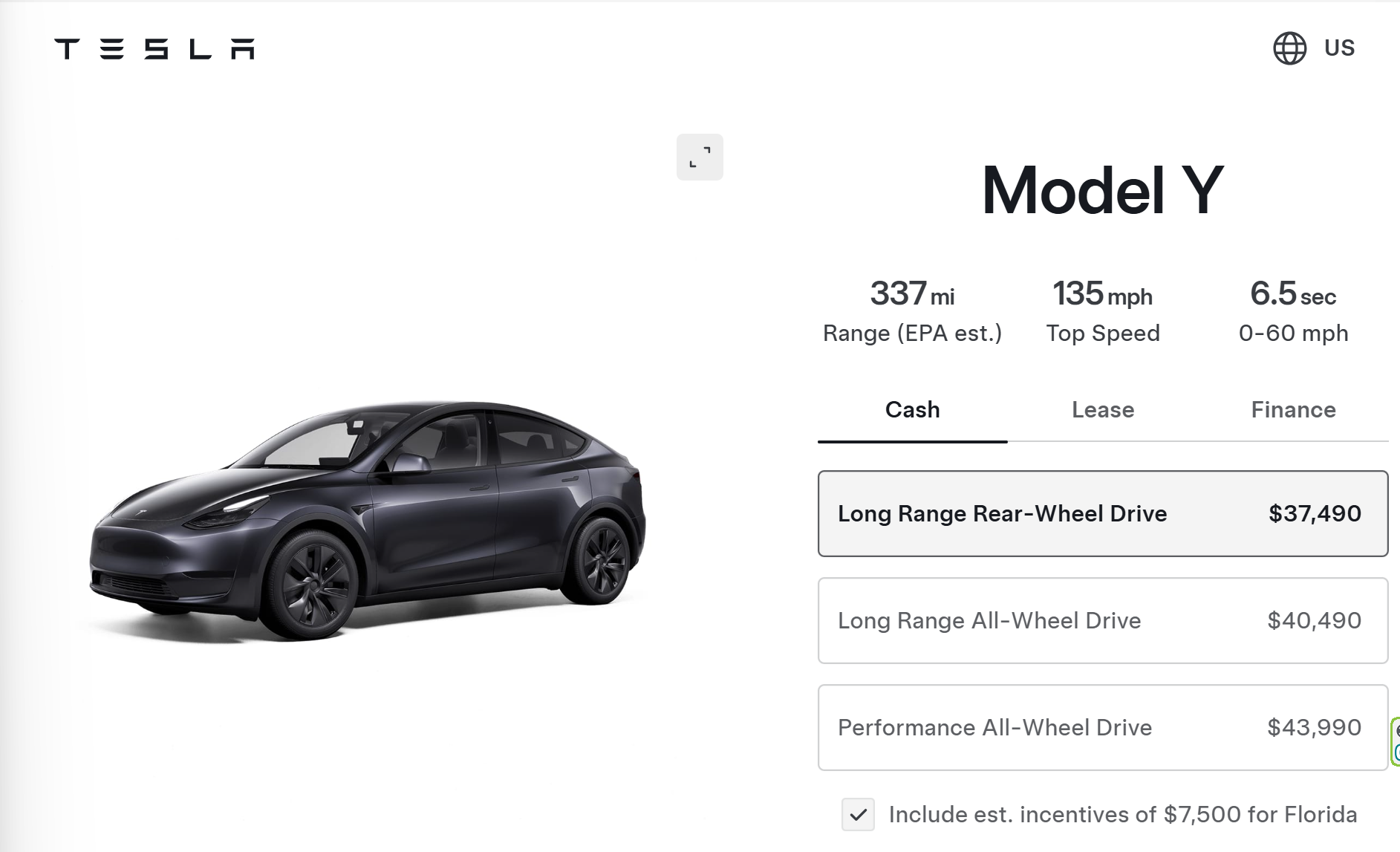

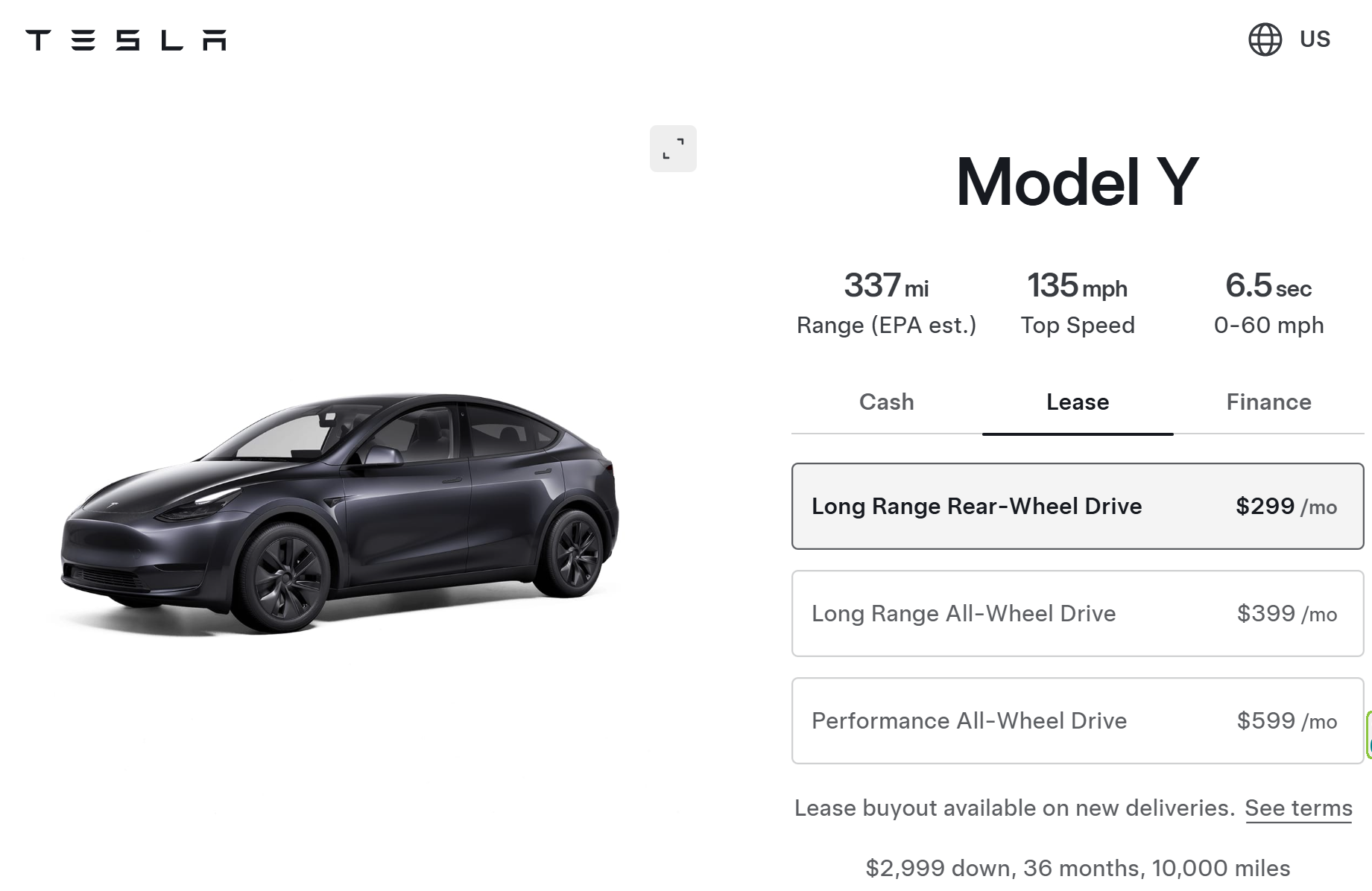

Below is an example of two models that appear to be vastly different deals.

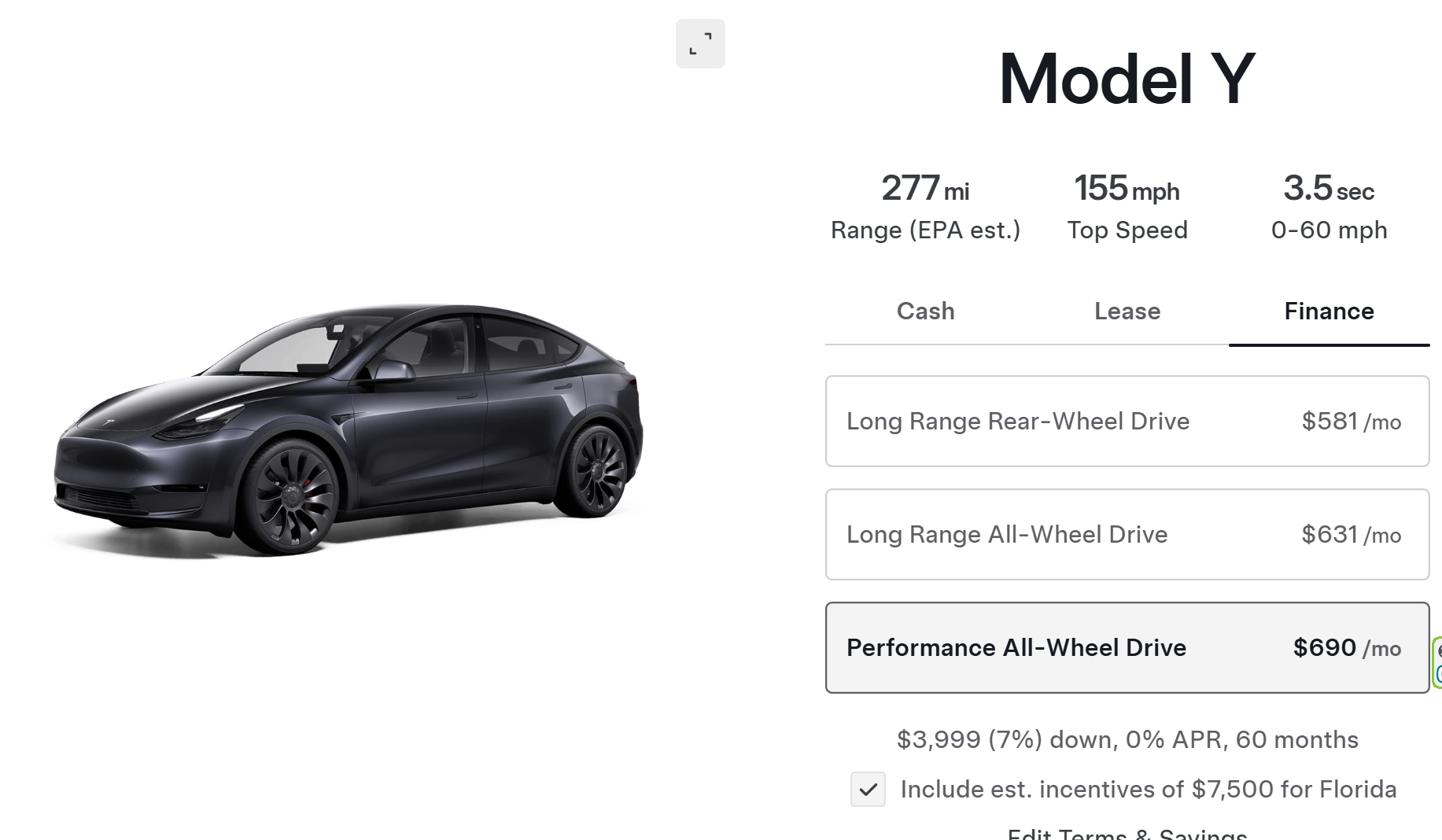

You notice the cash price of the Performance Model Y is $6,500, or 17% more than the Long Range Rear-Wheel Drive.

Now the lease payment (with the same $2,999 down payment, 36 months, and 10,000 miles a year) is double for the Performance! That seems odd. If I wanted the Performance, I would either just finance it or pay it off quickly if I needed to lease to get the tax credit.

You notice the finance payment is 18.8% higher for the Performance model, very similar to the 17% difference in price. Let’s look at the residual values and see if that tells us anything. The Long Range RWD has a residual value of $28,292, or $9,198 less than the cash price, while the Performance model has a residual value of $31,728, or $12,292 less than the cash price. This is 33% more depreciation than the Long Range model, but really only about $1,000 more than expected. The big elephant in the room is the Long Range has $10,764 in payments over 3 years and the Performance has $21,564 in payments, a shocking $10,800 more in payments for a car that is only $6,500 more to buy new. So, the lease seems to be a good deal for some vehicles.

- Long Range RWD Y — $299 a month

- Long Range AWD Y — $399 a month

- Long Range AWD 3 — $349 a month

The following don’t seem to be great lease deals to me:

- Long Range RWD 3 ($299 a month), since it is only $50 a month less than the AWD 3, which is of course better in snow and has more amplifiers and speakers, and the AWD has a residual value only $734 higher for a car with a $5,000 higher cash price.

- Performance 3 ($599 a month), since it has a much higher payment for a vehicle that is a little more expensive to buy with financing or buy with cash.

- Similarly, a Performance Y ($599 a month), since it has a much higher payment for a vehicle that is a little more expensive to buy with financing or buy with cash.

Conclusion

It does get complicated, but I hope I gave you some things to think about. In one sense, you want to decide what car best meets your needs first, but with all the different ways to buy the different vehicles, it is easy to talk yourself into an upgrade or downgrade just to get a better deal. Let me know in the comments if you agree with my analysis and see any other angles that I missed. Regardless of what you decide and if you even decide to buy a Tesla or some other vehicle, it might be good to buy before 2025, since the battery materials requirements change on January 1st, and then on January 20th, when we get a new president, we might have more changes that will likely not be positive for electric vehicle buyers.

If you want to take advantage of my Tesla referral link to get Reward Credits, here’s the link: https://ts.la/paul92237 — but as I have said before, if another owner helped you more, please use their link instead of mine. If you want to learn more about Tesla’s new referral program (August 2024), Chris Boylan has written an excellent article on it.

Disclosure: I am a shareholder in Tesla [TSLA], BYD [BYDDY], Nio [NIO], XPeng [XPEV], NextEra Energy [NEP], and several ARK ETFs. But I offer no investment advice of any sort here.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy