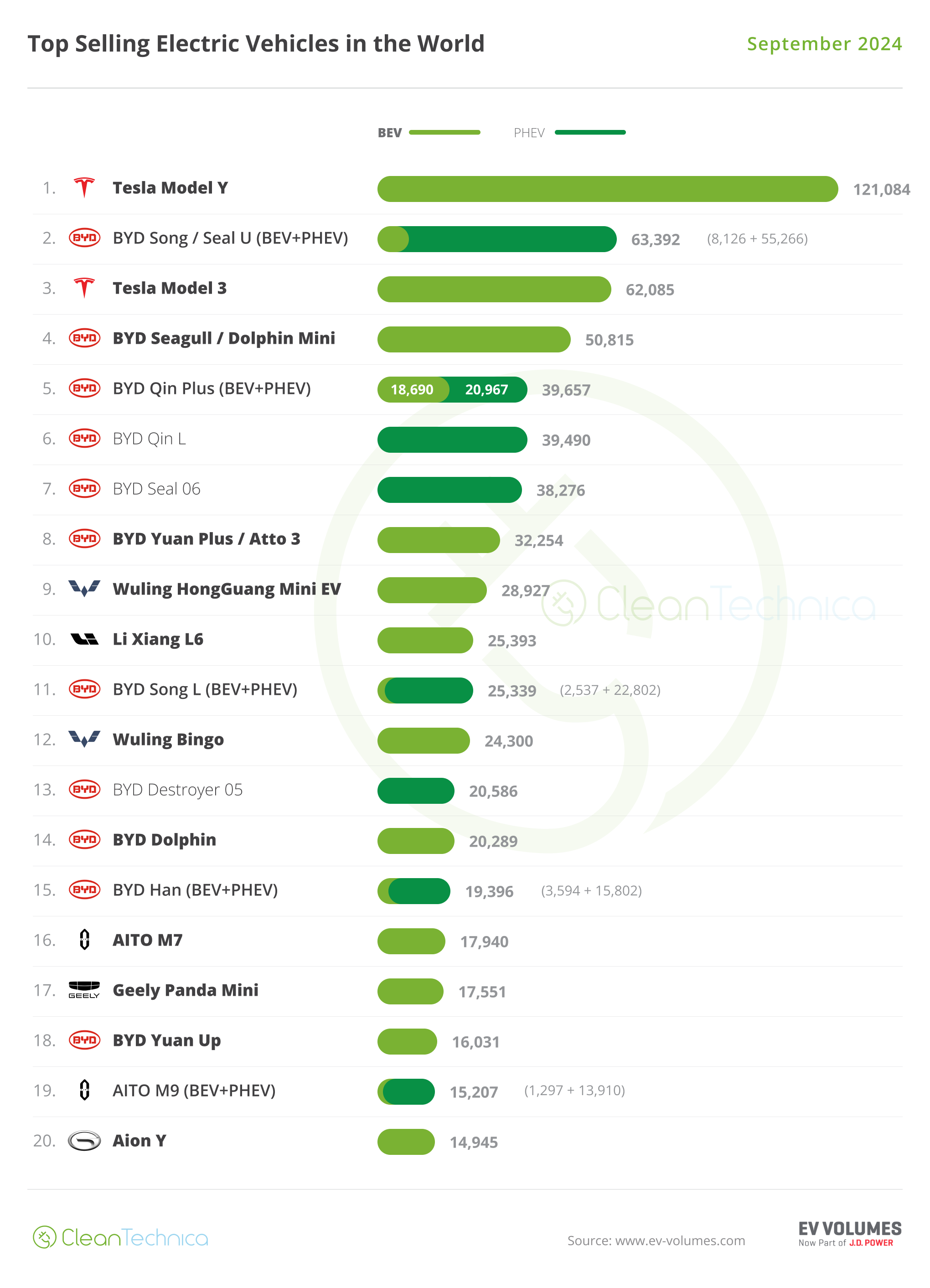

In recent years, the conventional Mannville oil play around Lloydminster and Cold Lake has witnessed a surge in activity and production. Termed an “emerging hot spot” for Canadian drillers by Bloomberg[1] , the play is cheap to develop with low associated GHG emissions. GLJ has a long history evaluating Mannville oil in Alberta and Saskatchewan and is seeing a notable resurgence of development with many years of sustainable growth planned.

Over 1,000 horizontal wells have been drilled in this area between 2019 and 2023 using an array of exploitation technologies. Not only is the well count impressive, so is the number of operators actively engaged in drilling and production within the play. A quick search on horizontal wells and operators producing from the Mannville group since 2019 illustrates the play’s expansive reach.

Well designs include several configurations including multi-leg horizontals, single-leg horizontals, and fishbone patterns. Wells can be open-hole or cased, and some even include small fracs. Operators continue to deploy a variety of fit-for-purpose designs and patterns based on localized geology, economic optimization, surface and fluid considerations, and strategy.

Figure 1: Lloydminster and Cold Lake Activity Hot Spots – Conventional Mannville Producing Horizontal Wells On Production 2019 – Present

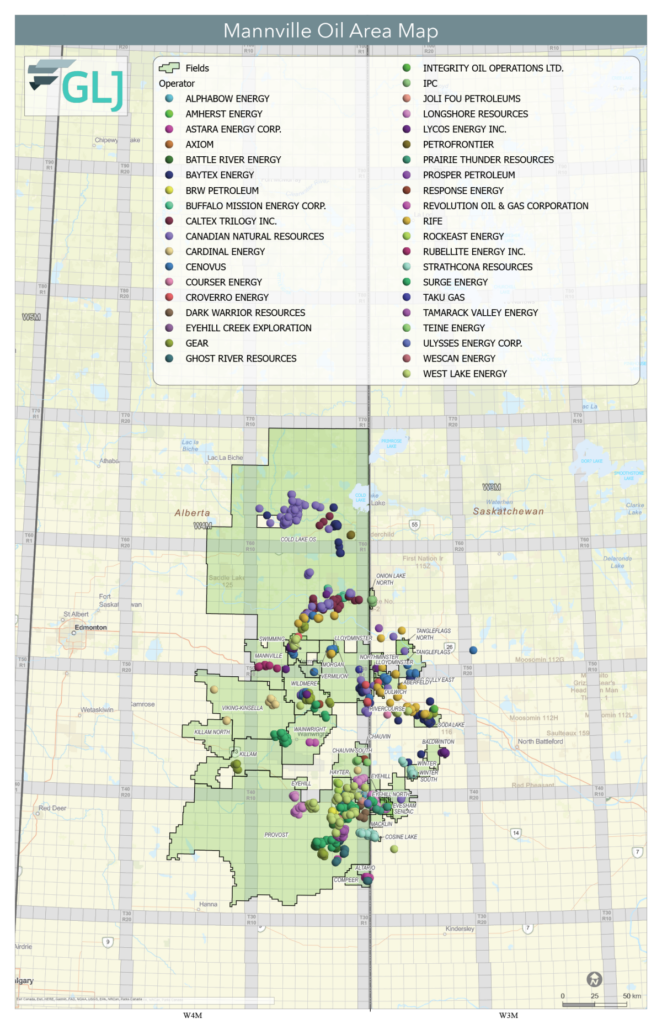

Based on production growth since 2019, the leading operators are CNRL, Baytex Energy, and Surge Energy. Other key players continuing to make strides include West Lake Energy, Caltex Trilogy, Strathcona Resources, and Rife Resources, just to name a few.

The increase in oil prices and success of multilateral wells since the end of 2020 has been like rocket fuel to the play. Recent wells have faster payback periods, which allows for fast recycling of cash. The play is very responsive in high oil price environments. The fast, low-cost wells, with quick payouts also mean the real option value of the play is very high compared to other plays which can take years for development to spool up.

Figure 2: Lloydminster and Cold Lake Area Conventional Mannville Production Growth by Operator; Producing Horizontal Wells On Production 2019 – Present

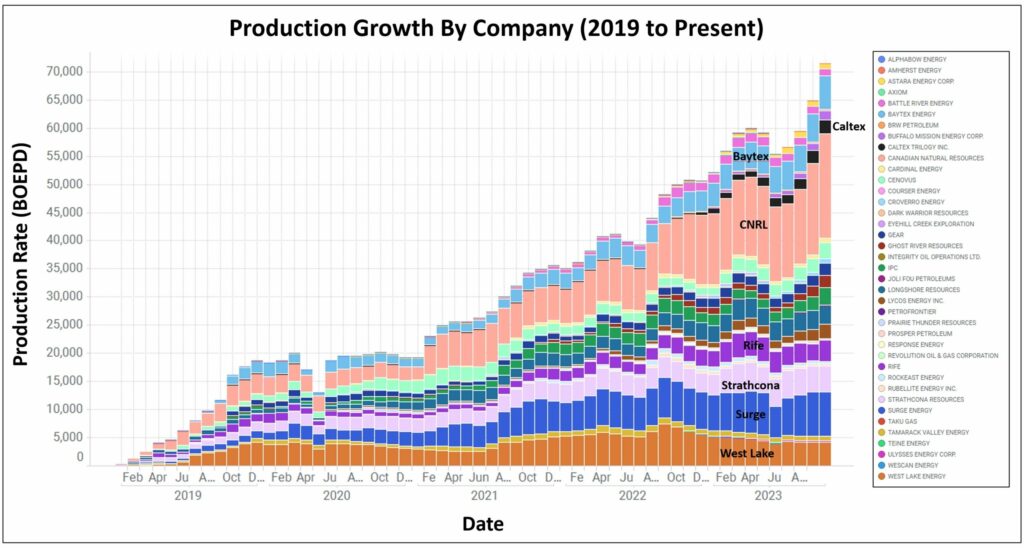

Figure 3: Lloydminster and Cold Lake Area Conventional Mannville Production Growth by Field; Producing Horizontal Wells On Production 2019 – Present

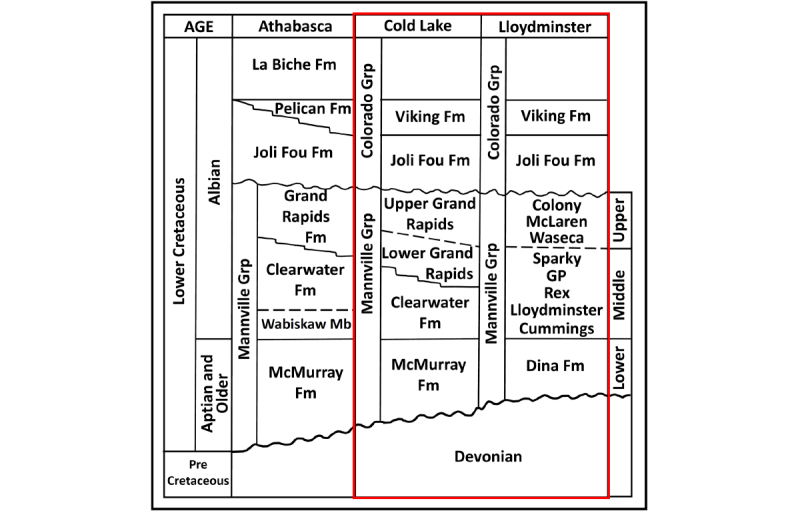

Geology drives the success of the play. Stay tuned for Part 2 which delves deeper into the geologic criteria necessary for success. The Mannville group, shown below, encompasses a variety of formations that were deposited in a range of different environments. The distinct members that constitute the Mannville group within the Cold Lake and Lloydminster areas include Colony, McLaren, Waseca, and Sparky, to name a few.

Figure 4: Mannville stratigraphy of east-central and northern Alberta (modified from O’Connell & Benns, 1987)[2]

Typically, formations like Sparky, McLaren, Waseca, and Colony are low water-cut and amenable to exploitation with multilaterals. But however we look at it, the Mannville oil play has been demonstrating remarkable production and netback results.

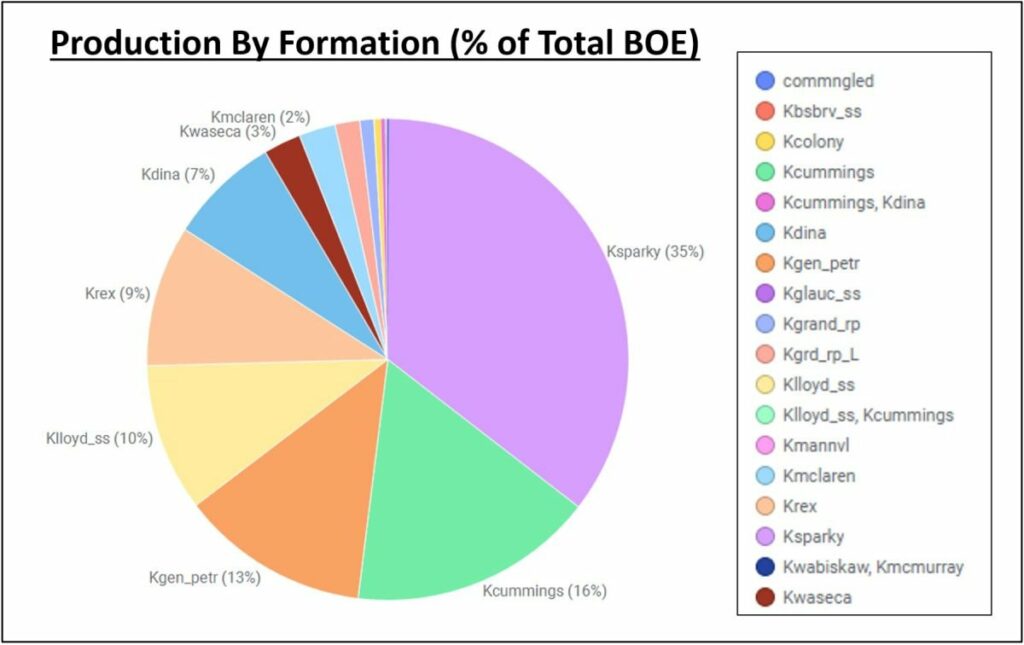

Figure 5: Lloydminster and Cold Lake Area Conventional Mannville Production by Formation; Producing Horizontal Wells On Production 2019 – Present (based on GeoSCOUT Producing Formations)

Well development costs are significantly lower (typically less than $2 million per well) compared to other plays such as the Montney and Duverney. Wells are produced under primary recovery with some operators implementing secondary recovery techniques. The forethought for secondary recovery in the future is important. GLJ is able to screen reservoirs for secondary and tertiary recovery and assist operators in maximizing the value of their assets.

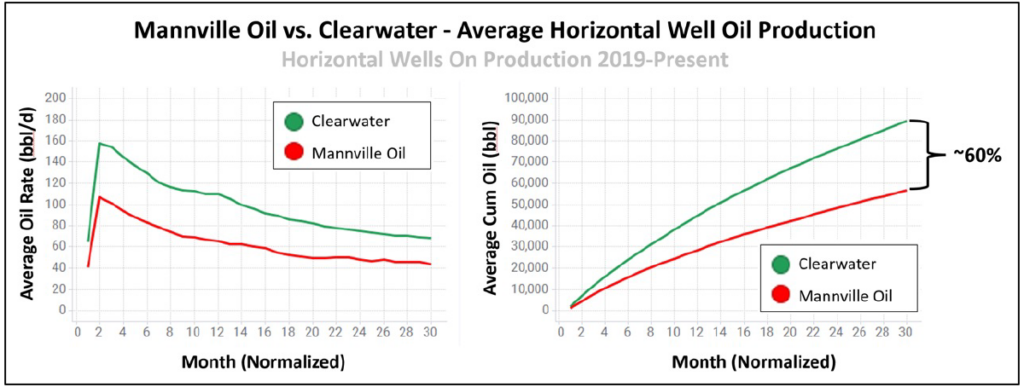

Since 2019, the average lateral length of wells in this area has remained relatively stable with a slight increase over time. Without any correction to length and legs in the ground, the average horizontal well oil production performance for the Mannville has already reached approximately 60% of that of an average multilateral Clearwater well.

Figure 6: Lloydminster and Cold Lake Area Conventional Mannville Horizontal Well Length by Year; Producing Horizontal Wells On Production 2019 – Present

(Note: Average lateral length calculated based on the individual lateral lengths (legs) for both single and multi-lateral wells.)

Figure 7: Production Comparison – Average Lloydminster and Cold Lake Area Mannville Horizontal Well vs. Average Clearwater Horizontal Well; dataset of Producing Horizontal Wells On Production 2019 – Present (excludes normalization for meters drilled per well)

Where do we go from here?

The Mannville stack undoubtedly contains a massive oil resource, characterized by variable and complex geology. The play is geologically driven and conventional in nature and stratigraphy can be challenging. The regional sands can vary in thickness, quality, and distribution, and channels that cut into the regional sands can complicate correlations.

Geological factors are among the most important drivers of success and well performance in the play. The reservoirs exhibit broad variation. Even in the same geological setting, the sands are not uniform. Differences occur over various scales, i.e., field to field, pool to pool, zone to zone, even well to well. The same formation can display dramatic changes in oil quality (viscosity and specific gravity), grain size, compaction, and cementation within a few sections, which impacts production performance. Free and bottom water can also complicate oil recovery.

Advantages:

- Low capital per well.

- Quick drill and on-production time.

- Large resource size.

- Shallow depth.

- Access to infrastructure.

- Well-delineated.

- Lower barrier to entry vs. hot plays such as the Clearwater, Montney, Duvernay.

Challenges To Overcome:

- Localized optimal well and completion design.

- Consideration for sand production.

- Oil gravity, viscosity, and permeability variations.

- Future EOR.

- Land acquisition.

Please stay tuned in the New Year for Parts 2 and 3 of our series, where we will delve deeper into the geology, performance highlights, and economics.

Get in touch with us to explore how we can help your company unlock its Mannville potential.

[1] https://worldoil.com/news/2023/10/23/new-canadian-hot-spot-draws-oil-drillers-seeking-cheaper-lower-emissions-crude/

[2] O’Connell, S. C., & Benns, G. W. (1987). The Geology of the Mid Mannville Subgroup in the West-Central Llyodminster Heavy Oil Trend, Alberta. Alberta Research Council Open File Report, Number EO 1988-1, 85.

Share This:

Next Article