Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

Looking through Deloitte’s 2025 Global Automotive Consumer Study more closely today, some things jumped out at me on differences between the Chinese, German, and US EV markets.

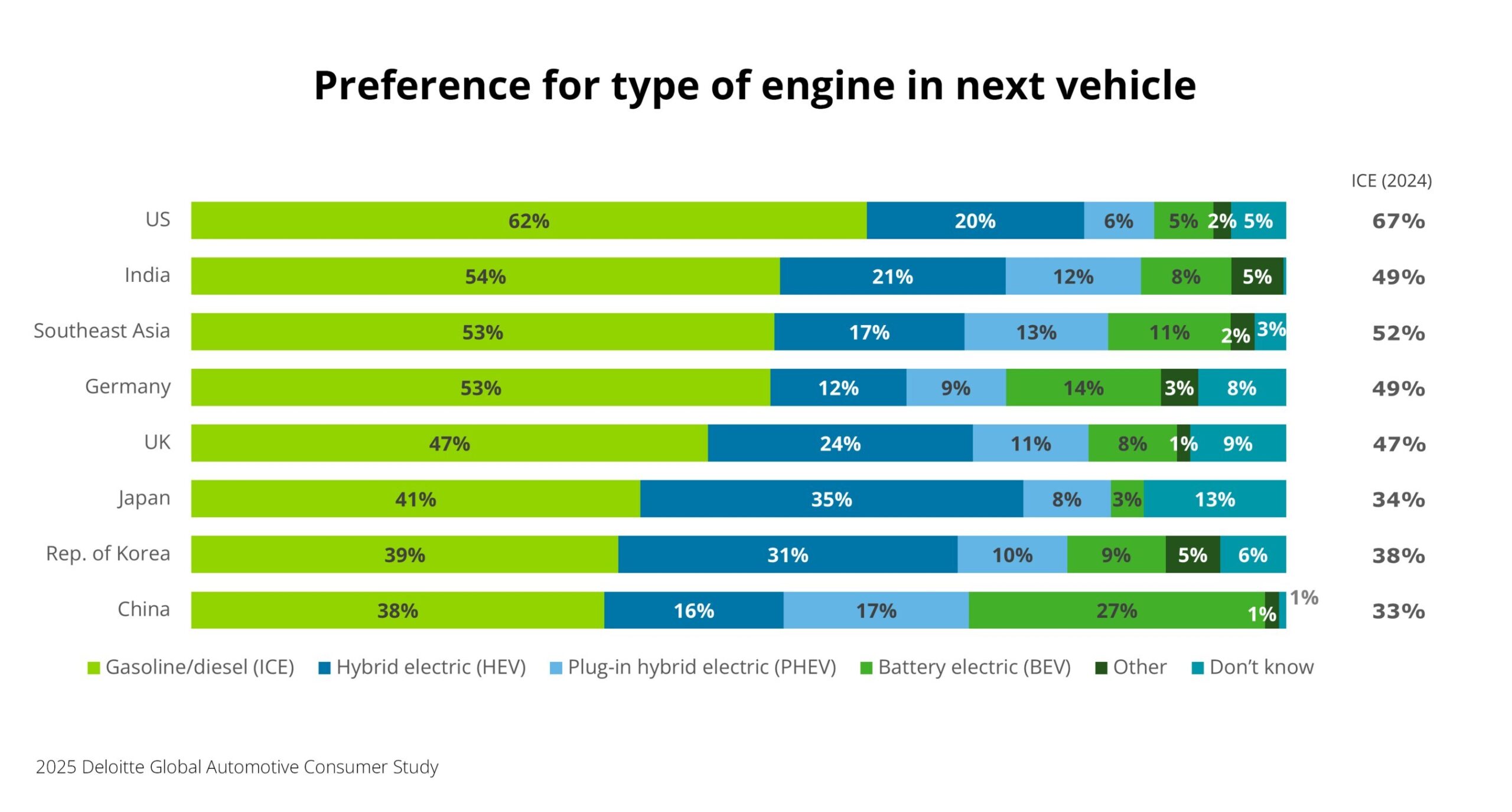

We already covered the obvious one from China being a more mature EV market — many more people plan to buy a BEV next in China than in Germany or the US, and many more also plan to buy a plugin hybrid there. But let’s go beyond that.

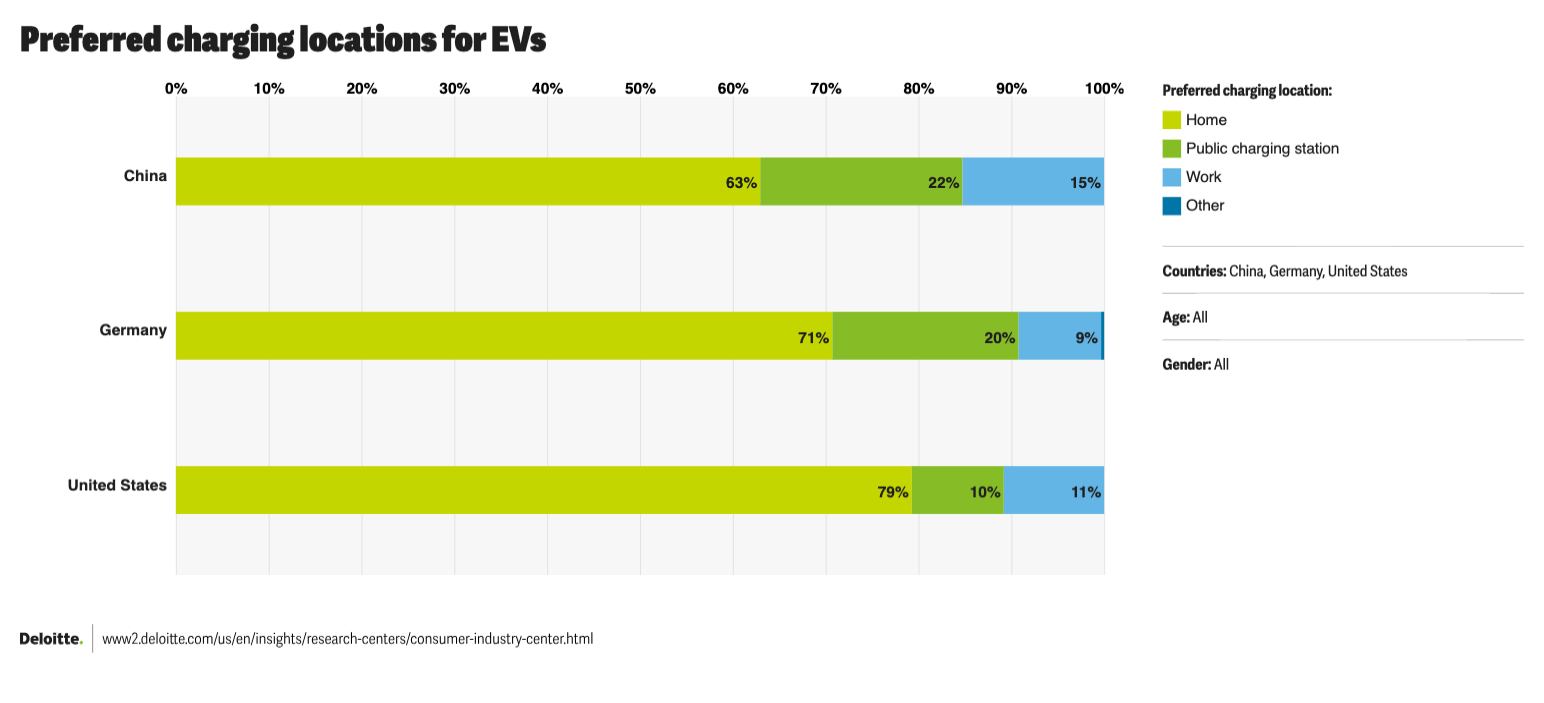

This one is not the most extreme, but I did find it interesting that about 50% more respondents in China (15%) selected their workplace as their preferred charging location compared to Germany (9%) or the USA (11%). I wonder how much of that comes from limited home charging options in the big cities of China or how much comes from people in the more mature Chinese EV market realizing that free workplace charging is a nice benefit.

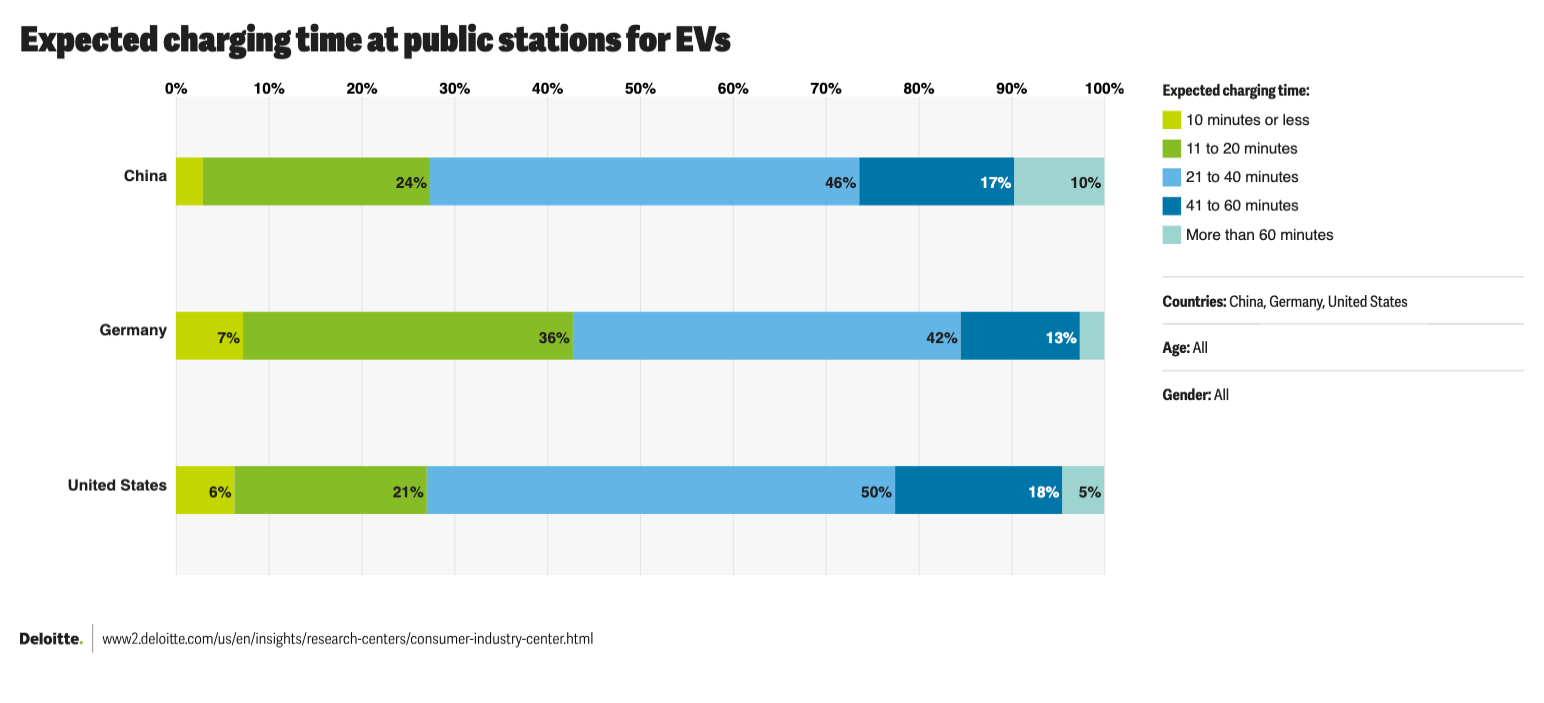

This one is quite interesting. Looking at how quickly people expect their EVs to charge at public charging stations (fast charging stations), only 3% of Chinese respondents expected charging to last only 10 minutes or less, and only 27% expected it to last 20 minutes or less. That compares with 7% and 34% in Germany, respectively, and 6% and 27% in the US. At the top end, 27% of Chinese respondents expect the charging to take more than 40 minutes, compared to 15% of German respondents and 23% of American respondents.

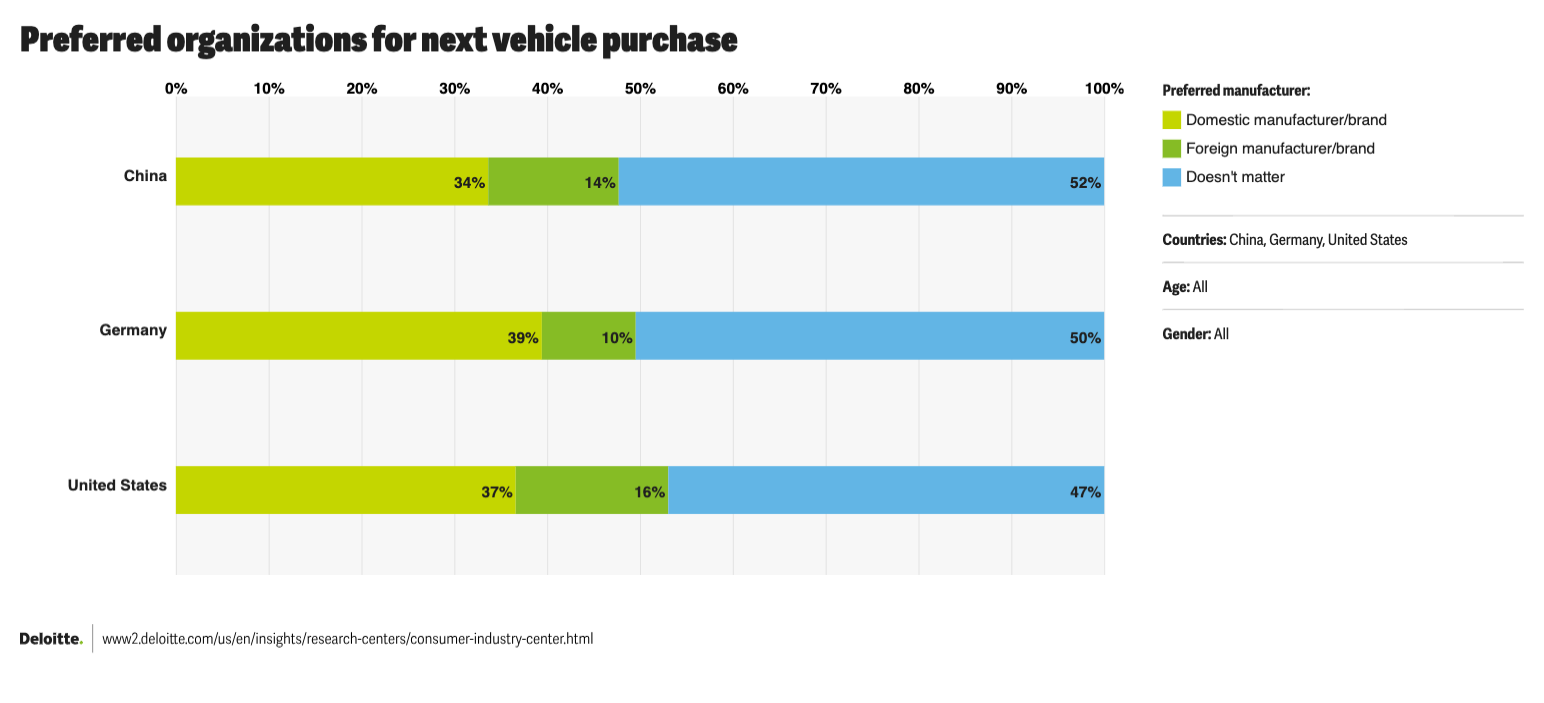

When it comes to loyalty to a domestic auto brand, Germanys are the most loyal, with 39% wanting to buy from a German automaker, compared to 37% of Americans and 34% of Chinese. Americans are most interested in buying from a foreign manufacturer (16%), with Chinese right behind (14%) and Germans not having much strong interest in specific foreign brands (10%). Overall, though, about 50% of consumers in all markets are apathetic to the nationality of the auto brand they’re going to buy from.

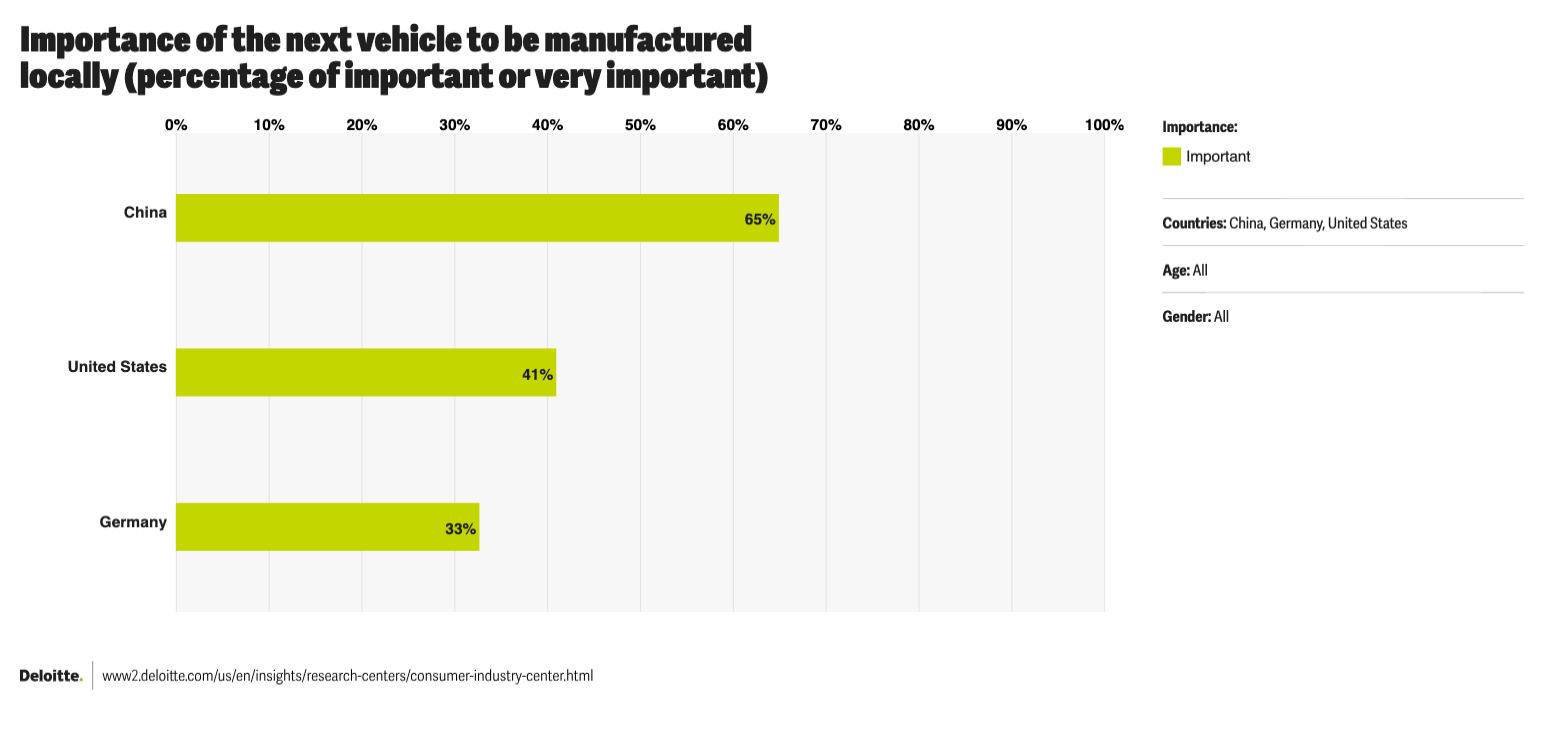

The odd thing, though, comparing the above, is looking at how important the different respondents said it was that the car they bought be produced locally:

Clearly, the long-running “make in China” focus has leaked through to consumers. Regarding Germany, one would also think its position in the European Union makes consumers more open to buying vehicles from Spain, Czech Republic, etc. That said, with so much of the German economy built around its big automakers, I’m surprised by this result.

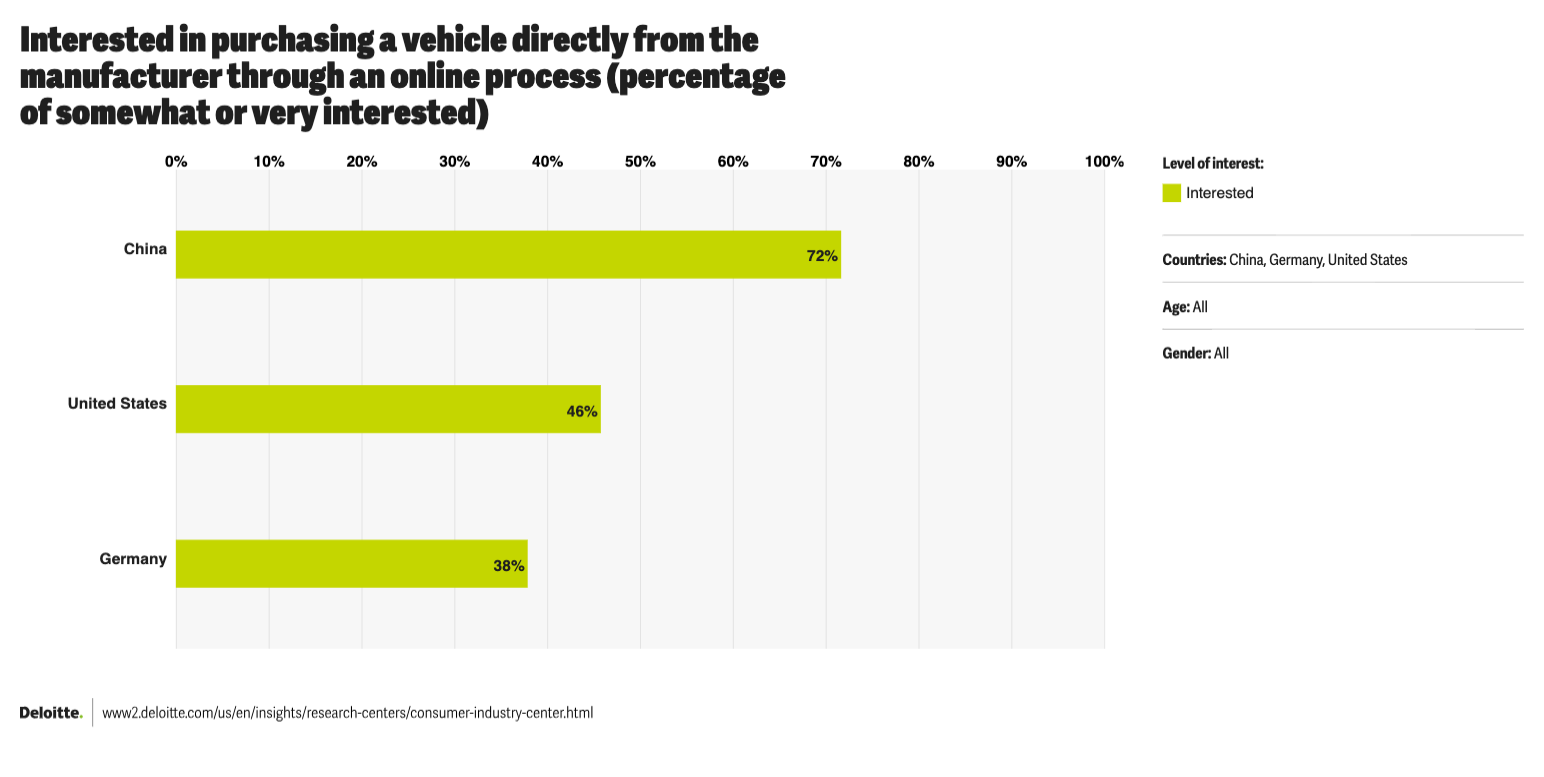

Consumers in China have gotten very accustomed to buying their cars directly from automakers online, with 72% of respondents there being interested in this. The Germans, meanwhile, are most interested in getting into an auto dealership/salon to make the purchase.

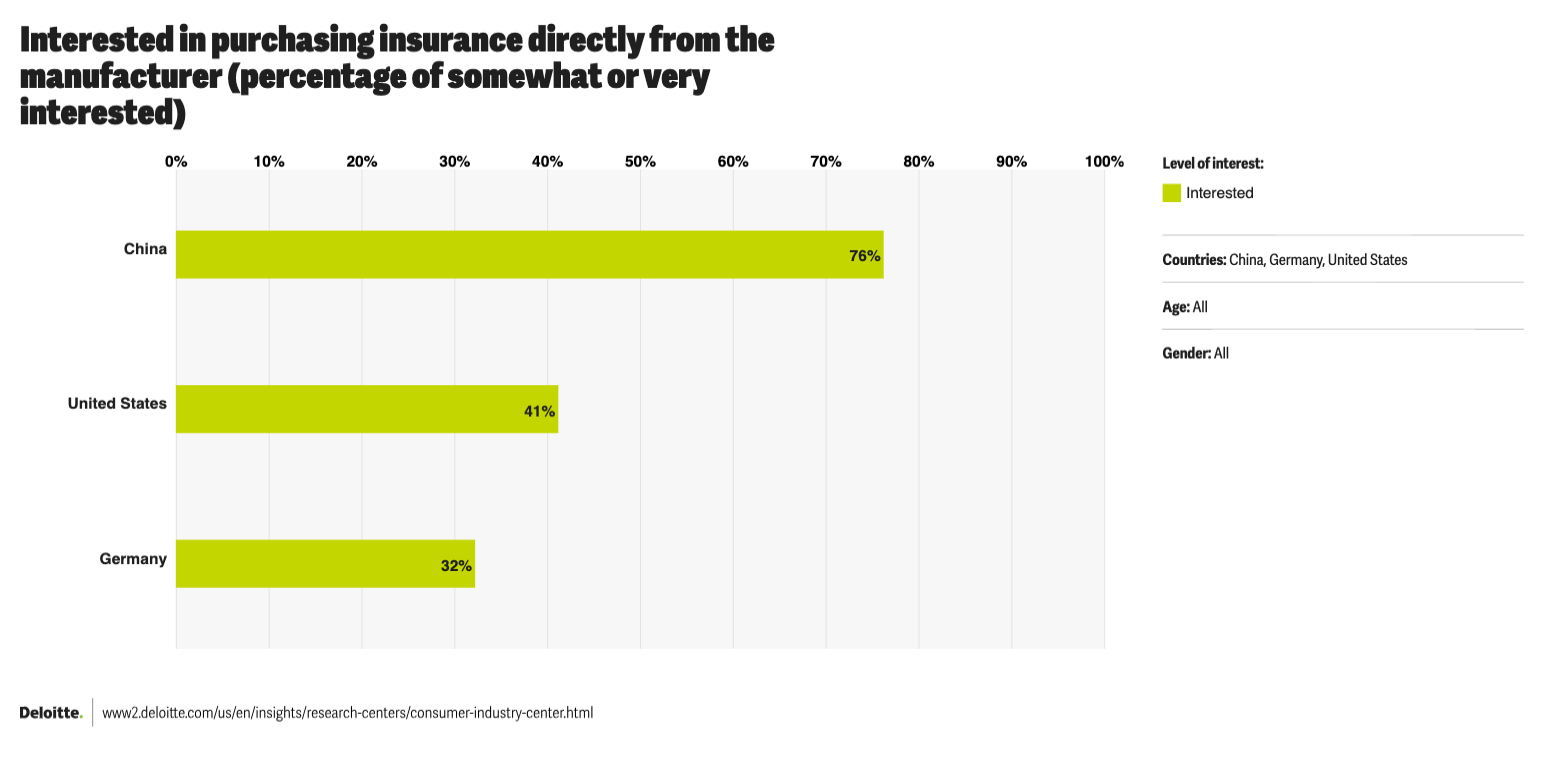

This one is really interesting to me. Clearly, Chinese consumers have gotten accustomed to buying insurance from the automaker as well.

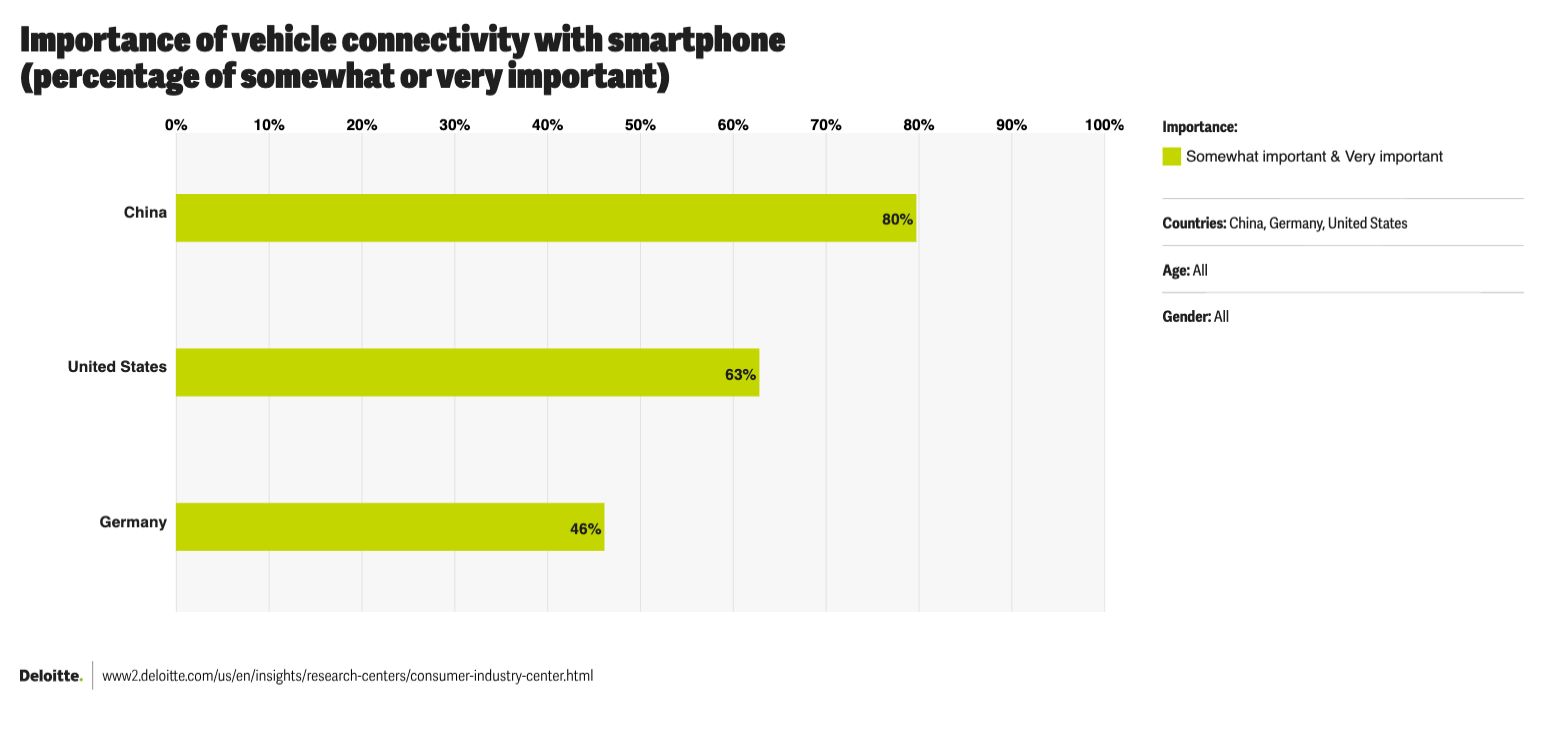

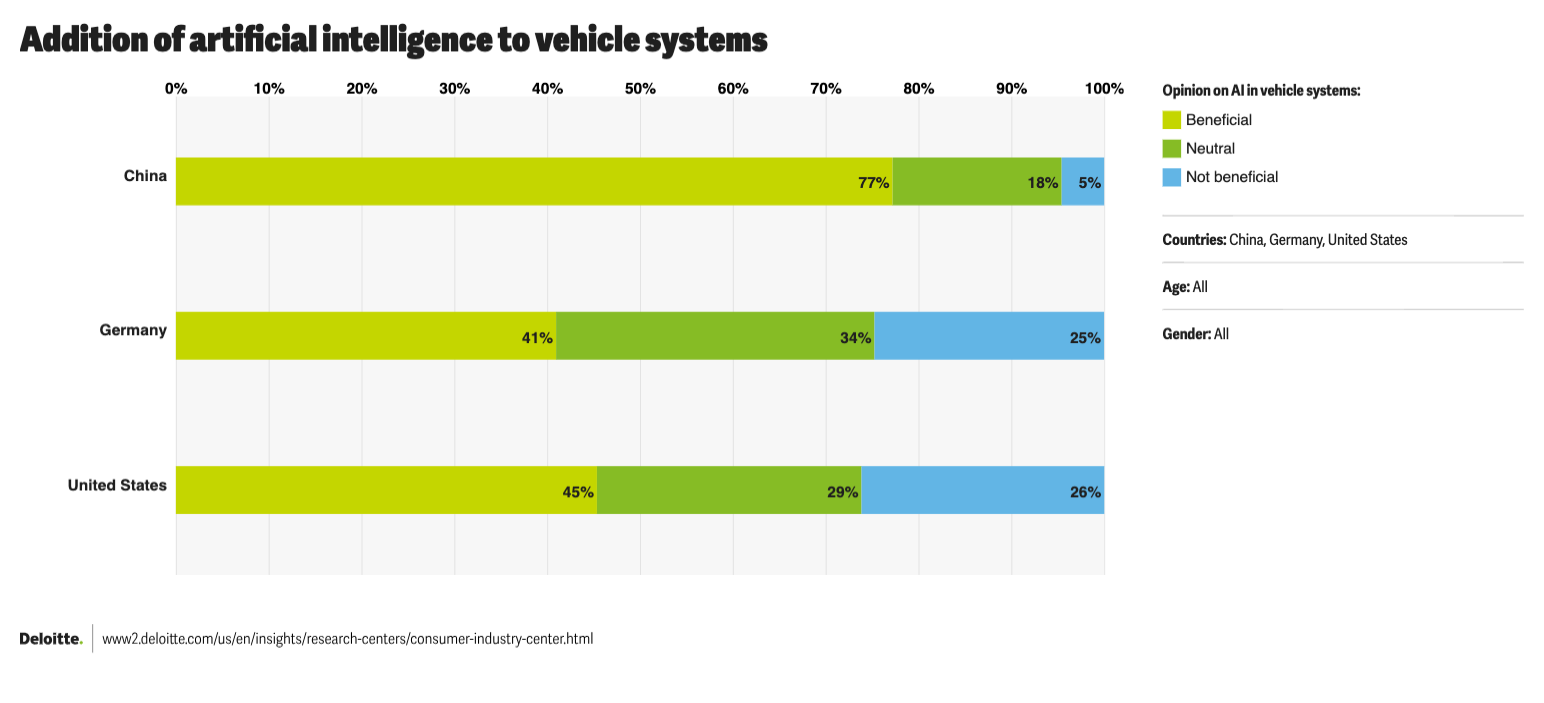

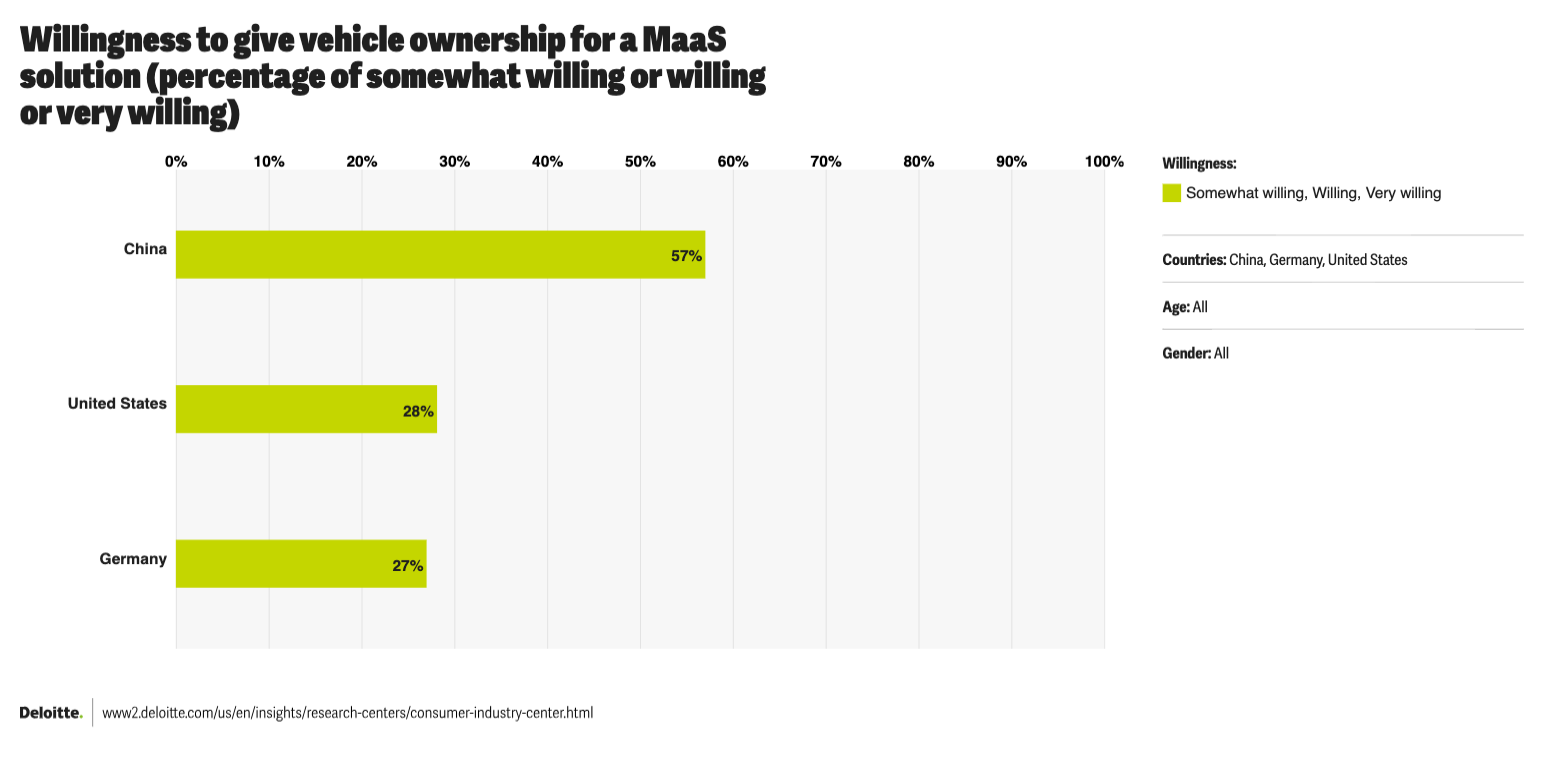

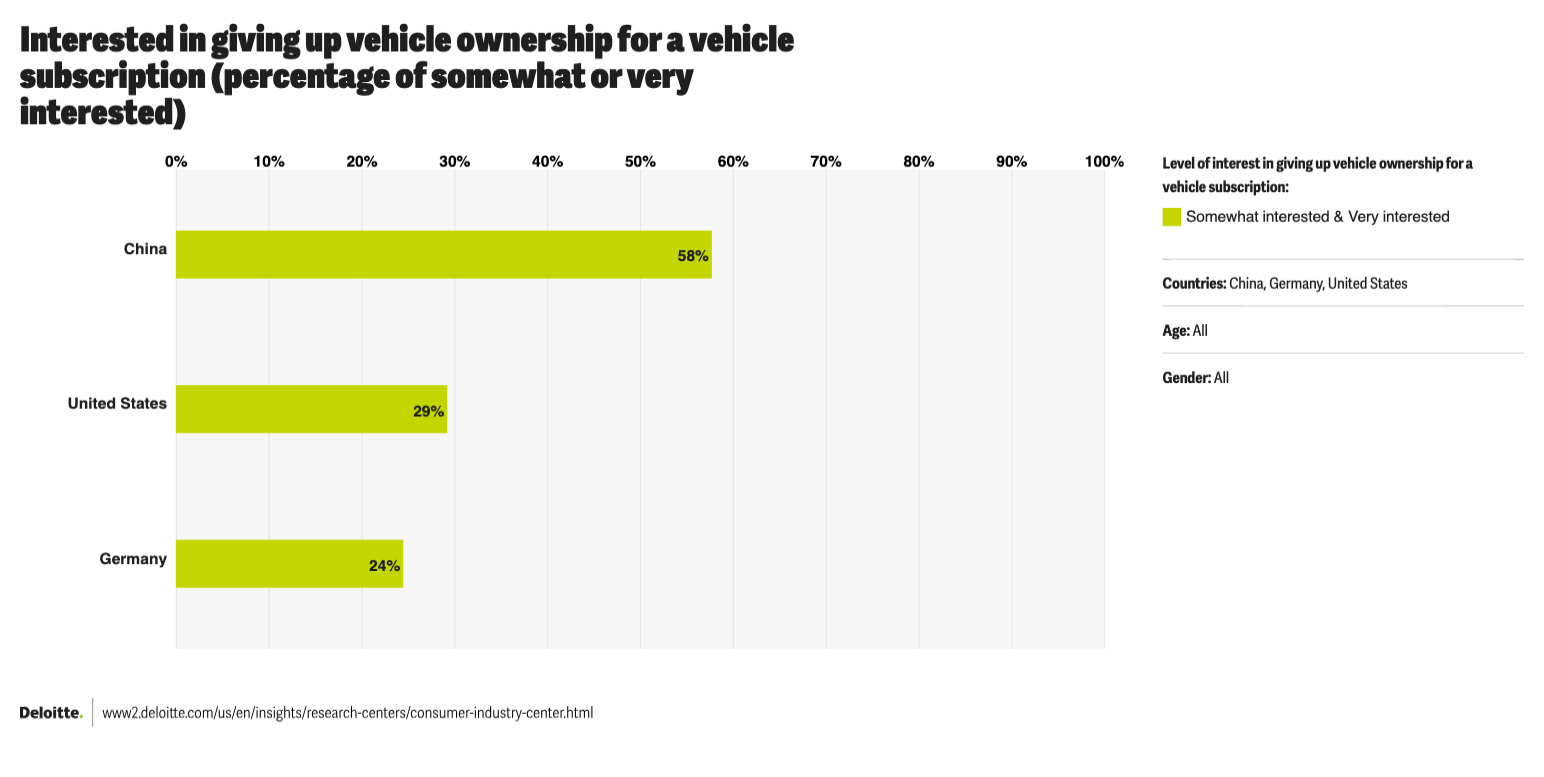

These last four seemed best to bunch together. Again, China’s more advanced EV market, or auto market in general, is coming through with consumers’ interest in having smart EVs, AI integrated into their EVs, and the potential for MaaS rather than owning cars and driving themselves. China is far ahead in these interests or demands, while Germans are the most reticent.

“More than three-quarters of consumers surveyed in India and China believe the addition of artificial intelligence to vehicle systems is beneficial. On the other hand, a quarter of consumers surveyed in Germany, the United States, and the United Kingdom remain skeptical about the technology,” Deloitte adds.

Any other thoughts from these findings?

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy