Select financial and operating information is outlined below and should be read in conjunction with the Company’s unaudited interim financial statements and management’s discussion and analysis for the three months ended March 31, 2024, available at www.sedarplus.ca and on Surge’s website at www.surgeenergy.ca.

Q1 2024 FINANCIAL AND OPERATING HIGHLIGHTS

Surge’s Board and Management continue to be optimistic regarding the outlook for crude oil prices based on a tight physical market, ongoing geopolitical issues, and the significant underinvestment in the energy industry over the past several years.

During Q1/24, Western Canadian oil producers were significantly impacted by wide crude oil differentials. The Western Canadian Select (“WCS”) differential (a discount to US WTI per barrel) averaged US$19 per barrel in Q1/24, however, has now tightened to approximately US$12 per barrel on the spot market. Additionally, the Mixed Sweet Blend (“MSW”) light oil differential, which averaged a discount to WTI of US$9 per barrel in Q1/24, is now currently trading at a US$3 per barrel discount to WTI.

Surge’s forecasted 2024 annual cash flow from operating activities increases by approximately $9 million for every US$1 per barrel increase in the WTI price1. Furthermore, every US$1 per barrel decrease in either the WCS or MSW differential increases the Company’s forecasted 2024 annual cash flow from operating activities by approximately $4.5 million1. A US$1 per barrel decrease in both differentials increases Surge’s forecast 2024 annual cash flow by $9 million1.

Surge is pleased to report the Company reduced its Scope 1 greenhouse gas emissions intensity by 18 percent in 2023 as compared to 2022. Surge has now reduced its Scope 1 emissions intensity by 28 percent since 2021. These results demonstrate the Company’s continued commitment to reducing the emissions intensity of its operations.

In Q1/24, Surge achieved average daily production of 24,903 boepd (86 percent liquids). These strong quarterly production levels were achieved with Surge having drilled four less (net) wells than originally budgeted for Q1/24, as the Company reacted to earlier than anticipated spring break up conditions in both SE Saskatchewan and Sparky core areas.

Highlights from the Company’s Q1 2024 financial and operating results include:

- Delivered cash flow from operating activities of $66.8 million, and generated adjusted funds flow2 (“AFF”) of $62.5 million;

- Achieved average daily production of 24,903 boepd (86 percent liquids);

- Returned over $12 million of cash dividends to shareholders; and

- Drilled 24 gross (21.4 net) wells, with activity focused in the Company’s Sparky and SE Saskatchewan core areas.

|

________________________________ |

|

1 Sensitivities are based on the Company’s 2024 guidance production of 25,000 boepd and the following pricing assumptions: US$75 WTI, US$16 WCS differential, US$3.50 EDM differential, $0.725 CAD/USD FX and $2.95 AECO. |

|

2 This is a non-GAAP and other financial measure which is defined under Non-GAAP and Other Financial Measures. |

FINANCIAL AND OPERATING HIGHLIGHTS

|

FINANCIAL AND OPERATING HIGHLIGHTS |

Three Months Ended March 31, |

||

|

($000s except per share and per boe) |

2024 |

2023 |

% Change |

|

Financial highlights |

|||

|

Oil sales |

150,716 |

152,664 |

(1) % |

|

NGL sales |

3,935 |

3,618 |

9 % |

|

Natural gas sales |

3,516 |

5,688 |

(38) % |

|

Total oil, natural gas, and NGL revenue |

158,167 |

161,970 |

(2) % |

|

Cash flow from operating activities |

66,785 |

54,506 |

23 % |

|

Per share – basic ($) |

0.66 |

0.56 |

18 % |

|

Per share diluted ($) |

0.66 |

0.55 |

20 % |

|

Adjusted funds flowa |

62,487 |

63,331 |

(1) % |

|

Per share – basic ($)a |

0.62 |

0.65 |

(5) % |

|

Per share diluted ($) |

0.62 |

0.64 |

(3) % |

|

Net income (loss)c |

(3,630) |

14,789 |

(125) % |

|

Per share basic ($) |

(0.04) |

0.15 |

(127) % |

|

Per share diluted ($) |

(0.04) |

0.15 |

(127) % |

|

Expenditures on property, plant and equipment |

49,400 |

45,733 |

8 % |

|

Net acquisitions and dispositions |

(8) |

(678) |

nmb |

|

Net capital expenditures |

49,392 |

45,055 |

10 % |

|

Net debta, end of period |

295,924 |

331,917 |

(11) % |

|

Operating highlights |

|||

|

Production: |

|||

|

Oil (bbls per day) |

20,620 |

21,055 |

(2) % |

|

NGLs (bbls per day) |

860 |

721 |

19 % |

|

Natural gas (mcf per day) |

20,539 |

20,172 |

2 % |

|

Total (boe per day) (6:1) |

24,903 |

25,138 |

(1) % |

|

Average realized price (excluding hedges): |

|||

|

Oil ($ per bbl) |

80.32 |

80.57 |

— % |

|

NGL ($ per bbl) |

50.25 |

55.78 |

(10) % |

|

Natural gas ($ per mcf) |

1.88 |

3.13 |

(40) % |

|

Netback ($ per boe) |

|||

|

Petroleum and natural gas revenue |

69.79 |

71.59 |

(3) % |

|

Realized gain (loss) on commodity and FX contracts |

0.06 |

(0.88) |

nm |

|

Royalties |

(13.30) |

(12.84) |

4 % |

|

Net operating expensesa |

(21.81) |

(22.26) |

(2) % |

|

Transportation expenses |

(1.18) |

(1.79) |

(34) % |

|

Operating netbacka |

33.56 |

33.82 |

(1) % |

|

G&A expense |

(2.26) |

(2.04) |

11 % |

|

Interest expense |

(3.73) |

(3.80) |

(2) % |

|

Adjusted funds flowa |

27.57 |

27.98 |

(1) % |

|

Common shares outstanding, end of period |

100,581 |

98,334 |

2 % |

|

Weighted average basic shares outstanding |

100,529 |

97,087 |

4 % |

|

Stock based compensation dilution |

— |

2,296 |

(100) % |

|

Weighted average diluted shares outstanding |

100,529 |

99,383 |

1 % |

|

a This is a non-GAAP and other financial measure which is defined under Non-GAAP and Other Financial Measures. |

|||

|

b The Company views this change calculation as not meaningful, or “nm”. |

|||

|

c Q1/24 includes a $15.1 million unrealized loss on financial contracts (Q1/23 – $3.6 million unrealized gain on financial contracts). |

|||

OPERATIONS UPDATE: CONTINUED DRILLING SUCCESS IN SPARKY AND SE SASKATCHEWAN CORE AREAS

SPARKY (MANNVILLE)

During Q1/24, Surge continued the Company’s core area Sparky development program, drilling a total of 10 gross (10.0 net) wells in the area.

Approximately 3.5 years ago, Surge announced the discovery of a large new Sparky crude oil pool at Betty Lake with an internally estimated 150 million barrels (25° API) of original oil in place (“OOIP”)3. In April 2024, Surge acquired a 50% working interest and operatorship of the 6-8 gas plant in the Betty Lake area for $3.7 million. This gas plant handles the natural gas volumes associated with the production of crude oil at Betty Lake. The Company’s current production at Betty Lake has now grown to approximately 2,300 boepd (90% oil); and the Company anticipates that operating expenses at Betty Lake will decrease by an estimated $1.50 per boe (from $11.32 per boe in Q1 2024) due to the acquisition.

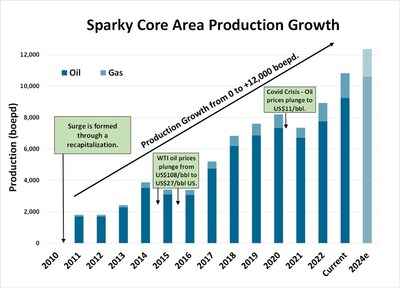

Surge has continued to systematically grow its Sparky core area production (>85% liquids; 23° API average crude oil gravity) from approximately 1,800 boepd in 2010 to nearly 12,000 boepd today (see chart below). Surge has also assembled an internally estimated 11 year development drilling inventory4 of more than 470 net locations in the Sparky/Mannville trend.

|

_______________________ |

|

3 See Oil & Gas Advisories. |

|

4 See Drilling Inventory. |

Surge’s internal estimates now indicate that the Company owns and controls more than 1 billion barrels of net OOIP3 in the medium and light gravity oil portion of the Sparky/Mannville play trend.

In addition to consistent production growth, over the last three years Surge has drilled 18 gross (18.0 net) multi-lateral wells in the Sparky and other Mannville formations. These 18 multi-lateral wells are currently producing a combined 1,250 boepd, representing approximately 11 percent of the Company’s total Sparky core area production.

During Q1/24, the Company drilled and brought on production two multi-lateral wells, one at Betty Lake and one at Hope Valley.

Both of these wells had strong 30 day initial production rates (“IP”), with the Betty Lake well producing at 170 boepd, and the Hope Valley well producing at 230 bopd. The multi-lateral well at Hope Valley is a follow up to the Company’s initial, proof-of-concept, 12 leg multi-lateral open hole well. Management is encouraged by the initial rates from this follow up Hope Valley well, as it continues to be optimized. Surge’s technical interpretation of its recent 46 square kilometer 3-D seismic program allowed the Company to optimally drill this well and has de-risked future drilling locations in Hope Valley.

In the second half of 2024, Surge anticipates drilling 27 gross (27.0 net) wells in the Sparky core area, including 8 gross (8.0 net) additional multi-lateral wells. The Company has now identified over 85 multi-lateral locations within its Sparky (Mannville) core area4.

SE SASKATCHEWAN

During the first quarter of 2024, Surge continued its core area SE Saskatchewan development program, highlighted by the drilling of 14 gross (11.4 net) wells in Surge’s large OOIP Steelman light oil pools.

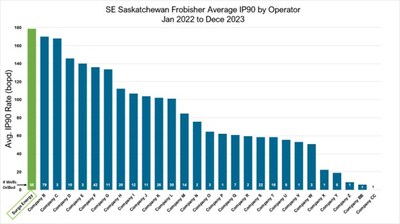

Surge continues to drill some of the highest initial production rate, light oil Frobisher wells of any operator in the Province of Saskatchewan. Notably, the Company’s 01-03-005-06W2 well, drilled in Q1/24 at Steelman, produced at a rate of more than 550 bopd on an IP30 basis.

The following chart illustrates Surge’s peer leading 180 bopd IP90 rates from 56 wells targeting the Frobisher formation over the last two years:

SE Saskatchewan Frobisher Average IP90 By Operator (January 2022 – December 2023)

Source: GeoScout

On average, Surge’s Frobisher wells pay out in approximately 12 weeks4 (at US$80 WTI per bbl pricing) and deliver internal rates of return of more than 450 percent, demonstrating the top-tier economics associated with the Company’s SE Saskatchewan drilling inventory. In the second half of 2024, Surge will be drilling 23 gross (19.7 net) wells in SE Saskatchewan, all targeting the Frobisher and Midale formations.

In less than three years, Surge has grown its SE Saskatchewan core area to more than 400 million bbls of net internally estimated OOIP3, while growing current production to more than 8,000 boepd, comprised of 90 percent high netback, light crude oil.

Surge has now assembled an internally estimated 7-8 year drilling inventory4 of more than 290 net drilling locations in the Frobisher and Midale formations.

EXPANDED FIRST LIEN REVOLVING CREDIT FACILITY & EARLY REPAYMENT OF SECOND LIEN TERM FACILITY B

Subsequent to the first quarter of 2024, the Company increased its revolving first lien credit facility by $60 million (40%) from $150 million to $210 million. This increased facility is comprised of a committed revolving term facility of $180 million and an operating loan facility of $30 million with a syndicate of lenders. The first lien credit facility is a normal course, reserve-based credit facility available on a revolving basis.

Concurrent with the increase to the first lien credit facility, Surge elected to exercise a one-time option for early repayment of a portion of the Company’s second lien term debt facilities. On April 30, 2024, the Company repaid the remaining $36 million of outstanding principle under its second lien Term Facility B, utilizing a portion of the incremental liquidity provided by the newly confirmed $210 million first lien credit facility.

ANNUAL SUSTAINABILITY REPORT RELEASED

Surge has released its third annual Sustainability Report, outlining the Company’s advancement of its environmental, social and governance practices, and their impact on Surge’s business and operating strategy.

The Company’s third annual Sustainability Report reaffirms Surge’s commitment to be a leader in reducing the impact of oil and gas operations on the environment. The report covers performance metrics for the 2021, 2022, and 2023 calendar years and aligns with guidance set forth by the Task Force on Climate-Related Financial Disclosure.

Surge is pleased to report the Company reduced its Scope 1 greenhouse gas emissions intensity by 18 percent in 2023 as compared to 2022. Surge has now reduced its Scope 1 emissions intensity by 28 percent since 2021. These results demonstrate the Company’s continued commitment to reducing the emissions intensity of its operations.

The Sustainability Report was approved by Surge’s Management team, as well as the Company’s Board of Directors, and is intended to allow all Surge stakeholders to better understand the Company’s commitment to responsible oil and gas operations.

Surge’s latest annual Sustainability Report can be accessed through the Company’s website at www.surgeenergy.ca.

OUTLOOK: ASSET QUALITY DRIVES SUPERIOR RETURNS

Surge is a publicly traded intermediate oil company focused on enhancing shareholder returns through free cash flow2 generation. The Company’s defined operating strategy is based on owning and developing high quality, large OOIP, conventional light and medium gravity crude oil reservoirs, and using proven technology to enhance ultimate oil recoveries.

Surge has now assembled dominant operational positions in two of the top four crude oil plays in Canada in its Sparky (>11,500 boepd; 85% medium gravity oil) and SE Saskatchewan (~8,000 boepd; 90% light oil) core areas, as independently evaluated by a leading brokerage firm5. Over 80 percent of the Company’s current production and Total Proved plus Probable NAV now comes from these two core areas3.

In the second half of 2024, Surge will continue to execute an active drilling program in both the Sparky and SE Saskatchewan core areas, with a total of 50 gross (46.7 net) wells budgeted to be drilled.

Surge remains on track to meet or exceed its production guidance for 2024.

|

___________________________ |

|

5 As per Peters Oil & Gas Plays Update from January 14, 2024: North American Oil and Natural Gas Plays – Half Cycle Payout Period. Note: Sparky is represented as “Conventional Heavy Oil Multi-Lateral” by Peters. |

The Company is well positioned to continue delivering attractive shareholder returns in 2024 and beyond, based on the following key corporate fundamentals:

- Estimated 2024 average production of 25,000 boepd (87 percent liquids);

- An estimated 24 percent annual corporate decline3;

- Budgeted 2024 cash flow from operating activities of $295 million at US$75WTI6;

- $48 million annual cash dividend ($0.48 per share, paid monthly);

- More than 1,000 (net) internally estimated drilling locations providing a 13-year drilling inventory4;

- $1.4 billion in tax pools at December 31, 2023 (approximate 4 year tax horizon at US$75 WTI pricing); and

- Total Proved plus Probable net asset value (“NAV”) of $17.63 per share and Total Proved NAV of $11.27 per share3.

With cash flow from operating activities strategically allocated between high rate of return capital expenditures, debt repayment, and cash dividends paid to shareholders, Management currently forecasts that the Company will achieve its previously announced Phase 2 return of capital net debt target in early Q4/24, based on current crude oil pricing.

Forward-Looking Statements

This press release contains forward-looking statements. The use of any of the words “anticipate”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “should”, “believe” and similar expressions are intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements.

More particularly, this press release contains statements concerning: Surge’s expectations regarding crude oil prices; the sensitivity of our forecasted 2024 annual cash flow from operating activities to changes in WTI prices and WCS and MSW differentials; our drilling inventory; estimated 2024 Sparky core area production growth; Surge’s planned 2024 drilling program; our expectation that Surge is on track to meet or exceed its production guidance for 2024; Surge’ belief that it is well positioned to deliver attractive shareholder returns in 2024 and beyond; estimated 2024 average production, corporate decline; dividends; Surge’s tax horizon; and management’s forecast for achievement of its Phase 2 return to capital net debt target.

The forward-looking statements are based on certain key expectations and assumptions made by Surge, including expectations and assumptions around the performance of existing wells and success obtained in drilling new wells; anticipated expenses, cash flow and capital expenditures; the application of regulatory and royalty regimes; prevailing commodity prices and economic conditions; development and completion activities; the performance of new wells; the successful implementation of waterflood programs; the availability of and performance of facilities and pipelines; the geological characteristics of Surge’s properties; the successful application of drilling, completion and seismic technology; the determination of decommissioning liabilities; prevailing weather conditions; exchange rates; licensing requirements; the impact of completed facilities on operating costs; the availability and costs of capital, labour and services; and the creditworthiness of industry partners.

Although Surge believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because Surge can give no assurance that they will prove to be correct. Since forward-looking statements address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, risks associated with the condition of the global economy, including trade, public health and other geopolitical risks; risks associated with the oil and gas industry in general (e.g., operational risks in development, exploration and production; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of reserve estimates; the uncertainty of estimates and projections relating to production, costs and expenses, and health, safety and environmental risks); commodity price and exchange rate fluctuations and constraint in the availability of services, adverse weather or break-up conditions; uncertainties resulting from potential delays or changes in plans with respect to exploration or development projects or capital expenditures; and failure to obtain the continued support of the lenders under Surge’s bank line. Certain of these risks are set out in more detail in Surge’s AIF dated March 6, 2024 and in Surge’s MD&A for the period ended December 31, 2023, both of which have been filed on SEDAR+ and can be accessed at www.sedarplus.ca.

The forward-looking statements contained in this press release are made as of the date hereof and Surge undertakes no obligation to update publicly or revise any forward-looking statements or information, whether as a result of new information, future events or otherwise, unless so required by applicable securities laws.

|

________________________________ |

|

6 Additional pricing assumptions: WCS differential of US$16, EDM differential of US$3.50, CAD/USD FX of $0.725 and AECO of $2.95 per mcf. |

Oil and Gas Advisories

The term “boe” means barrel of oil equivalent on the basis of 1 boe to 6,000 cubic feet of natural gas. Boe may be misleading, particularly if used in isolation. A boe conversion ratio of 1 boe for 6,000 cubic feet of natural gas is based on an energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead. “Boe/d” and “boepd” mean barrel of oil equivalent per day. Bbl means barrel of oil and “bopd” means barrels of oil per day. NGLs means natural gas liquids.

This press release contains certain oil and gas metrics and defined terms which do not have standardized meanings or standard methods of calculation and therefore such measures may not be comparable to similar metrics/terms presented by other issuers and may differ by definition and application. All oil and gas metrics/terms used in this document are defined below:

Original Oil in Place (“OOIP”) means Discovered Petroleum Initially In Place (“DPIIP”). DPIIP is derived by Surge’s internal Qualified Reserve Evaluators (“QRE”) and prepared in accordance with National Instrument 51-101 and the Canadian Oil and Gas Evaluations Handbook (“COGEH”). DPIIP, as defined in COGEH, is that quantity of petroleum that is estimated, as of a given date, to be contained in known accumulations prior to production. The recoverable portion of DPIIP includes production, reserves and Resources Other Than Reserves (ROTR). OOIP/DPIIP and potential recovery rate estimates are based on current recovery technologies. There is significant uncertainty as to the ultimate recoverability and commercial viability of any of the resource associated with OOIP/DPIIP, and as such a recovery project cannot be defined for a volume of OOIP/DPIIP at this time. “Internally estimated” means an estimate that is derived by Surge’s internal QRE’s and prepared in accordance with National Instrument 51-101 – Standards of Disclosure for Oil and Gas Activities. All internal estimates contained in this news release have been prepared effective as of January 1, 2024.

As of January 1, 2024, Surge’s internally estimated OOIP of the Sparky Core area is 1.1 billion barrels of oil, with a total estimate of 127 million barrels of oil produced (a recovery factor of 11.5% to date). Similarly, Surge’s internally estimated OOIP of the Betty Lake area is 150 million barrels of oil, with a total estimate of 1.85 million barrels of oil produced (a recovery factor of 1.2% to date). In SE Sask, Surge’s internally estimated OOIP is >400 million barrels of oil, with a total estimate of 39 million barrels of oil produced (a recovery factor of 9.8% to date).

Surge’s TPP (BTax) NPV10 value of its Sparky Core and SE Sask assets is $1,567 MM (run on Sproule’s 2023 Year End price deck: First year prices of US$81/bbl WTI, C$104/bbl EDM, C$88/bbl WCS & C$3.67/mmbtu AECO), which is 75% of the total corporate TPP (BTax) NPV10 value of $2,059 MM.

Surge’s 2023 year-end Proved Developed Producing reserves have a decline of 29 percent and a Proved plus Probable Developed Producing decline of 26 percent. Surge’s internally estimated declines are based off March-to-March monthly data to flush out impacts of December drilling.

Surge’s Net Asset Value is calculated as reserve value discounted at 10% on a before tax basis (Total Proved plus Probable: $2,059 MM; Total Proved: $1,421 MM) (each as set forth in the Sproule Report), less Surge’s net debt at December 31, 2023 of $290.1 million, and divided by 100.3 million basic shares outstanding as at December 31, 2023.

Drilling Inventory

This press release discloses drilling locations in two categories: (i) booked locations; and (ii) unbooked locations. Booked locations are proved locations and probable locations derived from an internal evaluation using standard practices as prescribed in COGEH and account for drilling locations that have associated proved and/or probable reserves, as applicable.

Unbooked locations are internal estimates based on prospective acreage and assumptions as to the number of wells that can be drilled per section based on industry practice and internal review. Unbooked locations do not have attributed reserves or resources. Unbooked locations have been identified by Surge’s internal certified Engineers and Geologists (who are also Qualified Reserve Evaluators) as an estimation of our multi-year drilling activities based on evaluation of applicable geologic, seismic, engineering, production and reserves information. There is no certainty that the Company will drill any or all unbooked drilling locations and if drilled there is no certainty that such locations will result in additional oil and gas reserves, resources or production. The drilling locations on which the Company actually drills wells will ultimately depend upon the availability of capital, regulatory approvals, seasonal restrictions, oil and natural gas prices, costs, actual drilling results, additional reservoir information that is obtained and other factors. While certain of the unbooked drilling locations have been de-risked by drilling existing wells in relative close proximity to such unbooked drilling locations, the majority of other unbooked drilling locations are farther away from existing wells where management has less information about the characteristics of the reservoir and therefore there is more uncertainty whether wells will be drilled in such locations and if drilled there is more uncertainty that such wells will result in additional oil and gas reserves, resources or production.

Assuming a January 1, 2024 reference date, the Company will have over >1,150 gross (>1,050 net) drilling locations identified herein; of these >615 gross (>575 net) are unbooked locations. Of the 489 net booked locations identified herein, 397 net are Proved locations and 92 net are Probable locations based on Sproule’s 2023 year-end reserves. Assuming an average number of net wells drilled per year of 80, Surge’s >1,050 net locations provide 13 years of drilling.

Surge’s internally used type curves were constructed using a representative, factual and balanced analog data set, as of January 1, 2024. All locations were risked appropriately and Estimated Ultimate Recoverable (“EUR”) reserves were measured against OOIP estimates to ensure a reasonable recovery factor was being achieved based on the respective spacing assumption. Other assumptions, such as capital, operating expenses, wellhead offsets, land encumbrances, working interests and NGL yields were all reviewed, updated and accounted for on a well-by-well basis by Surge’s Qualified Reserve Evaluators. All type curves fully comply with Part 5.8 of the Companion Policy 51 – 101CP.

Surge’s internal average Frobisher type curve profile of 240 boe/d (IP30), 185 boe/d (IP90) and 89 mboe (69 mbbl Oil + 10 mbbl NGL’s) EUR reserves per well, with assumed $1.45 MM per well capital, has a payout of ~12 weeks @ US$80/bbl WTI (C$105/bbl LSB) and a >450% IRR.

Assuming a January 1, 2024 reference date, the Company will have over >475 gross (>470 net) Sparky Core area drilling locations identified herein; of these >285 gross (>285 net) are unbooked locations. Of the 186 net booked locations identified herein, 140 net are Proved locations and 46 net are Probable locations based on Sproule’s 2023 year-end reserves. Assuming an average number of net wells drilled per year of 40, Surge’s >470 net locations provide >11 years of drilling.

Assuming a January 1, 2024 reference date, the Company will have over >340 gross (>290 net) SE Saskatchewan drilling locations identified herein; of these >160 gross (>140 net) are unbooked locations. Of the 153 net booked locations identified herein, 122 net are Proved locations and 31 net are Probable locations based on Sproule’s 2023 year-end reserves. Assuming an average number of net wells drilled per year of 40, Surge’s >290 net locations provide >7 years of drilling.

Non-GAAP and Other Financial Measures

This press release includes references to non-GAAP and other financial measures used by the Company to evaluate its financial performance, financial position or cash flow. These specified financial measures include non-GAAP financial measures and non-GAAP ratios, are not defined by IFRS and therefore are referred to as non-GAAP and other financial measures. Certain secondary financial measures in this press release – namely “adjusted funds flow”, “adjusted funds flow per share”, “adjusted funds flow per boe”, “free cash flow”, “net debt”, “net operating expenses”, “net operating expenses per boe”, “operating netback”, and “operating netback per boe” are not prescribed by GAAP. These non-GAAP and other financial measures are included because management uses the information to analyze business performance, cash flow generated from the business, leverage and liquidity, resulting from the Company’s principal business activities and it may be useful to investors on the same basis. None of these measures are used to enhance the Company’s reported financial performance or position. The non-GAAP and other financial measures do not have a standardized meaning prescribed by IFRS and therefore are unlikely to be comparable to similar measures presented by other issuers. They are common in the reports of other companies but may differ by definition and application. All non-GAAP and other financial measures used in this document are defined below, and as applicable, reconciliations to the most directly comparable GAAP measure for the period ended March 31, 2024, have been provided to demonstrate the calculation of these measures:

Adjusted Funds Flow & Adjusted Funds Flow Per Share

Adjusted funds flow is a non-GAAP financial measure. The Company adjusts cash flow from operating activities in calculating adjusted funds flow for changes in non-cash working capital, decommissioning expenditures and cashed settled transaction and other costs. Management believes the timing of collection, payment or incurrence of these items involves a high degree of discretion and as such may not be useful for evaluating Surge’s cash flows.

Changes in non-cash working capital are a result of the timing of cash flows related to accounts receivable and accounts payable, which management believes reduces comparability between periods. Management views decommissioning expenditures predominately as a discretionary allocation of capital, with flexibility to determine the size and timing of decommissioning programs to achieve greater capital efficiencies and as such, costs may vary between periods. Transaction and other costs represent expenditures associated with property acquisitions and dispositions, debt restructuring and employee severance costs, which management believes do not reflect the ongoing cash flows of the business, and as such reduces comparability. Each of these expenditures, due to their nature, are not considered principal business activities and vary between periods, which management believes reduces comparability.

Adjusted funds flow per share is a non-GAAP ratio, calculated using the same weighted average basic and diluted shares used in calculating income (loss) per share.

The following table reconciles cash flow from operating activities to adjusted funds flow and adjusted funds flow per share:

|

Three Months Ended March 31, |

||

|

($000s except per share amounts) |

2024 |

2023 |

|

Cash flow from operating activities |

66,785 |

54,506 |

|

Change in non-cash working capital |

(8,953) |

5,445 |

|

Decommissioning expenditures |

3,928 |

3,249 |

|

Cash settled transaction and other costs |

727 |

131 |

|

Adjusted funds flow |

62,487 |

63,331 |

|

Per share – basic |

$ 0.62 |

$ 0.65 |

Free Cash Flow

Free cash flow is a non-GAAP financial measure, calculated as cash flow from operating activities, before changes in non-cash working capital, less expenditures on property, plant and equipment and dividends paid. Management uses free cash flow to determine the amount of funds available to the Company for future capital allocation decisions.

Net Debt

Net debt is a non-GAAP financial measure, calculated as bank debt, term debt, plus the liability component of the convertible debentures plus current assets, less current liabilities, however, excluding the fair value of financial contracts, decommissioning obligations, and lease and other obligations. This metric is used by management to analyze the level of debt in the Company including the impact of working capital, which varies with timing of settlement of these balances.

|

($000s) |

As at Mar 31, 2024 |

As at Dec 31, 2023 |

As at Mar 31, 2023 |

|

Accounts receivable |

62,676 |

53,354 |

64,642 |

|

Prepaid expenses and deposits |

5,525 |

5,355 |

4,340 |

|

Accounts payable and accrued liabilities |

(98,715) |

(85,390) |

(89,094) |

|

Dividends payable |

(4,023) |

(4,013) |

(3,933) |

|

Bank debt |

(52,501) |

(42,797) |

(27,345) |

|

Term debt |

(170,675) |

(178,731) |

(247,724) |

|

Convertible debentures |

(38,211) |

(37,848) |

(32,803) |

|

Net Debt |

(295,924) |

(290,070) |

(331,917) |

Net Operating Expenses & Net Operating Expenses per boe

Net operating expenses is a non-GAAP financial measure, determined by deducting processing income primarily generated by processing third party volumes at processing facilities where the Company has an ownership interest. It is common in the industry to earn third party processing revenue on facilities where the entity has a working interest in the infrastructure asset. Under IFRS this source of funds is required to be reported as revenue. However, the Company’s principal business is not that of a midstream entity whose activities are dedicated to earning processing and other infrastructure payments. Where the Company has excess capacity at one of its facilities, it will look to process third party volumes as a means to reduce the cost of operating/owning the facility. As such, third party processing revenue is netted against operating costs when analyzed by Management.

Net operating expenses per boe is a non-GAAP ratio, calculated as net operating expenses divided by total barrels of oil equivalent produced during a specific period of time.

|

Three Months Ended March 31, |

||

|

($000s) |

2024 |

2023 |

|

Operating expenses |

51,937 |

52,892 |

|

Less: processing income |

(2,504) |

(2,534) |

|

Net operating expenses |

49,433 |

50,358 |

|

Net operating expenses ($ per boe) |

21.81 |

22.26 |

Operating Netback, Operating Netback per boe & Adjusted Funds Flow per boe

Operating netback is a non-GAAP financial measure, calculated as petroleum and natural gas revenue and processing and other income, less royalties, realized gain (loss) on commodity and FX contracts, operating expenses, and transportation expenses. Operating netback per boe is a non-GAAP ratio, calculated as operating netback divided by total barrels of oil equivalent produced during a specific period of time. This metric is used by management to evaluate the Company’s ability to generate cash margin on a unit of production basis.

Adjusted funds flow per boe is a non-GAAP ratio, calculated as adjusted funds flow divided by total barrels of oil equivalent produced during a specific period of time.

Operating netback & adjusted funds flow are calculated on a per unit basis as follows:

|

Three Months Ended March 31, |

||

|

($000s) |

2024 |

2023 |

|

Petroleum and natural gas revenue |

158,167 |

161,970 |

|

Processing and other income |

2,504 |

2,534 |

|

Royalties |

(30,144) |

(29,042) |

|

Realized gain (loss) on commodity and FX contracts |

137 |

(1,995) |

|

Operating expenses |

(51,937) |

(52,892) |

|

Transportation expenses |

(2,663) |

(4,047) |

|

Operating netback |

76,064 |

76,528 |

|

G&A expense |

(5,126) |

(4,610) |

|

Interest expense |

(8,451) |

(8,587) |

|

Adjusted funds flow |

62,487 |

63,331 |

|

Barrels of oil equivalent (boe) |

2,266,221 |

2,262,361 |

|

Operating netback ($ per boe) |

33.56 |

33.82 |

|

Adjusted funds flow ($ per boe) |

27.57 |

27.98 |

For further information, please visit our website at www.surgeenergy.ca or contact:

Neither the TSX nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility of the accuracy of this release.

SOURCE Surge Energy Inc.

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2024/08/c3316.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/May2024/08/c3316.html

Share This: