As employment decelerates, the media continue to choose to see a Goldilocks “soft landing” scenario, and it’s right in line with a seasonal “last chance power drive”

Never mind that a soft landing is more myth than reality, at least in the boom/bust age of Inflation onDemand birthed by Alan Greenspan well over two decades ago. Let’s see how Friday’s November Payrolls report shakes out, but in the interim this morning is another sign of the happy seasonal market tout for the fabled soft landing. Click graphic, get article telling you the happy news according to economists.

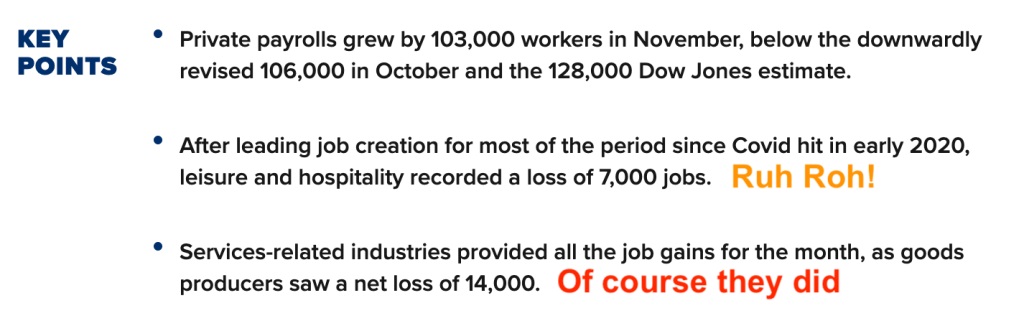

Here is the summary from CNBC with a certain internet wise guy’s markups.

So Hazel’s vaunted services industry in general keeps the Good Ship Lollipop’s rudder sailing a serpentine yet relatively true course (although her particular hospitality segment is flagging and if I could wipe that grotesque smile off her face, I would). We’ll get a better view of the broad employment situation on Friday, but little in this report bodes well.

So Hazel’s vaunted services industry in general keeps the Good Ship Lollipop’s rudder sailing a serpentine yet relatively true course (although her particular hospitality segment is flagging and if I could wipe that grotesque smile off her face, I would). We’ll get a better view of the broad employment situation on Friday, but little in this report bodes well.

Services-related industries provided all the job gains for the month, as goods-producers saw a net loss of 14,000 due to declines of 15,000 in manufacturing, despite the settlement in the United Auto Workers strikes, and 4,000 in construction. Recent layoffs in Silicon Valley and on Wall Street also did not show up in the data, as both sectors posted gains on the month.

“Restaurants and hotels were the biggest job creators during the post-pandemic recovery,” said ADP’s chief economist, Nela Richardson. “But that boost is behind us, and the return to trend in leisure and hospitality suggests the economy as a whole will see more moderate hiring and wage growth in 2024.”

The media will never follow the negative progression that is probably in play. The economy is decelerating. Again, we’ll get a better idea of details in Friday’s payrolls report, but dollars to donuts certain hard services like healthcare (and maybe government) are doing the work now. That’s not productive (or leading) at all.

Deceleration: noun; reduction in speed or rate

The financial media (and likely your financial adviser) will focus on the interim, which is technically still a not too hot, not too cold Goldilocks phase. Rah rah sis boom bah! Strike up a cheer, girls!

I have had to spend a lot of time over the last 2 decades acting as if I am bullish on this casino because that is what inflationary policy created. But if you think I am becoming more strident lately, more negative, you are not imagining things. When the time would be right I was always ready to see reality, as opposed to what they told me to see…

I believe, subject to seasonal party animal spirits and a perhaps final stock market suck-in, the party is over for a while.

Meanwhile… this:

For “best of breed” top down analysis of all major markets, subscribe to NFTRH Premium, which includes an in-depth weekly market report, detailed market updates and NFTRH+ dynamic updates and chart/trade setup ideas. Subscribe by Credit Card or PayPal using a link on the right sidebar (if using a mobile device you may need to scroll down) or see all options and more info. Keep up to date with actionable public content at NFTRH.com by using the email form on the right sidebar. Follow via Twitter@NFTRHgt.

*********