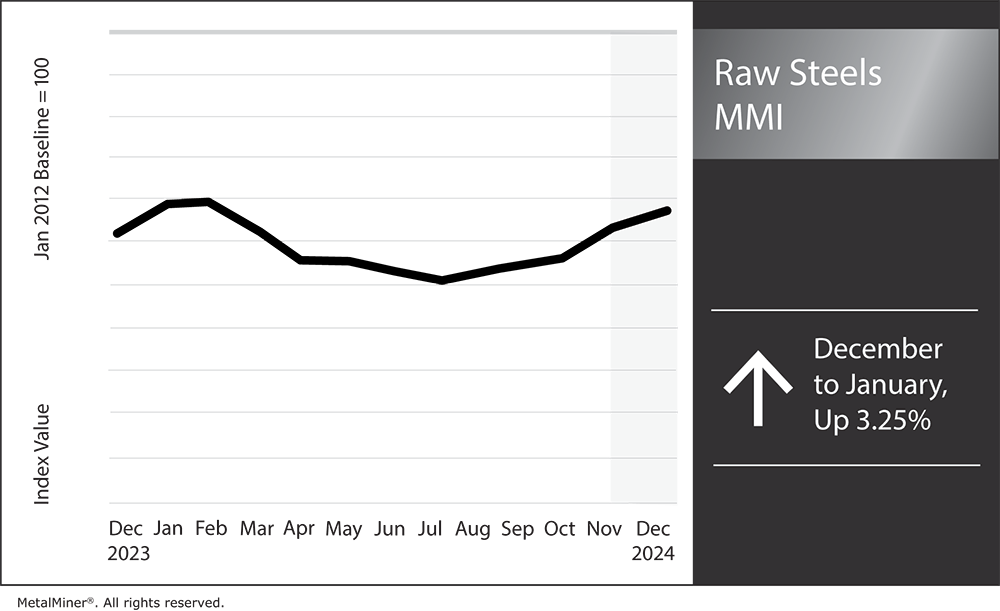

The Raw Steels Monthly Metals Index (MMI) rose 3.25% from December to January.

U.S. flat rolled steel prices closed the year decidedly bullish. A nearly 14% month-over-month rise saw HRC prices easily outperform all base metals both during the month and throughout 2023 as a whole. Meanwhile, plate prices saw an upside correction after prices traded down throughout November.

Empower your steel purchasing with the latest market analysis and strategic advice during times of fluctuating steel demand. Sign up for MetalMiner’s free weekly newsletter.

HRC Prices See First Decrease Since September

HRC prices finished 2023 very strong. In fact, the turn of the year marked three consecutive months of increases that saw prices rise over 61% from their late-September low. While the bullish market came in contrast to an otherwise contracted manufacturing sector, it appears the tides might be shifting again.

During the first week of January, HRC prices saw their first, albeit modest, week-over-week decrease since September. The early-year decrease remains but one data point, which – on its own – is too little to confirm a trend shift. However, it could signal that the bullish momentum within flat rolled steel prices has begun to wane. If not now, prices might find a new peak soon.

HRC Market Backwardation Holds as Capacity Utilization Rate Creeps Up

The first clue within the market occurred in mid-December, when spot and future prices shifted into backwardation for the first time since the beginning of the month. This inversion, in which futures prices begin trading below spot prices, came alongside spot prices breaching the $1,000/st mark. Before the historic uptrend of 2020 and 2021, that level was seemingly unheard of within the market. In fact, from 2012, the closest HRC prices came to that level was when they hit $904/st in July 2018. This is considerably higher than the previous high of $744/st from February 2012.

Amid far-from-bullish demand conditions and headwinds looming in the new year, markets appeared to deem the $1,000/st mark as a resistance level from which prices would struggle to sustain further gains. As prices continued to rise during the second half of December and the first weeks of January, the premium of spot prices over futures became increasingly substantial. By January 9, the premium rose to $192/st, the most significant delta between the two price points since June 2023.

Expert steel sourcing strategies, right at your fingertips. The Monthly Metals Outlook report is your guide to sourcing success. Check out a free sample copy.

Correlation Between Futures and Spot Steel Prices

Clearly, market backwardation doesn’t necessarily dictate the future direction of spot prices. However, the strong, almost 94% correlation between futures and spot prices suggests that futures remain a strong leading indicator.

Meanwhile, data from the American Iron and Steel Institute showed that the capacity utilization rate remained notably suppressed below the 75% mark throughout Q4. However, it appears capacity returned online by early January, as the rate jumped to 76.9%. Although the rate does not differentiate between specific forms of steel, it loosely mirrors HRC prices, often lagging behind price trend shifts.

Steelmakers likely anticipate a jump in sales during Q1. This would be consistent with historical trends. The steel market will continue to see demand from the construction industry, especially government-funded projects, in the new year. However, the recent increase in output will likely threaten the tight supply conditions that producers manufactured throughout Q4. By late December, mill lead times had already shown evidence of easing from their quarterly peak, though this came prior to the jump in the capacity utilization rate. If mills miss the mark on how much demand materializes during Q1, prices could easily reverse to the downside once again.

Steel Prices: Outlook for 2024

What will the new year bring for hot rolled coil prices and other forms of flat rolled steel?

For starters, the market already saw the first price hike of 2024. On January 3, Cleveland-Cliffs announced a $50 per net ton increase for HRC, CRC, and HDG, elevating its minimum HRC price to the top of the market at $1,150 per net ton. Its previous hike occurred roughly one month prior, in early December.

Meanwhile, new capacity is on its way. Specifically, the market will soon see the expansion of AM/NS Calvert, the joint venture between ArcelorMittal and Nippon Steel. Though there is no official completion date, estimates say the expansion will add a new EAF with a capacity of around 1.5 million metric tons of steel slabs per year.

Construction on the expansion began in February 2021, with completion originally set for H2 2023. However, construction obstacles and labor shortages have delayed the project, which company officials now expect to come online during H2 2024. Considering the historically low capacity utilization rate among domestic steelmakers, the addition of new capacity in 2024 will add another challenge to the current uptrend for flat rolled steel prices.

Looking for historically accurate steel price forecasting? View MetalMiner’s full metals catalog and let MetalMiner customize your needs based on your specific steel type, forms and gauges.

Biggest Moves for Raw Materials and Steel Prices

- U.S. shredded scrap prices saw the largest increase of the index, rising 20.21% to $464 per short ton as of January 1.

- Chinese steel billet prices moved sideways, with a modest 1.48% increase to $595 per metric ton.

- Meanwhile, Chinese coking coal prices traded down, declining 4.66% to $351 per metric ton.

- Korean standard steel prices fell 5.24% to $220 per metric ton.

- HRC Midwest futures appeared bearish, dropping 13.57% to $930 per short ton.