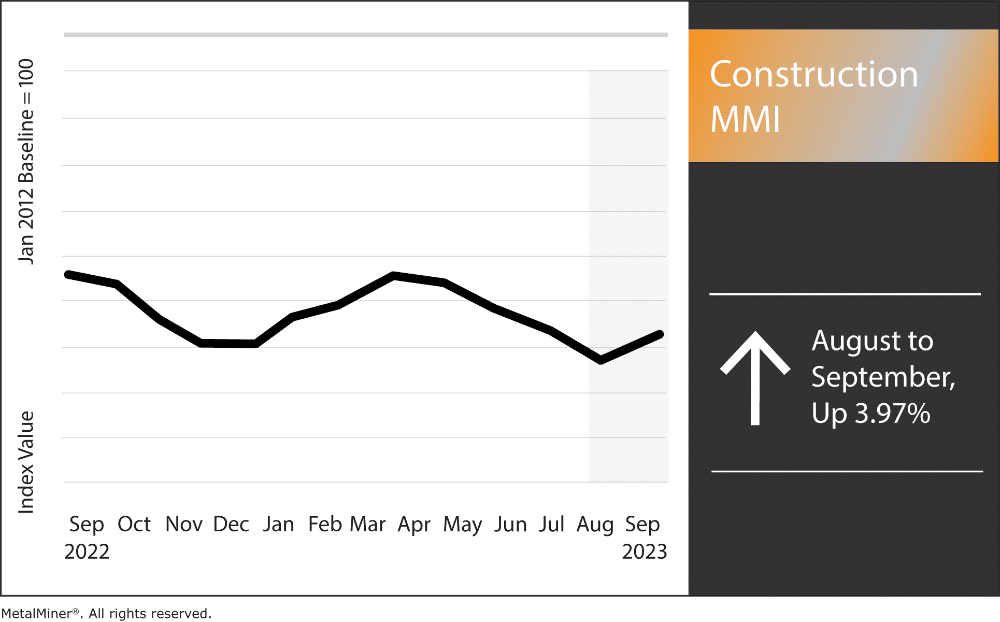

The Construction MMI (Monthly Metal Index) rose for the first time in five months, welcoming a 3.97% increase. However, this rise could prove deceiving as the index still faces numerous bearish sentiments. Bar fuel surcharges rising helped the index rise month-over-month, along with did aluminum bar prices. Steel rebar and h-beam steel prices, on the other hand, moved sideways. Indeed, China is their primary source, and the weakening of Chinese imports caused both to suffer. In total, Chinese imports into the U.S. fell 7.9% compared to August 2022. Buyers who purchase these particular forms of steel are encouraged to place other sources outside of China on the back burner in case sourcing from China becomes infeasible. To get a scope of metal market price forecasts and the best sourcing tactics for 2024, subscribe to the Annual Metals Outlook.

Slumping Chinese Demand Continues to Impact Steel Prices

China’s economic downturn and the ongoing trade dispute with the U.S. continue to cause drops in steel demand. According to Reuters, any indications of true contraction in China, which continues to be the main driver of demand growth worldwide, are particularly bad news for the metals industry. China’s first-quarter trade numbers reflect the rising supply pressures, with imports of ores and concentrates declining in volume and flow.

The delayed rebound in China’s economy weighed on demand, resulting in gloomy sentiment in industrial metals markets. Consensus price projections barely moved in May 2023. This was most likely because the continuous volatility and unpredictability of the macroeconomic environment directly impacts the cost of commodities, steel, and other metals sourced from China.

Steel Demand in China Could Rise

Some experts project that China’s pent-up demand for steel will continue in the second half of 2023. In March’s policy meetings, there was a call to slow down China’s conservative economic policy program for 2023. However, concerns over demand from a pivotal buyer persist, even though Bloomberg reports that China’s industrial downturn slowed slightly. Despite this, China’s economy continues to create an overall slump in global base metals.

Get steel price forecasts, steel purchasing strategies and comprehensive market insight for 2024. Subscribe to MetalMiner’s 2024 Annual Outlook.

Impacts on U.S. Construction

The downturn in Chinese manufacturing also affects U.S. builders, with the decline in Chinese imports into the U.S. being one of the primary results. Indeed, government officials continue to prepare for economic damage as China’s imports of everything from electronics to building materials decline.

Since China is a significant steel exporter, the decline in Chinese imports has resulted in lower steel prices in the U.S. As demand growth slows and the surplus supply burdens the market, analysts predict that Chinese steel prices will decline until 2024. Given that steel goods like rebar are a significant part of the building process, this decline in steel prices directly impacts the construction industry.

However, the impact of the decline in Chinese imports goes beyond steel prices alone. For instance, the cost of building materials in the U.S. has increased by around 2% due to the trade war. The additional taxes on Chinese imports, which have raised the price of building supplies, are also to blame for this rise. The decline in Chinese imports has also caused a glut of Chinese steel throughout Asia. As a result, Indonesia, Thailand, and India continue to prepare to support their players as they fend off price declines.

Do you know the 5 best practices of sourcing steel?

Construction MMI: Noteworthy Shifts in Steel Prices

- Chinese h-beam steel moved sideways, decreasing by just 1.5%. This left prices at $512.37 per metric ton.

- Chinese rebar also edged sideways with a 2.77% decrease. This brought prices to $523.11 per metric ton.

- Weekly Midwest bar fuel surcharges rose by $10.34, bringing prices to $0.64 per mile.

- Finally, Weekly Rocky Mountain bar fuel surcharges rose sharply by 18.97%. Prices at month’s start sat at $0.69 per mile.