The Raw Steels Monthly Metals Index (MMI) moved sideways, with a mere 0.12% increase from September to October.

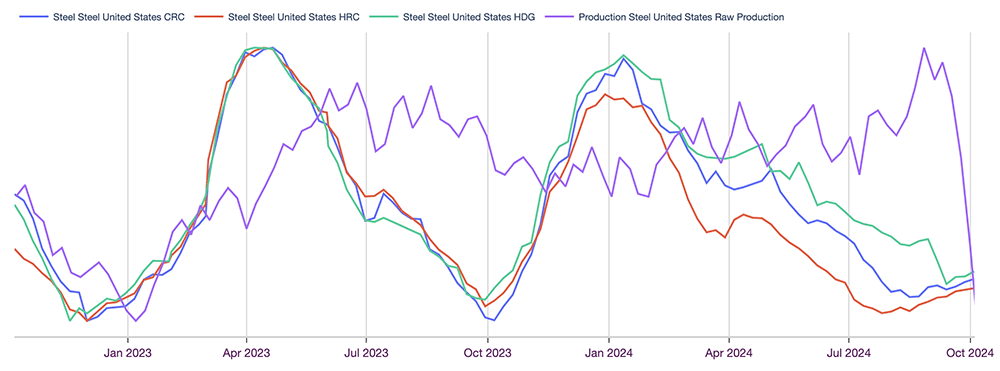

U.S. flat rolled steel prices showed mixed direction during September. HRC prices traded up, CRC prices moved sideways and HDG prices traded down. However, CRC and HDG prices found at least a short-term bottom in September. By early October, they had followed HRC prices to the upside in search of a new peak.

Steel Output Plummets, Steel Prices Inch Higher

The steel market is nearing the midway point of steel mill maintenance outages, which began in August. Currently, they remain set to finish up by the end of November. Total U.S. output remained strong during the early weeks of outages before plunging by mid-September. By October 4, data from the American Iron and Steel Institute showed raw steel output fell to its lowest level since January 2023, down 9.88% from its late August peak.

(Click image for larger view)

Mills attempted to invert the price trend ahead of outages, with varying degrees of success. Meanwhile, HRC prices found a bottom in late July, followed by mostly uninterrupted week-over-week increases that saw prices rise 7.3% to where they stand today at $703/st. For their part, HDG prices remained in decline until they found a bottom on September 13.

Prices subsequently rose 2.6% from the $965/st seen in mid-September, reaching $990/st on October 5. While the bias for flat rolled steel currently appears modestly bullish, momentum has proven slow, finding little support amid constrained demand conditions.

MetalMiner just released its 2025 Annual Outlook Report, which gives a full, 12-month scope of forecasts for industrial metals prices throughout 2025. Click here to download your free sample.

Nucor, Cliffs Hold HRC Spot Prices At Premium

Both Nucor and Cliffs made notable efforts to support prices over recent months. For instance, Nucor started its consumer spot price reporting at the bottom of the market. However, the mill appeared to shift its approach by late July, holding prices at a premium to MetalMiner’s HRC index during the final months of Q3.

Nucor began reporting a weekly consumer spot price at the start of April to help reduce volatility and offer markets “price transparency.” However, the trend over recent months suggests that both Nucor and Cleveland Cliffs instead hoped to influence HRC prices to the upside. HRC mill lead times continued to trend shorter by the close of July, after both Nucor and Cliffs’ spot prices bottomed out on July 22 and July 26, respectively. Track the latest mill lead times in MetalMiner’s Monthly Outlook.

Markets Resist Premium, Demand Remains Soft

While HRC prices followed mill spot prices to the upside over recent months, the market has largely resisted the same premium asked for by mills. As of October 7, Nucor’s HRC price held a $27/st premium over MetalMiner’s HRC index price, well above its roughly $7/st average premium since the start of April.

Get all the news on shifts in steel prices, along with other valuable commodity news. Sign up for the free weekly MetalMiner newsletter here.

Ahead of the outages, demand conditions appeared to be cooling rather than heating up, with distributor inventory levels on the rise. Some of this may result from stocking efforts ahead of mill maintenance. However, mill lead times trended only modestly longer throughout August, and appeared to stabilize by mid-September. This suggests that even with the help of supply constraints, demand seemed too soft to offer the price momentum mills have been looking for.

What’s Next for Steel Prices After Outages?

As certain mills come back online, the market will have to manage the loss of the final 56% of the almost 1 million short tons of flat rolled steel estimated to be impacted by maintenance outages in October and November. The outages will have helped shore up at least some of the supply glut accumulated from robust output levels witnessed during the year.

Considering the tepid response by steel prices thus far, mills may find it challenging to maintain an upward price trend by the end of Q4 when capacity returns. This could lead other mills to follow Cleveland Cliffs’ decision to indefinitely idle one of its blast furnaces until market conditions improve.

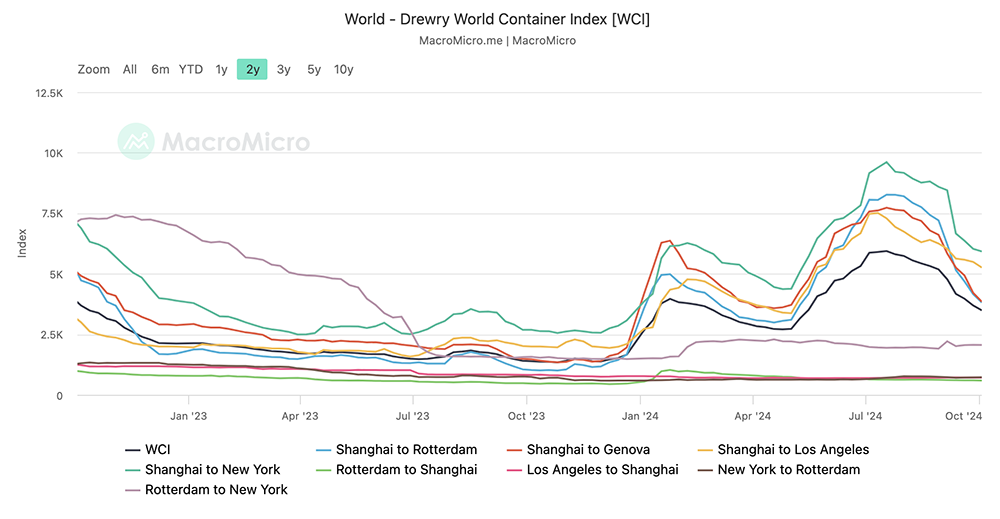

Although a turnaround in manufacturing conditions could support a recovery, that has yet to occur. In fact, ISM’s Manufacturing PMI fell deeper into contraction during September, at 47.2. Meanwhile, imports will likely offer an increasing challenge in mill attempts to raise prices further. The Drewry World Container Index (WCI) showed that 40’ container freight rates remained in decline after finding a peak in late July. Freight rates and longer lead times have placed a cap on imports throughout the year, even as global steel prices remain at a discount to U.S. prices.

Biggest Moves for Raw Material and Steel Prices

- Chinese steel slab prices rose 10.4% to $552 per metric ton as of October 1.

- Chinese coking coal prices increased by 9.61% to $213 per metric ton.

- LME primary three-month steel strap prices saw a 7.3% rise to $397 per metric ton.

- U.S. shredded steel scrap prices moved sideways, with a 1.85% decline to $372 per short ton.

- Chinese HRC prices fell 2.32% to $421 per short ton.

MetalMiner should-cost models: Give your organization levers to pull for more price transparency from service centers, producers and part suppliers. Explore the models now.