Big changes seem on the way for the Polish steel industry. Recently, local steel news outlets reported that several companies have expressed interest in leasing Polish plate producer Huta Częstochowa, which Liberty Steel acquired in 2021, after a local court declared the plant bankrupt in July.

Among the potential suitors for the plant is the Ukrainian metals and mining group Metinvest. “We can confirm that we were invited to consider leasing the steel plant, with the possibility of later acquiring it,” daily newspaper Życie Częstochowy quoted Metinvest’s chief commercial officer Dmitriy Nikolayenko as saying on August 15. “At present, we don’t have information on what condition the previous owner left the site in. We need to conduct a thorough assessment, including a comprehensive due diligence study, which would determine the launch date of the steelworks,” Nikolayenko added.

Metinvest officials were not available for comment, despite several attempts. Other parties interested in leasing Huta Częstochowa include Katowice-headquartered coal producer Węglokoks, which has stakes in other Polish rolling assets. One official at that company would only tell MetalMiner that the company is analyzing the possibility and declined to comment further.

MetalMiner’s monthly MMI report gives you price updates and market trends for the steel industry and 9 other metal industries. Sign up for free.

Metinvest Could Expand Non-Ukraine Capacity

Information on the group’s website showed that Metinvest’s assets outside of Ukraine include Italian plate producers Ferriera Valsider and Metinvest Trametal. The latter is in the Friuli Venezia Giulia region and has a 600,000 metric tons per year capacity to roll plate in 4-180mm and a maximum width of 3200 mm.

Ferriera Valsider, in the Veneto region, can roll up to 400,000 metric tons per year of heavy plate in 8-200mm gauges and widths of up to 3,000 mm as well as 600,000 metric tons of HRC in 1.8-25mm gauges per year to a maximum width 1,555mm.

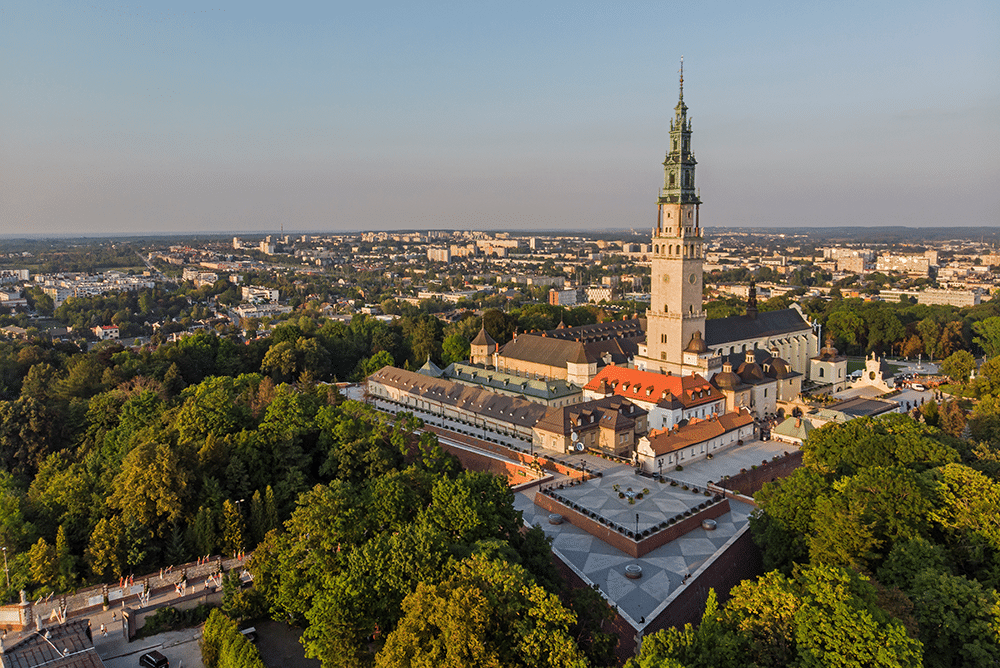

Huta Częstochowa is 80 kilometers north of Katowice, the Silesian Voivodeship’s capital, and can produce about 1.2 million metric tons per year of plate in 5-20 mm gauges on two rolling mills. Information on Liberty Steel’s website indicated that products from the plant target wind towers and unpressurized tanks.

Yellow goods, construction, as well as vehicular and water transport sectors are also targets for Huta Częstochowa’s production. In addition, the plant can produce welded pipes in 1,000-3,000mm diameters.

The Plant Has a Checkered Financial History

The Częstochowa District Court placed Huta Częstochowa into bankruptcy on July 25. Reports from Polish media and steel news outlets stated that this was because the plant had not operated in six months and had not received any new orders. A source with GFG Alliance told MetalMiner that the plant was working at minimal levels earlier in the year, but worsening market conditions in Europe created cash flow problems.

Plate produced in northern Europe is currently about €605 ($675) per metric ton EXW, down from €700 ($780) earlier in the month. This is due partly to lower seasonal demand in the European summer as well as declining input prices.

The current bankruptcy is not Huta Częstochowa’s first. Indeed, the same court that announced the current bankruptcy also placed the plant into bankruptcy in September 2019 after its board filed for bankruptcy in June.

Knowledge is key in navigating metal market fluctuations from mill closures. Don’t miss out on MetalMiner’s expert analysis and up-to-date information. Subscribe to MetalMiner’s free weekly newsletter.

Liberty Hopes to Retain its Steel Industry Positions

Sunningwell International Polska reportedly expressed interest in taking over the plant’s lease in 2019, after Polish courts previously placed the plant into bankruptcy. The company withdrew from the planned sale in 2020, after which Liberty Steel acquired it for the reported sum of zł. 190 million ($43.3 million).

Liberty Steel originally took over the lease for Częstochowa in December of that year and then fully acquired the plant in May 2021. Liberty’s parent company, GFG Alliance, stated on August 15 that it had filed an appeal against the bankruptcy proceeding.

“Liberty is appealing because it believes the business proved it had strong support from its largest creditor, had a Letter of Intent from a credible financial institution for a €100 million [$111 million] working capital loan, and was already undergoing a restructuring and restart process,” the company stated in an announcement.

“Liberty’s appeal also highlights a number of court procedural issues which have a significant impact on the validity of the proceedings,” the company stated.