The downtrend for nickel prices showed signs of exhaustion, with significant potential to impact stainless steel prices. Nickel moved sideways throughout January with a modest 1.60% decline. While directional momentum remained slow, prices continued to edge lower during the first weeks of February and now sit at their lowest level since April 2021.

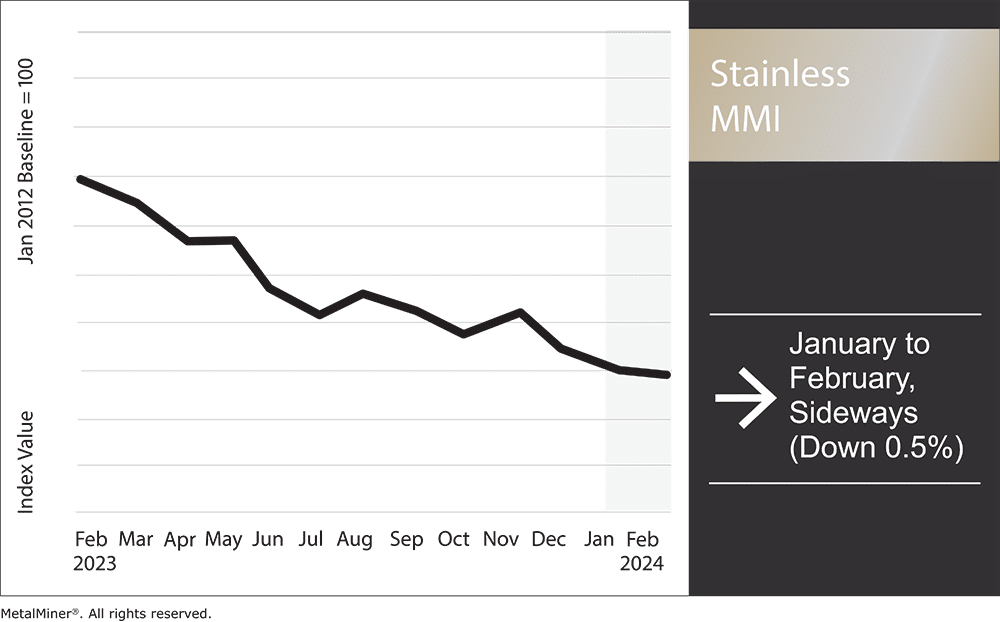

Overall, the Stainless Monthly Metals Index (MMI) moved sideways, falling 0.5% from January to February.

Nickel and stainless steel market mastery starts here. Subscribe to MetalMiner’s weekly newsletter and optimize your sourcing strategies.

Outokumpu’s Q4 Reports Show Weaker 2023 Market

Outokumpu noted a “challenging market environment” throughout 2023 in its fourth-quarter results. Although the company reported that distributor destocking efforts slowed by the end of the second half, global deliveries nonetheless saw an overall 9% decline.

In the Americas, Outokumpu described the 2023 market as “relatively strong,” although it began to weaken toward the end of the year. Despite the company’s seemingly positive characterization, stainless steel deliveries in the region fell by 16% from 2022. Meanwhile, Outokumpu’s European operations found a bottom during the third quarter, which turned into a slow recovery during Q4. Furthermore, stainless steel deliveries saw a 4% year-over-year decline. In addition to lower stainless steel prices, this negatively impacted the company’s profitability.

Outokumpu’s results appear emblematic of the global market. Moreover, both European and U.S. 304 cold rolled stainless steel prices saw considerable downside throughout the year. Nickel prices, which boast respective 78% and 82% correlations to European and U.S. 304 prices, proved a significant drag on global stainless steel costs even as base prices held flat.

Despite Outokumpu favorable opinion of the U.S. market, data from WorldStainless states that slower demand led to a 12.9% year-over-year cut in U.S. stainless steel melt shop production during the first three quarters. Furthermore, European production saw an 8% decline during the same period.

Outokumpu Expects Q1 2024 Increase in Deliveries, Hopes to Expand U.S. Cold Rolled Capacity

In the same quarterly report, Outokumpu forecasted a 5 to 15% increase in its global stainless steel deliveries for the first quarter of 2024. Q1 typically experiences a seasonal rise in stainless steel demand, which Outokumpu likely factored into its outlook. The company also believes Europe’s slow recovery will continue, thus helping to boost the market. However, the company made no mention of its outlook for the Americas, as that market has yet to find a bottom.

Simultaneously, Outokumpu continued to pursue increased cold rolling capacity as part of its larger strategy for the Americas. The company’s current capacity stands at 55 kilotons, with the overall goal being to reach 80 kilotons. That said, Outokumpu opted not to specify how it intended to increase its market share. However, it did note that capacity expansion would target North America and that the firm would make final decisions within a year.

Market Sources Have Yet to Experience Q1 Pickup

While Outokumpu remains optimistic, some U.S. distributors continued to experience bearish market conditions throughout January. Meanwhile, mill lead times have yet to increase from historically low levels despite lower output from mills.

Many manufacturers continued to work through inventories they overbuilt back when markets began to rebalance following years of tight supply conditions. The over-purchasing led numerous manufacturers to forgo H1 negotiations, which likely contributed to a slowdown in stainless steel deliveries.

This caused some distributors to speculate that H2 negotiations could begin earlier than usual if those end users manage to rebalance inventories in the coming months. However, as nickel prices continue to show a downside bias, buyers remain unwilling to make long purchases, expecting the surcharge to continue to fall. This, combined with a still well-supplied market, will challenge steelmakers’ efforts to increase prices without further cuts to capacity.

Biggest Moves for Nickel and Stainless Steel Prices

Read the 5 Mistakes Buyers Can Make When Sourcing Stainless Steel

- Chinese 316 stainless steel scrap prices jumped by 63.37% to $3,818 per metric ton as of February 1.

- Chinese 316 cold rolled coil prices appeared bullish, with a 9.28% rise to $4,275 per metric ton.

- Meanwhile, Chinese ferrochrome prices fell 3.18% to $1,344 per metric ton.

- Korean 304 cold rolled coil prices saw a 6.46% decline to $2,491 per metric ton.

- The U.S. Allegheny Ludlum Surcharge for 304/304L coil prices dropped by 6.89% to $0.93 per pound.