After nickel prices saw a sharp slowdown in May, prices started to form sideways trends in relief to the downtrend. Like other base metals, nickel prices rallied during the first weeks of June until bullish momentum exhausted itself and prices retraced to the downside. Prices found a bottom at the end of June and continue to move sideways near the bottom of their current trading range.

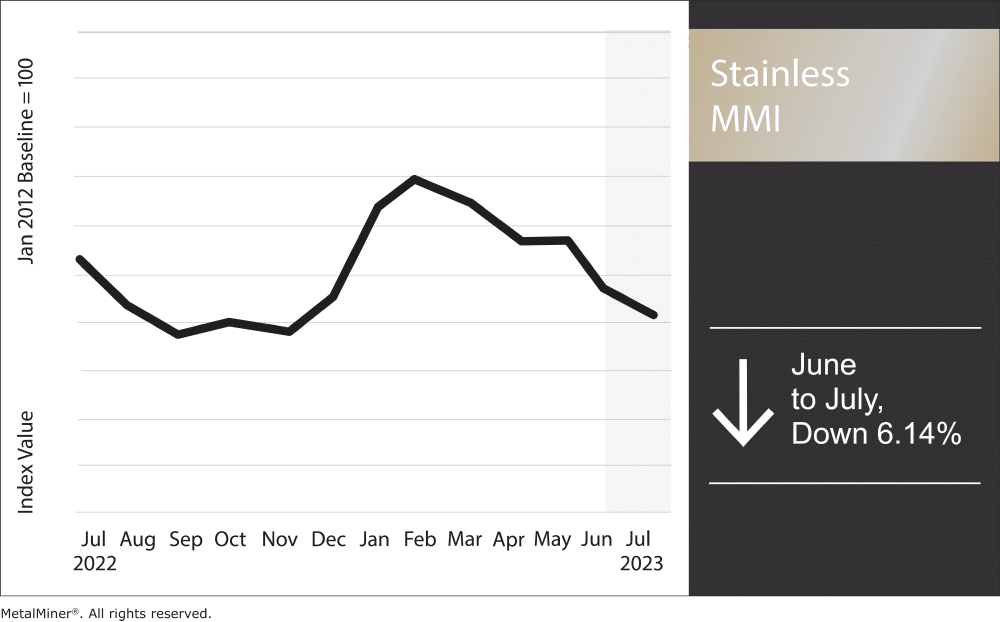

Overall, the Stainless Monthly Metals Index (MMI) continued to decline, with a 6.14% drop from June 1 to July 1.

It’s time to start thinking about annual nickel and stainless contract negotiations. But what cost-saving tactics should you be armed with when negotiating with your suppliers for 2024? Join our special August fireside chat: 2024 Annual Budgeting & Forecasting Workshop.

Global Stainless Steel Melt Shop Production Dropped in Q1

In a recent July 10 release, WorldStainless figures showed a notable slowdown in global stainless steel production. During Q1, stainless steel melt shop output fell 5.0% from 2022. China saw the only year-over-year increase, as production rose 4.1%. The remaining regions all noted sharp drops from Q1 2022, which outweighed China’s increase.

The results appeared less bearish quarter over quarter. Between Q4 2022 and Q1 2023, Chinese production declined by 2.9%. The remainder of Asia (excluding South Korea) also saw a 8.0% quarterly decline. However, Europe, the U.S. and the regional category that includes Brazil, Russia, South Africa, South Korea and Indonesia saw production improve from the end of last year, as output for the regions rose by 8.9%, 11.5% and 11.0%, respectively. Due to China’s overwhelming market dominance, global production levels still saw a 0.3% quarterly decline.

View MetalMiner’s track record of forecasting where industrial metal prices are headed.

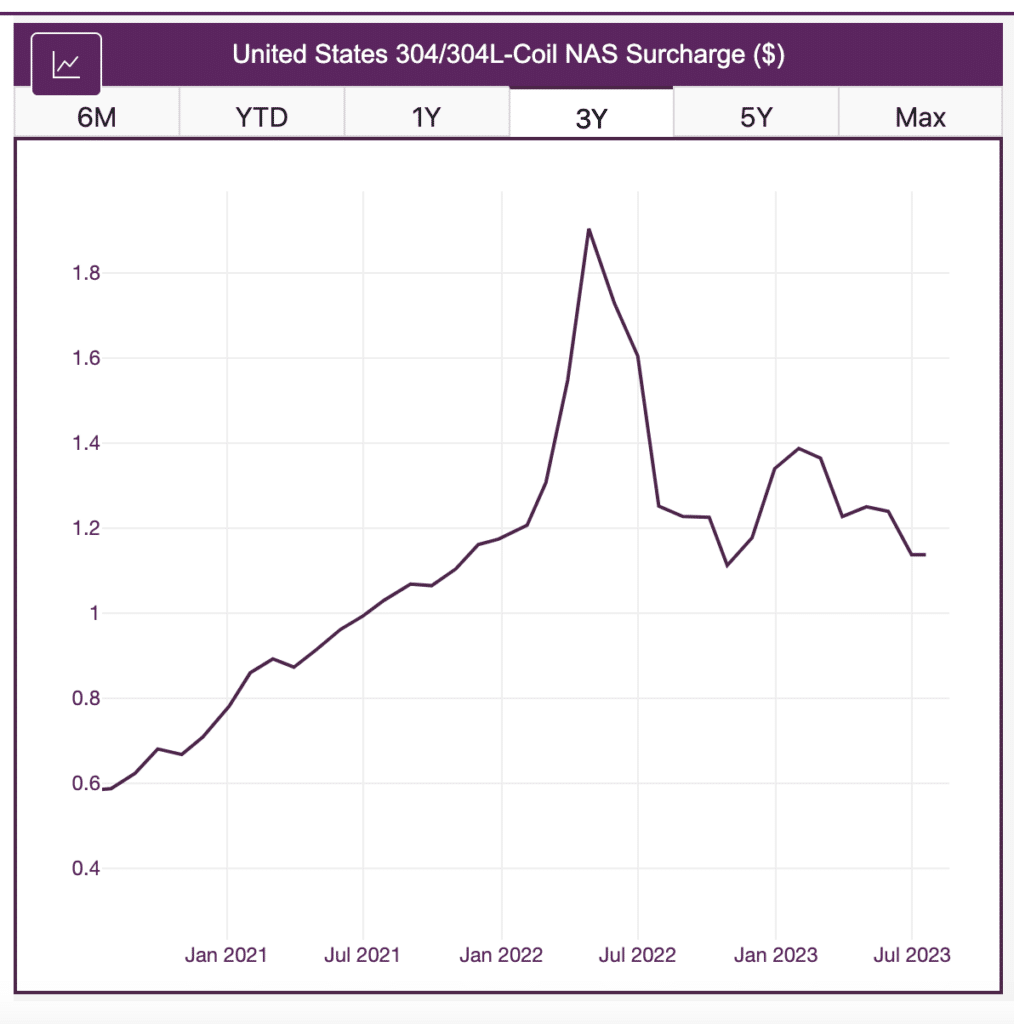

304 Stainless Surcharge Remains Bearish But Nickel Prices See Modest Rise

While domestic base prices have remained steady since 2021, the 304 surcharge peaked in January. It then appeared mostly bearish throughout the first half of 2023. Sliding nickel prices, the most volatile component of the stainless surcharge, have added a strong drag to the overall surcharge.

We know what you should be paying for metals — MetalMiner should-cost models are the ultimate savings hack by showing you the “should-cost” price for gauge, width, polish and finish adders, plus a 304 surcharge forecast. Explore what value they can add for your organization.

Following relatively sharper declines throughout Q1, however, the descent appeared to decelerate throughout Q2 before they found an at least temporary bottom at the end of June. Currently, nickel prices appear sideways. Nonetheless, they saw a modest bounce off of short-term support levels during the first weeks of July. In total, nickel prices rose 2.84% since the end of June, which will add support to the surcharge.

Get weekly updates on nickel price trends and other commodity news with MetalMiner’s free weekly newsletter. Click here.

ING Bearish on Nickel in H2

In spite of July’s modest increase in nickel prices, the outlook remains bearish. In its recent July 10 outlook, ING noted a rising surplus and China’s economic weakness will add a strong weight on nickel prices during the remainder of the year.

China, which accounts for roughly 70% of global nickel consumption, saw its recovery stagnate amid slow domestic consumption and weak manufacturing activity. Its aging population, high youth unemployment rate and struggling property sector have translated to lower-than-expected growth throughout the year. While modest rate cuts saw base metal prices briefly spike last month, any future stimulus measures are expected to remain small, which would translate to limited impact on metal prices and China’s overall consumption.

Meanwhile, Indonesia continues to expand the market surplus. While much of the expansion has benefitted Class 2 nickel versus Class 1, the growing shift among battery manufacturers to use intermediary products has helped soften demand for Class 1 nickel. Beyond that, Tsingshan’s move to convert copper plants into Class 1 nickel plants using nickel matte will help boost overall supply.

Nonetheless, ING noted the demand related to the global energy transition will help cap some of the expected downside for prices. Additionally, Class 1 supply will remain comparatively tight to Class 2 nickel, and as LME inventories remain historically low, this will temper any bearish momentum.

Buy with confidence. MetalMiner’s Monthly Buying Outlook Report provides monthly market analysis, price forecasts and purchasing strategies for 10 different metal types, including nickel and 304 stainless. Request a demo and get a free sample copy.

- Chinese ferromolybdenum lump prices saw the only increase of the index, with a 1.0% rise to $34,921 per metric ton as of July 1.

- Meanwhile, the Allegheny Ludlum Surcharge for 16/316L coil fell 4.97% to $1.83 per pound.

- Chinese ferrochrome lump prices 6.56% to $1,209 per metric ton.

- LME primary three month nickel prices fell 6.98% to 20,000 per metric ton.

- With the largest decline of the index, the Allegheny Ludlum Surcharge for 04/304L coil fell 7.44% to $1.21 per pound.