Nickel prices remained decidedly bearish throughout October, experiencing the largest monthly decline amongst base metals. Indeed, prices fell over 7% to their lowest level since October 2021.

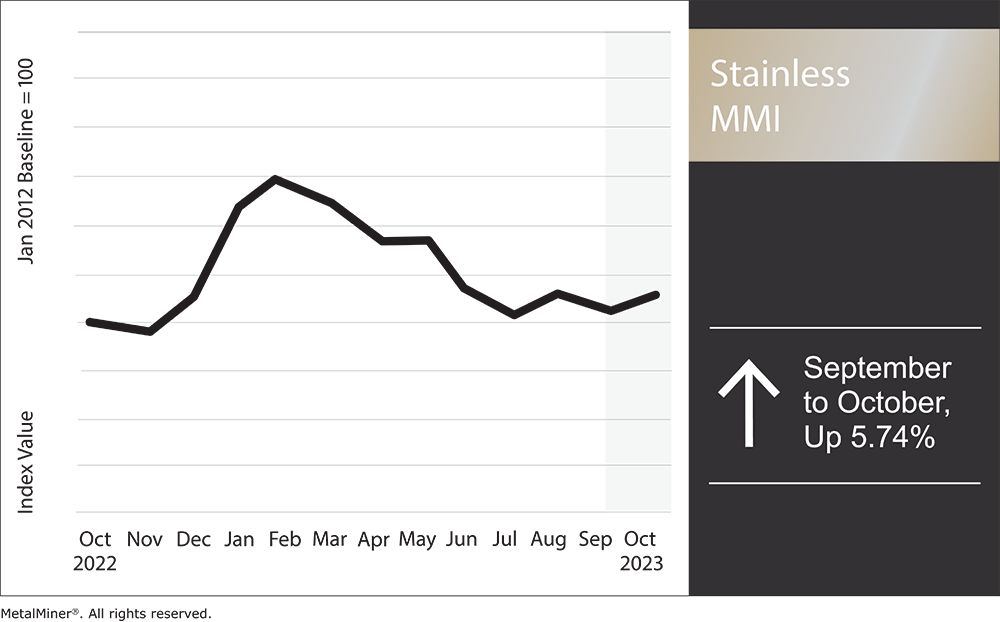

Overall, the Stainless Monthly Metals Index (MMI) continued to decline, dropping 5.74% from September to October.

Crush the competition by getting access to weekly exclusive nickel market intel. Opt into MetalMiner’s free weekly newsletter.

Stainless Mills Scramble For Orders

After data from the World Stainless Association showed a 0.9% decline in stainless steel melt shop production during H1, by Q4, the stainless market remains bleak. Nonetheless, domestic mills continue to hold firm on base prices, despite competitive import pricing. The stainless 304 surcharge remains bearish, however, amid declining nickel prices.

Service centers continue to scramble for orders. September appeared to skip the expected seasonal pickup, as inventories remain relatively full. This, combined with low demand and a falling surcharge, has left service centers and end users reluctant to purchase beyond their immediate needs.

As the end of the year approaches, most companies will likely look to reduce their inventories. Although mills are expected to maintain base prices, this could translate to higher transactional discounts throughout the remainder of 2023.

We know what you should be paying for metals. MetalMiner should-cost models are the ultimate savings hack because they show you the “should-cost” price for gauge, width, polish, and finish adders. Explore what value they can add to your organization.

2024 Surplus to Weigh on Nickel Prices

An expected surplus next year continues to paint a bearish fundamental outlook amid falling nickel prices. According to the International Nickel Study Group (INSG), 2024 will see the third consecutive year of excess supply. While the INSG expects both demand and production to increase, the delta between the two is also likely to expand. Following a 104,000-ton surplus in 2022, forecasts show supply will outpace demand by 223,000 tons in 2023 and 239,000 tons in 2024.

Amid Indonesia’s rising position within the global nickel market, most of the surplus in 2023 and 2024 will benefit Class 2 nickel. This is opposed to LME deliverable Class 1 nickel. And while LME inventories remain below where they stood at the start of the year, they nonetheless appeared to find a bottom in August and have subsequently increased by over 16% to where they stand today in mid-October.

As a result, the rising supply has left investors with a negative outlook for nickel prices. According to data from the LME, total investor positioning remained net short by early October. The delta between long and short positions appeared even wider for investment funds, whose large positions share gives them significant influence over price direction. Although nickel prices began to move sideways during the first half of October, the bearish market bias likely means the risk remains to the downside for nickel prices and, thus, the stainless surcharge.

Do you have a buying strategy based on current nickel prices? MetalMiner’s Monthly Buying Outlook Report provides monthly price forecasts and purchasing strategies for 10 different metal types. Opt in and view a free sample copy.

Amid Nickel Boom, Indonesia Vies For Trade Deal with U.S.

Meanwhile, rising supply and the significant expansion in downstream investments have left Indonesia as the leading global producer within the overall nickel market. Amid the global push toward EVs, the archipelago, which boasts the largest global nickel reserves, now hopes to negotiate a trade deal with the U.S. This would allow Indonesia to capitalize on its assets and their use in EV batteries.

The United States Inflation Reduction Act requires a proportion of minerals used in EV batteries to be produced or assembled in North America or a free trade partner. According to a recent Reuters report, Indonesian President Joko Widodo stated, “Indonesia invites the U.S. to discuss the formation of the Critical Mineral Agreement.” Such a plan could allow nickel exports to receive “green subsidies,” which benefit pricing and the supply chain into the U.S. as the Biden administration continues to roll out its renewable spending.

While it remains unclear if or when a trade agreement will be reached, in a bilateral meeting, Vice President Harris noted that the U.S. will continue to work with Indonesia to secure “critical minerals required to expand our clean energy economies.”

Read next: 5 Mistakes Buyers Can Make When Sourcing Stainless Steel

Biggest Moves in Stainless Steel and Nickel Prices

- Chinese ferrochrome lump prices once again saw the largest increase within the overall index, rising 2.7% to $2,050 per metric ton as of October 1.

- Korean 304 cold rolled coil prices edged upward, increasing 0.63% to $2,659 per metric ton.

- Meanwhile, Indian primary nickel prices fell 6.68% to $19.50 per kilogram.

- LME primary 3 month nickel prices declined by 7.72% to $18,875 per metric ton.

- Chinese ferromolybdenum lump prices 9.04% to $35,423 per metric ton.