Nickel prices continued to the upside during the first half of March, taking a momentary pause from their long-term downtrend. However, prices found a peak by March 13, reaching their highest level since October 2023. Following that, the rally collapsed, and prices returned to the downside. Overall, nickel prices fell 5.56% month over month.

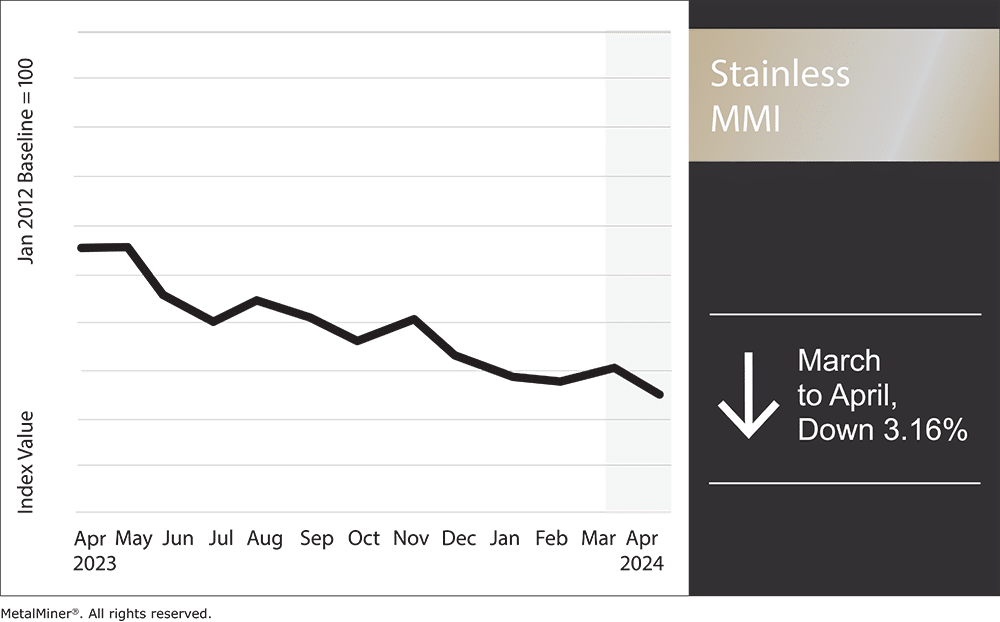

The Stainless Monthly Metals Index (MMI) fell 3.16% from March to April.

Receive weekly updates and nickel and stainless market intelligence, helping your company adapt and thrive in the face of changing demand dynamics. Opt into MetalMiner’s free weekly newsletter.

Falling Nickel Prices Temper Stainless Sentiment

As usual, the Q1 stainless market experienced a seasonal pickup from Q4, although falling nickel prices appeared to temper those gains.

Distributors reported improved demand conditions, which would suggest the market found a bottom during Q4. However, some noted that Q1 was a “disappointment” from a historical perspective. While limited in detail, Outokumpu’s recent pre-silent call ahead of their quarterly financial release suggested a stronger U.S. market. This contrasts with their Q4 2023 commentary, which indicated the U.S. market had yet to find a bottom.

The bounce in nickel prices triggered a boost in purchasing activity. However, as nickel prices started to retrace, market sentiment appeared to weaken as stainless surcharges seemed bound for another decline. By the end of Q1, distributors still characterized the stainless market as “slow.”

Bearish Nickel Outlook Amid Ballooning Inventories

While nickel prices found another bottom on March 27, the outlook remains bearish. There is little evidence that prices are on the verge of another breakout. Meanwhile, the threat of mine closures and process delays from Indonesia offered short-lived relief to what otherwise appears to be a largely oversupplied market. As a result, the most recent bounce in prices is more likely “market noise” rather than a meaningful shift in trend.

Although they do not offer a meaningful correlation to prices, LME inventories continued to balloon throughout March and now sit at their highest level since May 2022. This trend directly opposes markets like copper, which continue to witness inventory drawdowns ahead of an increasingly tight supply outlook. While both nickel and copper prices appeared bullish in recent months, optimism within the copper market remains driven by fundamental expectations. However, conditions in the nickel market suggest a very opposite trend.

LME copper and nickel prices show a 71.74% historical correlation since 2012. While both markets will benefit from demand in certain categories, such as EVs, supply conditions could see the current mediocre correlation erode in the coming years.

Indonesia Now the 300-lb Gorilla in the Nickel Market

It will hardly come as a shock to those watching the market over recent months that Indonesia now stands as the big (and getting bigger) player in the nickel market. Estimates say Indonesia will account for roughly half of global primary nickel output in the coming years, giving the country significant control over market direction.

Indonesia also made its intentions to keep nickel prices below the $18,000 per metric ton level very clear. For reference, nickel prices stood at $17,080 per metric ton as of April 3. According to the Financial Times, over half of global nickel production will become unprofitable should prices fall as low as $16,500. However, Indonesia will remain largely insulated from this due to its use of cheaper energy sources like coal. Absent of government support, falling prices appear poised to pull more output offline. Should this occur, it could offer support to the market. However, as Indonesian production levels continue to rise, the price risk remains to the downside.

Biggest Stainless and Nickel Price Shifts

- Korean 304 cold rolled stainless prices rose 3.69% to $2,625 per metric ton as of April 1.

- Chinese ferrochrome prices moved sideways, with a modest 0.77% rise to $1,351 per metric ton.

- LME primary three month nickel prices fell 5.56% to $16,740 per metric ton.

- Chinese primary nickel prices fell 5.82% to $18,109 per metric ton.

- Indian primary nickel prices saw the largest decline of the overall index, with a 9.86% drop to $15.89 per kilogram.