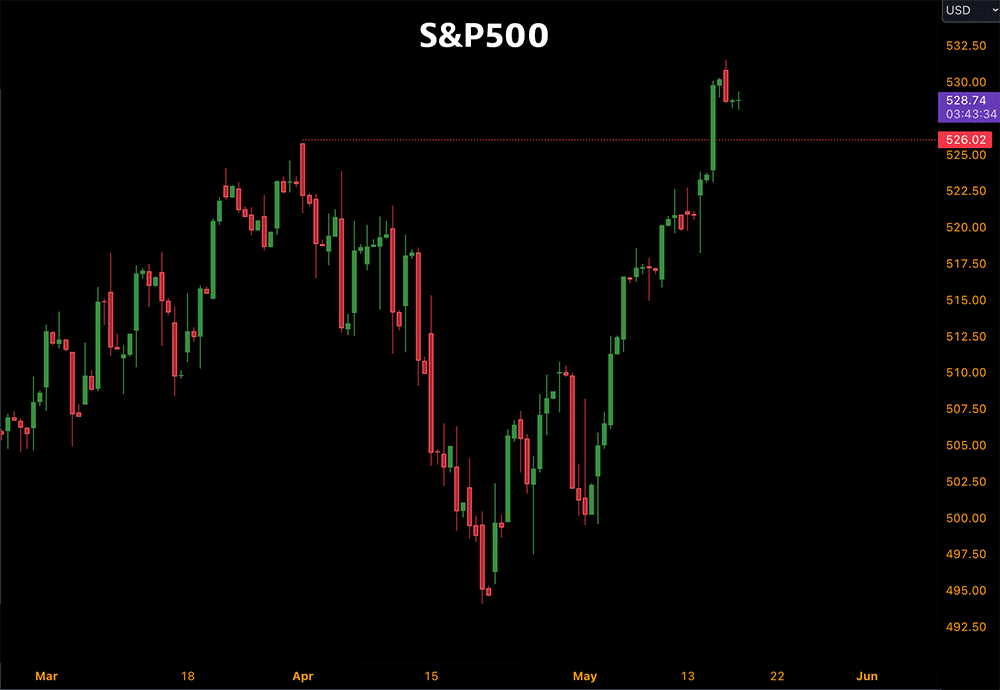

With the most recent economic data coming in hot for this month, overall financial markets presented optimistic signals. Amid futures tied to major stock indexes rallying to new highs, markets could see a significant impact on metal prices, including gold and copper prices.

The S&P500 closed just over $528, and the NASDAQ composite index closed with fresh new highs above $18,600. Meanwhile, precious metal prices such as gold, silver and platinum saw significant bullish upsides. This boost coincides with CME copper futures, which presented new yearly highs just above 5.0 earlier this month as geopolitical tensions continue to run rampant in the Middle East. However, these tensions apparently did not drive markets this month.

In addition, recent price action within the indexes and currencies also caused treasury yields to tumble, with investors and traders anticipating the Federal Reserve will begin cutting interest rates in September. This anticipation brings enthusiasm driven by positive market data. Within a 12-month period, CPI data rose 3.4%, which is in line with expectations.

Crush the with competition by getting access to weekly exclusive market intel on metal prices and more. Opt into MetalMiner’s free weekly newsletter.

Treasury Yields Decline

After S&P500 futures prices tumbled and retraced below $5,040.00 late last month, markets quickly found a relief rally, forming a bullish bias that drove prices to fresh new highs. With recent data acting as a major driver in current price action, investors may expect a pullback. Still, contrary to recent stock market indexes, treasury yields remain in a short-term downtrend due to recent bearish pressure.

10Y Yield futures presented robust declines and potential headwinds in the coming months. After prices peaked just above 4.7in late April, markets presented strong bearish pressure, forming lower lows at the start of May. Continuation to the downside may stem from further anticipation of the Federal Reserve cutting rates later this year, which could see a 4.0 price on the Yield.

Precious Metal Prices

Gold prices remain on track for another consecutive weekly gain as Friday price action rose 1.3% to just over $2,408/oz. Again, improved interest rate cut expectations helped spot gold prices trade in a bullish trend this month. This signals that inflation may be slowing down. After gold prices retraced from their April high earlier last month, prices formed a temporary bottom. This managed to drive current prices above the $2400/oz mark once more.

Gold prices forming a bullish bias in the short term also helped spot silver prices climb to fresh new highs. With silver futures contracts trading past their April high just above $30.5/oz, the current trend will likely remain strong, with price action potentially testing the 2021 highs. Platinum prices also saw a bullish bias. Indeed, this drove current market prices above $1050/oz, with fresh new highs forming above the January peak. Further upside for platinum may remain apparent as other precious metals continue to trade higher.

Discover how MetalMiner Insights empowers you to optimize metal sourcing for maximum cost savings and ROI. Learn more.

Copper Prices Skyrocket

CME copper prices also remained strong, with aggressive rallies to the upside creating new highs above 5.0 on the futures contract. This indicates a strong copper market fueled by geopolitical tensions, positive government data, fundamental demand, and short positions placed by firms. This past month, Trafigura and IXM looked to take on physical delivery of copper to hedge against large short positions placed on the CME exchange.

As failed positions placed on copper to the downside become unprofitable, firms have begun to take on delivery in order to close out larger short positions. This, in turn, caused buyer momentum to build, resulting in copper prices creating new highs, with a yearly gain of 28% and 14% over the last week alone.

Anticipating the Next Stock Market Trends

Ultimately, treasury yields resulted in a headwind. The 10Y Yield futures price peaked late last month at around 4.7, causing a lower weekly high to form. Analysts anticipate prices to trade lower as indexes and precious metal prices continue up. And with treasury prices trading below their May opening price, lower lows and highs will likely drive the overall trend further down, potentially testing March lows at 4.0.

As government data continues to roll in hot, traders and investors may expect higher prices on precious metals and a further downside on treasuries. Speculation that the Federal Reserve will cut rates in September continues to play a significant role in May’s price action for indices, metals, and treasuries.

Elevate your metal and commodity market intelligence, Subscribe to MetalMiner’s free Monthly Metals Index report to gain a deep understanding of the dynamics affecting 9 different metal industries.