DNV, a major global risk management company, has come to the common conclusion that solar PV power will get so cheap that it will eventually dominate new electricity capacity and production. “In 2050, solar PV will be in unassailable position as the cheapest source of new electricity globally,” the company stated in its annual global energy report. Naturally, some would say that this will happen well before 2050, and is already starting to happen, but the “unassailable” part is on the way still.

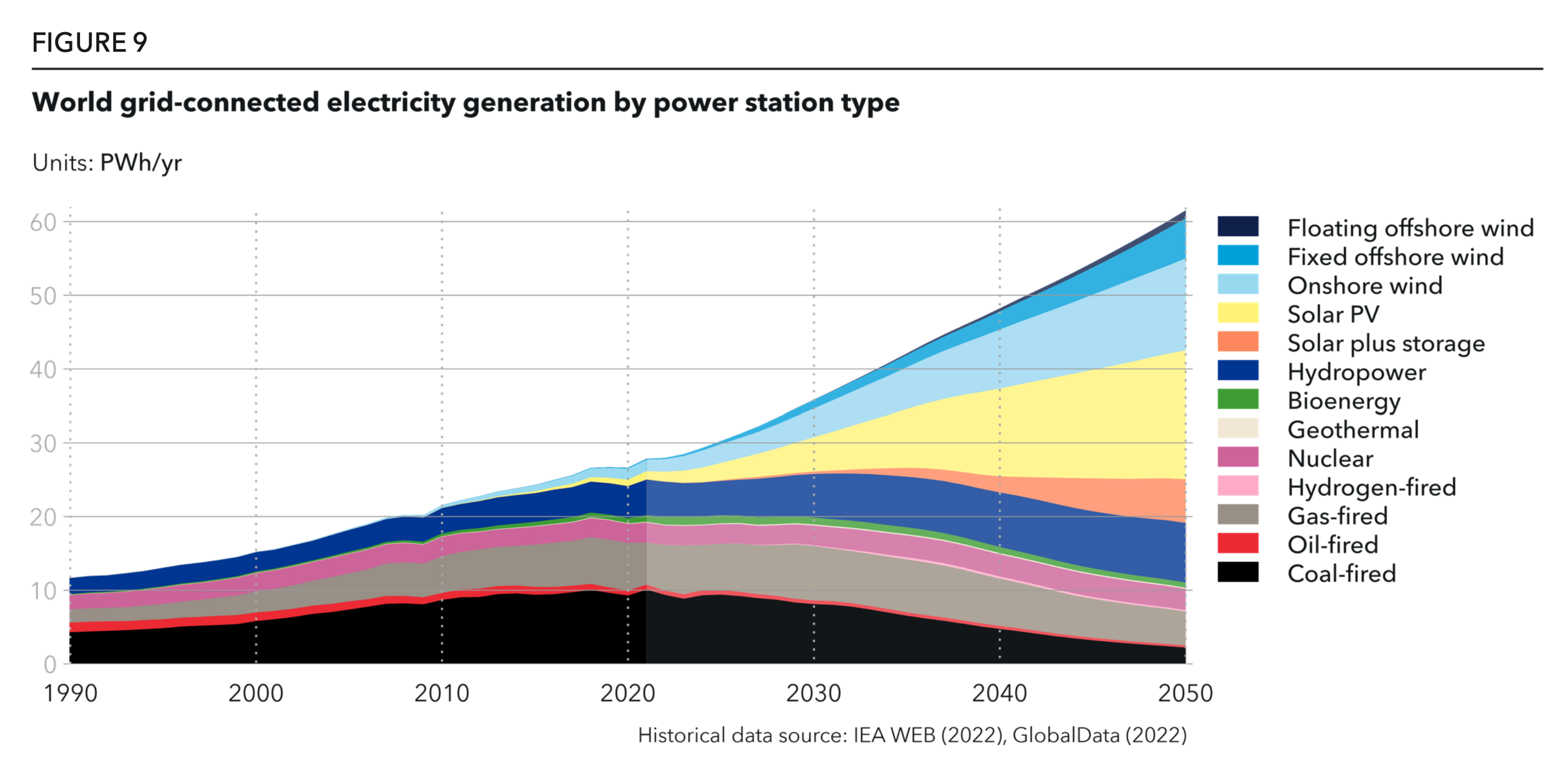

To put that word into numbers, DNV expects coal to have 4% of the market by then and fossil gas to have 8% market share. And that’s regarding electricity generation! DNV’s not talking about new power installation capacity with those figures. By 2050, DNV expects 70% of the world’s electricity to be coming from variable renewables (wind and solar) and expects fossil fuels to account for just 10% of electricity production.

How much does solar power have to grow, in terms of capacity, to reach that level of dominance in the electricity market? DNV predicts it will grow 24 times over compared to the 2020 solar PV total.

DNV points out that new solar power installations reached 1 gigawatt (GW) in 2004, then reached 10 GW six years later in 2010, then reached 100 GW nine years later in 2019, then — despite everything going on in the world — reached 150 GW in 2021. DNV sees the market getting up to 550 GW a year by 2050.

“From 2030 onwards, we expect annual additions of between 300 and 500 GW. By mid-century, total installed capacity will be 9.5 TW for solar PV and 5 TW for solar + storage. The resulting 14.5 TW of solar capacity is 24 times greater than in 2020.”

Naturally, the growth of solar PV will be driven by drops in solar PV costs. “We expect the average LCOE of solar PV to fall by at least 40% by 2050, with individual projects falling by as much as 60% relative to today’s average cost. With its high cost-learning rates (26% at module level per doubling of capacity, declining to 17% in 2050), solar PV will be the cheapest source of new electricity globally by a considerable margin, despite its lower capacity factors relative to other VRES sources. By 2050, 23 PWh/yr of solar electricity will be generated worldwide.”

Solar is expected to account for 30% of on-grid global electricity production by 2050, on the back of 54% of the world’s power capacity.

Furthermore, solar PV will get a big boost from the cost drops and growth of battery energy storage. DNV expects battery energy storage costs to drop 80% by 2050, based on a 19% cost-learning curve. Here’s the rest of DNV’s short summary of the topic: “Storage: pumped hydro currently provides most of today’s power system storage, but will only contribute marginally in the future. Batteries will provide most of the enormous future storage needs (Figure 17), either as standalone or in solar+storage or vehicle-to-grid configurations. From 2020 to 2050, standalone utility-scale storage will grow from 2.7 TWh to 8.8 TWh, more than doubling in size. Of this, Li-ion battery storage capacity will see the largest growth, from almost nothing to 4.4 TWh by mid-century. Towards the end of this decade, solid-state batteries appear to offer the best potential for a next wave in performance and cost improvements. Alternative chemistries will also evolve to satisfy the growing demand for longer-duration storage (5+ hours).”

Those are DNV’s thoughts on where the world on-grid electricity market, solar power, and storage will be by 2050. What are yours?

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …