WASHINGTON, D.C. — Since the Inflation Reduction Act (IRA) passed one year ago, U.S. solar and storage companies have announced over $100 billion in private sector investments, helping bolster the American economy, according to new analysis released today by the Solar Energy Industries Association (SEIA).

Solar and storage manufacturing is now surging in the United States, as 51 solar manufacturing facilities have been announced or expanded in the last year.

“The unprecedented surge in demand for American-made clean energy is a clear sign that the clean energy incentives enacted last year by Congress are working,” said SEIA president and CEO Abigail Ross Hopper. “This law is a shining example of how good federal policy can help spur innovation and private investment in communities that need it most. We are unleashing abundant clean energy that is creating jobs and capable of delivering affordable, reliable power to every home and business in this country.”

These new and expanded solar factories will invest nearly $20 billion into American communities and will amount to 155 gigawatts (GW) of new production capacity across the solar supply chain. These announcements include:

- 85 GW of solar module capacity

- 43 GW of solar cells

- 20 GW of silicon ingots and wafers

- 7 GW of inverter capacity

By 2026, the U.S. will have over 17 times its current manufacturing capacity across modules, cells, wafers, ingots, and inverters when these announced factories are in operation, which is enough to supply a majority of solar projects expected to be built in the U.S.

Over the next decade, the U.S. solar and storage industry will create 137,000 more jobs than it otherwise would have before the IRA was passed, with the entire industry workforce projected to grow to nearly 500,000 jobs by 2033.

Solar manufacturing facilities announced in the last year will employ more than 20,000 Americans. The nation’s solar manufacturing workforce is set to triple in size to over 100,000 jobs in the next decade.

In addition, 65 GWh of energy storage manufacturing capacity has been announced across 14 new or expanded facilities. Since the IRA was passed, over 3 GW of new large-scale energy storage projects have been deployed, and an estimated 100,000 customers have installed a residential solar system paired with battery storage.

By 2033, U.S. solar capacity will reach 668 GW, enough to power every home east of the Mississippi River and offset 459 million metric tons of CO2 annually. These reduced emissions from solar represent roughly one-third of all power sector emissions in 2021.

The solar industry will generate $565 billion in private sector investments over the next decade.

Learn more about this historic law and its profound impact on manufacturing investments, job growth, and clean energy deployment.

(SEIA Members: Access Detailed Resources & Information about the IRA)

The Inflation Reduction Act (IRA) is the most transformational clean energy policy in history. The passage of this historic legislation has had an immediate impact long-term outlook for the U.S. solar industry.

The Last Year of Solar and Storage Growth

- In the last year, U.S. solar and storage companies have announced over $100 billion in new private sector investments.

- Solar and storage manufacturing is now surging in the United States, as 51 solar manufacturing facilities have been announced or expanded in the last year.

- New solar manufacturing facilities will invest nearly $20 billion into American communities.

- Since the IRA passed, 155 gigawatts (GW) of new production capacity has been announced across the solar supply chain. These announcements include:

-

- 85 GW of solar module capacity

-

- 43 GW of solar cells

- 20 GW of silicon ingots and wafers

-

- 7 GW of inverter capacity

- In addition, 65 GWh of energy storage manufacturing capacity has been announced across 14 new or expanded facilities.

IRA Forecasts

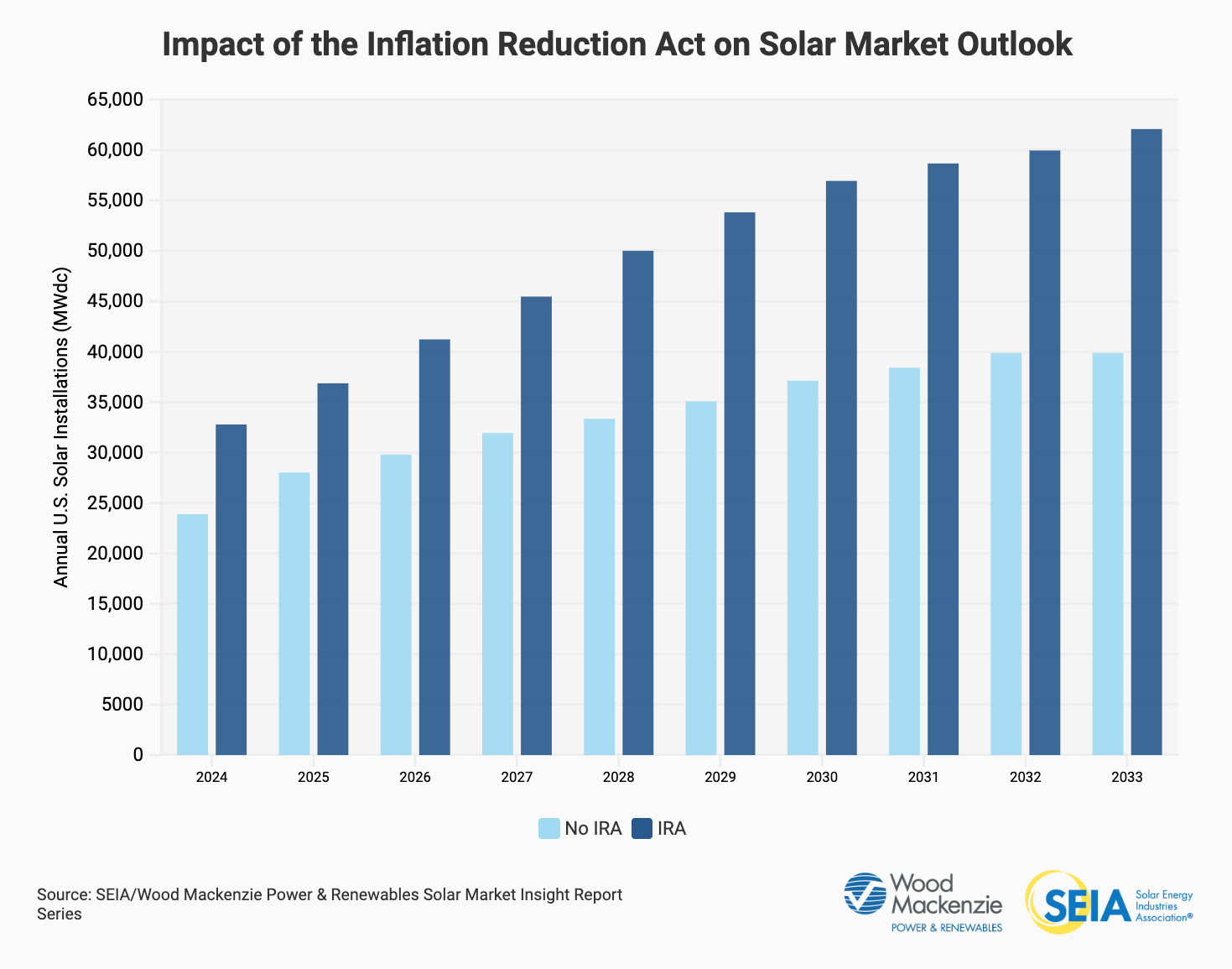

- Over the next 10 years, the IRA will lead to 48% more solar deployment than would otherwise be expected under a no-IRA scenario.

- By 2033, the U.S. will have installed 669 GW of total solar capacity, more than 4 times the amount installed today.

- By 2031, solar energy will produce more electricity each year than all U.S. coal-fired power plants in 2022.

- The IRA will drive an additional 160 gigawatts (GW) of solar over the next 10 years when compared to a no-IRA scenario.

- The IRA will lead to over $565 billion in new investment over the next decade, $144 billion more than under a no-IRA scenario.

- The solar industry’s annual CO2 emissions offsets will increase from 169 million metric tons (MMT) today to more than 459 MMT by 2033.

- 10 years from now, there will be enough solar power installed to power every home east of the Mississippi.

The IRA & U.S. Jobs

Over the next decade, industry employment will nearly double, from 263,000 today to 478,000 by 2033. Solar manufacturing jobs will swell to over 100,000 by 2033.

The IRA will create an additional 137,000 jobs by 2033 when compared with a no-IRA scenario.

Addressing Climate Change

Solar deployment spurred by the Inflation Reduction Act will offset an additional 665 million metric tons (MMT) of carbon emissions over the next 10 years when compared with a no-IRA scenario.

By 2033, U.S. solar installations will offset 459 MMT of CO2 annually, representing 30% of 2021 U.S. electricity sector emissions.

Resource Type Fact Sheet

Courtesy of SEIA.

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it! We just don’t like paywalls, and so we’ve decided to ditch ours. Unfortunately, the media business is still a tough, cut-throat business with tiny margins. It’s a never-ending Olympic challenge to stay above water or even perhaps — gasp — grow. So …