Nearly 96% of Canadian oil and gas firms have fewer than 100 employees, outpacing the U.S., Norway and the European Union

By Ven Venkatachalam and Lennie Kaplan

Follow CEC on Linkedin CEC Linkedin

Follow CEC on Facebook CEC Facebook

Follow CEC on Twitter CEC Twitter

Robin Davis of All-Weld Company Ltd., is photographed in Toronto, Ontario on Friday, July 31, 2020. (Photo by Peter Power/Canadian Energy Centre)

Overview

Small business plays a key job creation role in Canada‘s economy. There is a general notion that only big companies benefit from the development of Canada’s oil and gas sector.

As this Fact Sheet demonstrates, the vast majority of Canada’s oil and gas firms are small businesses. When Canada’s oil and gas sector is healthy, the small businesses therein are able to flourish.

This Fact Sheet compares oil and gas companies by size (small, medium, and large) as measured by employee counts; it then compares the share in the industry that are small businesses; and then compares these businesses by country (Canada with the U.S., Norway, and then with the European Union.

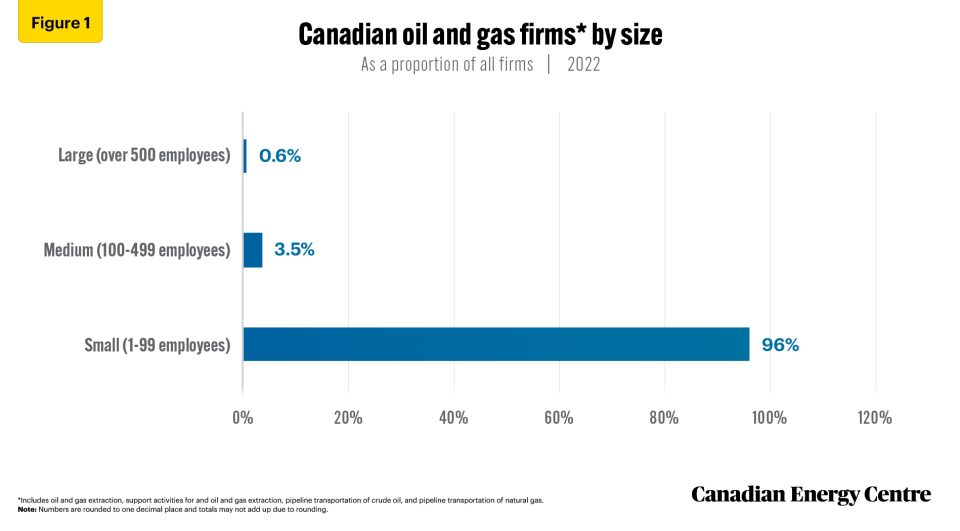

Comparisons of Canadian oil and gas firms by size

For the purposes of our analysis, Statistics Canada defines small businesses as those with between one and 99 paid employees. Medium-size enterprises are those with 100 to 499 employees, while large enterprises have 500 or more employees.

As of 2022, for oil and gas firms in Canada:

- 96.0 per cent are small;

- 3.5 per cent are medium-size companies; and

- 0.6 per cent are large companies (see Figure 1).

Source: Authors’ calculation based on Statistics Canada Table 33-10-0661-01

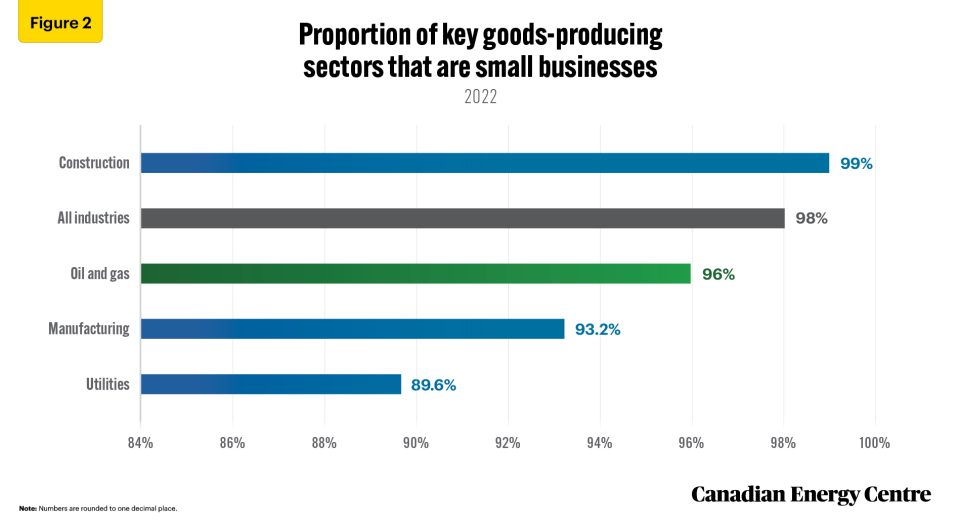

Industry comparisons in Canada

In Canada, the oil and gas sector has a higher proportion of small businesses than other major industries, with the exception of construction. As of 2022, 96.0 per cent of all oil and gas energy firms had between 1 and 99 employees compared with 93.2 per cent in manufacturing, 89.6 per cent in utilities, and 99 per cent in the construction sector. The all-industry average is 98 per cent¹ (see Figure 2).

1. The 98 per cent average for all industries is high largely because of the sheer size of the construction sector. In 2022, there were 154,252 firms in that sector compared with 51,726 in manufacturing, 6,486 in oil and gas, and 1,410 in utilities.

Source: Authors’ calculation based on Statistics Canada Table 33-10-0661-01

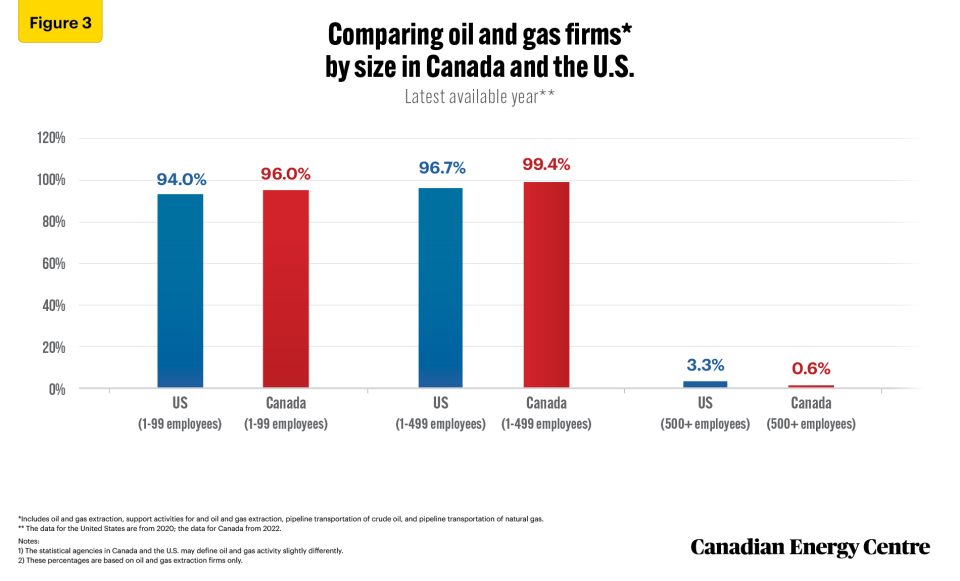

Canada-U.S. comparisons of oil and gas sector company size by employee count

Canada and the United States define small businesses differently. In Canada, small businesses have 1 to 99 employees whereas in the United States they have from 1 to 499 employees.

For a more standardized comparison between the two countries, Figure 3, which includes oil and gas extraction firms only, shows both the number of companies with 1 to 99 employees and the number with 1 to 499 employees in each country.

Using Canadian definitions of firm size:

- Small business comparisons: 94.0 per cent of all oil and gas extraction firms in the United States have between 1 and 99 employees compared with 96.0 per cent in Canada.

- Small and medium-size business comparisons: Adding in medium-size employee counts (defined in Canada as 100 to 499 employees), reveals that 96.7 per cent of all oil and gas firms in the United States have between 1 and 499 employees (i.e., are small and medium-size using Canadian definitions) compared with 99.4 per cent in Canada.

- Large oil and gas companies: Corporations with over 500 employees comprise 3.3 per cent of all oil and gas firms in the United States while in Canada “big oil and gas” accounts for just 0.6 per cent of all oil and gas firms (see Figure 3).

Sources: Derived from Statistics Canada Table 33-10-0661-01 and U.S. Small Business Administration (2023)

Comparing Canada with Europe: Number of firms involved in oil and gas

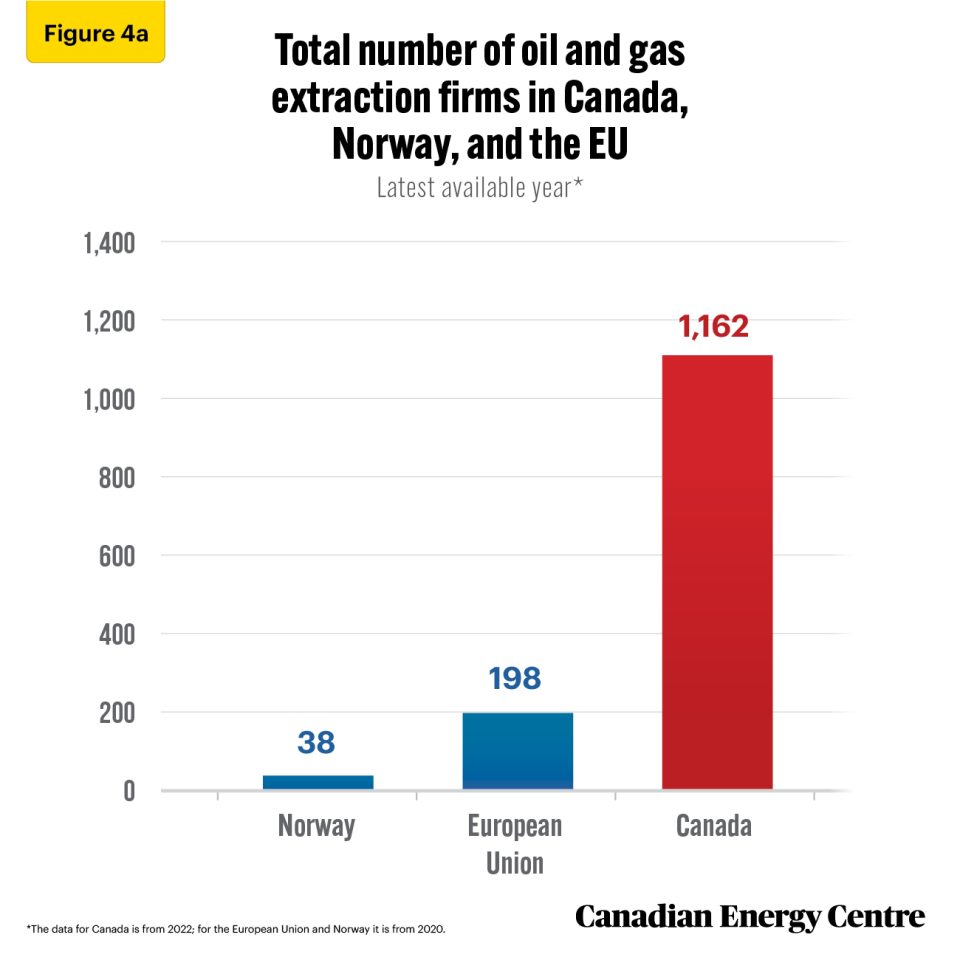

The final set of comparisons contrasts Canada with Norway (another major oil producer) and with the European Union (of which Norway is not a member). The first comparison (Figure 4a) illustrates the number of oil and gas firms in each jurisdiction, which makes it plainly obvious how important the oil and gas sector is to Canada.²

- Of the three jurisdictions, Canada has the greatest number of oil and gas extraction firms by far—small, medium, and large—at 1,162 in total.

- In contrast, Norway has just 38 oil and gas extraction firms³ and the European Union just 198 firms in total involved in oil and natural gas activity.

2. Canada-European Union comparisons are drawn from a smaller subset of oil and gas activity—oil and gas extraction only—which allows for international comparisons. 3. Large firms dominate Norway’s oil and gas sector given that all of its oil and gas comes from offshore drilling, which is a complicated and expensive undertaking.

Source: Eurostat (undated) and Statistics Canada Table 33-10-0661-01

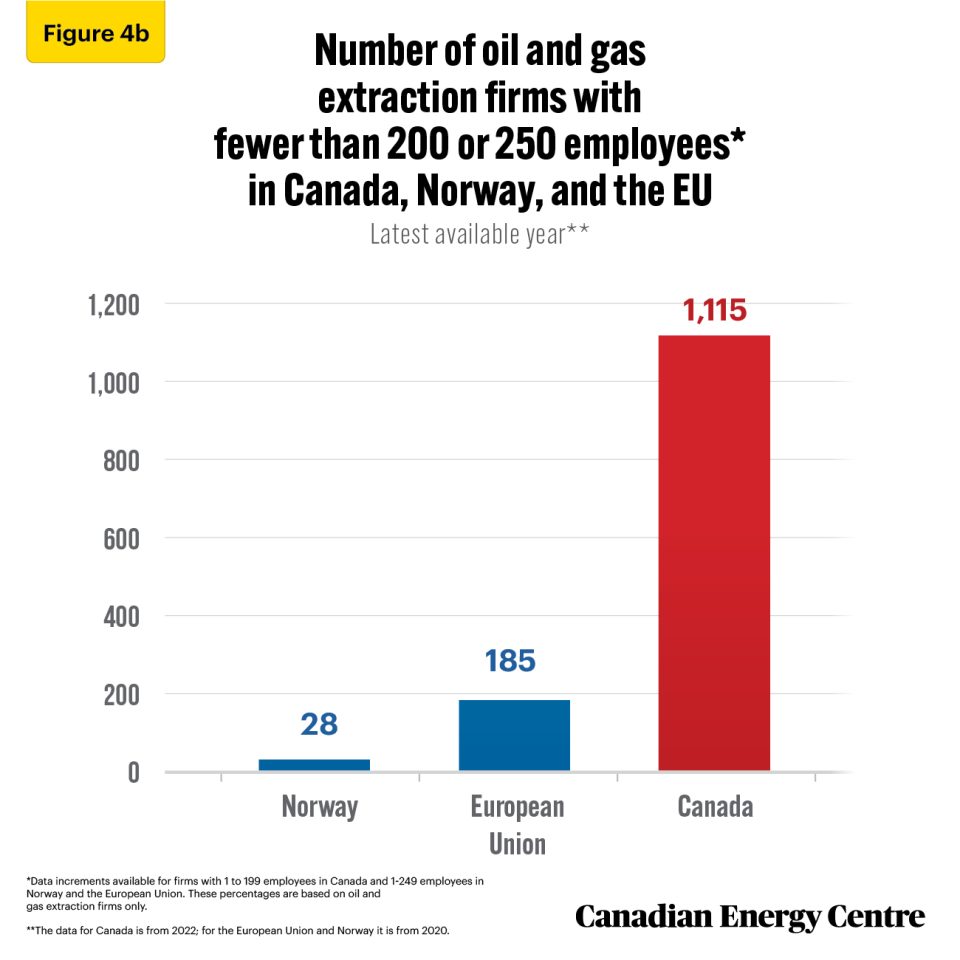

Unlike Canada-U.S. comparisons, data limitations do not allow for exact firm size comparisons based on 1-99 or 1-499 employee counts between Canada, Norway, and the European Union. The best we can do is compare firms in Canada with 1-199 employees (i.e., below 200) with those in Norway and Europe that have 1-249 employees (i.e., below 250). Figure 4b breaks down the proportion of oil and gas extraction firms by size for each jurisdiction.

- Norway has just 28 oil and gas extraction firms with fewer than 250 employees;

- The European Union has 185 firms that employ fewer than 250 employees; and

- Canada has 1,115 oil and gas extraction firms with fewer than 200 employees. In other words, even with Canada’s more limited employee count, the absolute number of oil and gas companies in Canada with smaller workforces is about five times that of Norway and the European Union combined (1,115 firms versus 213 oil and gas enterprises in Norway and the EU together).

Source: Eurostat (undated) and Statistics Canada Table 33-10-0661-01

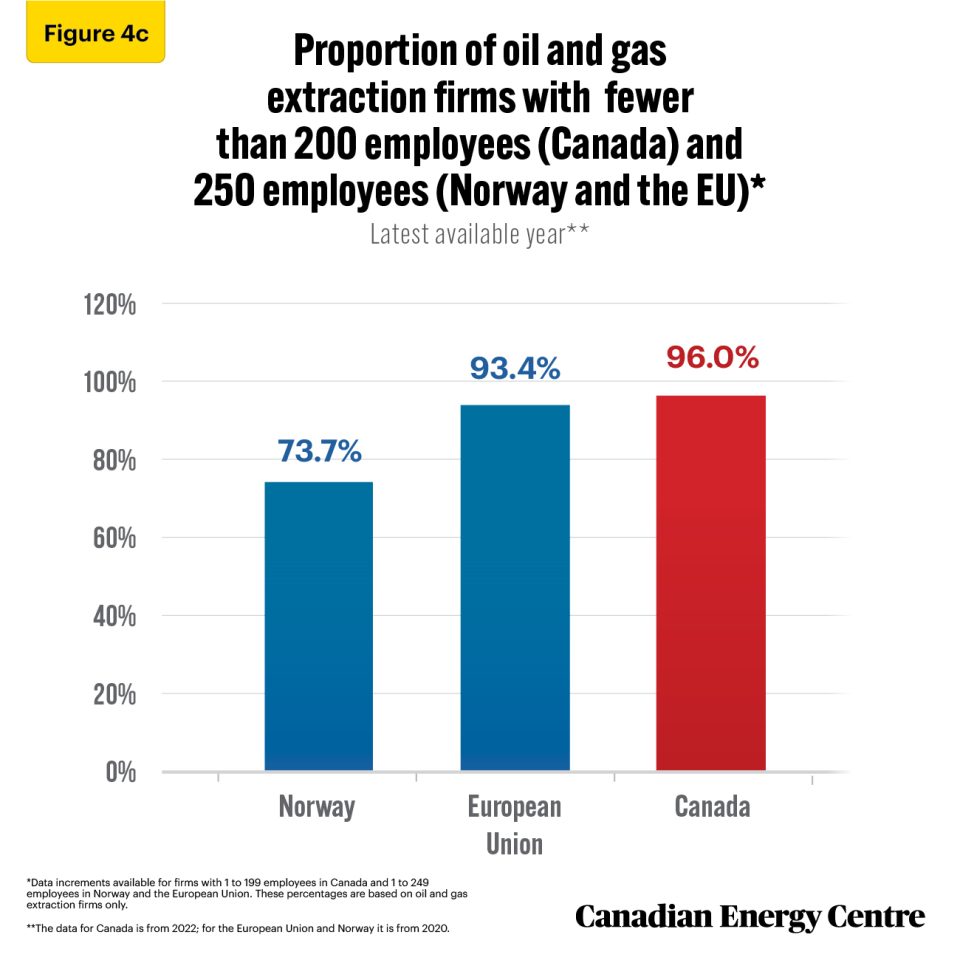

“Big oil” is a more accurate description in Europe than Canada

This slightly modified comparison shows that smaller businesses constitute 73.7 per cent of all oil and gas extraction firms in Norway, 94.3 per cent of all firms in the European Union, and 96.0 per cent of all and gas extraction firms in Canada (see Figure 4c). Canada’s oil and gas extraction sector is thus overwhelmingly composed of small and medium-size businesses relative to Norway and the European Union.

Source: Eurostat (undated) and Statistics Canada Table 33-10-0661-01

Conclusion

Most oil and gas firms in Canada are small or medium-size businesses whether measured domestically and compared with other sectors, or in international comparisons with the United States, Norway, and the European Union.

Notes

This CEC Fact Sheet was compiled by Ven Venkatachalam and Lennie Kaplan at the Canadian Energy Centre: www.canadianenergycentre.ca. The authors and the Canadian Energy Centre would like to thank and acknowledge the assistance of an anonymous reviewer for reviewing the data and research for this Fact Sheet.

References (All links live as of July 31, 2023)

Canada (2022), Key Small Business Statistics 2022, Innovation, Science and Economic Development Canada <https://tinyurl.com/2hme3n9s>; Eurostat (undated), Enterprise Statistics by Size Class and NACE Rev.2 Activity (from 2021 Onwards) <https://tinyurl.com/34auxean>; Statistics Canada (2023), Table 33-10-0661-01, Canadian Business Counts, with employees, December 2022 <https://tinyurl.com/5n82zpa2>; U.S. Small Business Administration (2023), 2022 Small Business Profile <https://tinyurl.com/3c6as4en>; United States Census (2023), 2020 SUSB Annual Data Tables by Establishment Industry <https://tinyurl.com/59u4t446>.

Creative Commons Copyright

Research and data from the Canadian Energy Centre (CEC) is available for public usage under creative commons copyright terms with attribution to the CEC. Attribution and specific restrictions on usage including non-commercial use only and no changes to material should follow guidelines enunciated by Creative Commons here: Attribution-NonCommercial-NoDerivs CC BY-NC-ND.

Share This: