I warned the miners were weak, and they again buckled under the pressure.

As a result, yesterday’s comments remain up to date, and I encourage you to read them to understand what should unfold in the weeks ahead.

The Power of Reversals

A reversal can be powerful. Two are often a game-changer. We just saw three.

On Wednesday, I wrote the following:

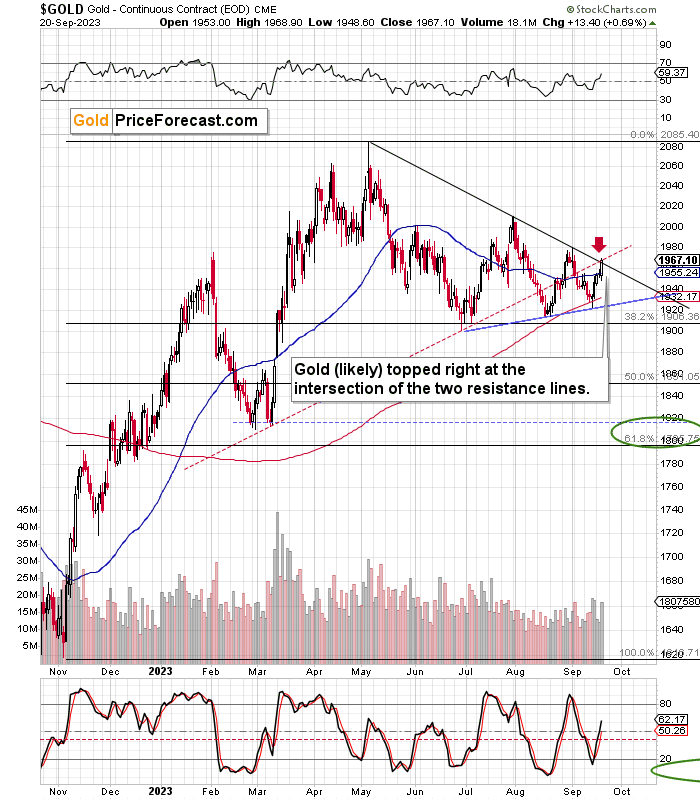

The momentum remains positive, so reaching this target – close to $1,965 – might be what triggers the reversal.

The reversal is likely anyway because the fact that both resistance lines cross creates a triangle-vertex-based reversal point. And it is due right about now.

Consequently, we might see some very interesting action in the upcoming days – with gold likely reversing its course, but quite likely from slightly higher price levels.

On the chart below, it’s clearly visible that gold did indeed move to the above-mentioned combination of resistance levels.

And on the chart below, you can see that it also reversed.

The reversal was clear, and if we want to be precise, gold moved slightly above the resistance line and then invalidated this tiny breakdown, which made the reversal even more bearish!

Strong Bearish Implications

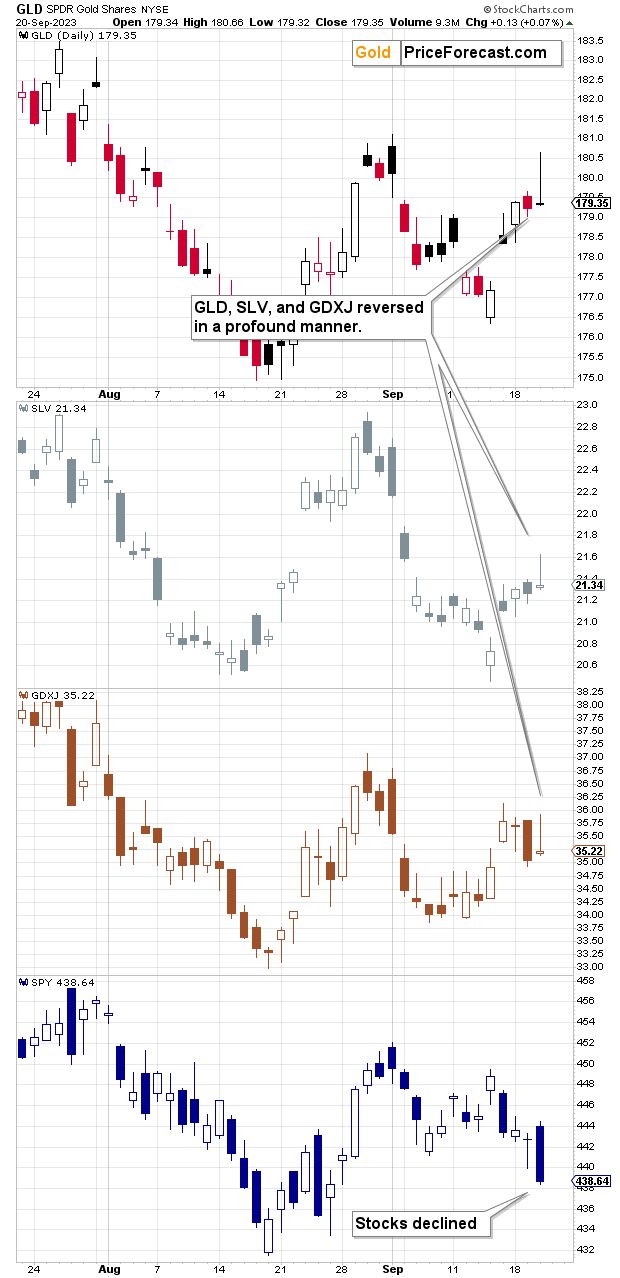

Besides, gold was not the only part of the precious metals sector that reversed in a profound manner. We saw the same things in silver and mining stocks.

The gravestone doji candlesticks are a form of an intraday reversal, which is likely to be followed by lower prices.

Since we saw not one but three of such reversals, the overall bearish implications are much stronger than if we just saw one. This further reinforces the scenario that I featured previously – namely, the precious metals sector corrected after the bullish reversal, but it wasn’t likely to correct substantially before turning south once again. What we just saw is confirmation that the move lower is about to start. It’s not yet too late to position oneself to benefit from it, but it might soon be.

********