Silver has just broken higher out of a short-term consolidation. This price behavior results in a target of $38.65, a 16% anticipated gain for silver over the months ahead. For investors seeking increased profit above this figure, silver miners have recently begun to provide positive leverage above and beyond the bullion price.

Silver has just broken higher out of a short-term consolidation. This price behavior results in a target of $38.65, a 16% anticipated gain for silver over the months ahead. For investors seeking increased profit above this figure, silver miners have recently begun to provide positive leverage above and beyond the bullion price.

Silver’s Breakout

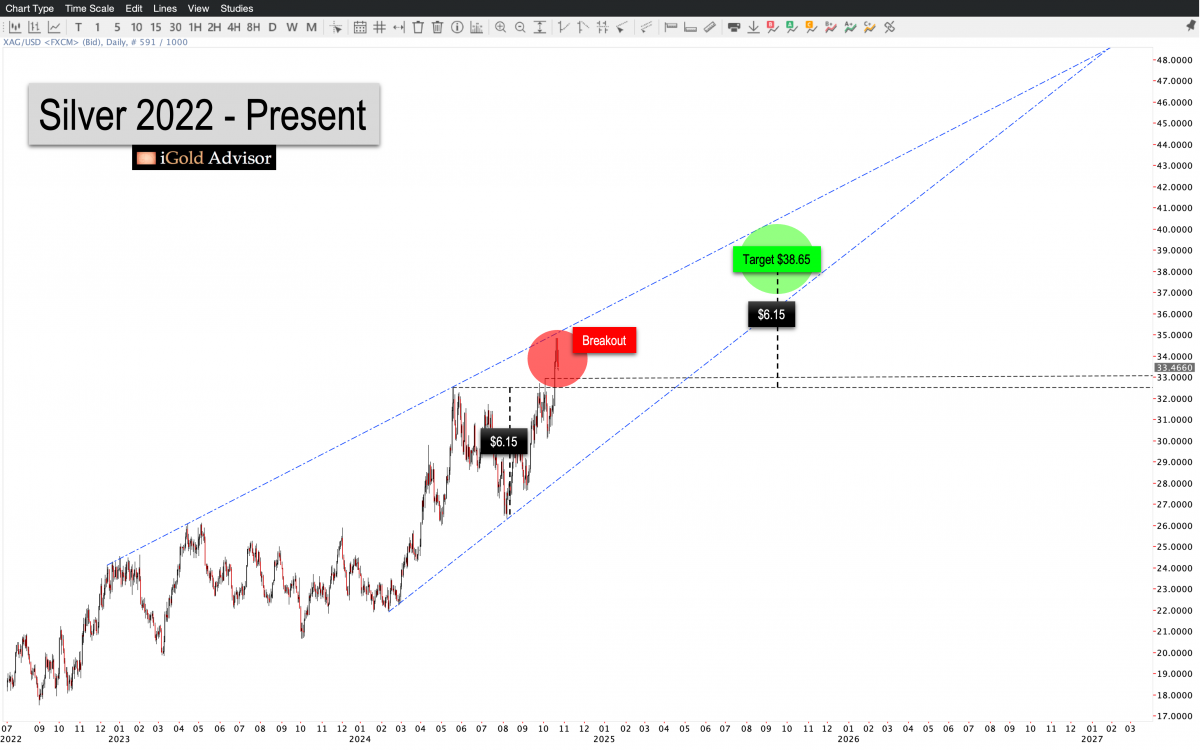

Silver’s breakout is clear to see on the chart below:

Note the five-month cup consolidation below the $32.50 figure (black dashed line). This consolidation began in May, and has just recently broken upward to trigger the pattern.

In the case of silver, the consolidation had an amplitude of $6.15 below the breakout point. We can reasonably now expect that $6.15 worth of short-sellers and hedgers will be incentivized to cover those positions. Silver thus has a reasonable target of $6.15 + $32.50, yielding a target of $38.65 for the coming months.

Timing the Target

We now need to place silver’s $38.65 target into the visible pattern boundaries in order to project an anticipated timeline for the advance.

Note the wedge-like pattern (blue dashed lines) that is forming in the silver market, with both sellers and buyers emerging at higher intervals since 2022. When we place the amplitude target of $38.65 within the visible pattern, we see that silver should be expected to achieve its target no later than Q2 – Q3 of 2025.

Invalidation Point

We must always identify a point at which we observe that something has changed in the market, and that a target has been invalidated. In the case of silver above, should the breakout point of $32.50 fail to act as support for at least two days over the coming weeks, it would suggest that the breakout has failed. In other words, a new swath of sellers would have emerged to overpower the short-coverers and hedge-closers. While this scenario is unlikely, we must always identify the point at which it would occur on the chart.

In technical analysis, breakouts are considered valid until proven otherwise. We thus maintain the $38.65 target assuming the market does not close back below $32.50 for multiple daily closes.

Leverage in Silver Miners

An advance from the current silver price of $33.30 to the $38.65 target will equate to a 16% increase in the price of silver over the coming months.

For those investors seeking profits above and beyond this 16% figure, we have recently begun to observe positive leverage within the silver mining complex.

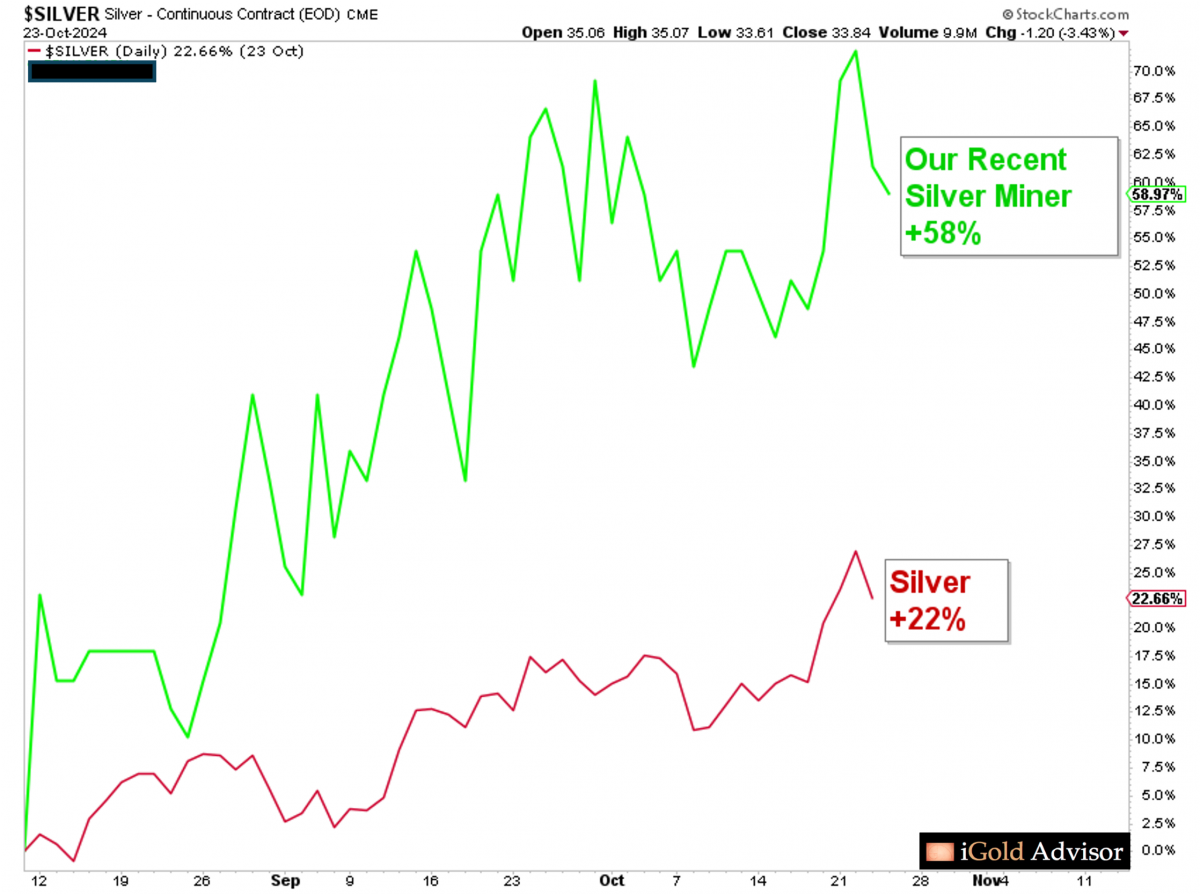

Below is the price of silver since the August lows, juxtaposed to a silver mining company (Silver Miner “X”) that we have recently purchased. Note that as silver itself is higher by 22% from the August lows, Silver Miner “X” is higher by 58%, or nearly triple the gain of silver bullion.

While we do not give away the names of the silver mining companies we invest in for free, investors who would like to achieve these types of gains may find more on our premium research available at www.iGoldAdvisor.com

Takeaway on Silver

The silver market has just triggered a breakout which yields an official target of $38.65 over the months ahead. This will represent a 16% gain above the current price for spot silver and bullion.

For those investors who would like to achieve higher gains, silver miners have recently begun to show positive leverage to the underlying bullion price.

*******