Chinese Silver Demand

Chinese Silver Demand

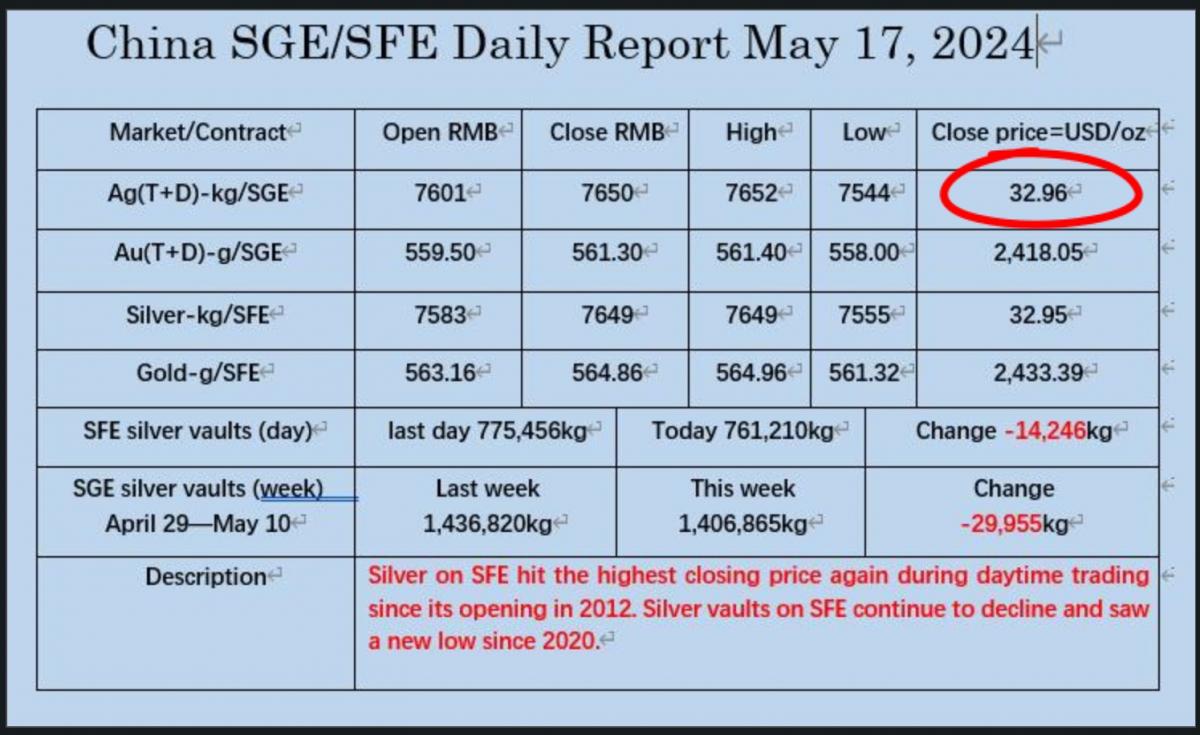

Demand for silver in China is rising. Priced in US dollars, silver closed at $32.96 on May 17th (Shanghai exchange). Arbiters buy silver at or below $30.00 in the US and sell it at a premium to China. Just a reminder that there is far more fiat currency in the world than there is actual metal.

source: https://x.com/oriental_ghost/status/1791373161285800295/photo/1

Soaring Copper Prices

Copper hit a new all-time high due to supply constraints at smelters. Supply issues and shortages could be the dominant theme for tangible assets throughout the remainder of this decade.

Our Gold Cycle Indicator finished at 244. The next cycle low is expected during the first half of June.

Technical Outlook

GOLD- Gold is consolidating after its breakout above $2100. I expect a $2800 to $3000 price target sometime in the third quarter.

SILVER DAILY- A breakout above $30.00 in May would support a quick spike towards $36.00. After the June low, we see a run into the mid $40s. In the event of a real supply crunch, a spike to $50+ remains possible.

PLATINUM- I believe platinum is very close to confirming a major breakout of the 16-year downtrend. A retest of the upper boundary supports a $8000+ price target.

GDX- The multi-year correction in miners resembles a head and shoulder bottom. A breakout above the 3-year trendline would support a $60 to $70 price target.

GDXJ- Juniors confirmed a breakout above the 3-year trendline, and prices should take out the $62.93 high of 2020 in the coming months.

SILJ- Silver juniors confirmed a breakout; prices should test the $18.00 level in the coming months.

S&P 500- Stocks continue to fresh highs despite a weakening consumer. I feel the upside is limited and wouldn’t be surprised if we get a sell-in May reversal before the month’s end.

Metals and miners are confirming new bull markets (the surprises are to the upside). The setup in silver looks explosive and prices could rip above $30.00. Expect a peak (1 to 2 years) in metals and miners sometime between July and September.

AG Thorson is a registered CMT and an expert in technical analysis. For daily market updates, consider subscribing www.GoldPredict.com.

*********