Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

A segment of Tesla shareholders is nervous. Many investors aligned themselves with the upstart all-electric car company early on, and they saw their portfolios rise with Tesla’s tremendous brand growth through consistently increasing revenues and sales. But enough is rarely enough, and now a vocal minority of Tesla shareholders are searching for methods to reinvigorate the company’s upward momentum. One solution that’s getting mileage is an old topic revisited: whether Tesla should initiate a full-fledged traditional marketing campaign to attract a new customer base.

Tesla’s entire marketing strategy is conducted digitally and via physical stores, and that means only negligible amounts are spent on traditional marketing methods. Yet, there are some disadvantages to social media marketing when compared to traditional marketing venues of television, film, radio, newspapers, magazines, billboards, and direct mail. For example, full-time on-site workers, individuals without internet access, and baby boomers are less likely to follow social media than others. Is Tesla missing out on these target audiences?

Then again, does traditional marketing make sense for Tesla at this transitional moment in transportation electrification?

CNBC cited a recent online poll conducted by @TroyTeslike, a popular and widely trusted Tesla follower. There were over 8000 responses. The majority of participants suggested that Tesla should start advertising through traditional means.

Traditional marketing messages, many shareholders feel, could focus on things like the falling cost of EVs and safety features like over-the-air software updates. Such campaigns could compete more directly with companies that are experienced marketers — Ford has been flush when promoting its F-150 Lightning pickup, and General Motors has run Super Bowl ads for the last 3 years.

The topic broke through in May at Tesla’s annual shareholder meeting when an attendee challenged CEO Elon Musk to expand advertising beyond social media. At the time, Musk seemed to consider the idea.

“There are amazing features and functionality about Teslas that people just don’t know about. Although, obviously, a lot of people who follow the Tesla account, and my account to some degree, it is preaching to the choir, and the choir is already convinced,” Musk said. “I think what you are saying does have some merit, and I believe in taking suggestions, and we’ll try a little advertising and see how it goes.” The shareholders cheered their leader. Musk replied, “I wasn’t expecting that level of enthusiasm.”

Nonetheless, Tesla has shown only a slight interest since then in traditional marketing. [Editor’s note: It should also be noted that at the time of this meeting, Elon Musk was pushing hard for advertisers to come back to Twitter, so there was much suspicion that finally — after more than a decade refusing to consider traditional advertising and criticizing the strategy — the reason for this concession was really to try to help Twitter.]

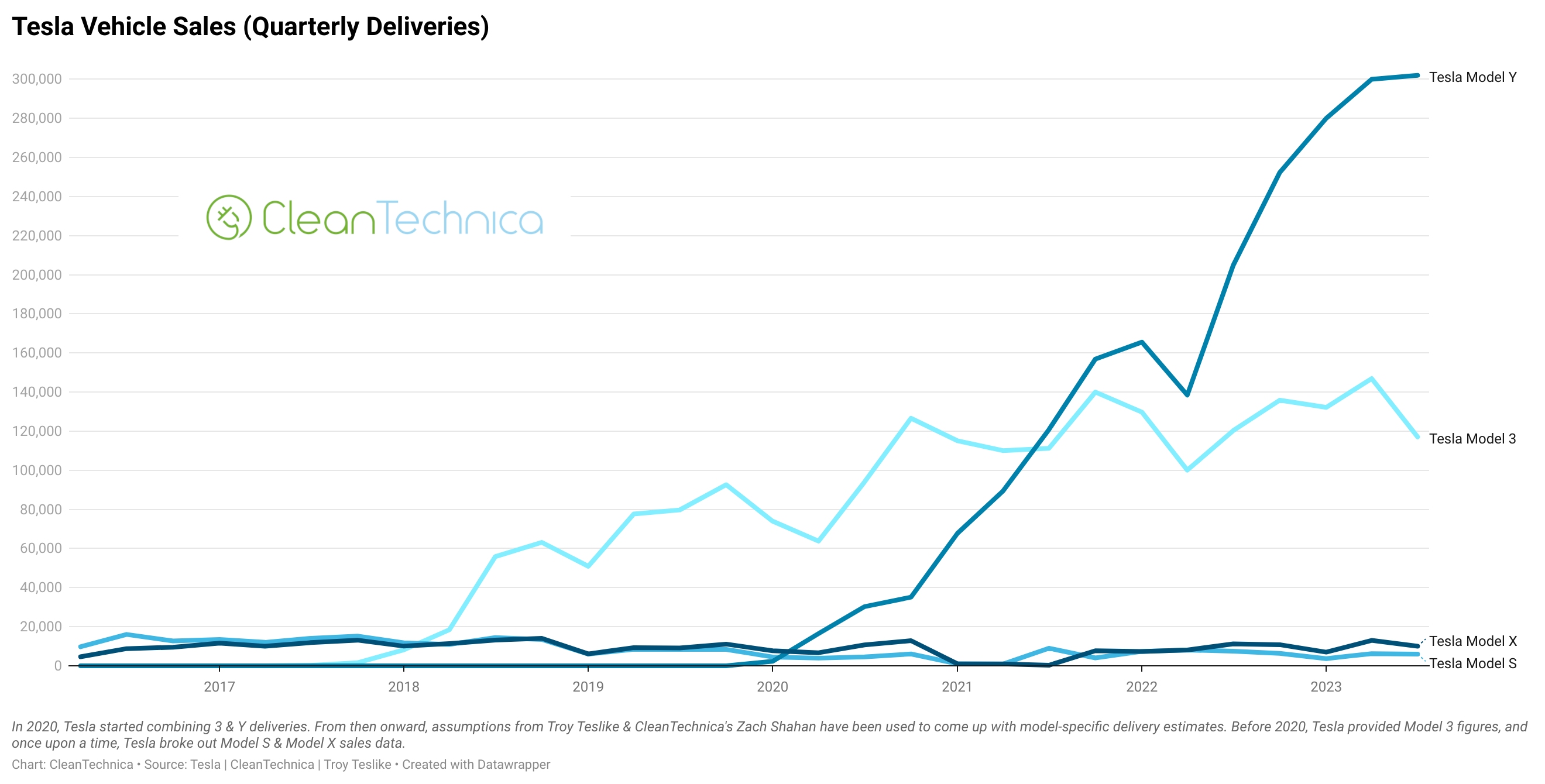

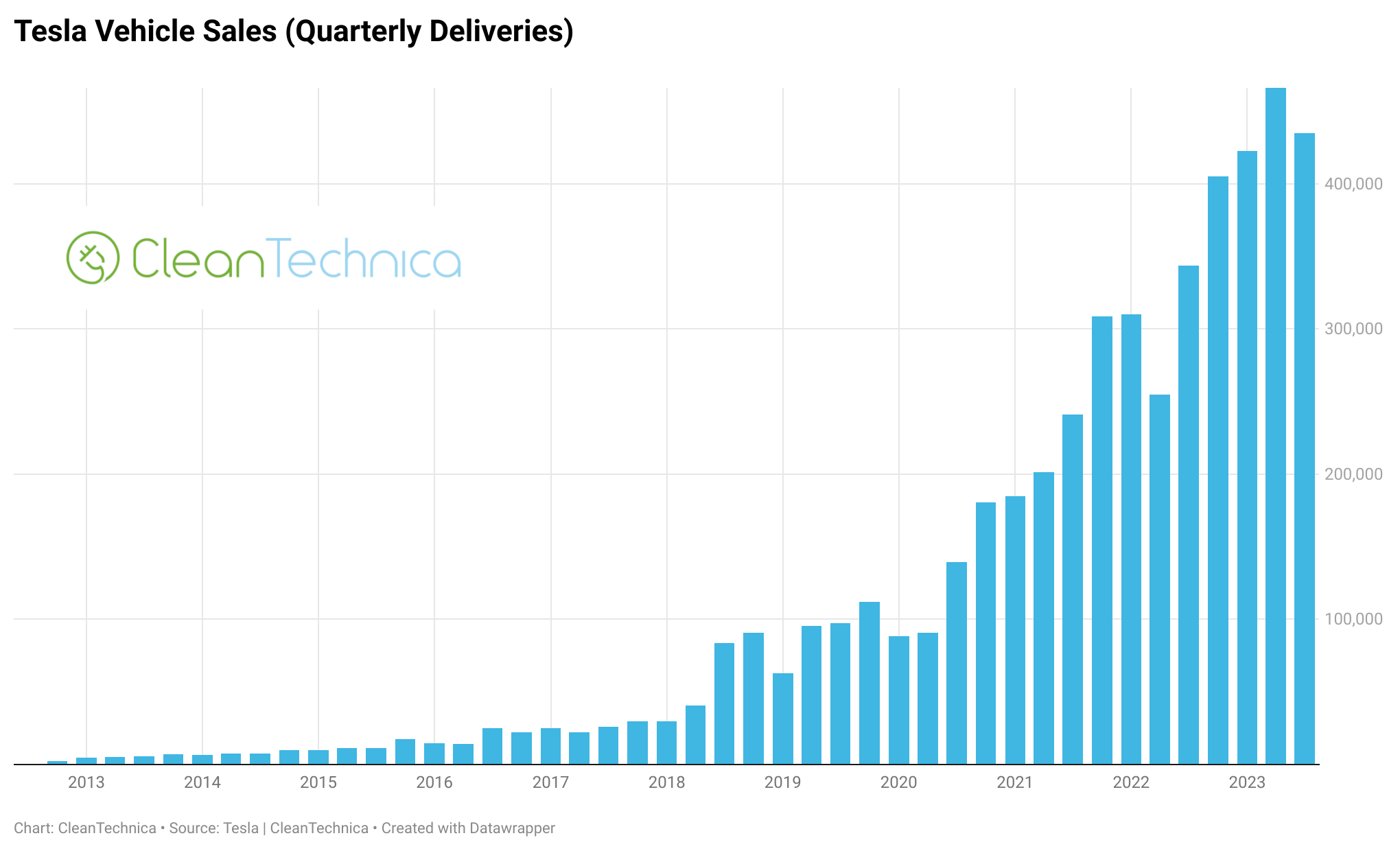

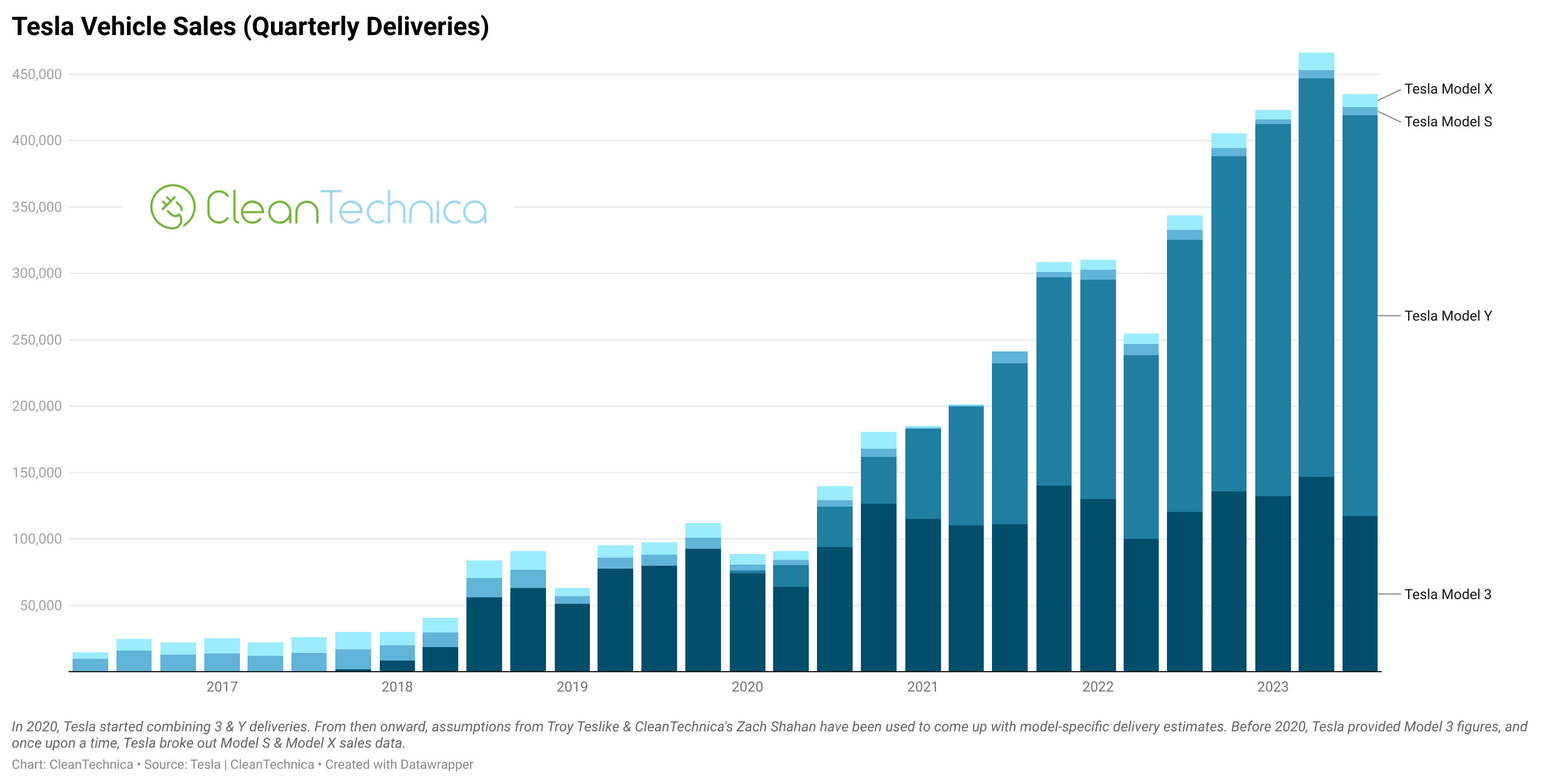

Instead, price cuts on its popular Model 3 and Model Y have boosted sales volumes to achieve Tesla’s ambitious target of 1.8 million unit sales this year. “It’s better to shift a large number of cars at lower margin and harvest that margin in the future as we perfect autonomy,” Musk told analysts on the Q1 2023 conference call. Musk noted that many Model 3s can be purchased in the US for less than the average cost of a new passenger vehicle.

Questions from shareholders about the direction of the company have erupted.

- Is prioritizing vehicle volume over margins actually feasible?

- Can Tesla maintain its standing while its US market share among EVs has been slipping?

- Is it the right move for Tesla to be focusing on adding technology to its older Model S and Model X?

- How much longer will Tesla shareholders have to wait for the long-anticipated Cybertruck launch?

- Is Tesla missing out on a viable unit sales booster without more familiar media campaigns?

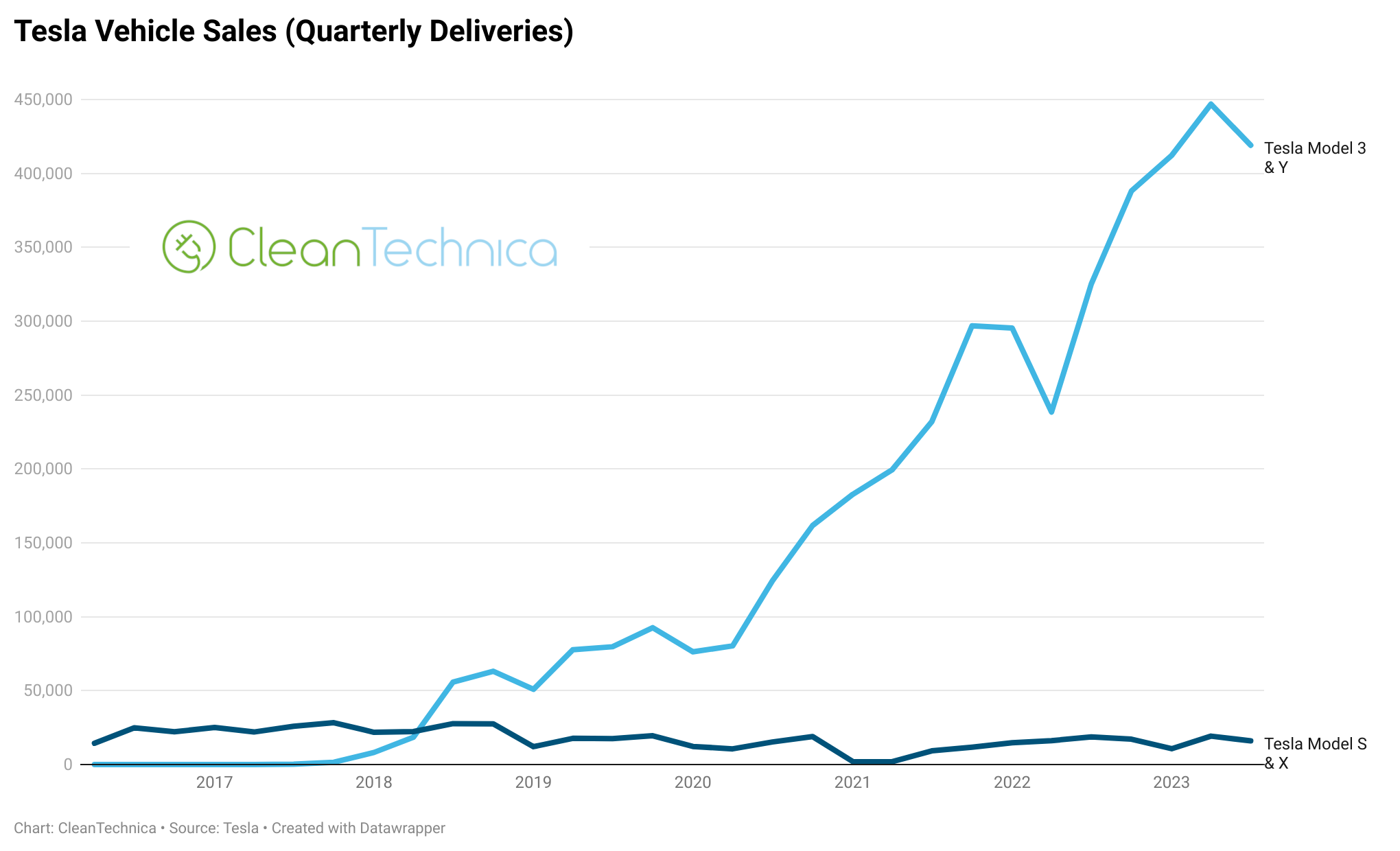

With the next quarterly results report scheduled to take place tomorrow, October 18, 2023, Tesla recently announced Q3 production and delivery numbers — over 430,000 vehicles produced in Q3 and over 435,000 vehicles delivered. The company acknowledged that a sequential decline in volumes was the result of planned downtimes for factory upgrades so the company could roll out a newer version of the Model 3.

Sometimes it seems that investors are only able to see short-term results for their investments — even when other options are omnipresent.

Likely Directions for Tesla in the Next 1–5 Years

Disruptive innovation is a term used frequently with the introduction of companies that change the business models of their competitors with new technologies and complex problem solving abilities. The car industry is not impervious to change and innovation, but it does adapt slowly, as demonstrated by the Detroit automakers and others who were reluctant to invest in battery EVs. Automotive News argues that automakers and their supply chains have come around and have invested hundreds of billions of dollars in emerging technologies that promise to transform how vehicles are constructed and how people will get around. That investment stream is now outpacing other industries’ quests for innovation.

That realization is quite important — for the single most significant macro problem that humanity faces this century is resolving the sustainable production and use of energy.

A vertically aligned company like Tesla has many opportunities within the paradigm of energy usage and production, and those options make the company uniquely placed in the auto industry. Musk identified in Master Plan 3 how the company’s EVs, batteries, and energy products serve as Tesla’s foundation toward achieving the transition to electrifying everything. Then the year started to play out, and Tesla gained market share in battery EVs through the first half of 2023, due in part to the Model Y becoming the best selling vehicle of any kind globally in the first quarter.

Tesla stated during its 2023 Investor Day presentation that it will cut the cost of its next generation of vehicles in half, largely by using innovative manufacturing techniques like building the cars in smaller modular units, then bringing those units together in smaller factories. The insight was also part of the company’s Master Plan 3.

In order to qualify for a portion of the $7.5 billion earmarked for EV charging network expansion in the 2021 Bipartisan Infrastructure Law, Tesla acquiesced and said it would open up 7,500 chargers from its Supercharger and Destination Charger network to non-Tesla vehicles by the end of 2024. This North American Charging Standard (NACS) will certainly increase overall Tesla share value.

Some analysts believe the Tesla production line upgrades could spark a rebound in deliveries in the 4th quarter of 2023 by allowing Tesla to refresh its lineup with models that could compete better with offerings from rivals such as Ford in the US and BYD in China.

Over the next 5 years, the most promising non-automotive business vertical might be energy storage and generation. This segment involves selling and installing solar panels and stationary batteries for residential and commercial clients. Energy may become a larger percentage of Tesla’s revenue, supporting top-line growth and giving it much-needed diversification.

The Motley Fool projects that Tesla will cut prices on next-generation vehicles by half through technological improvements and manufacturing efficiencies. If successful, these efforts could free up room for more price cuts while protecting Tesla’s margins.

And we can’t forget the company’s intensive artificial intelligence (AI) development, which entered a new phase this year with initial production of Dojo training computers. The Dojo supercomputer will be able to process massive amounts of data, including videos from its cars, to further develop software for self-driving cars. The resulting Full Self-Driving system builds on top of Tesla’s standard Autopilot driver-assistance system and costs $15,000, which is about double what the feature cost in 2020 and nearly 3 times what it cost in 2019. If approved by the NHTSA, the correlating market value could skyrocket.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

EV Obsession Daily!

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

Tesla Sales in 2023, 2024, and 2030

CleanTechnica uses affiliate links. See our policy here.