OTTAWA, ON: The Canadian Taxpayers Federation is calling on members of Parliament to pass the original Bill C-234 following Parliamentary Budget Officer reports showing the Senate’s amendments would cost farmers $910 million by 2030.

“Making it more affordable for farmers to grow food will make it more affordable for families to buy food,” said Franco Terrazzano, CTF Federal Director. “MPs must reject the Senate’s amendments and make sure the original Bill C-234 becomes law now.”

The federal government provided an agriculture exemption for carbon taxes on diesel and gasoline, but neglected to exempt natural gas and propane.

Bill C-234 would exempt the carbon tax charged on natural gas and propane used by farmers to dry their grain and heat their barns. The House of Commons passed this bill on March 29, 2023.

On Dec. 12, 2023, the Senate passed the bill with amendments that would apply carbon tax relief to drying grain, but not heating barns. An amendment also ends the relief after three years.

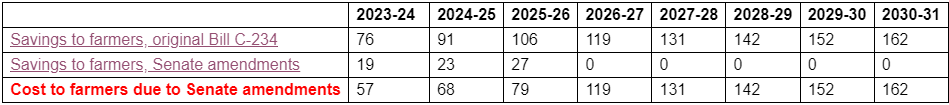

PBO reports show the Senate’s amendment would cost farmers $910 million. The table at the end of this news release shows the carbon tax relief from the original Bill C-234 versus the Senate’s amendments, according to two reports the PBO published on Bill C-234.

Without relief, the carbon tax on natural gas and propane will cost farmers almost $1 billion by 2030, according to a previous PBO report.

“Farmers have been waiting too long for much-needed relief,” said Gage Haubrich, CTF Prairie Director. “The House of Commons already passed this bill twice, now it’s time for Prime Minister Justin Trudeau to ensure the original Bill C-234 becomes law.”

Relief from original bill versus Senate’s amendments: PBO reports ($ millions)

— 30 —

For more information or to schedule interviews, please contact:

Franco Terrazzano

CTF Federal Director

Phone: 403.918.3532

Email: fterrazzano@taxpayer.com

Gage Haubrich

CTF Prairie Director

Phone: 306.750.8757

Email: prairie.director@taxpayer.com

Share This: