Each week Josef Schachter gives you his insights into global events, price forecasts and the fundamentals of the energy sector. Josef offers a twice monthly Black Gold newsletter covering the general energy market and 36 energy, energy service and pipeline & infrastructure companies with regular quarterly updates. We also hold quarterly webinars and provide Action BUY and SELL Alerts for paid subscribers. Learn more.

Economic, Political & Military Update:

Inflation pressure persists in the US leaving the Fed little room to lower rates at the coming meetings. Insurance, housing, food, electricity costs are all making consumers less able to afford what would have been considered basics. Going to McDonald’s, Starbucks, Pizza Hut or KFC with the family is now more expensive. Consumers are frustrated by the higher prices and they now eat there less often. These stocks have all been hit as consumers hold back spending due to their budget squeeze. Household savings are lower now than in 2008 and are at a miniscule 2% level.

Some of the new data points that are concerning include:

- Unit Labour costs rose 4.7% in Q1/24 (the most in a year) and were much higher than the 0.4% in Q4/23. Non-Farm Productivity fell to a meak 0.3% way below the 3.5% of Q4/23.

- The April NonFarm Payroll report showed a rise of 175K new jobs but was below the forecast of 210K. Average hourly earnings rose 3.9%, a too hot number for the Fed. The Unemployment rate rose to 3.9% from 3.8% as more people tried to enter the workforce. Think ‘undocumented illegal immigrants’ able to find work under Biden administration approvals. All the job gains appear to have been in part-time employment. Foreign born workers are taking the jobs that are out there but data shows that total Americans unemployment hit a new high.

- Powell said he ‘doesn’t see the stag or the flation’ in US data but the US Treasury Secretary uses the stagflation word regularly.

- Debt issuance by the Treasury will be over US$2T this year and crowding out is likely. Bond vigilantes will want yields over inflation so future data will be watched carefully and bonds can move quickly to new data points. China and Japan, the largest holders of US debt are now sellors as they need the funds to stabilize their own currencies and now buy gold as their reserve backstop. They want to get away from unrelenting deficit spending and who will govern after the upcoming Presidential election.

- Debt fueled spending continues in the US with school loan forgiveness by the President (to get youth votes in November) and “pork” in the recent budget deal (by both parties to get votes).

- Defense spending (war spending) is holding back consumer weakness. War economies with the resultant inflation pressure (in those sectors) are occuring in the US, the UK, Russia, Iran, China, Israel, North Korea and Taiwan.

- Cynics of US government data criticize how they calculate CPI as they have multiple times in the last four years changed the inputs to artificially lower the reported inflation. What do you see as your personal inflation? Do you buy into inflation being under 4%?

- The Fed, under pressure from the Treasury that is finding it harder to find buyers for its record funding this year, has agreed to lower its quantitative tightening by letting its books fall by US$25B of Treasuries versus US$60B monthly beginning in June.

On the wars front:

- The US is pushing for a ceasefire in Gaza accompanied by the release of hostages. Hamas was to offer 40 against multiples from Israel but now they only want to release 33 and some of those will be of bodies that died under their control. For this Hamas wants a permanent ceasefire. Israel wants live hostages released as well as the bodies of the fallen and no permanent ceasefire.

- President Biden to increase the pressure on Israel has paused a shipment of 3,500 bombs that they expected Israel to use in its move to destroy Hamas in Rafah.

- Providing support for Palestinian civilians has been haphazard and less than needed. Those in the Rafah area are now caught up in a war zone with no easy escape to a safe zone. Gazans have been denied refuge in Egypt.

- Russia is drilling troops near Ukraine for the use of battlefield nuclear weapons in response to NATO countries talking of sending their troops into Ukraine to fight Russia. France and Poland have said they are considering such an option. If NATO wants WWIII then this move would start a conflagration. It is appearing like the neocon warmongers in the west want the war in Europe to spread to change the narrative from deficit spending and the immigrant crisis to fighting the Russian bear.

- The US has given Ukraine more offensive weapons to hit Russia and Crimea. New Army Tactical Missile Systems (ATAMS) with a 200 mile range. Biden is now providing weapons to Ukraine to hit farther into Russia. The first batch of F-16 jets are expected within weeks.

Market Update: The general stock market correction is underway. The Dow Jones Industrials Index peaked in late March at 39,900 and has fallen to 38,923 as we write this report. Our target of 36,000, that we have been writing about for some time, is within reach during this quarter. Having cash and underweight the MEME names (FAANG’s and AI stocks) has helped to not lose as much as the major index.

Energy stocks peaked in early April as crude reached its high of US$88/b on the mideast war premium expansion. The run from early February was very rewarding and the ideas on our SER BUY List for the most part did very well. We see the general market and the energy sector as vulnerable. A modest correction should occur and that would provide the next low risk BUY signal which we see occurring during Q3/24. The S&P/TSX Energy Index peaked at 308 in week two of April and has fallen today to 296. A downside target below 240 in the coming months is likely. The overbought condition can be confirmed from the S&P Energy Sector Bullish Percent Index which rose from 39% bullish in February 2024 to 91% two weeks ago. The recent weakness has pulled this Index down to 78% today. Over 90% is an overbought reading. It should decline below 20% to give off an oversold level and a BUY window once again.

Our new SER issue feature called ‘TOP PICKS NOW’ highlights the best ideas at the time of each SER report. The ideas have worked out very well as not all stocks rise and peak at the same time nor do they bottom at the same time. If you want to see what our subscribers are looking at, sign up now for access to the Schachter Energy Research reports at https://bit.ly/2FRrp6k.

Bullish pressure for crude prices comes from:

- The potential for a pick up in the Middle East war.

- The Ukrainian success in attacking refineries in western Russia and the Iranian backed Houthis Red Sea and Gulf Of Aden attacks on shipping.

- OPEC is planning to extend its official cuts to the end of 2024 with the hope this tightens up global inventories and raises oil prices much further. Compliance however is still a problem and there is now more than adequate world supplies.

- The area to watch now is China demand. It is quite weak now but could rebound if the government’s stimulus moves take hold.

Bearish pressure for crude comes from demand weakness in many OECD economies. Also, the US is an exporter of crude (4.5 Mb/d last week). We expect a decline below US$75/b based upon fundamentals as demand falls during the spring shoulder season by 2.0 – 2.5 Mb/d. Note the build in US stocks this week (next section). For a refresher, during the last correction WTI fell (in December) to an intra-day low of US$67.71/b from US$79.60/b from just a few weeks before. In 2023, WTI fell from US$83.53/b in April to US$66.80 in June. In 2021, crude fell from US$76.98 in June to US$61.74/b in August.

We see a war premium still in the price of crude so if a ceasefire and hostage release is obtained during the talks sponsored by Egypt, Qatar and the US is successful we may see a fall in prices of US$5-6/b as a result of this action alone. Overall we could see prices US$10/b lower than today if events unfold successfully.

So remain patient and let the market do its normal swinging around and use the next period of market and energy price weakness to build up your energy weightings.

EIA Weekly Oil Data: The EIA data released today May 8th showed increases in inventories. US Commercial Crude Inventories fell 1.4 Mb to 459.5 Mb. The Strategic Reserve showed an increase of 0.9 Mb on the week to 367.2 Mb and is above last year’s level of 362.0 MB or up by 5.2 Mb. Refinery levels rose 1.0 points to 88.5%, lowering crude inventories. Motor gasoline inventories rose 0.9 Mb and are now 8.3 MB above 2023 levels. Distillate fuels saw a rise of 0.6 Mb to 116.4 Mb and are 10.3 Mb above last year’s storage levels. Total Stocks including the SPR are 9.9 Mb above last year and are now at 1,596.8 Mb.. Cushing inventories rose 1.8 Mb to 35.3 Mb and highlighted the inventory build Cushing inventories are now above last years level of 34.0 Mb. US Exports rose 550 Kb/d to 4.47 Mb/d.

US Crude production was flat at 13.1 Mb/d and is up 800 Kb/d above last year’s level. Motor Gasoline consumption rose by 178 Kb/d to 8.80 Mb/d while Jet Fuel saw a decline of 222 Kb/d to 1.49 Mb/d. Total Demand fell 127 Kb/d to 20.3 Mb/d. Year-to-date demand is up 0.3% or at 19.86 Mb/d versus 19.80 Mb/d last year.

OPEC has extended its production cutbacks to the end of June and members continue talking about extending the official cuts to the end of 2024 to curtail inventories and firm prices up even further. OPEC will decide their next move at a face-to-face meeting in Vienna on June 1st.

EIA Weekly Natural Gas Data:

The natural gas report out last Thursday showed a normal rise in storage levels. The increase was 59 Bcf, with the largest rise in the East at 17 Bcf. This compares to an injection of 56 Bcf last year and the 5-year average injection rate of 60 Bcf. Storage is now at 2.48 Tcf. US Storage is now 21.3% above last year’s level of 2.05 Tcf and 34.9% above the five year average of 1.84 Tcf.

NYMEX is today priced at US$2.21/mcf. The Freeport Texas LNG facility has reopened. Demand in Asia is picking up and Egypt is now importing more LNG as it is in short supply ahead of an expected very hot summer season and high air-conditioning usage.

We recommend buying the very depressed natural gas stocks during periods of market weakness (these stocks are very cheap now) as we see higher natural prices in Q4/24 and much higher prices in 2025. We plan to add additional natural gas names to our Action BUY list when we get the next low risk energy BUY signal.

Baker Hughes Rig Data: In the data for the week ending May 3rd, the US rig count fell eight rigs to 605 rigs (they fell six rigs in the prior week). Rig activity is now 19% below the level of 748 rigs in 2023. Of the total rigs working last week, 499 were drilling for oil and this is 15% below last year’s level of 588 rigs working. The natural gas rig count is down 35% from last year’s 157 rigs, now at 102 rigs due to the weak natural gas prices at this time. This sharp decline in drilling should continue for a few more months but the industry is seeing declining production. Recent data shows US daily natural gas production at 95.5 Bcf/d down from the high late last year of 106 Bcf/d. Once storage comparisons improve we should see natural gas prices lift.

In Canada, there was a rise of two rigs to 120 rigs working (versus a decline of 9 rigs last week). Canadian activity is up 29% from last year’s 93 rigs. Activity for oil is at 60 rigs compared to 34 last year or up by 76% as companies add more oil to meet TMX pipeline demand. Activity for natural gas is at 60 rigs compared to 59 last year and condensate rich wells are the focus of this activity. In our discussion with E&P companies they are planning on lower spending during Q1-Q3 due to low natural gas commodity prices. They have mentioned that they might increase activity later in the year, if natural gas prices rise materially as LNG Canada starts up. The industry needs north of $2.50/mcf to see the economics attractive to drill more gas wells. As we get closer to LNG Canada ramping up in Q4/24 and natural gas fills the Coastal GasLInk pipeline, prices should lift.

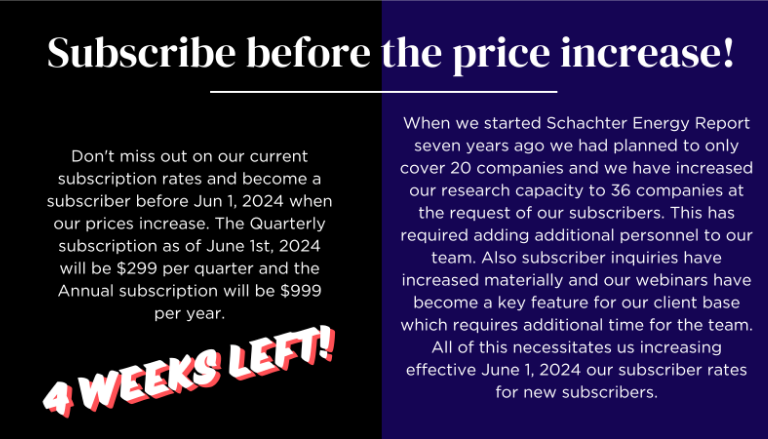

Current subscribers will not be affected by the price change as long as they keep an active subscription. Subscribers who sign up before Jun 1, 2024 will be grandfathered in at the original prices of $249 per quarter or $799 per year as long as their subscription remains active.

Subscribe now to lock in the savings!

Energy Stock Market: The S&P/TSX Energy Index today is at 295, up 7 points from our last issue. We would not chase the sector here but wait for the developing correction to lower prices and then add to portfolios. We are bulls but we don’t want to chase stocks. We like to BUY when stocks are cheap and are being ignored. That is not the case now. There still are some stocks that are BUYS but that list has shrunk. We cover those that remain cheap in our TOP PICKS NOW section of our SER reports.

Investors should decide what you want your energy weighting to be for this long energy super cycle. Our BUY List includes ideas from the Pipeline & Infrastructure area, Canadian oil and natural gas ideas, energy service ideas and companies working internationally. Our list includes large Conservative ideas and small to large caps in our Growth and Entrepreneurial categories. Add to your current ideas or add new ideas. We expect that WTI should lift above US$90/b in 2H/24 as winter 2024-2025 demand should exceed supplies at that time and we see recovering economies globally.

CONCLUSION:

Longer term we remain very bullish. Our view remains that before the end of this decade we expect to see WTI prices exceeding the high in 2008 of US$147.27/b.

Please take advantage of the current SER pricing structure to become a subscriber before our price increase on June 1st. We are in an exciting energy super cycle and there is a lot more to the upside. To get our specific views and to learn about the companies we cover, become a subscriber. Getting a subscription will help you navigate your energy investments as this cycle unfolds into the end of this decade.

WTI is priced now (as we write this report) at US$78.34/b (low so far today US$76.89/b). Near term we see a break of US$75/b occurring as inventories build during this shoulder season. We expect to take advantage of the bargains in energy stock prices with new BUY ideas if one more of our BUY signals is triggered. Down market days for energy stocks are the best days to build your positions for the lengthy energy super cycle we see lasting into the end of the decade.

Our next SER Report comes out tomorrow Thursday May 9th. This report will cover the last three companies that have reported Q4/23 results since our last SER report. It will also include an updated Insider Trading Report. Starting in late May our SER reports will cover Q1/24 results.

Our upcoming quarterly webinar on Thursday May 9th will be very timely given the market’s disruptions. Subscribers can send in their inquiries to info@schachterenergyreport.ca and we will try to get to as many of them as we can during the 90 minute event.

Our new ‘TOP PICKS NOW’ section in each report has been very well received and has had significant positive performance. It covers the best ideas from our five groupings that we cover (Pipelines/Infrastructure/Royalty Companies. Domestic Natural Gas Companies, Domestic Liquids Producers, International E&P Companies and Energy Service Companies). Not every issue will have an idea in every grouping if the stocks in such a group are not at bargain buy levels. In the upcoming issue we have three very attractively priced ideas that one can consider now. If interested in these reports, become a subscriber. Go to https://bit.ly/2FRrp6k.

Please save the date for our 2024 ‘Catch The Energy’ conference on Saturday October 19th at MRU. We have received confirmation that the Honourable Brian Jean, Minister of Energy and Minerals of Alberta will be our opening Speaker. We have started to meet with Presenter energy companies and have started signing up presenters for this year’s conference. As this list develops we will start providing you with the names of the Presenting companies in our upcoming reports as we did last year. We have space for 35 companies in the energy industry of today and 10 spots for the TMX sponsored energy industry companies of the future (clean-tech, renewable energy, and critical minerals). This mix can change depending upon response from our meetings. If you know of companies that are public or nearing going public and have a compelling story to tell, have them contact us at info@schachtereenergyreport.ca.

As usual subscribers will receive two complimentary tickets to the event, so another great reason to become a subscriber.

Please feel free to forward our weekly ‘Eye on Energy’ to friends and colleagues. We always welcome new subscribers to our complimentary energy overview newsletter.

Share This:

Next Article