Each week Josef Schachter gives you his insights into global events, price forecasts and the fundamentals of the energy sector. Josef offers a twice monthly Black Gold newsletter covering the general energy market and 35 energy, energy service and pipeline & infrastructure companies with regular quarterly updates. We also hold quarterly webinars and provide Action BUY and SELL Alerts for paid subscribers. Learn more.

Economic, Political & Military Update:

The eyes of the world are focused on the Middle East after the massive terrorist attack and invasion by Hamas in southern Israel. This surprise attack by air, land and sea was worse than the 1973 Yom Kippur invasion with horrendous civilian casualties (1,300 murdered and over 3,200 wounded) and horrific mutilations of civilians. Worse yet hundreds are now captive and will be used by Hamas as shields if Israel comes in to destroy Hamas and free the captives (which include US and Canadian hostages). For the poor residents of Gaza (2.3M people) the area under control by the Hamas terrorist organization, this war just adds to their misery.

Some of the current issues to be aware of:

- The US has sent a second carrier group to the eastern Mediterranean in case the war spreads from just Gaza to Lebanon, Syria and Iran. When, not if, Israel moves into Gaza to eliminate Hamas, Hezbollah (who control Lebanon) and Syria (both Iranian proxies) will likely attack Israel and then the US will be involved to backstop Israel and would be drawn into the fight with the regional terrorist organizations and countries as Israel fights a two or three front war.

- Syria launched missiles into northern Israel (the Golan Heights) and Israel returned fire hitting airport runways in Damascus and Aleppo. This could end up a very important battle area if the war expands beyond Gaza.

- The US has mobilized its special forces and marines if needed to free the US hostages in Gaza held by Hamas. They are working with Israel on intelligence and other matters to find the least casualty alternative.

- Diplomatic activity is ongoing to see if a less extreme solution (extermination of Hamas) is possible. Qatar, Saudi Arabia and Egypt are all involved at the request of President Biden. One possible help would be if Egypt opened its border with Gaza and let the 2M civilians in Gaza move into refugee camps in their country while the fighting persists. This is not likely as Hamas wants as many living shields as possible to make Israel the bad guy as they enter Gaza to remove Hamas fighters. This will be a very deadly assault no matter how much care Israel takes. Street fighting in the rubble of Gaza will prove gruesome. Once Israeli troops enter Gaza, a new chapter in Middle East wars will have begun.

- Qatar has blocked Iran’s access to the US$6B that was freed up in the prisoner exchange at the behest of the US. Biden has been under heavy pressure to make this happen.

- Israel has called up over 360,000 reservists with more than 300,000 sent to the south surrounding Gaza and many of the rest sent to the Lebanon/Syria borders. Israel has declared this a war and is moving to a war footing, expecting a lengthy conflagration.

- Hezbollah is a big worry for Israel and the US as it has hundreds of thousands of trained soldiers (fighting the civil war in Syria as they propped up President Assad) and has large quantities of missiles with guidance systems (over 100,000 drones and missiles). .

- Crude prices initially lifted after the terrorist attack from US$81.50/b for WTI to US$87.24/b. They have backed off today to US$82.76/b on the back of the US data showing a new 2023 high for US production (13.2 Mb/d – up 300 Kb/d on the week, and up 1.3 Mb/d from the same time in 2022)) and a 10.2 Mb increase in Commercial Stocks.

- European gas prices took off (over 20%) as Australian unions gave notice to resume strikes at LNG plants, Israel shut in its offshore natural gas production, and a gas pipeline connecting NATO member states Finland and Estonia was breached by an external force. Russia is being blamed and reporters see this seen as retaliation for the US bombing the Nord Stream 2 pipeline.

- Most horrifying is that the founding member of Hamas, Khaled Mashal has called on muslims around the world to have a ‘Day of Rage’ this Friday (the Friday of Al Aqsa flood). He called on supporters all around the world to Jihad to attack Jewish centres and people. The quote in English was ‘today we are asking for your blood and souls to be sacrificed for Palestine.’ Many communities will see greater police presence at synagogues and Jewish gathering places. New York Mayor Eric Adams placed the city on’ high alert’ as they are concerned about lone-wolf terrorists who Hammas radicalized. Expect more security in your own communities over the days ahead.

Daily economic news really doesn’t matter when war is being fought and thousands have already died.

Market Movement: We have warned about a breach of the 33,600 level for the Dow (today at 33,508), which completes a topping formation for the Dow. A close below 32,600 would set up the waterfall decline phase to below 30,000. Stay patient with cash reserves.

Once this correction has lowered stock prices and fear has returned to the markets over the coming weeks, be ready to buy the bargains that develop. As the general stock market declines we expect energy prices to back off and the Energy Bullish Percent Index to retreat back to below 10% and ring the bell for the next BUY window. The last BUY signal was in March and we added 14 new ideas to our Action BUY List. Many energy stocks are down from their 2022 highs, and many trade around Proved Developed Producing (PDP) Reserve valuations levels. If you want to see what our subscribers are looking at, sign up now for access to the Schachter Energy Research reports at https://bit.ly/2FRrp6k.

Bullish pressure for crude prices comes from the cuts by Saudi Arabia that have been extended to the end of 2023. The war drums (Hamas, egged on by Iran) adds to this positive view of higher crude prices. If any major producer of crude sees production decline then a price jump of some significance could occur. Iran last month produced 3.1Mb/d. If they get dragged into the war and the US puts new more punitive sanctions on them, then we could see a sharp price spike as seen when the US and NATO cut off sales by Russia to Europe.

Bearish pressure for crude comes from the weakness in OECD economies in the US, Europe and Japan. The significant rise in US production and storage levels is justification for crude to breach US$80/b if not for the war drums. I still expect WTI crude to bottom between US$75-US$78/b over the coming weeks. This is just based on current fundamentals.

EIA Weekly Oil Data: The EIA data (data cut-off October 6th) was clearly bearish for crude prices. Commercial Crude Stocks rose 10.2 Mb to 424.2 Mb as Net Imports rose 2.0 Mb/d on the week. The SPR saw no change on the week. Motor Gasoline inventories fell 1.3 Mb as refineries head deeper into maintenance season. Distillate Fuels saw a decline of 1.8 Mb/d. Total Stocks (excluding the SPR) rose 6.3 Mb to 1,278.0 MB or 65 days of consumption. Refinery Utilization fell 1.6% to 85.7% as the fall maintenance season is underway. US crude production rose surprisingly by 300 Kb/d to their prior peak of 13.2 Mb/d. Production in 2023 is up 1,300 Kb/d above year ago levels, as longer reach horizontal wells are producing more. Cushing inventories fell 0.3 Mb to 21.8 Mb. Motor Gasoline consumption rose 567 Kb/d to 8.58 Mb/d. Jet Fuel saw a decline of 216 Kb/d to 1.49 Mb/d. Total Demand rose 509 Kb/d to 19.67 Mb/d as Other Oils demand rose 542 Kb/d to 5.09 Mb/d. Total US consumption is below last year on a year-to-date basis by 0.6%. Consumption was at 20.13 Mb/d versus 20.26 Mb/d last year. So, overall a report not supportive of higher crude prices as US production rises.

EIA Weekly Natural Gas Data: The EIA data released on October 12th was bullish for natural gas prices as it showed a build of only 84 Bcf for the week ending October 6th as electricity demand remains strong. Storage is now at 3.53 Tcf. The biggest increase was in the Midwest (30 Bcf). This compares to the five-year injection rate of 73 Bcf and the 2022 injection of 125 Bcf. US Storage is now 9.8% above last year’s level of 3.21 Tcf and 4.8% above the five year average of 3.37 Tcf. NYMEX is today priced at a very healthy US$3.37/mcf. Texas is worried that it may not have enough peak power so it’s trying to lock up around 3,000 megawatts of additional power during the worst of winter.

Our forecast is for NYMEX to rise above US$3.50/mcf in the next few weeks as cooler weather arrives. NYMEX should rise to over US$4.50/mcf during winter 2023-2024. Europe should see tightened supplies this winter as tight supplies and war premiums impact available LNG cargo. We recommend buying the very depressed natural gas stocks during periods of general market weakness. We intend to add additional natural gas names to our Action BUY list when we get the next low risk energy BUY signal.

Baker Hughes Rig Data: In the data for the week ending October 6th the US rig count fell four rigs to 619 rigs (down 7 rigs last week). Rig activity is now 19% below the level of 762 in 2022. Of the total rigs working last week, 497 were drilling for oil and this is 17% below last year’s level of 602 rigs working. The natural gas rig count is down 25% from last year’s 158 rigs, now at 118 rigs. The natural gas focused Haynesville now has 39 rigs working down from 70 rigs working last year or down by 44%.

In Canada, there was a 11 rig decrease in the rig count (one rig increase last week) to 180 rigs. Canadian activity is down 16% versus last year when 215 rigs were working. Activity for oil is down 27% to 108 rigs compared to 148 last year. Activity for natural gas is 7% at 72 rigs up from 67 last year. The main focus on natural gas drilling has been on the liquids rich condensate Montney and Duvernay plays.

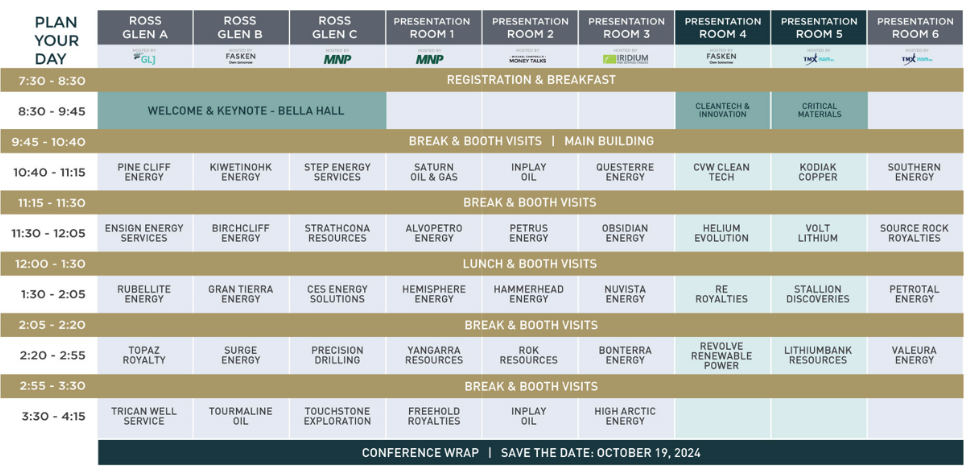

Catch the Energy Conference Update: We are sold out of all available tickets this year and now have a lengthy waiting list which for the most part we don’t see being able to accommodate due to MRU space limitations. Hopefully, next year you can access tickets earlier to make sure you can attend. Our current count is over 750 (Attendees and Sponsors, Presenters/Exhibitors) and 45 companies. This is up from last year’s 560 attendees, with 34 Presenter/Exhibitors. We are now at our maximum count for the facilities and this will be our target for 2024.

Our Premier, Danielle Smith will open the conference. This plenary session will take place in the Bella Concert Hall starting at 8:30AM. Registration is in the Roderick Mah Centre of Continuous Learning Conference Center and starts at 7:30AM. Breakfast will be served in front of the Bella Hall at 8:00AM.

Thank you to our Sponsors, Exhibitors and Presenters. It is again a great lineup this year!

One exciting new feature is that STEP Energy Services Ltd. is bringing two of their newest rigs (one a frack unit and the other a command center for their latest coil-tubing rig) for attendees to tour. They recommend those interested to expect a 15-minute tour.

Here is our conference schedule for now (as always subject to last minute changes).

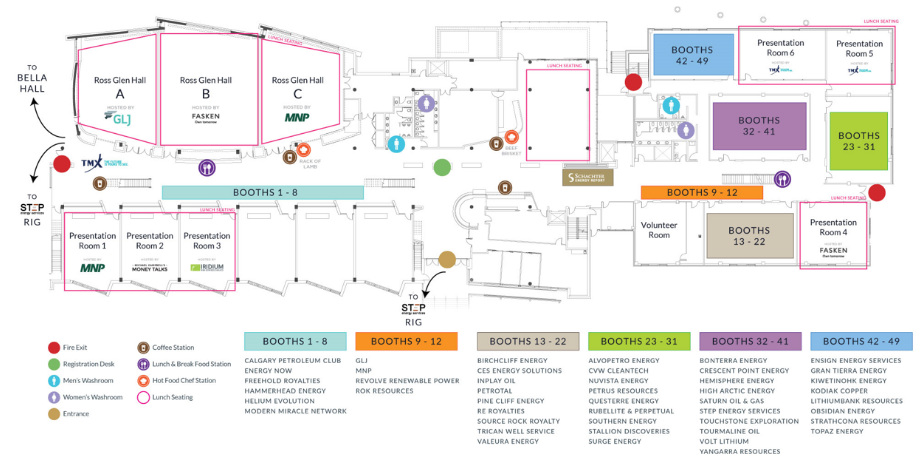

Our floor plan for the Presentations starting at 10:40AM with nine rooms running and five presentations slots has the attached Roderick Mah Centre Layout.

Energy Stock Market: The S&P/TSX Energy Index today is at 267, up 13 points from last week as the Middle East war drums lift stocks of energy companies in ‘safe countries’. As the general market decline continues and the Dow Jones Industrials breaches 30,000, we expect the S&P/TSX Energy Index to fall below 220, only 47 points away. This would trigger another key BUY signal for us. Get your BUY List ready!

New BUY ideas will be issued as energy stocks fall into our BUY ranges. Decide what you want your energy weighting to be for this long energy super cycle. Our Coverage List includes ideas from the Pipeline & Infrastructure area, Canadian oil and natural gas ideas, energy service ideas and companies working internationally. Our list includes large Conservative ideas and small to large caps in our Growth and Entrepreneurial categories. Add to your current ideas or add new ideas when we send out the next low risk entry point recommendations. We expect that WTI should lift and stay above US$90/b during winter 2023-2024, as winter demand recovers and demand should clearly exceed supplies.

CONCLUSION:

We see the March crude price decline to US$64/b as being the low for 2023.

Our long term optimism on the sector is due to our view that in 2H/24 WTI will exceed US$100/b as demand rises and exceeds supplies. Before the end of this decade we expect WTI prices will exceed the high in 2008 of US$147.27/b. Near term we expect to see a backoff in prices as the general stock market correction impacts most areas and energy, a high beta area, is normally one that corrects during market declines. The S&P Energy Sector Bullish Percent Index recently was at a 2023 high of 96%, a warning signal of too much euphoria by energy stock investors. It fell to 48% over a week ago but has bounced to 57% on the terrorist attack in Israel. It should send out a BUY signal in the coming weeks as it falls below 10% Bullishness.

WTI is priced today at US$82.76/b down nearly US$3/b from last week. As the stock market retreat continues we should see WTI crude get dragged down further. As markets retreat we expect to take advantage of the bargains in energy stock prices. More BUY ideas will be added to our Action BUY List when we get the next low risk BUY window. Down market days during that time are the best days to build your positions for the lengthy energy super cycle we see lasting into the end of the decade.

We plan on sending a PDF of our ‘Catch The Energy’ conference presentation to all subscribers next week. Another reason to subscribe.

Our next SER Monthly Report comes out tomorrow Friday October 13th. Our November reports will cover the Q3/23 results of all the companies we cover, split over the two November issues. If interested in our upcoming reports please become a subscriber. Go to https://bit.ly/2FRrp6k.

Please feel free to forward our weekly ‘Eye on Energy’ to friends and colleagues. We always welcome new subscribers to our complimentary energy overview newsletter.

Share This: