Each week Josef Schachter gives you his insights into global events, price forecasts and the fundamentals of the energy sector. Josef offers a twice monthly Black Gold newsletter covering the general energy market and 36 energy, energy service and pipeline & infrastructure companies with regular quarterly updates. We also hold quarterly webinars and provide Action BUY and SELL Alerts for paid subscribers. Learn more.

We will be moving our office in the last two weeks of April so our next ‘Eye On Energy’ will come out on May 1st, subject to our computers and tech being up and running on Friday April 26th. Our next SER Report will come out on May 9th the same day our second quarter Webinar occurs at 7PM MT.

Economic, Political & Military Update:

The hoped for pivot by the Federal Reserve to lower interest rates has been boxed in by rising interest rates which have pivoted higher as the inflation data has itself pivoted higher. The Fed is now unlikely to make any reductions in its Fed Funds rates until after the election and then only if the economic data weakens into year end. This burst of the optimists view of a decline in rates of three times this year (at the beginning of the year, the view was for six declines) now is a concern for the bulls. A hoped for June rate cut is now unfathomable. The Dow has declined >1,500 points in the last three weeks from 39,900 to the low so far today of 38,352 and we expect the 36,000 level to be reached shortly if Q1/24 earnings are disappointing or guidance is worrisome. Much lower levels for the major indices are likely during Q2/24.

Today the CPI data came in hotter than expected and reversed the downward trend that the Fed wanted to see. The CPI month over month came in at 0.4% (4.8% annualized) and above the 0.3% forecasted. The Fed’s super core inflation rate (services inflation – excluding energy and housing) rose by a problematic 0.7% in the month. This acceleration in inflation is due to Medicare payments, car insurance (up 22%), transportation (up 10.7%) and food (up 5.7%). Add to this the recent sharp rise in energy prices, and the acceleration in inflation is the reverse of the Biden administration talking points. US interest rates have spiked today with the 10-year Treasury yield reaching 4.54% from just 4.20% just two weeks ago. The 2-Year Treasury yield has risen from 4.54% two weeks ago to 4.96% currently. A breach of 5% would significantly impact stock valuations.

The US Jobs data for March came in hotter than expected with a gain of 303K new jobs (consensus was for a gain of 212K). Private sector jobs rose 232K versus the forecast of 160K jobs. The job growth was all part-time work as mostly illegal migrants found jobs at low pay rates. In March part-time jobs rose 691K to 28.63M while full-time jobs fell 6,000 to 132.9M. Over the last year the number of full-time jobs has collapsed by 1.35M while part-time work has increased by 1.89M.

The Bank of Canada held its key rate unchanged at 5% today due to the inflation pressure data despite a drop in payrolls for March in our country. Canada lost 2,200 jobs in March (forecast was for a gain of 25,000 jobs) and the unemployment rate rose to 6.1% from 5.8%. The rate rise was due to 60,000 people searching for work.

Mixed economic data in the US continues with some data showing a sustainable economy with real GDP growth of 3% due to large Federal deficit spending, but also with data showing inflation reversings to the upside. A stagflation pivot is not what the bond and stock market want to see. So let’s go through the recent economic & political releases of significance.

- More commentators (Citadel Founder, Ken Griffin) and (JP Morgan’s Jamie Dimon) are warning about the fiscal spending excess and that raising funds to fund the deficit will get more difficult as bond vigilantes demand more yield for the increased risk.

- The six-month Federal deficit gave more evidence of this problem with the first six months having a deficit of US$1.1T, or pushing 6% of GDP. Rising entitlements, Biden’s write-off of student loan debt, and the funding of infrastructure and military spending are decimating the budget process. Interest cost of debt is now a bigger expenditure than defense or entitlements. NUTS!

- Insiders continue to sell – with TESLA insiders dumping their stock aggressively and Tim Cook is exiting Apple shares to the tune of US$120M.

- US small business (the National Federation of Independent Businesses (NFIB) noted that business sentiment has fallen to the lowest level in 11 years.

On the wars front:

- Iran has yet to directly attack Israel for the assassination of two of its key IRGC generals that were in their Consulate in Damascus. Iran’s leaders have threatened to attack Israeli diplomatic missions around the world but have not yet authorized attacks. Iran has put its ballistic missiles into ‘combat mode’.

- Hamas has negotiated with the US, Egypt, Qatar and Jordan for a hostage release and a lengthy ceasefire (Biden wants 6-8 weeks) to get aid into Gaza but so far no deal has been reached. President Biden is livid with Prime Minister Netanyahu over food access to the starving but Israel has only agreed for two more gateways for food to enter but not sufficient to feed all those in need.

- Israel fired the two officers responsible for the attack against the aid workers. Will they be prosecuted for ignoring procedures?

- President Biden has breached the issue of future US support to Netanyahu based upon how Israel treats the civilians in Gaza. He has mentioned he would halt or limit military aid which Israel needs if it wants to finish off Hamas. He wants an immediate ceasefire given the high casualty rates among civilians in Gaza.

- Israel has withdrawn large numbers of its soldiers from Gaza for rest and rearmament to get them ready for an attack against the last large concentration of Hamas soldiers and leadership. Home leave has been canceled as well as they prepare for any Iranian attack either directly or via their proxies. Israel has also called up its reservists as it expects some Iranian attack in the short term.

- Israel has found Chinese weapons in Gaza.

- Ties that Israel has with its Arab neighbors are near a breaking point so a fight with Hezbollah or Iran could further destabilize the region.

- Russia has made progress in eastern Ukraine on the battlefront and is looking to take Kharkov (Ukraine second largest city with 1.5M people) and Sumy as NATO cannot provide sufficient weapons for Ukraine to halt Russian offensive action.

Market Update: The general stock market correction is underway. Energy stocks are also overbought and as the general stock market retreats, energy stocks, which are high beta, should weaken as they have in past market declines. When that happens be ready to buy the bargains that develop across all markets. In our new ‘TOP PICKS NOW’ we highlight the best ideas at the time of each SER report. If you want to see what our subscribers are looking at, sign up now for access to the Schachter Energy Research reports at https://bit.ly/2FRrp6k.

Bullish pressure for crude prices comes from:

- The potential for a wider Middle East war if Iran gets directly involved. The Israeli attack on an Iranian consulate to get an IRGC general was a major escalation.

- The Ukrainian success in attacking refineries in western Russia and the Iranian backed Houthis Red Sea and Gulf Of Aden attacks on shipping.

- OPEC is seriously considering extending its official cuts to the end of 2024 with the hope this tightens up global inventories and raises oil prices much further. Compliance however is still a problem.

- The area to watch now is China demand. It is weak now but could rebound if the government’s stimulus moves take hold.

Bearish pressure for crude comes from demand weakness in some OECD economies. Also, the US is an exporter of crude (2.7 Mb/d last week) which is lower than prior weeks as supplies remain abundant at the present time. We expect a decline below US$80/b based upon fundamentals as demand falls during the spring shoulder season by 2.0 – 2.5 Mb/d. Note the build in US stocks this week (next section). Now we are higher as the war front and political issues are impacting prices. For a refresher, during the last correction WTI fell (in December) to an intra-day low of US$67.71/b from US$79.60/b from just a few weeks before. In 2023, WTI fell from US$83.53/b in April to US$66.80 in June. In 2021, crude fell from US$76.98 in June to US$61.74/b in August. So remain patient and let the market do its normal swinging around and use the next period of market and energy price weakness to build up your energy weightings.

EIA Weekly Oil Data: The EIA data released today April 10th showed a healthy increase in inventories. US Commercial Crude Inventories rose 5.8 Mb to 457.3 Mb and are now only 13.3Mb below last year. The Strategic Reserve showed an increase of 0.6 Mb on the week to 364.2 Mb and is only 5.3Mb below last year’s 369.6 MB. Refinery levels fell 0.3 points to 88.3%. This compares to 89.3% last year. Motor gasoline inventories rose 0.7 Mb and are now 6.3 MB above 2023 levels. Distillate fuels saw a rise of 1.7 Mb to 117.7Mb and are 5.3 Mb above last year’s storage levels. Total Stocks including the SPR rose 13.0 Mb to 1,591.7 Mb. Cushing inventories fell 0.2 Mb to 33.0 Mb.

US Crude production was flat at 13.1 Mb/d and is up 800 Kb/d above last year’s level. Motor Gasoline consumption fell by 624 Kb/d to 8.61 Mb/d while Jet Fuel saw a fall of 127 Kb/d to 1.61 Mb/d. Total Demand fell quite sharply, by 2.06 Mb/d to 19.2 Mb/d as Other Oils demand fell 706 Kb/d to 4.18 Mb/d. Year-to-date demand is up 0.4% or at 19.86 Mb/d versus 19.78 Mb/d last year.

OPEC has extended its production cutbacks to the end of June and members are now talking about extending the official cuts to the end of 2024 to curtail inventories and firm prices up even further. OPEC will decide their next move at a face-to-face meeting in Vienna on June 1st.

EIA Weekly Natural Gas Data:

The natural gas report out last Thursday showed a decline in storage levels. The withdrawal was 37 Bcf, with the largest decline in the East at 24 Bcf. This compares to the withdrawal of 23 Bcf last year and the 5-year average withdrawal of 0 Bcf. Storage is now at 2.26 Tcf. US Storage is now 23.0% above last year’s level of 1.84 Tcf and 38.9% above the five year average of 1.63 Tcf.

NYMEX is today priced at US$1.90/mcf. US production is declining. Hedge funds are now covering their massive shorts of the commodity. The Freeport Texas LNG facility has opened one train and the other two trains under maintenance should be up and running in May. Demand in Asia is picking up and Egypt is now importing more LNG as it is in short supply ahead of an expected very hot summer season and high air-conditioning usage .

We recommend buying the very depressed natural gas stocks during periods of market weakness as we see higher prices in Q4/24 and much higher prices in 2025. We plan to add additional natural gas names to our Action BUY list when we get the next low risk energy BUY signal.

Baker Hughes Rig Data: In the data for the week ending April 5th, the US rig count fell one rig to 620 rigs (it fell three rigs in the prior week). Rig activity is now 17% below the level of 751 rigs in 2023. Of the total rigs working last week, 508 were drilling for oil and this is 14% below last year’s level of 590 rigs working. The natural gas rig count is down 30% from last year’s 158 rigs, now at 110 rigs due to the weak natural gas prices at this time. This sharp decline in drilling should in the coming months produce noticeable declines in natural gas production.

In Canada, there was a decline of 15 rigs to 136 rigs (down 18 rigs in the prior week) as spring breakup is underway. Canadian activity is up 7% from last year’s 127 rigs. Activity for oil is at 65 rigs compared to 52 last year or up by 25% as companies add more oil to meet the upcoming TMX pipeline demand. Activity for natural gas is at 71 rigs, down four rigs from last year. In our discussion with E&P companies they are planning on lower spending during Q1-Q3 due to low natural gas commodity prices. They have mentioned that they might increase activity later in the year, if natural gas prices rise materially as LNG Canada starts up. The industry needs north of $2.50/mcf to see the economics attractive to drill more gas wells. As we get closer to LNG Canada ramping up in Q4/24 and natural gas fills the Coastal GasLInk pipeline, prices should lift.

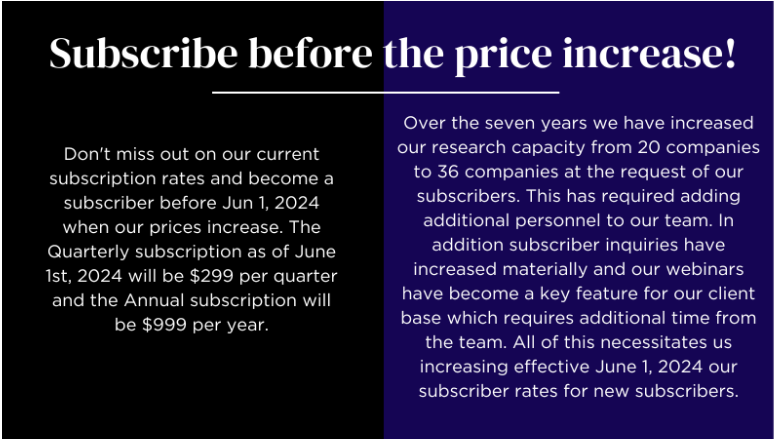

Current subscribers will not be affected by the price change as long as they keep an active subscription. Subscribers who sign up before Jun 1, 2024 will be grandfathered in at the original prices of $249 per quarter or $799 per year as long as their subscription remains active.

Subscribe now to lock in the savings!

https://schachterenergyreport.ca/subscriptions/

Energy Stock Market: The S&P/TSX Energy Index today is at 307, up 11 points from last week. The sharp rise is focused on Canadian oil stocks and the market looks frothy to me. Natural gas stocks and most energy service companies are lagging behind. The sector is now quite overbought with the S&P Energy Bullish Percent Index at 87%, just below the 90% threshold that would indicate to take profits. We would not chase the sector here but wait for the inevitable correction to add to portfolios. We are bulls but we don’t want to chase stocks. We like to BUY when stocks are cheap and are being ignored. That is not the case now. There still are some stocks that are BUYS but that list has shrunk. We cover those that remain cheap in our TOP PICKS NOW section of our SER reports.

Investors should decide what you want your energy weighting to be for this long energy super cycle. Our BUY List includes ideas from the Pipeline & Infrastructure area, Canadian oil and natural gas ideas, energy service ideas and companies working internationally. Our list includes large Conservative ideas and small to large caps in our Growth and Entrepreneurial categories. Add to your current ideas or add new ideas. We expect that WTI should lift above US$90/b in 2H/24 as winter 2024-2025 demand should exceed supplies at that time and we see recovering economies globally.

CONCLUSION:

Longer term we remain very bullish. Our view remains that before the end of this decade we expect to see WTI prices exceeding the high in 2008 of US$147.27/b.

WTI is priced now (as we write this report) at US$86.17/b, up US$1/b from last week. We expect to take advantage of the bargains in energy stock prices with new BUY ideas if one more of our BUY signals is triggered. Down market days for energy stocks are the best days to build your positions for the lengthy energy super cycle we see lasting into the end of the decade.

Our next SER Report comes out tomorrow Thursday April 11th. This report will cover 4 more companies that have reported since our last SER report. We are near the end of the Q4/23 reports. Starting in late May our reports will cover Q1/24 results.

Our new ‘TOP PICKS NOW’ section in each report has been very well received and has had significant positive performance. It covers the best ideas from our five groupings that we cover (Pipelines/Infrastructure/Royalty Companies. Domestic Natural Gas Companies, Domestic Liquids Producers, International E&P Companies and Energy Service Companies). Not every issue will have an idea in every grouping if the stocks in such a group are not at bargain buy levels. In the upcoming issue we have three very attractively priced ideas that one can consider now. If interested in these reports, become a subscriber. Go to https://bit.ly/2FRrp6k.

Please save the date for our 2024 ‘Catch The Energy’ conference on Saturday October 19th at MRU. We have received confirmation that the Honourable Brian Jean, Minister of Energy and Minerals of Alberta will be our opening Speaker. We have started to meet with Presenter energy companies and have started signing up presenters for this year’s conference. As this list develops we will start providing you with the names of the Presenting companies in our upcoming reports as we did last year. We have space for 35 companies in the energy industry of today and 10 spots for the TMX sponsored energy industry companies of the future (clean-tech, renewable energy, and critical minerals). This mix can change depending upon response from our meetings. If you know of companies that are public or nearing going public and have a compelling story to tell, have them contact us at info@schachtereenergyreport.ca.

As usual subscribers will receive two complimentary tickets to the event, so another great reason to become a subscriber.

Please feel free to forward our weekly ‘Eye on Energy’ to friends and colleagues. We always welcome new subscribers to our complimentary energy overview newsletter.

Share This: