Each week Josef Schachter gives you his insights into global events, price forecasts and the fundamentals of the energy sector. Josef offers a twice monthly Black Gold newsletter covering the general energy market and 35 energy, energy service and pipeline & infrastructure companies with regular quarterly updates. We also hold quarterly webinars and provide Action BUY and SELL Alerts for paid subscribers. Learn more.

Economic, Political & Military Update:

The stock and bond markets continue to have positive momentum as AI stocks and lower interest rates (on some softer economic data) help both markets. The Bulls see a ‘soft landing’ at worst and the possibility of the Fed and other Central Banks lowering interest rates during 1H/24. Some US economic bulls forecast the Fed may pivot and cut as early as their March meeting. Speculation is that the ECB will lead the rate cut forces as European economies are slowing faster. Today the Bank of Canada kept its key rate at 5% but refused to rule out another rate hike, saying it was still concerned about inflation even as it said prices were generally easing. This was seen as mildly dovish by the market.

However there is also bullish economic data to hold the Fed, keeping rates at current rates for some time. The Q3/23 reading on the US economy showed a rise of 5.2% way above expectation as consumer and government spending exceeded forecasts. This Friday’s jobs report for November will get close scrutiny and the forecast is for job growth of 180K. The ADP jobs data today came in at 103K new jobs in November compared to 106K job growth in October. Pay increases came in at up 5.6% from the prior year for job-stayers and 8.3% for job-switchers. These large wage increases are problematic for the Fed. The November number includes 30,000 from returning striking auto workers. The next FOMC press conference with Fed Chairman Powell is on Wednesday December 14th.

Any bad news on inflation or problems in Congress passing bills, could change the positive market dynamic quickly. We are more worried about the next 5,000 points on the downside for the Dow Jones Industrials Index than about missing the next 5,000 points on the upside. We do not see the Fed lowering Fed Funds rates in 1H/24 and maybe not until 2H/24 if the economy (inflation and wage increases) do not slow sufficiently. If energy rises sharply in 2H/24 as we forecast then that adds to the Fed’s dilemma. Caveat Emptor!

Some of the noteworthy data to consider for the mixed picture for the bulls and the bears are:

- US Consumer spending rose only 0.2% in October, down from the faster pace of 0.7% in September.

- Core CPI rose 3.5% from a year ago and remains well above the Fed target of 2%.

- Moody’s downgraded China from stable to negative due to the weakening economy and ongoing real estate problems. Chinese cities have some US$11T of off-balance-sheet and much is feared to be at high risk of default unless Beijing comes to the rescue, which the CCP does not want to do. The Chinese stock markets have been very weak this year.

On the two wars fronts:

- The US has seen increased rocket and drone attacks against US forces in Iraq and Syria. The US navy has shot down multiple drones that were aimed at Israel and US military assets in the region.

- Iran’s Yemini proxies have attacked shipping around Yeman and the US is now working with allies to escort ships around the Gulf Of Aden.

- Israel is being attacked again with rockets from Gaza but is under pressure to hold back or control its major offensive in Southern Gaza due to the high civilian death toll. They are now attacking and have surrounded the second largest Gaza city, Khan Younis, in Southern Gaza. Israel has shown the media large quantities of captured missiles and other weapons captured in Northern Gaza from buildings and tunnels close to schools and hospitals.

- Ukraine’s military now is stalled and battle lines may hold due to winter and the lack of new funds and weaponry from its NATO allies. The US may not be able to come to the rescue with more funds due to the dysfunction in Washington. Current fund allocated are nearly all spent.

- Putin may slow walk his military activities as he awaits who will be in the White House after the November 2024 Presidential election. If Trump wins Putin may see a path to victory as the largesse from the US ends for Ukraine.

Market Update: We continue to expect stock market weakness into the year-end. Once this correction has lowered overall stock prices and fear has returned to the markets, be ready to buy the bargains that develop. Energy is now near capitulation as WTI has breached US$70/b. We are watching our indicators for BUY signals which may occur shortly. The last BUY signal for the S&P Energy Bullish Percent Index was in March and we added 14 new ideas to our Action BUY List. With many energy stocks down significantly from their October 2023 highs, and many trading around Proved Developed Producing (PDP) Reserve valuations levels there are some great bargains out there now. If you want to see what our subscribers are looking at, sign up now for access to the Schachter Energy Research reports at https://bit.ly/2FRrp6k.

Bullish pressure for crude prices comes from OPEC’s continuation of the 2.2 Mb/d cuts in their quota allocations to the end of Q1/24 (and maybe beyond) of which the Saudis have made the largest cuts. Originally, Saudi Arabia proposed 700,000 b/d of new cuts with the African countries bearing the most quota cuts, but this was rejected quickly by those members. Brazil was invited to join the cartel but has decided to just accept observer status for now. Brazil produced 4.1 Mb/d this year and with new fields coming on offshore, should see production over 4.3 Mb/d in 2H/24.

Remember the official announcements have nothing to do with real production cuts. Rhetorical barrels versus actual barrels. Official announced cuts have been 2.2 Mb/d but real cuts have been only 289 Kb/d as we discussed in our mid-November ‘Eye on Energy’.

Bearish pressure for crude comes from the weakness in OECD economies in the US, Europe and Japan and from the second largest consumer China. The significant rise in US production this year (900 Kb/d) and softer US demand in 2023 (see next section) also have pressured crude prices. Russia is now selling more oil and making more money on a monthly basis than before the invasion of Ukraine as it sells oil above the US$60/b sanction price. Our expectation that WTI crude prices would decline and reach US$70-US$73/b this month has now occurred. We had thought it possible for the WTI price to probe below US$70/b. It fell today to an intra-day low of US$69.32/b.

EIA Weekly Oil Data: The EIA data (data cut-off December 1st) was mixed for crude prices. Commercial Crude Stocks fell 4.6 Mb to 445.0 Mb but are up 31.1 Mb above last year’s levels. The SPR saw a rise of 0.3 Mb on the week. Motor Gasoline inventories rose 5.4 Mb as Refinery activity rose 0.7% to 90.5% from 89.8% last week. It is down from 95.5%, last year at this time. Distillate Fuels saw a rise of 1.3 Mb/d. US crude production fell 100 Kb/d to 13.1 Mb/d. Production in 2023 is up 900 Kb/d above year ago levels, as longer reach horizontal wells with improved fracking procedures and more sand, are producing more crude. Cushing inventories rose 1.9 Mb to 29.6 Mb and up from 23.9 Mb a year ago. Motor Gasoline consumption rose 260 Kb/d to 8.47 Mb/d. Jet Fuel saw a decline of 255 Kb/d to 1.42 Mb/d. Total Demand rose 694 Kb/d to 19.61 Mb/d due to Distillate consumption rising 742 Kb/d and Other Oils up 374 Kb/d. Total US consumption is below last year on a year-to-date basis by 0.7%. Consumption was at 20.15 Mb/d versus 20.29 Mb/d last year.

EIA Weekly Natural Gas Data: The EIA data released last Thursday November 30th was neutral for natural gas prices as it showed a build of 10 Bcf for the week ending November 24th. Storage is now at 3.84 Tcf. The biggest increase was in the South Central area (20 Bcf). This compares to the five-year withdrawal of 21Bcf and the 2022 withdrawal of 38 Bcf. US Storage is now 9.8% above last year’s level of 3.50 Tcf and 8.6% above the five year average of 3.53 Tcf. NYMEX is today priced at US$2.71/mcf as the weather is above normal for this time of year.

Our forecast is for NYMEX to rise above US$3.50/mcf as cooler winter weather arrives. NYMEX should spike over US$4.50/mcf during the coldest days of winter 2023-2024. Europe should see tightened supplies this winter as well as colder weather has arrived earlier than in North America.

We recommend buying the very depressed natural gas stocks during periods of general market weakness. We intend to add additional natural gas names to our Action BUY list when we get the next low risk energy BUY signal.

Baker Hughes Rig Data: In the data for the week ending December 1st the US rig count rose three rigs to 625 rigs. Rig activity is now 20% below the level of 784 in 2022. Of the total rigs working last week, 505 were drilling for oil and this is 19% below last year’s level of 627 rigs working. The natural gas rig count is down 25% from last year’s 155 rigs, now at 116 rigs. The natural gas focused Haynesville now has 39 rigs working down from 69 rigs working last year or down by 43%.

In Canada, there was a five rig decrease to 192 rigs. Canadian activity is down 2% from last year when 195 rigs were working. Activity for oil is down 5% to 122 rigs compared to 128 last year. Activity for natural gas is up 4% at 70 rigs up from 67 last year. The main focus on natural gas drilling has been on the liquids rich condensate Montney and Duvernay plays.

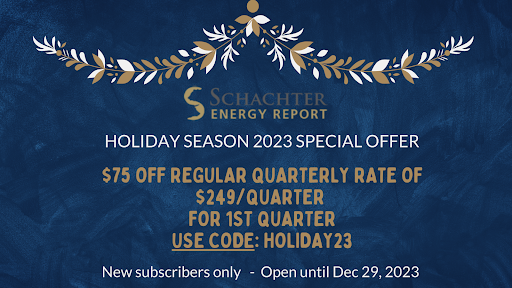

This holiday season we are offering a special deal of $75 off the regular quarterly rate of $249. Just use code: Holiday23 at checkout. We are getting very close to sending out Action Alerts so it is a great time to subscribe. https://schachterenergyreport.ca/subscriptions/

Energy Stock Market: The S&P/TSX Energy Index today is at 242, down 8 points (or 3% today) as WTI breached US$70/b. We expect the S&P/TSX Energy Index to fall below 230, and could reach 220 for a spike bottom. We are close to triggering new BUY ideas as our BUY signals occur. Get your BUY List ready!

New BUY ideas will be issued as energy stocks fall into our BUY ranges. Decide what you want your energy weighting to be for this long energy super cycle. Our Coverage List includes ideas from the Pipeline & Infrastructure area, Canadian oil and natural gas ideas, energy service ideas and companies working internationally. Our list includes large Conservative ideas and small to large caps in our Growth and Entrepreneurial categories. Add to your current ideas or add new ideas when we send out the next low risk entry point recommendations. We expect that WTI should lift above US$90/b in 2H/24 as winter demand should exceed supplies at that time and we see recovering economies globally.

CONCLUSION:

We see the crude price decline in March to US$64/b as being the low for 2023. The current decline from the high of US$95.03/b in late September should find a bottom shortly.

Before the end of this decade we expect WTI prices will exceed the high in 2008 of US$147.27/b.

WTI is priced today at US$69.48/b. We expect to take advantage of the bargains in energy stock prices with new BUY ideas shortly. Action BUY Alerts are likely in the coming days. Down market days for energy stocks are the best days to build your positions for the lengthy energy super cycle we see lasting into the end of the decade.

Our December SER Monthly to be released on December 21st and will cover the remaining two companies of the 35 covered companies Q3/23 results. The report will also include an update of our quarterly Insider Trading Report and discuss any Action Alert ideas that come out before the cut-off date of December 14th. If interested in this upcoming important report become a subscriber. Go to https://bit.ly/2FRrp6k.

We are working to add three or four new energy ideas to our Coverage List in early 2024 that we see as exciting ideas for this energy super cycle.

Please feel free to forward our weekly ‘Eye on Energy’ to friends and colleagues. We always welcome new subscribers to our complimentary energy overview newsletter.

Share This: