US stocks ripped higher on Monday, with all three indexes closing at new records.

Yahoo Finance said the S&P 500 marked its best year-to-date performance at the end of September since 1997 and its best fourth quarter since Q4 of 2021.

Over the last three months, the Dow led the major indexes’ gains, up 8.2%. The S&P gained 5.4%, and the Nasdaq added nearly 3%.

The Federal Reserve’s jumbo interest rate cut and signs of resilience in the US economy have lifted confidence, helping stocks post three weekly wins in a row. The final trading day of the month and the quarter also came with profit taking and rebalancing.

Reuters’ monthly roundup, printed last Friday, was equally optimistic in its assessment of the economy. Highlights were increased consumer spending and lower inflation.

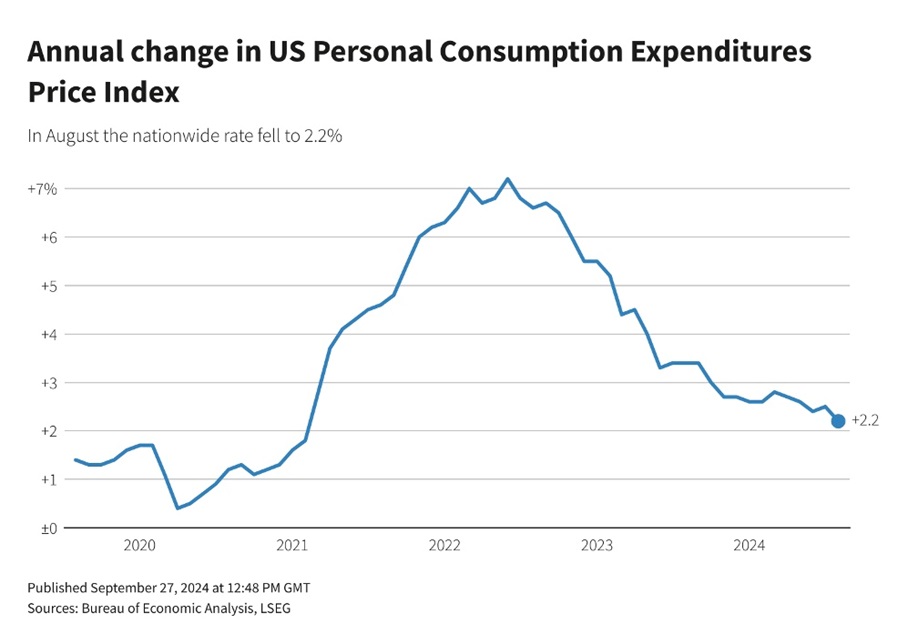

In the 12 months through August, the PCE price index increased 2.2%, which was the smallest year-year-on-year gain since February 2021, and 0.4% lower than the 2.5% rise in July.

Consumer spending, which accounts for nearly 70% of US GDP, rose 0.2% last month after a 0.5% gain in July, according to the Commerce Department’s Bureau of Economic Analysis. Spending was concentrated in services, especially housing, utilities, financial services and insurance.

Spending continues to be supported by solid wage gains.

“The resilience of consumer spending and the stronger foundations strengthen our conviction that the near-term outlook for the economy remains bright,” said Michael Pearce, deputy chief U.S. economist at Oxford Economics. “That should eventually help drive a re-acceleration in the pace of hiring and help keep labor market conditions solid over the coming year or two. That is one factor that will help convince the Fed to slow the pace of rate cuts next year.”

In fact the news on consumer spending is better than Reuters makes it out to be. Reporting on the Bureau of Economic Analysis’s annual revisions for inflation-adjusted consumer income, spending, and the savings rate, Wolf Richter of Wolf Street said consumers “made a lot more money, and they saved a large portion of it, and they spent more than we thought.”

The numbers are simply stunning.

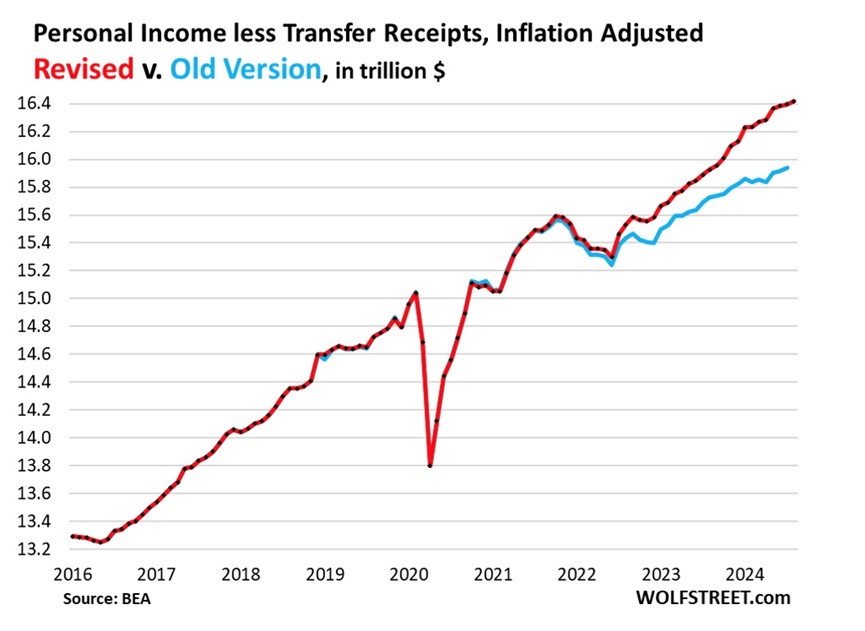

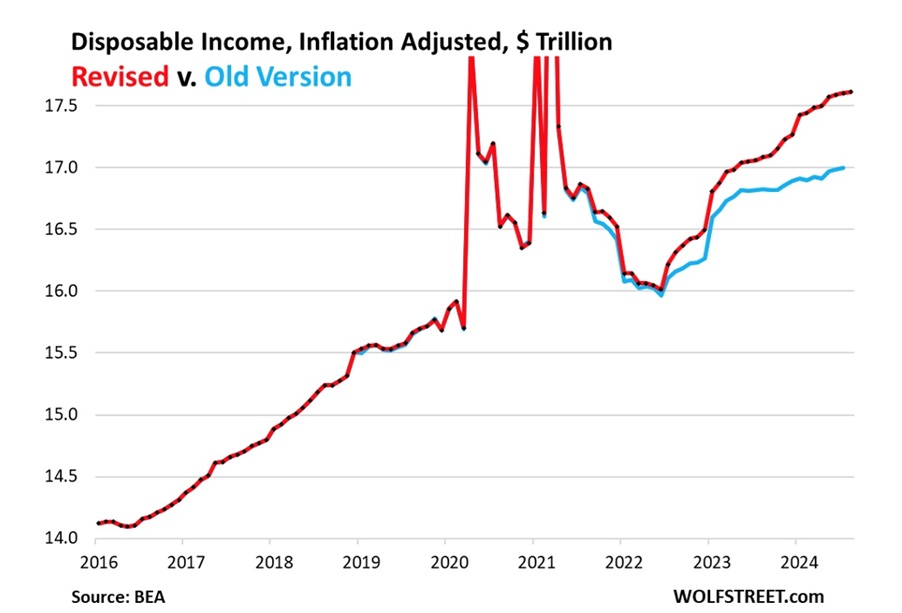

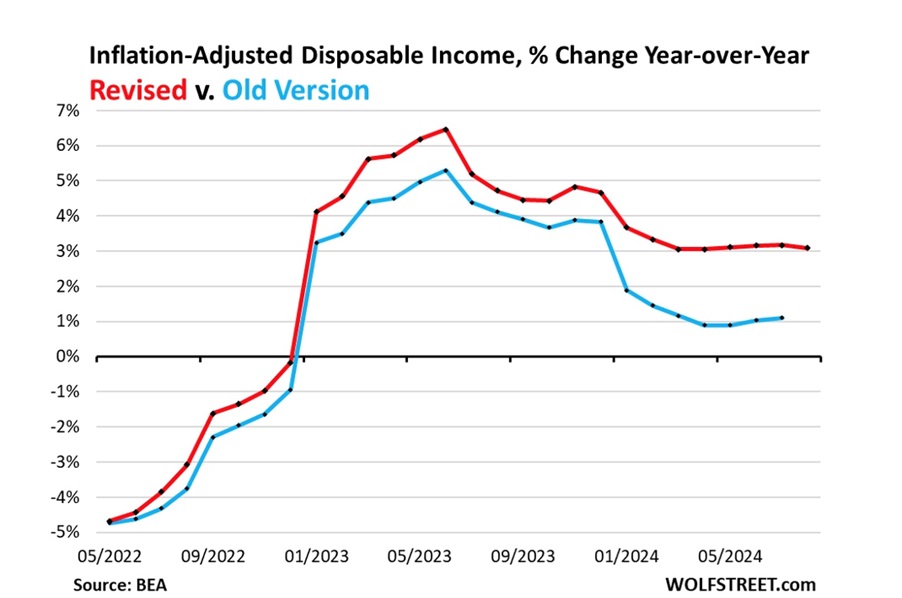

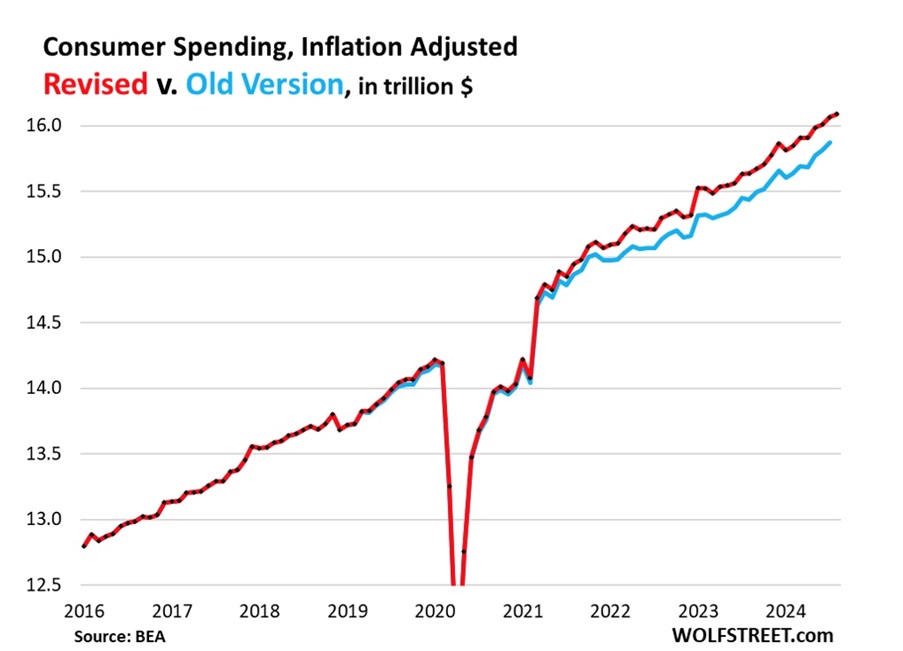

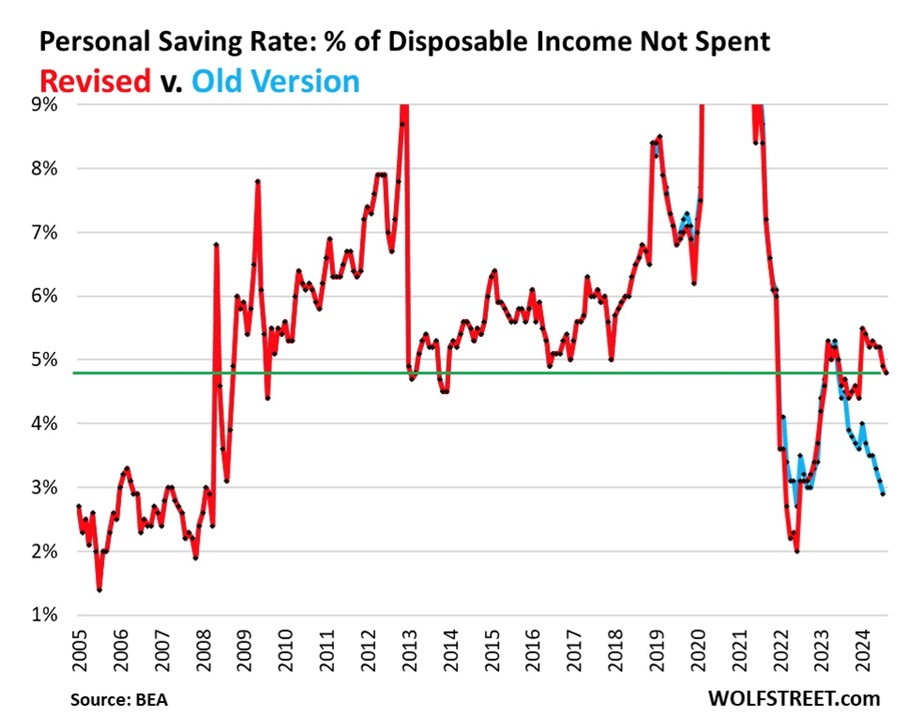

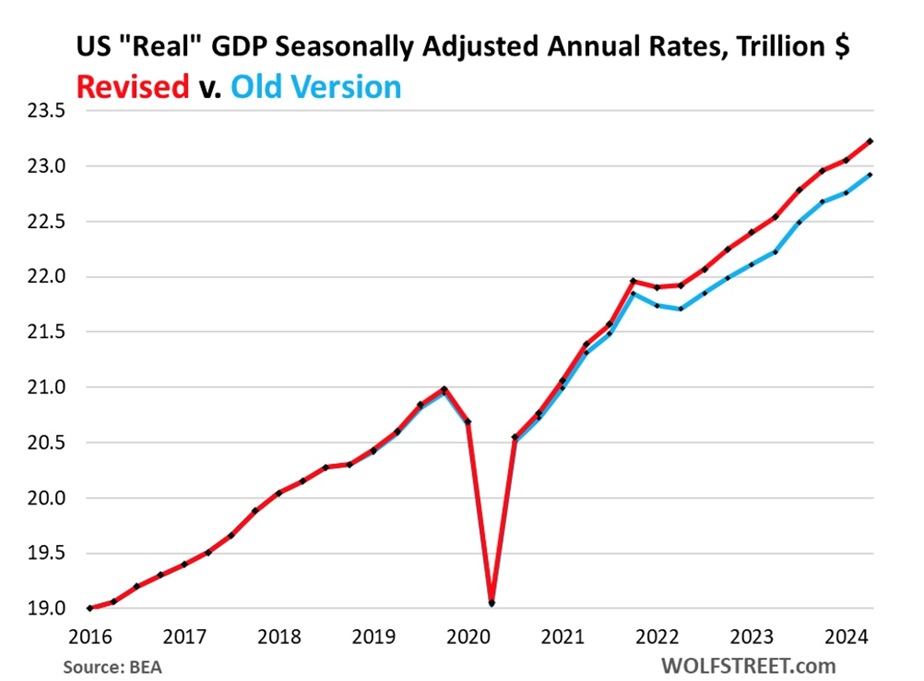

The below charts show red for the revised data through August and blue for the unrevised data through July.

The first chart is personal income without transfer receipts — referring to government payments such as welfare, unemployment insurance benefits — adjusted for inflation. The revised version for August was +3.1% year over year, and the revised version for July was +3.2% year over year compared to the old version for July of +1.6%. Over the two years between July 2022 and July 2024, the revised version was +6.0%, nearly double the old version of +3.6%.

The second chart is disposable income adjusted for inflation. The revised version for August was +3.1% year over year, and the revised version for July was +3.2% year over year compared to the old version for July of 1.1%. Over the two years between July 2022 and July 2024, the revised version of disposable income adjusted for inflation was +8.5%, versus the old version of +5.5%.

The next chart shows inflation-adjusted disposable income, percentage change year over year. Wolf Richter notes Disposable income is income from all sources after income taxes and social insurance payments. It includes income from wages and salaries, interest, dividends, rentals, farms, personal businesses, etc., and from transfer payments from the government, but excludes capital gains. Disposable income is what consumers have left to spend on goods and services and to save.

The last five revised increases (April-August) were over 3.1%, about triple the unrevised increases over the April-July period of around 1%.

In the fourth chart, consumer spending adjusted for inflation, revised spending for August was +2.9% year over year, while revised spending for July was +2.8% year over, compared to the old version for July of +2.7%. In the two-year period from July 2022 to July 2024, inflation-adjusted consumer spending rose by 5.6% compared to the old version’s +5.3%.

Because consumer income was so much higher than expected, and consumer spending was only revised up a little, the savings rate, defined as the percentage of disposable income that consumers didn’t spend, was much bigger than expected.

The chart below shows the savings rate for July was 4.9% compared to the old version’s 2.9%. The savings rate in August was 4.8%.

The last chart shows inflation-adjusted GDP for the second quarter was $305 billion higher than the old version. It indicates that GDP increased much faster between 2022 and 2024 than previously thought.

According to the BEA, real gross domestic GDP increased at an annual 3% in the second quarter, compared to 1.6% in the first quarter. The increase primarily reflected increases in consumer spending, inventory investment and business investment.

1982 redux?

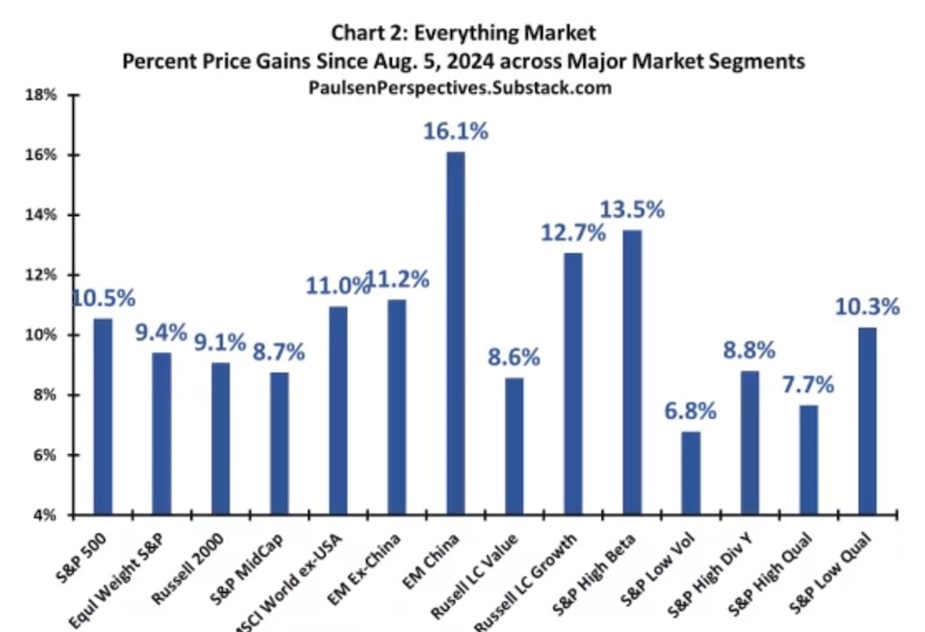

The Federal Reserve’s decision to cut interest rates by 50 basis points boosted US stocks and has some observers wondering whether we are heading towards an “everything rally”.

Hedge fund manager Eric Jackson of EMJ Capital told CNBC the current environment of economic growth and interest rates resembles the early days of the 1982 bull market, the first 10 months of which the stock market gained 107%.

A 1982 ‘everything’ rally will spark multi year bull market – Richard Mills

Historical S&P 500 chart. Source: Yahoo Finance

Historical Dow chart. Source: Yahoo Finance

While most students of economic history recall the Volcker-caused recession (referring to the Fed chair of the day, Paul Volcker) of 1982 due to the sudden hiking of interest rates to deal with out-of-hand inflation, less likely remember the bull market of the 1980s and 1990s.

From the August 1982 bottom through to the end of 1999, the S&P 500 gained 20% per year.

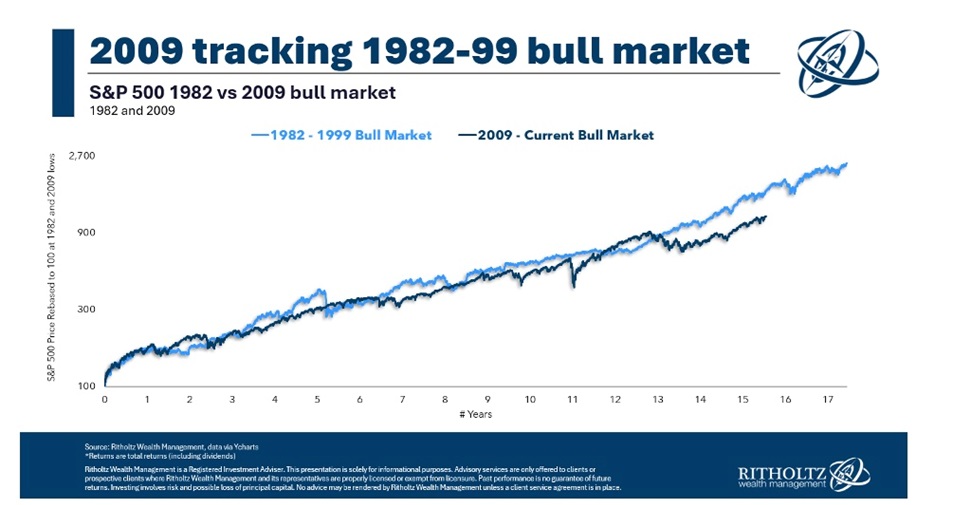

One source compared that two-decade bull market — interrupted by the “Black Monday” disaster in 1987 — with the bull market that ensued following the financial crisis in 2009.

From the Great Financial Crisis lows, A Wealth of Common Sense found the S&P is now up almost 17% per year — close to the annual 20% gain from 1982 to 2000.

It notes the latter bull market “finished with a bang as the dot-com bubble took off a the end of the 1990s,” with the S&P up 37%, 23%, 33%, 28% and 21% from 1995-99, then asks whether AI could push the index into the same lofty growth percentages.

Two other similarities between now and then are the market crash and the soft landing. In 1987, the stock market fell 34% in a week, whereas in the spring of 2020, the covid crash saw the market fall 34% over the course of a month.

There was a soft landing in 1995 after the Fed initially rapidly raised interest rates, versus now, where all the indicators point to a no-recession soft landing following two years of Fed rate increases.

“I’m not always one for repeating and rhyming when it comes to the markets, but the magnitude and length of this bull market are getting more impressive each year,” writes Ben Carlson. Read more on the history of bull markets.

Carlson isn’t the only strategist calling for another epic bull market. In an interview with MarketWatch, Jim Paulsen said:

“It is this cocktail of ‘full support’ at the front end of a bull market which commonly has created an ‘Everything Market’ during the early part of a new bull. That is, for a period, almost everything simultaneously rises – value, growth, small, large, defensive, and cyclical stocks – and usually by a lot.

Short rates are falling, bond yields have declined, money growth is rising, fiscal stimulus has again expanded, and disinflation is still evident; and because of this new and overwhelming support, expectations for a soft landing should grow while both consumer and business confidence improves.”

So what drives the “everything rally” and what ends it?

According to Real Investment Advice, easier monetary accommodation by the Fed and improved earnings are the key drivers for equities.

As stock prices increase, more money is pulled in. Higher demand for stocks, gold, real estate, cryptocurrencies, etc. comes from several sources including hedge funds, private equity, share buyback programs, passive indexes, pension funds, institutional funds, retirement plans, global investors, and retail investors.

RIA notes that 2024 is on track to be the second-strongest year of monetary inflows — money flowing into assets — since 2021.

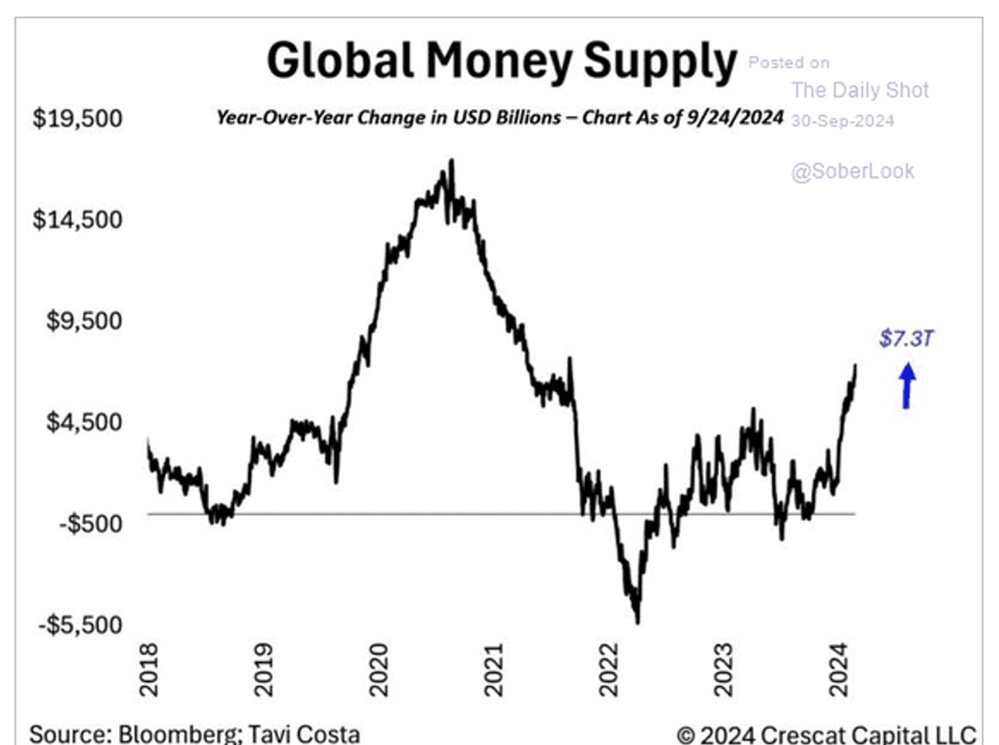

Even more important is the amount of capital supplied by central banks. The chart below shows a year over year increase of $7.3 trillion in the global money supply, as of Sept. 24, 2024, leading to RIA’s number one reason why asset prices are rising in the “everything market”: liquidity.

Another reason to support the “everything rally” is the amount of investment capital currently still in cash, waiting to be deployed now that rates have come down.

Crane Data points out that, up until the rate cut, the focus among investors was on short-term deposits like money-market funds. And that makes sense. Why risk your investment capital on a stock when you can get 5% risk-free in a savings account, or more in a money market fund? That may have been the best use of capital during inflation’s peak in 2022, offering a haven while stocks and bonds plummeted in value, but times have changed. Crane Data states:

All that cash sitting on the sidelines is about to be unleashed. Again, any day now. Well, now the day is here so we will see if they are right.” The FT says, “It is hard to ignore the size of this asset class. Added together, money market funds hold easily north of $6tn in the US…

The mining sector in comparison to the rest of the stock market is small. It doesn’t need $6 trillion to move prices; even a half billion dollars flooding into resource orientated stocks would be enough to wake up sleeping mining equities.

If liquidity is what drives bull markets, it stands to reason that they end when the flow of liquidity slows.

Paulsen notes “technical extremes” marked short to long-term corrections and consolidations for stocks and gold when three factors occurred:

- The market traded at 2-or more standard deviations above the 4-year moving average

- Relative Strength was overbought on a long-term basis

- The MACD was elevated and triggering a “sell signal.”

As Paulsen noted in his interview, “everything markets” typically last only six months to a year. He expects this one to be in force at least for “the next several months.”

Conclusion

Interest rates are coming down, the dollar is weakening and the yield curve is uninverting, meaning interest rates on long-term bonds are now higher than the rates on shorter-term bonds like 3-month and 2-year Treasuries. (When the opposite occurs, it’s known as a yield curve inversion, and is a well-known recessionary signal).

Weakening US dollar index. Source: MarketWatch

A recession is also likely when the yield curve uninverts, but there is a lot of evidence piling up to show that is not the case this time.

The Wolf Street charts reveal that consumers made a lot more money, saved a large portion of it, and they spent more than expected.

Higher demand for stocks, gold, real estate and other assets are coming from a number of sources, providing the necessary liquidity for “an everything rally” where all stock market sectors rise.

2024 is on track to be the second-strongest year of monetary inflows — money flowing into assets — since 2021. Central banks have increased the global money supply by $7.3 trillion, year on year.

Comparisons are being made to the bull market of 1982-2000, the first 10 months of which the stock market gained 107%.

It’s not only consumers and central banks that are fueling gains. Governments are doing their part too.

So-called “blacktop” infrastructure, the traditional kind such as roads, bridges, wastewater treatment plants, etc., should provide a thick layer of spending to bolster the nascent bull market.

According to The Atlantic Council, the global infrastructure financing gap is estimated to be around $15 trillion by 2040. To provide basic infrastructure for all people over the course of the next two decades, every year the world would need to spend just under $1 trillion more than the previous year in the infrastructure sector.

In the US, there is a $2.5 trillion infrastructure funding gap during the 10-year period from 2020 to 2029, based on figures provided by the American Society of Civil Engineers (ASCE). Failure to address it is estimated to result in the loss of $10 trillion in GDP by 2039.

But it’s not all gloom and doom.

In November 2021, the Biden administration passed the Infrastructure Investment and Jobs Act (IIJA), allocating $1.2 trillion for roads, bridges, power & water systems, transit, rail, electric vehicles, and upgrades to broadband, airports, ports and waterways, among other items.

The IIJA is the largest expenditure on US infrastructure since the Federal Highways Act of 1956. Rolled out over 10 years, it includes $550B in new spending.

Biden’s other signature piece of infrastructure legislation is the Inflation Reduction Act, passed by Congress in August 2022. It includes more than $150 billion in infrastructure financing, with the bulk of the funding directed towards transportation and clean energy projects.

According to Canary Media, most of the clean energy manufacturing investment and job creation is in the so-called “Battery Belt” of the southeastern US. As of last August, more than 100 new facilities or factory expansions had been announced totaling nearly $80B in new investments.

US Battery Belt red states could be biggest losers in upcoming election — Richard Mills

This means that $70 billion of the IRA has yet to be spent.

At AOTH we keep a close eye on the dollar and bond yields because they have so much bearing on precious metals and other commodities. We aren’t worried about a recession but the amount of global debt and in particular household debt is concerning.

Visual Capitalist just published an infographic indicating that the global debt, all sectors, for the first quarter of 2024 reached $315.1 trillion. That’s nine times higher than the US national debt of $35 trillion. It rose for the second straight quarter to a new record high.

But in the US, we explained there are three ways the federal government could “kick the debt can down the road”, in other words, there are three things they can do to keep the good times rolling of lower rates/ lower borrowing costs, lots of money sloshing through financial markets (liquidity) and a stock market bull, while avoiding the unpleasant outcomes including a potential debt default that could occur if nothing is done to address it.

The first thing to do is start to lower interest rates back to their Goldilocks 3% range. The Fed cut rates by 50 basis points this month and other countries have already started.

More cuts could follow depending on the labor market.

The next step would be making household debt tax deductible like in Norway. Imagine what might happen. The rise in economic growth would more than make up for the reduced amount of taxes brought in by the IRS.

A much more extreme way of handling the crushing US national debt burden would be to simply get rid of it. Wipe it off the books.

A cross-the-board ‘Debt Jubilee’ might sound radical, but a reading of history shows that retiring debt can actually make a country’s economy, and its indebted citizenry, all the better for it.

Because we live in a fiat monetary system, currencies are not backed by anything physical; the reserve currency, the US dollar, was de-coupled from the gold standard in the early 1970s. It’s not like a raid on vaults full of gold, which have an inherent, physical store of value.

In reality there is nothing preventing central bankers from doing a complete global reset, putting all debt back to zero.

Governments, businesses and households would finally be free of the debt shackles that constrict their ability to grow. They could start borrowing and spending all over.

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

*********