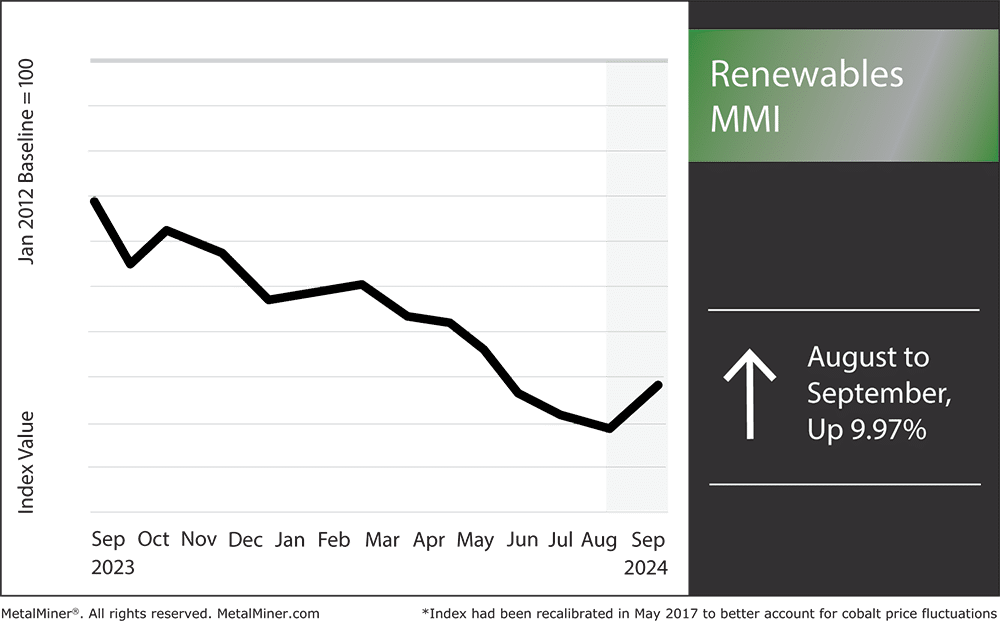

The Renewables MMI (Monthly Metals Index) finally witnessed a significant increase in price action for the first time in a year. In total, the index ascended by 9.97%, drawing fresh attention to renewable resources. The main culprit for the increase in price action was a significant rise in neodymium prices, likely in response to China’s rare earths export restrictions, which go into effect on October 1st.

Overall, the index could witness more bullish momentum in the upcoming months. This is not only due to the forthcoming export restrictions but also China’s addition of aluminum and steel to its decarbonization initiatives. And while this behooves renewables in the long run, it may cause some temporary supply chain disruptions in the short-term.

China’s Decarbonization of Aluminum and Steel: What It Means for Renewable Energy

China’s recent move to include aluminum and steel in its carbon emissions trading system (ETS) marks a pivotal moment for industries that depend on these materials, particularly renewable energy. While this decision represents a significant stride towards reducing the global carbon footprint of two essential commodities, it brings some short-term challenges for U.S. renewable energy projects.

Harnessing Renewable Resources: Aluminum and Steel

Steel and aluminum are vital to building and operating infrastructure for solar, wind, and other forms of renewable energy. Thanks to its corrosion resistance and light weight, aluminum is a key component in wind turbines and solar photovoltaic (PV) systems. Manufacturers looking to harness renewable resources use aluminum in over 85% of solar PV components, including inverters and frames (updates like these covered weekly on MetalMiner’s LinkedIn page).

Meanwhile, steel is valued for its strength and durability. Among other things, it offers the structural framework for solar panel frames and wind turbine towers. Together, these metals support the transition to clean energy by enabling the large-scale deployment of renewable technologies.

China’s Decarbonization Push

China is pushing the steel and aluminum industries to adopt cleaner methods by incorporating them into its ETS. This is crucial to China’s ability to meet its carbon neutrality targets by 2060. This expansion will likely have significant long-term benefits for global environmental efforts, as cleaner production of steel and aluminum will reduce the overall carbon footprint of the infrastructure that supports renewable energy.

MetalMiner Insights notes that China’s push for decarbonization could also spur innovation. As manufacturers shift to cleaner methods, we may see the development of low-carbon steel and aluminum technologies, which will eventually lower emissions throughout the supply chain.

Short-Term Challenges for U.S. Renewable Energy Projects

Although China’s decarbonization goal presents immediate hurdles for U.S. renewable energy providers, the long-term environmental benefits are still evident. Currently, China manufactures over 60% of the aluminum produced worldwide, and these imports play a significant role in U.S. developments. As stiffer regulations drive up production costs for these essential components in China, American businesses will inevitably feel the impact.

The Biden administration’s tariffs on Chinese steel and aluminum, set at 25%, further complicate the supply chain. While intended to protect domestic industries, these tariffs have increased the cost of importing these metals. As a result, renewable energy projects in the United States may face delays and higher expenses in the short-term.

Domestic Solutions and Strategic Sourcing

In response to these challenges, the U.S. government has taken steps to reduce its reliance on imports altogether. MetalMiner’s weekly newsletter emphasizes the importance of strategic sourcing in this environment, recommending that companies leverage market intelligence and forecasting tools to navigate price fluctuations and secure better deals.

Still, increasing domestic capacity will take time. Meanwhile, U.S. renewable energy companies will need to look into alternative suppliers and employ flexible sourcing strategies to keep their projects moving forward.

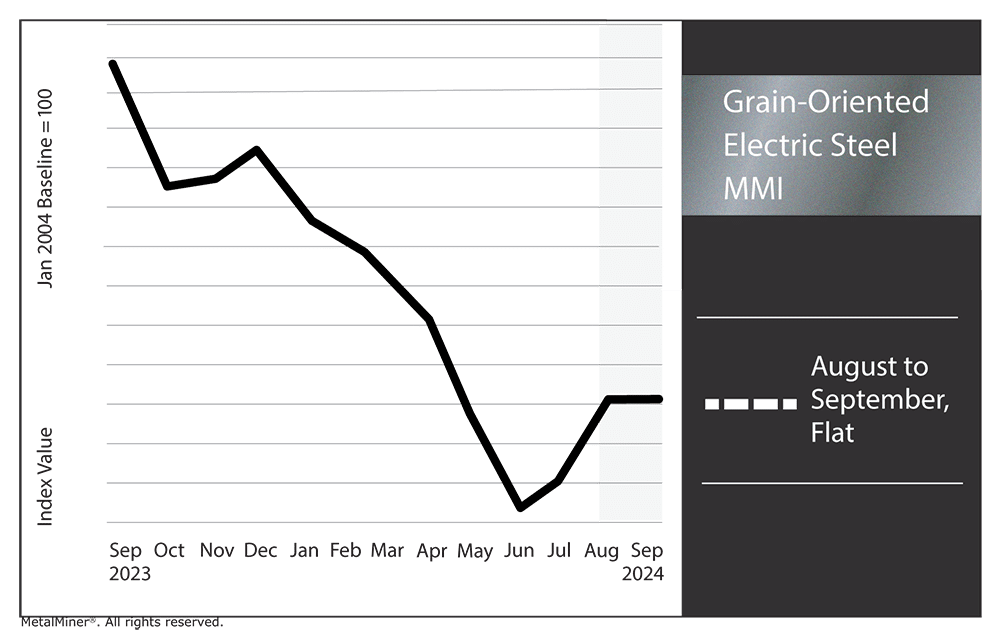

Grain Oriented Electrical Steel MMI

Month-over-month, the Grain Oriented Electrical Steel MMI (GOES MMI) traded flat, not exhibiting any changes in price action one way or the other.

Renewables/GOES MMI: Noteworthy Price Shifts

- Silicon prices moved sideways, dropping 2.47% to $1,605.93 per metric ton.

- Cobalt prices dropped 3.47 to $23.07 per kilogram.

- Steel plate prices dropped 5.72% to $1054 per short ton.

- Finally, neodymium prices increased significantly, jumping 12.2% to $70,337.95 per metric ton.