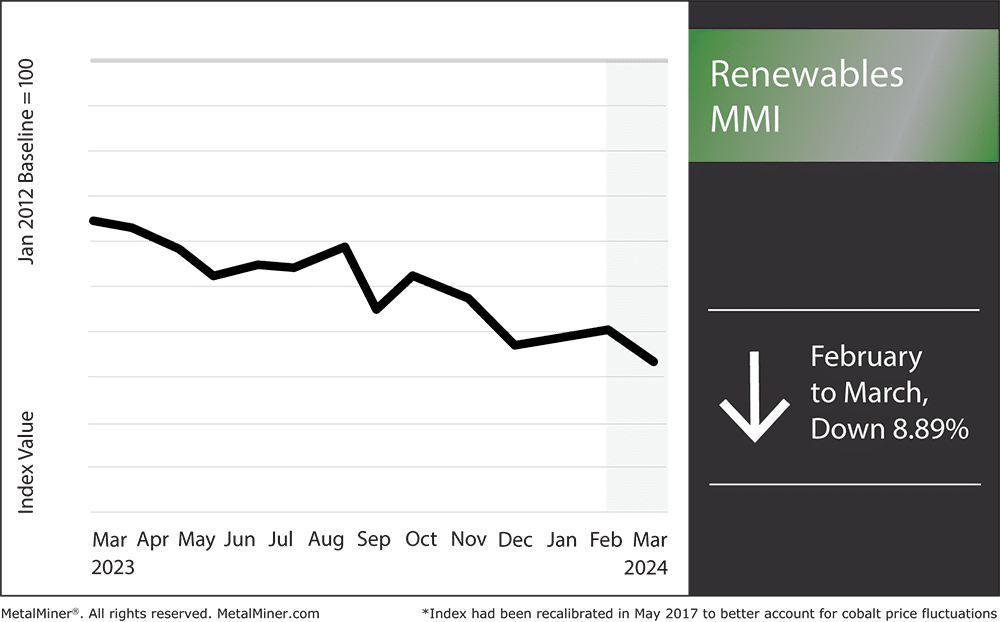

After several months of slight upward momentum, the Renewables MMI (Monthly Metals Index) broke the sideways-to-upward trend, declining by 8.89%. Neodymium dropping in price proved to be the main culprit for the index dropping. Every other component of the index either moved sideways or slightly down. Meanwhile, renewable energy news sources continue to keep their eyes on elements like neodymium (mainly sourced from China), especially as the outlook for China’s economy for the remainder of 2024 remains questionable. Any massive downfall in China’s economy could have a large impact on any renewable energy metals sourced from the nation, including neodymium, silicon, and steel plates.

Don’t make sourcing and purchasing decisions based on chance. Get the full scope of 2024 metal price forecasts and sourcing strategies with MetalMiner’s Annual Metal’s outlook. Get a free sample of our recent March 2024 update.

Renewable Energy News Indicated Green Energy is Facing Kickback

A recent article touched on an interesting subject: countries attempting to stop utility-scale wind and solar projects. However, if the world remains driven to reach long-term clean energy goals, this pushback raises the question of “why.”

Concerns regarding shortages of land space are amongst disputes over project placement. The rationale is that wind and solar farms require large land tracts, which may generate rifts within various parts of the country.

Knowledge is key in navigating renewable market fluctuations. Don’t miss out on MetalMiner’s expert analysis and up-to-date information. Subscribe to MetalMiner’s free weekly newsletter.

The Tug of War Between Government Climate Goals and Local Opposition

Concerns about the effects of renewable energy projects on the environment and local property values are other factors fueling this resistance. For instance, fears of declining land prices continue to cause communities across America to push back against large-scale wind and solar ventures. This opposition highlights a growing conflict between state climate targets and local communities. Renewable energy news sources report that some states even began overturning municipal zoning regulations that obstruct green initiatives.

Still, the growing opposition to renewable energy is a reflection of broader cultural dynamics as well as economic and land space concerns. The key problem lies in striking a balance between community interests, environmental imperatives, local autonomy over land use, and state regulations for the transition to clean energy.

Potential Solutions

When negotiating this dilemma, policymakers need to consider the complexity of the issues surrounding the implementation of renewable energy. For instance, technological innovations and community involvement tactics could help allay public worries about renewable energy projects and land use conflicts. Completing a smooth transition to a lower-carbon energy system necessitates striking a careful balance between community involvement, economic concerns, and environmental imperatives.

Moreover, addressing the reasons behind opposition to renewable energy sources will be essential in promoting a sustainable course for the U.S. as it works toward a cleaner future. Through addressing and involving local concerns, encouraging openness in project development, and cultivating communication among stakeholders, the country may surmount obstacles to the uptake of renewable energy. This would help clear the path toward a more environmentally friendly future.

MetalMiner’s MMI report includes 10 metal price reports and can be used as an economic indicator for contracting, price forecasting and predictive analytics. Sign up here.

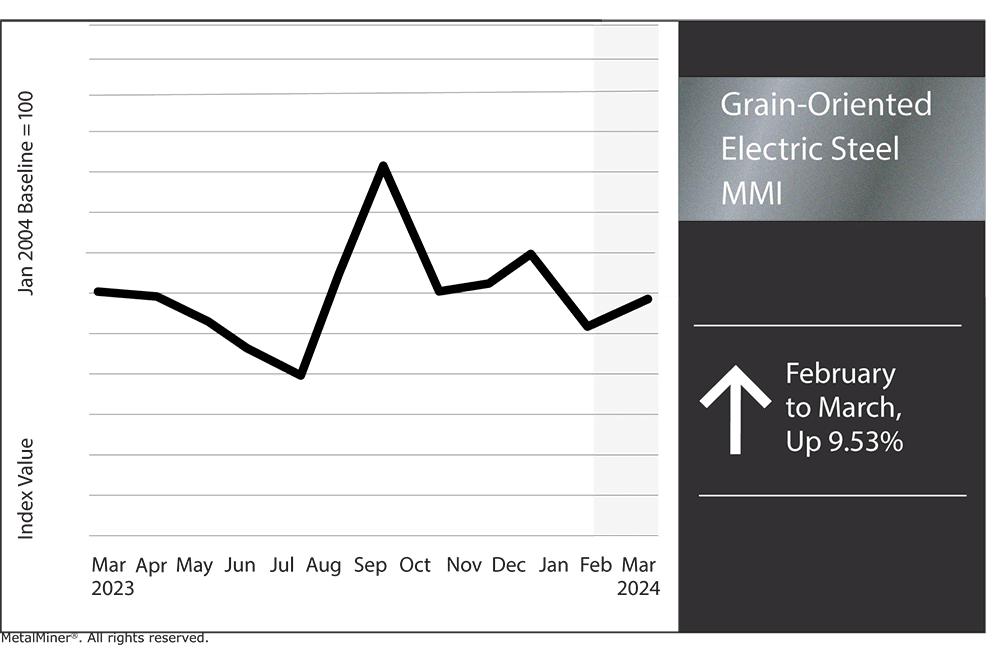

Grain Oriented Electrical Steel MMI

Month-on-month, the Grain Oriented Electrical Steel MMI broke its downward trend, moving up by 9.53%.

Renewables MMI: Noteworthy Price Shifts

- Chinese cobalt moved sideways, dropping a modest 0.46%. This left prices at $28.25 per kilogram.

- Chinese silicon prices followed suit with cobalt, moving sideways and dropping down 0.46%. This left prices at

- Lastly, U.S. steel plate prices moved down by 3.22%, leaving prices at $1,353 per short ton.