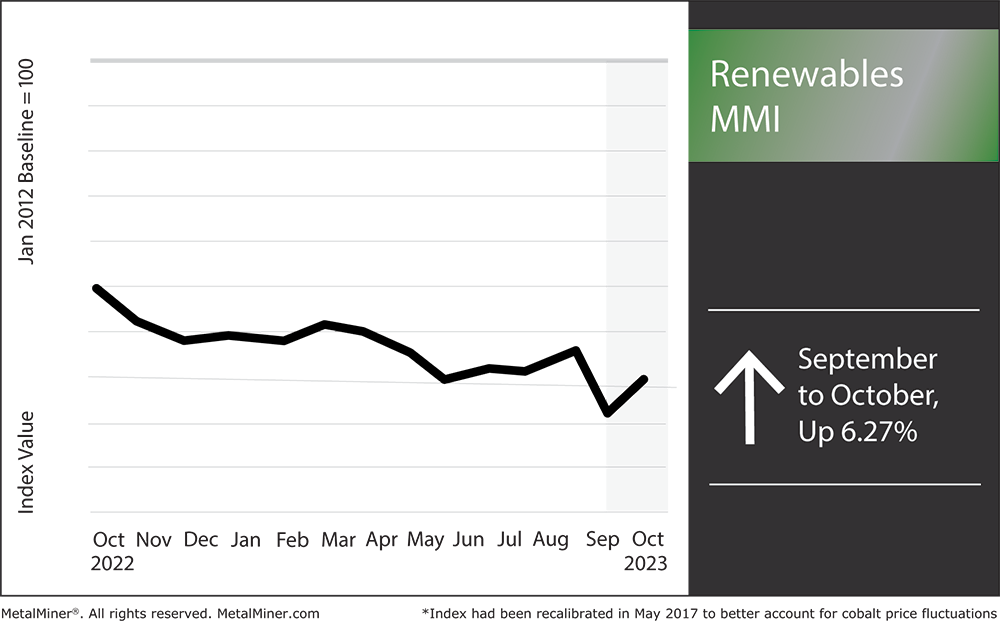

The Renewables MMI (Monthly Metals Index) saw a welcome boost month-on-month, rising 6.27%. Grain-oriented electrical steel, silicon, and neodymium were the main factors that increased the index, while the lithium-ion battery market remains a point of contention. In the case of silicon, futures initially rose back in June due to production cuts within China, the world’s #1 manufacturer. It appears the after-effects of the cuts finally impacted prices, mainly due to stockpiling buyers. That said, most steel parts of the index dropped or moved sideways. The UAW strike primarily impacted these sectors, causing lower steel demand, fewer steel scrap supplies, and price hikes from Cleveland Cliffs.

Does your company have China exposure and you’re considering near-shoring to Mexico? Join MetalMiner on 10/25 at 11 AM CST for our October Fireside chat “Don’t Ship Your Pants: Options for Near-shoring.”

Lithium-Ion Battery Dilemma: Raw Material and Fires

As the EV movement expands and batteries and new tech metals grow in demand, the battery market faces its fair share of challenges. Indeed, diversifying supply chains remains one issue. This would mean nations won’t have to rely on only one source or country for materials like silicon and cobalt. The other ongoing problem with cobalt and lithium-ion (lithium-ion battery material especially) is fire hazards, which MetalMiner touched on briefly in a March article.

A standard lithium-ion battery is perfectly safe when used correctly. In fact, according to TÜV SÜD, a global testing and certification agency, most will remain safe as long as owners follow the right storage, charging, and disposal processes.

However, because lithium-ion batteries are complex, even minor manufacturing flaws can cause significant issues. For instance, a short circuit that results from a flaw in the separator that keeps the positive and negative electrodes apart could ignite a fire. A lithium-ion battery can also overheat and catch fire if overcharged, which is an easy mistake to make.

Indeed, lithium-ion fires are becoming more and more common. According to fire departments in major cities like New York and San Francisco, rechargeable batteries, especially lithium-ion batteries, have been implicated in an increasing number of fires. These experts add that one of the best ways to ensure lithium-ion battery safety is to not overcharge them and switch them out when they reach a certain age.

Get valuable market trends, price alerts, and commodity news, supporting your business in mitigating the impact of increasing metal prices. Register for MetalMiner’s free weekly newsletter.

Some Analysts Predict a Coming Supply Chain Shortage

The world currently faces a possible shortage of raw materials to make batteries because of the rising demand for EVs, as metals like lithium, cobalt, and nickel will continue to remain vital materials in the manufacturing process. In fact, about eight kilograms (17 pounds) of lithium go into every battery. Moreover, lithium production will more than triple this decade, causing EV manufacturers to worry about a possible oncoming shortage of raw materials.

Another obstacle that automakers must overcome as they increase supplies is a lack of refinery capacity to purify raw lithium into battery material. Also, issues pertaining to tense U.S.-Chinese ties further continue to increase uncertainty. That said, other governments, including Indonesia, Chile, and Zimbabwe, want to maximize their return on lithium, cobalt, and nickel deposits. In this case, the idea is to require miners to invest in refining and processing before they can export.

Meanwhile, costs for EV batteries remain susceptible to increases due to these possible raw materials shortages. According to a recent analysis from research firm E Source, battery cell prices will potentially increase 22% between 2023 and 2026, reaching a peak of $138 per kilowatt-hour.

Because of all of these factors, the possible shortage of raw materials for EV batteries is a significant challenge that automakers and governments must address and face head-on.

MetalMiner customizes price points, price forecasts, and procurement solutions based on the specific metal type your company purchases. See MetalMiner’s full metal catalog.

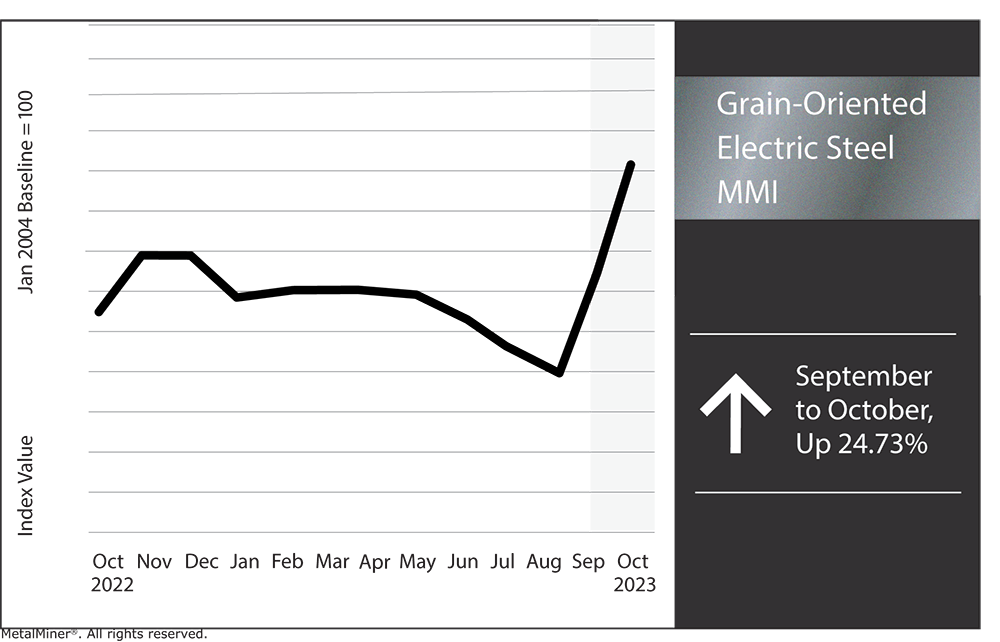

Grain-Oriented Electrical Steel MMI

The GOES MMI witnessed another huge spike month-over-month, this time rising by 24.73%. Indeed, China’s renewed demand and production could prove a prominent factor in the price increase. Prices also have a tendency to rise dramatically from September onward until the end of the year, which is (historically) right around contract negotiation time. The influx, in short, was expected. However, the index still faces long-term bearish pressure due to high construction costs, which continue to impact the cost of building power grids while hurting GOES demand.

Renewables/GOES MMI: Lithium-Ion Battery Material Costs & Other Price Trends

- Silicon increased by 9.46%, leaving prices at $2,034.86 per metric ton.

- Chinese cobalt cathodes moves sideways, dipping down by a mere 0.37%. This ultimately brought prices to $36,906.9 per metric ton.

- Finally, Chinese neodymium increased by 3.57%, bringing prices to $87,383.83 per metric ton.