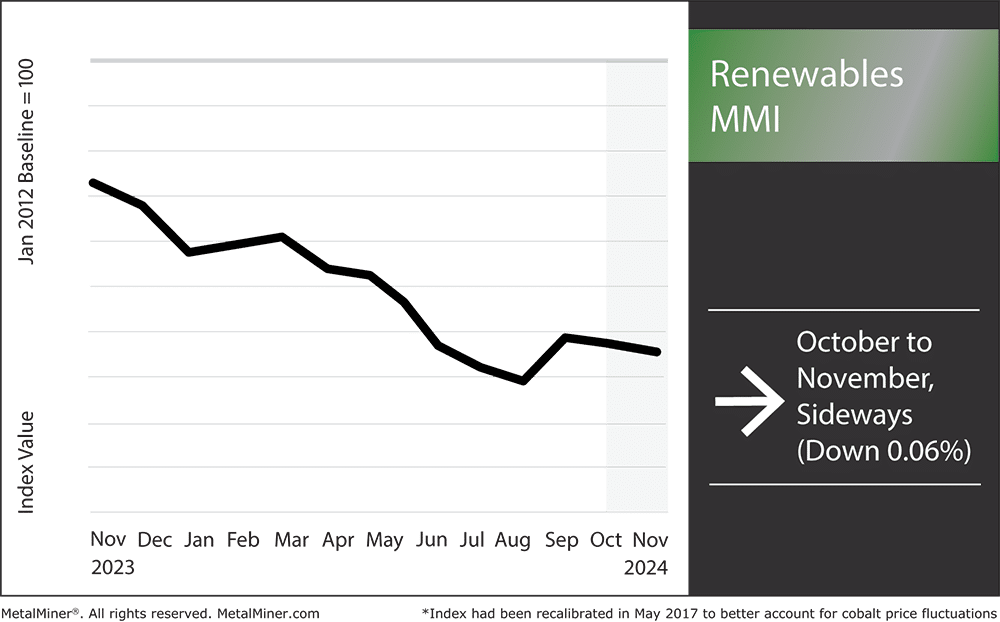

The Renewables MMI (Monthly Metals Index) held firmly sideways, shifting down a mere 0.06%. With the incoming Trump administration, it is possible the renewable energy sector could witness market shifts in the upcoming year. The Biden Administration prioritized the expansion of renewable energy systems, including more specific projects like electric vehicles. However, the Trump Administration may shift funding to other areas, which could place some bearish pressure on certain metals.

These exact market shifts still remain unclear at this time, as Trump’s new administration is not yet in power. However, buyers of metals like silicon, cobalt, copper, nickel and other renewable energy metals should remain prepared for potential market shifts due to policy changes.

Shifts in Renewable Energy: Metals and Price Drivers

The price of copper, which is common in solar technology and electrical wiring, has increased due to growing global demand as well as its crucial role in electrification and grid growth. Meanwhile, demand pressures from the energy storage and electric vehicle industries continue to affect nickel and cobalt.

Additionally, steel plate remains foundational for building wind turbine structures, with prices fluctuating in response to a combination of demand drops and international trade policies. For companies sourcing these metals, understanding market drivers and securing stable pricing is essential to project planning and cost management. Read how Squeezing Out Costs in a Falling Demand Market can support procurement teams in managing these volatile conditions.

Potential Shifts With the New Trump Administration

The election of Donald Trump for president introduces potential policy shifts that could influence the renewable energy sector. For example, the Trump administration could make plans to shift unused funds from the Inflation Reduction Act (IRA) elsewhere, a law that offers financial assistance for specified energy projects and renewable energy systems.

Despite this state-level initiatives and market demand may propel the renewable energy sector’s growth despite potential changes in federal legislation. For instance, the rise of Texas as a pioneer in renewable energy shows how market dynamics and state regulations can significantly influence the expansion of clean energy.

Impact on Demand for Metals Used in Renewable Energy Systems

Steel, copper, nickel and cobalt are among the metals used in the renewable sector to produce solar panels, wind turbines and other renewable energy systems. Any policy changes made under the Trump administration could impact the demand for these commodities.

For example, the development of wind turbines requires a significant amount of steel. The need for steel plate could decline if the incoming administration shifts federal funding for renewable energy projects to other government areas.

Again, any variables that could affect these metal price drivers and trends remain in question, especially with regard to federal support and regulatory frameworks.

Plan your metal purchases with precision, ensuring maximum profits using MetalMiner Insights’ comprehensive short and long-term price forecasts. Click here

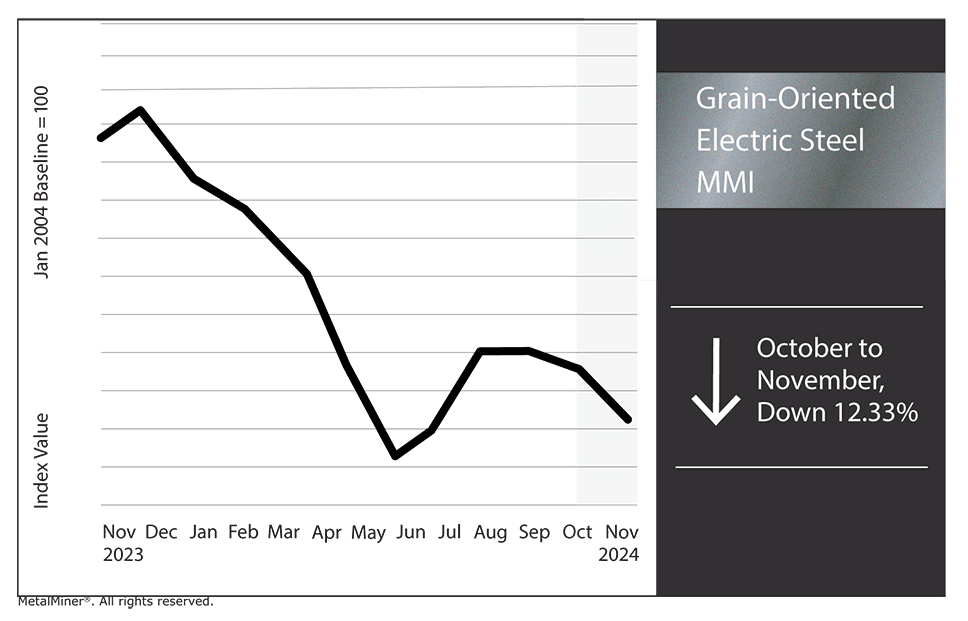

Grain-Oriented Electrical Steel MMI

The Grain-Oriented Electrical Steel MMI (GOES MMI) dropped by 12.33%. Overall, the market for electrical steel in the U.S. saw mixed supply and demand dynamics in the past month. Despite recent hurricanes disrupting logistics, regional demand varied, with robust consumption in the Southeastern U.S.

Renewables MMI: Noteworthy Price Shifts

Changes could be on the way for elements used in renewable energy systems. Subscribe to MetalMiner’s free Monthly Metals Index report and use it to anticipate renewable energy market changes and make strategic purchasing decisions.

- Neodymium prices moved sideways, dropping by 1.7%. This left prices at $73,824.52 per metric ton.

- Chinese silicon prices also moved sideways. Altogether, prices shifted down 0.47% to $1,644.47 per metric ton.

- Chinese cobalt prices moved sideways, rising by just 0.55%. This brought prices to $22.74 per kilogram.

- Lastly, steel plate prices also moved sideways, increasing by 1.74% to $995 per short ton.