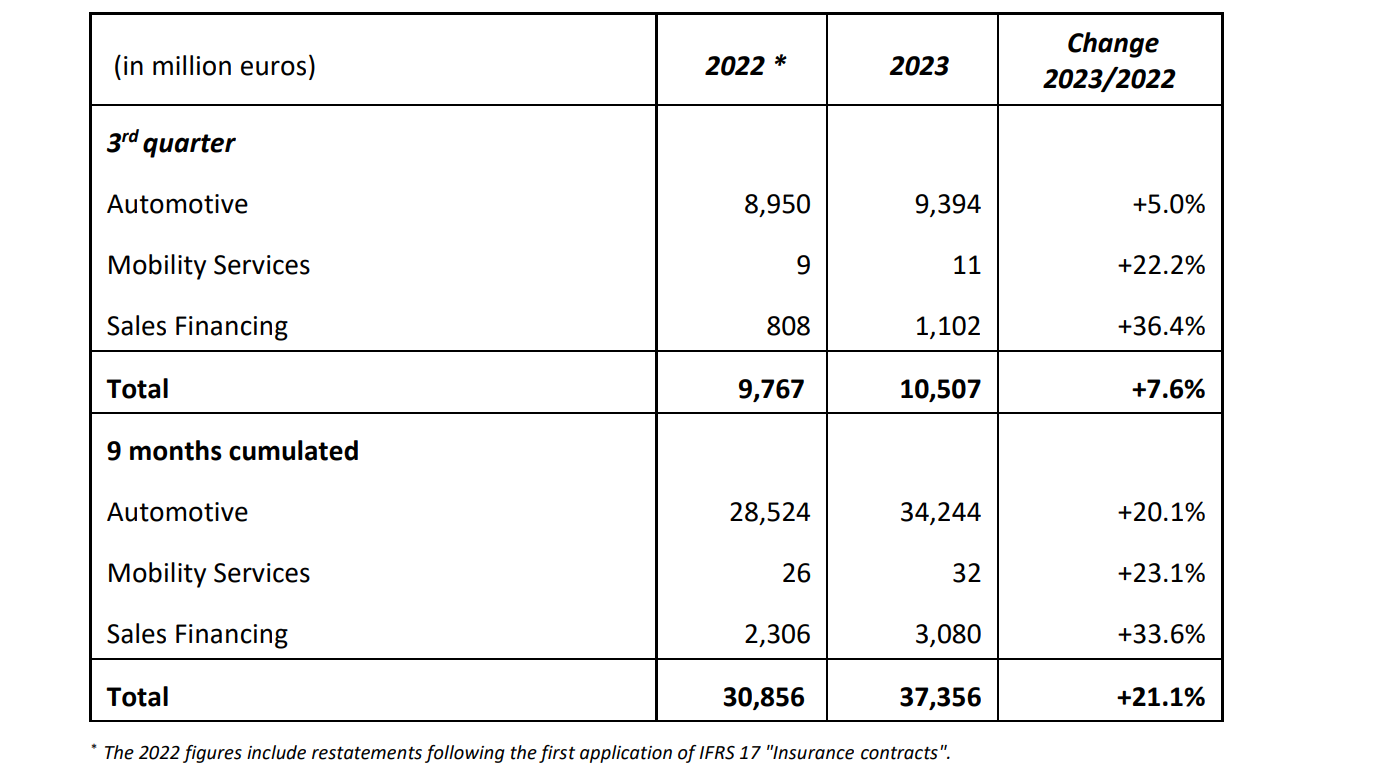

| Group revenue for 2023 Q3 amounted to €10.5 billion, up 7.6% compared to 2022 Q3. At constant exchange rates6, Group revenue was up 13.8%. Automotive revenue reached €9.4 billion, up 5.0% compared to 2022 Q3, or +11.3% at constant exchange rates. The negative exchange rates effect of -6.3 points is mostly linked to the Argentinean peso devaluation and to a lesser extent to the Turkish lira. |

| 2023 9-months: Group revenue at €37.4 billion, +21.1% vs 2022 9m1, +25.3% at constant exchange rates2 Auto revenue at €34.2 billion, +20.1% vs 2022 9m1, +24.2% at constant exchange rates2 Group registrations up 10.9% globally and 21.3% in Europe 2023 Q3: Group revenue at €10.5 billion, +7.6% vs 2022 Q31, +13.8% at constant exchange rates2 Auto revenue at €9.4 billion, +5.0% vs 2022 Q31, +11.3% at constant exchange rates2 Group registrations up 6.1% globally and 15.3% in Europe Continued strong price effect at 7.5 points over the quarter Europe orderbook remains very healthy at 2.5 months of forward sales at the end of September 2023 guidance confirmed: a Group operating margin between 7% and 8% a free cash flow superior or equal to €2.5 billion Renault Group expects a Group operating margin in H2 above H1, which was at 7.6%. “Renault Group achieved again a strong performance in the third quarter with total revenue increasing by 13.8% at constant exchange rates. We have entered the last quarter with confidence and confirm the improvement of our profitability in the second half of the year and beyond, driven by our product offensive, along with the benefits of our cost reduction program and our disciplined commercial policy focused on value. In the meantime, we are moving fast forward on all our Revolution projects and this quarter was very active. We officially launched Horse and signed the JV agreement with Geely. Ampere carve-out will occur in November and we will present in detail its strategy during a Capital Markets Day on November 15th. We also announced the Flexis Project together with Volvo Group and CMA CGM, a true game changer to tackle the challenges of electrifying LCVs in the urban logistics sector. We are progressively building our next-gen automotive company. Finally, following the signature of the Alliance definitive agreements in July, we confirm that the completion of the transaction is expected by the end of the year, as planned. This will create additional value through common operational projects and give Renault Group the opportunity to optimally reallocate part of its capital.” said Thierry Piéton, Chief Financial Officer of Renault Group. 1 The 2022 figures include restatements following the first application of IFRS 17 “Insurance contracts”. 2 In order to analyze the variation in consolidated revenue at constant exchange rates, Renault Group recalculates the revenue for the current period by applying average exchange rates of the previous period. |

Renault Group’s consolidated revenue

Information Source: Read More

Energy ,Petrol , Electric Power , Natural Gas , Oil , Climate , Renewable , Wind , EV , LPG , Solar , Electric , Electric Vehicles,

.jpg)

.jpg)