The next decade will be pivotal for achieving net-zero emissions by 2050. And with consumers and regulators likely to shift to more sustainable offerings and impose stricter environmental mandates, respectively, companies are feeling the pressure to reach their ambitious sustainability targets in the next several years. Retailers are no exception.

One imperative for retailers is to make more of their packaging sustainable. By 2030, retailers with the boldest ambitions plan to increase their share of recycled content in packaging to 50 percent, reduce their virgin-plastic footprint by 50 percent, and move to 100 percent reusable, recyclable, or compostable materials in their private label range, where they have most control over outputs.

But realizing these ambitious goals is far from easy. The demand for postconsumer recycled plastic packaging will increase threefold by 2030, in part because of retailers’ sustainability goals and increased regulatory targets—while the supply of such materials is only expected to double, according to a McKinsey analysis. Regulators around the globe are mandating a variety of compliance measures to curb the use of packaging, especially plastics. Consumers continue to demand that the brands they buy use sustainable packaging. At the same time, persistent inflation makes reducing costs a must-do.

Last year, we recommended a set of actions that consumer goods companies could take to make their packaging more sustainable. This time, we’re turning our attention to retailers, whose margins are even slimmer, leaving them more vulnerable to the cost and supply hurdles on the horizon that threaten financial performance.

Drawing on our work with leading global retailers, we have identified four bold, strategic actions that extend across the entire value chain and call for retail CEOs, chief sustainability officers, and chief procurement officers to reimagine their approach to sustainable packaging. It’s important to note that no single packaging type—plastic, glass, metal, cardboard, or paper—has every attribute of sustainable packaging. All these materials have benefits and costs, which vary based on their application, regional standards, and other factors.

Overcoming the sustainable-packaging premium

One of the biggest myths about—and obstacles for adoption of—sustainable packaging is that it is always more expensive for retailers to use when compared with less sustainable materials. But the reality is far more nuanced.

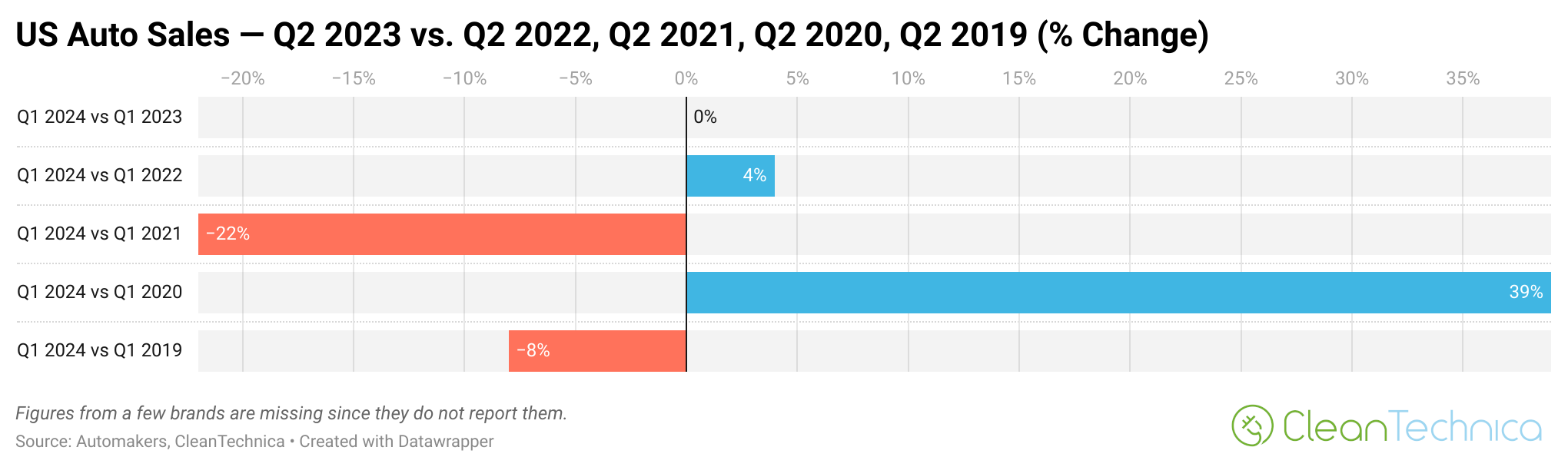

Take plastics as an example: it’s true that if all retailers meet their sustainability pledges, the demand for recycled plastics (around 90 million tons) will likely far outpace the global supply (around 60 million tons) by 2030 (exhibit). This will put upward pressure on prices and erode retailers’ margins. It’s also true that there is often a premium on recycled materials.

But retailers won’t necessarily have to pay these significant premiums over time—particularly if they invest in their capabilities and engage in the value chain further upstream in line with the four actions we describe below. By doing so, we also estimate that retailers can reduce their plastic packaging cost base by 15 percent on average, and up to 40 percent in some categories.

Four actions to create a more sustainable packaging strategy

Retailers have a unique opportunity to become true leaders in sustainable packaging. To do so, they should collect comprehensive data, clear organizational hurdles, and develop new ways of doing business both internally and externally, as we outline below.

These actions can also help retailers reduce their commodity price exposure, derisk their supply chain, expand revenue streams, and deliver on consumer expectations—without passing on higher prices to the customer.

Action 1: Assess—then optimize—the full packaging portfolio

“You can’t manage what you don’t measure” is the principle that should guide a retailer’s journey to create a more sustainable packaging portfolio.

Organizations need to create a 360-degree view of their packaging footprint. They should assess everything from their use of raw materials, environmental footprint, cost, and formats across all their SKUs as part of a broad baseline analysis. Once the data is consolidated, retailers can identify the biggest opportunities across their portfolio, which will help define their optimal packaging strategy. For example, retailers have not historically focused on optimizing their private label packaging, which accounts for an increasing share of retailers’ businesses. They also miss opportunities to apply learnings that could shape best practices in packaging across their various markets.

To truly understand the packaging portfolio, retailers should create specific teams dedicated to working on sustainable packaging. Ideally, this should be a cross-disciplinary group with experience in both sustainability and procurement. At least one person on this team should be responsible to create a full, transparent picture of the retailer’s materials usage, which can be completed in collaboration with suppliers. This team should also be responsible for defining packaging guidelines (which materials they want to use for each product, for instance), identifying which products should be redesigned, and working with packaging and goods suppliers to create new packaging.

Action 2: Integrate sustainability principles into the packaging design process

Once retailers have a comprehensive understanding of their packaging portfolio and footprint, they can develop an informed plan for making all future packaging more sustainable. This will require them to integrate design-for-sustainability principles into their packaging design process—principles that seek to minimize the use of nonsustainable materials, favor materials with the smallest environmental footprint possible, and harmonize to a consistent set of materials by category, all while keeping the user experience front and center.

Design-for-sustainability levers include reducing excess packaging through approaches such as “skinny design,” or through changes in packaging formats (for example, some beverage companies are opting to use multipack tapes instead of plastic rings for six-packs). Another lever is the choice of materials: again, using plastics as an example, retailers can choose plastic polymers that are recyclable or biodegradable and consider alternative materials in their packaging portfolio, such as paper or cardboard, where it makes sense.

Another aspect of making the packaging design process more sustainable is to use innovative methods for sourcing materials. That may mean a retailer working directly with packaging suppliers to design sustainable product packaging. Smaller private label suppliers could then procure directly from these packaging suppliers and ultimately capture savings on materials procurement that come with scale.

To source these scarce materials, such as recycled plastics, retailers may be required to engage in strategic partnerships.

Action 3: Establish new partnerships along the value chain

Many retailers work with a wide array of small-scale private label suppliers, which tend to have neither robust sustainable packaging capabilities nor access to recycled materials. This fragmented landscape—which is further exacerbated in geographies without deposit return schemes—makes it even more difficult for retailers to create closed-loop packaging systems. Retailers will therefore have ample opportunity to establish partnerships or explore new ownership models along the value chain to secure scarce supply—without paying a premium.

Potential partners include packaging suppliers, as described above; waste managers, which can help ensure that used packaging is returned to a retailer for reuse or recycling; and mechanical and chemical recyclers, with whom a retailer may co-invest in recycling plants or establish offtake agreements (long-term contracts in which a retailer agrees to purchase a set amount of the recycler’s supply), which enable the recycling partner to invest in building capacity. Retailers could also partner with consumer-packed-goods manufacturers to explore new consumption models, such as refillable solutions.

Partnerships with recyclers are particularly critical for two main reasons. First, they can help a retailer secure feedstock access at competitive prices, which they can then provide to their suppliers. Second, across geographies, retailers are likely to experience a bottleneck at the recycling stage in their value chain, because of the limited availability of quality, recyclable waste and the limited recycling capacity and infrastructure to support recycling.

Each of these types of partnerships is essential—and it is even better when they are multipronged. For instance, leading retailers have recently engaged in partnerships with packaging companies and advanced materials producers to tackle plastic waste and increase the share of recycled materials that they can use in their packaging. Waste managers and mechanical recyclers are also creating integrated chemical recycling solutions, with plans to build up significant packaging capacity over the next several years. And several packaging suppliers and recyclers have established partnerships with retailers in order to collect waste from consumers in their store network.

Such partnerships represent a radical shift in how retailers and private label suppliers do business. But creating these relationships will help businesses gain access to much-needed supply in an otherwise stretched market.

Action 4: Build new internal capabilities

Without investing in its talent and capabilities, however, it is unlikely that a retailer can successfully establish a new approach to sustainable packaging. To work well with new partners such as recyclers, packaging suppliers, and waste managers, internal talent should develop a deep understanding of the technical complexities within packaging and recycling technologies. Evaluating a chemical recycling partner’s offtake offer, for example, requires deep chemical know-how. Building up in-house capabilities—both through hiring and upskilling—should be a chief priority.

Capability-building efforts should also include augmenting store operations. This could involve training store employees on how to collect recycled packaging and investing in in-store infrastructure, such as refill–reuse stations or receptacles for used packaging.

Reverse logistics are also important in ensuring the feedstock collected ends up in the right hands for further processing along the value chain. Today, retailers tend to handle reverse logistics in isolation. Syncing reverse logistics with supply and procurement efforts across the business will be key.

Finally, retailers should dedicate sufficient resources to understanding the regulatory landscape for circular packaging, which is becoming more complex. A retailer would do well to create channels for communication and coordination between international teams to discuss regulatory developments and to share best practices.

Tackling this sustainable packaging challenge holistically gives retailers the chance to achieve cost savings and drive earnings, meet sustainability targets, and deepen consumer loyalty, a winning trifecta. But retail executives should seize the window of opportunity now before packaging costs rise to a prohibitive level. The clock is ticking.