(Reuters) – The effective closure of the Red Sea to tankers carrying liquefied natural gas (LNG), while a concern, is unlikely to shift prices for the super-chilled fuel because other factors are driving the market.

QatarEnergy, the world’s second-biggest LNG shipper, has stopped sending tankers via the Red Sea, a senior source with direct knowledge of the matter told Reuters on Monday, with at least four vessels being held up since the weekend.

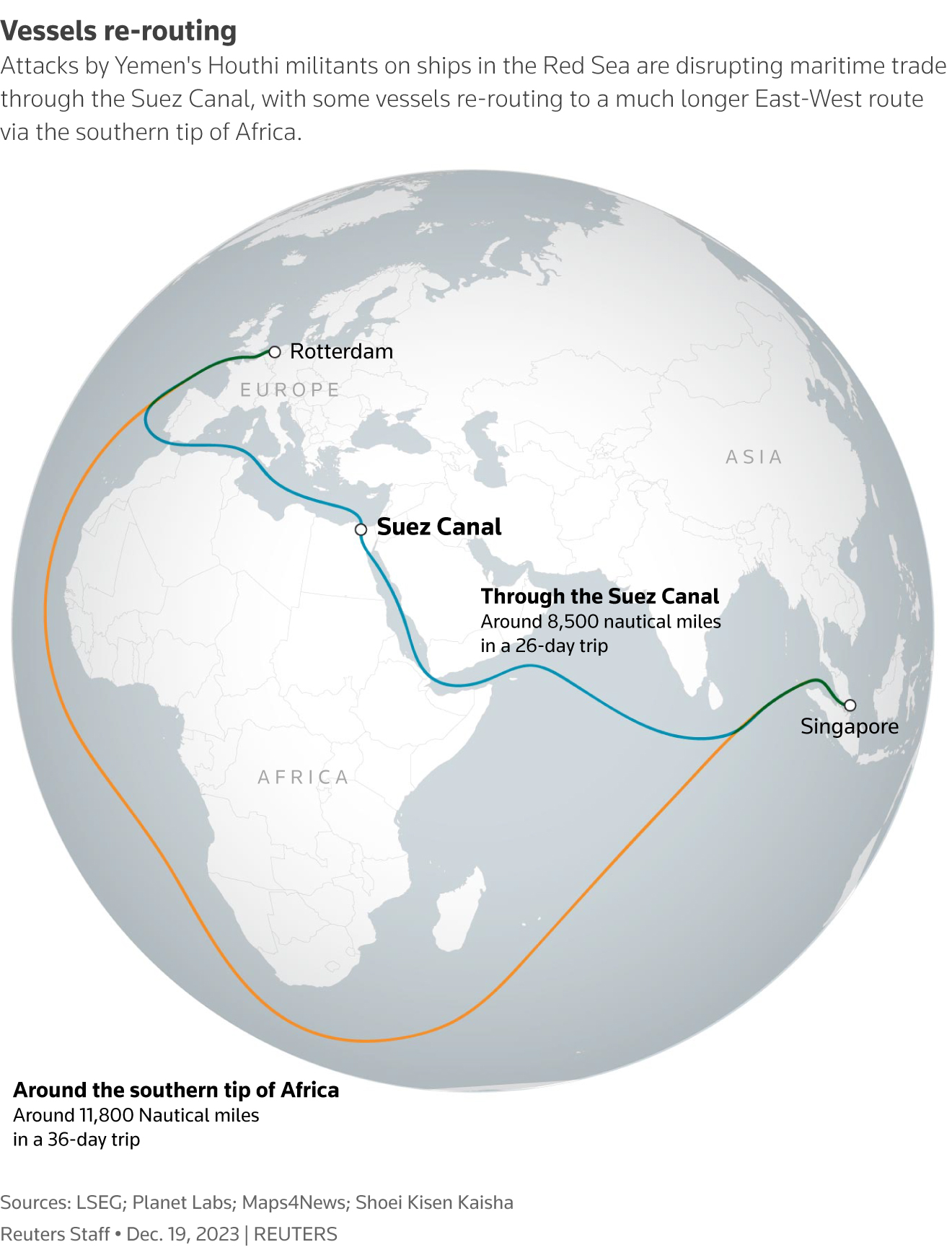

The halt on traversing the channel that links the Indian Ocean to the Mediterranean Sea via the Suez Canal comes as Yemen’s Iran-aligned Houthi group continues to attack vessels in the key shipping lane.

If the Red Sea remains closed for an extended period it will force LNG tankers and other vessels to take the longer route around the Cape of Good Hope in South Africa, adding to costs and voyage durations.

But even in this worst-case scenario, LNG cargoes will still be moving from Qatar to customers in Europe.

It’s also worth noting the volume of LNG affected is relatively small, and the current market dynamics are flexible enough to compensate without putting significant upward pressure on spot prices.

The bulk of Qatar’s LNG heads to buyers in Asia, the top-importing region, with data compiled by commodity analysts Kpler showing that on average Asia takes about 80% of the Middle East producer’s volumes.

In December, Qatar shipped 6.02 million metric tons of LNG to Asia and 1.09 million to Europe, and the volume shipped to Europe has been anchored around that level for the past five months.

Even if Qatar’s shipments to Europe were to decline, it’s likely that any shortfall could be made up by the United States, which became the world’s largest LNG exporter in 2023, overtaking both Qatar and Australia.

The United States is a swing shipper of LNG, supplying buyers in both Europe and Asia, but increasingly focusing on Europe, especially with the loss of much of the continent’s supply of Russian pipeline gas in the wake of Moscow’s invasion of Ukraine almost two years ago.

SUPPLY SURGE

U.S. LNG exports hit a record high of 8.56 million tons in December, according to Kpler, with Europe receiving 5.87 million and Asia 2.2 million, and small volumes heading to the Americas.

The United States has the ability to boost shipments to Europe if required, and it may also suit to send less to Asia given the current delays affecting shipping through the Panama Canal, caused by a lack of rain leading to draught restrictions and lower shipping movements.

The current situation in the Red Sea has the potential to escalate, but for the moment it’s more of a concern than a factor driving prices.

Rather, spot LNG prices are being driven by robust supply from the United States and Australia, which is proving enough to meet the strong demand in Asia over the winter peak period.

Asia’s LNG imports were 26.56 million tons in December, the highest in Kpler records going back to 2009 and up from 23.31 million in November.

The strength in demand is continuing into January, with Kpler estimating arrivals at 25.61 million tons, which would be well above the 23.38 million recorded in January 2023.

Joining the United States with record exports in December is Australia, which shipped 7.22 million tons in the month, eclipsing the previous all-time high of 7.18 million in June 2022.

Qatar also saw strong exports in December, recording 7.11 million tons, the most since January 2023, according to Kpler.

The robust supply is keeping spot LNG prices muted in Asia, with the weekly assessment dropping to a seven-month low of $10.10 per million British thermal units (mmBtu) in the seven days to Jan. 12.

New York-traded contracts linked to the benchmark S&P Global Commodity Insights JKM marker didn’t trade on Monday because of U.S. public holiday, but they ended at $11.20 per mmBtu on Jan. 12, declining for a fifth straight day.

European natural gas prices dropped on Monday as mild weather forecasts and ample inventories trumped concerns over Middle East instability, with benchmark Dutch TTF contracts ending at 29.90 euros ($32.64) per megawatt hour, down from 31.60 euros at the close on Jan. 12.

The price is equivalent to about $9.59 per mmBtu, which isn’t high enough to draw spot LNG cargoes away from Asia, a further sign that so far the market is relatively unconcerned about the attacks on shipping in the Red Sea.

The opinions expressed here are those of the author, a columnist for Reuters.

($1 = 0.9160 euros)

Share This: