Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

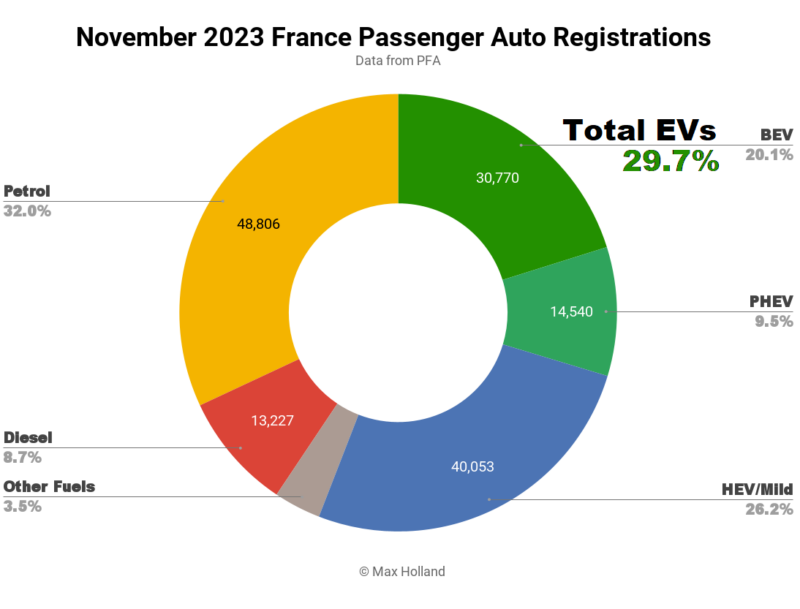

November saw a new record 29.7% EV share in France, up from 24.4% year on year. Full electrics alone took over 20% of the auto market for the first time. Overall auto volume was 152,709 units, up 14% YoY, though still well under the 2017-2019 seasonal average (roughly 180,000 units). The refreshed Tesla Model 3 was the best selling full electric, and second best overall.

November’s market saw combined plugin EVs take a new record 29.7% share, with 20.1% full electrics (BEVs), and 9.5% plugin hybrids (PHEVs). These compare with YoY figures of 24.4%, with 15.2% BEV, and 9.2% PHEV.

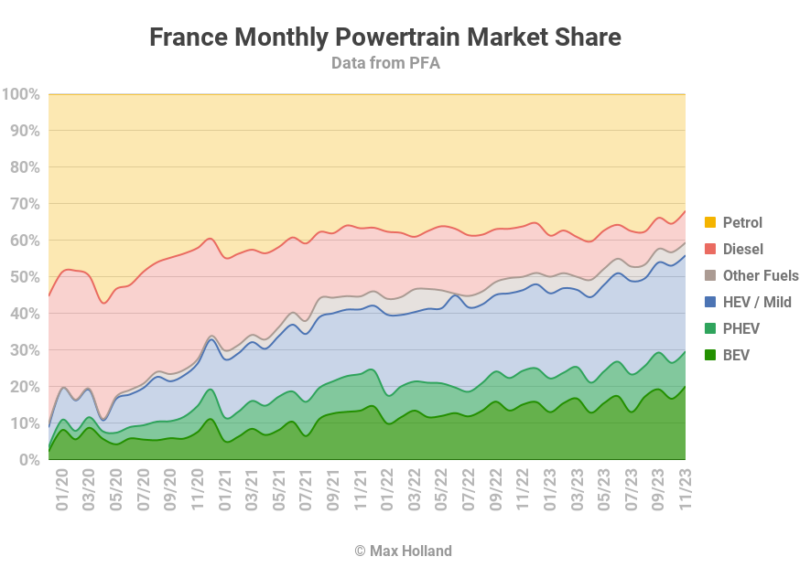

As with other European markets at a similar stage of the EV transition, we can see that PHEVs have mostly plateaued, whilst BEVs continue to steadily grow market share — even whilst the overall market volume is increasing, back towards pre-2020 levels.

In volume terms, BEVs grew 52% YoY, to 30,770 units. Meanwhile, PHEVs grew volume at 18% YoY (just outperforming the broader market), to 14,540 units.

Diesel volume was down 28% YoY, at 13,227 units and 8.7% share – the sixth consecutive month below 10% share.

Recall that the eco-bonus rules in France are about to tighten, with the older, more generous terms seeing a 15th December cut off for placing orders, and a 15th March cut off date for deliveries. So we can expect January to mid-March to see a pull-forward of BEV registration volumes. This is a neat scheduling fit for manufacturers, since the neighbouring German market is having its pull-forward right now, ahead of a January 1st rule change.

Best Selling BEVs

The newly refreshed Tesla Model 3 was the best selling BEV in November, and second best selling vehicle overall, with 6,081 units, a new record volume.

The runners up were the Tesla Model Y, and the Dacia Spring. Each of these top 3 BEVs were inside France’s overall top 10 best selling vehicles in November.

There were no major moves in the BEV top 20, but notice that the new Fiat 600 has now entered the ranks (19th), and — judging by the popularity of its smaller, and less fully-fledged sibling, the 500 — should have much further to climb.

We unfortunately don’t have early access to all the detailed sales data for every BEV model, so we can’t detect the debut of every fresh new BEV onto the French market. We can be sure that popular newcomers, like the Fiat 600, will quickly grow to join the top 20, where they become clearly visible.

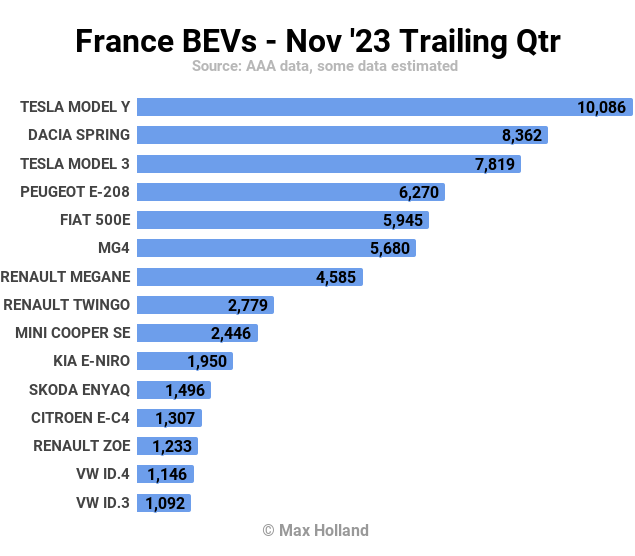

Let’s get an update on the trailing quarter performances:

Here the Tesla Model Y still has a decent lead, although it is less dominant than in some other European markets.

There are mostly only very minor changes in rankings since the prior period (June to August). The Citroen e-C4 has had a climb up to 12th, from 16th previously, mainly thanks to its larger battery and even better efficiency, that now make it an only-car-you-need for a majority of families.

Conversely, the Volkswagen ID.3 has slipped to 15th, from 11th previously. This may be somewhat shaped by a shift in allocation to the German market in November and December, to accommodate the pull-forward mentioned above.

It will be interesting to see which models wax and wane over the coming months as the incentive landscape changes.

Outlook

The 14% YoY recovery of the auto market was a relative bright spot, as France’s broader economic situation moved in the opposite direction. The French economy in Q3 fell to its lowest growth rate since 2021, at just 0.6% YoY growth. Headline inflation improved somewhat, to 3.4% in November, from 4% In October, though with interest rates remaining at 4.5%, and still on an upward trend. Manufacturing PMI remained almost flat and negative, at 42.9 points in November, from 42.8 in October.

S&P Global reports that “Looking ahead, manufacturers were still strongly pessimistic for the next twelve months, as firms were reportedly preparing for lower orders from clients in the automotive and construction industries.”

As stated earlier, the balance between EVs and other powertrains will be shaped in the coming few months by the changing incentive landscape. There will be some short-term discontinuities. We will find out after December 15th which BEV models the government evaluates as eligible for more support, and which models are disfavoured. I will bring you a summary of that publication in next month’s report.

What are your thoughts on France’s EV transition? Please jump into the comments below to join in the conversation.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

CleanTechnica Holiday Wish Book

Our Latest EVObsession Video

I don’t like paywalls. You don’t like paywalls. Who likes paywalls? Here at CleanTechnica, we implemented a limited paywall for a while, but it always felt wrong — and it was always tough to decide what we should put behind there. In theory, your most exclusive and best content goes behind a paywall. But then fewer people read it!! So, we’ve decided to completely nix paywalls here at CleanTechnica. But…

Thank you!

CleanTechnica uses affiliate links. See our policy here.