Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

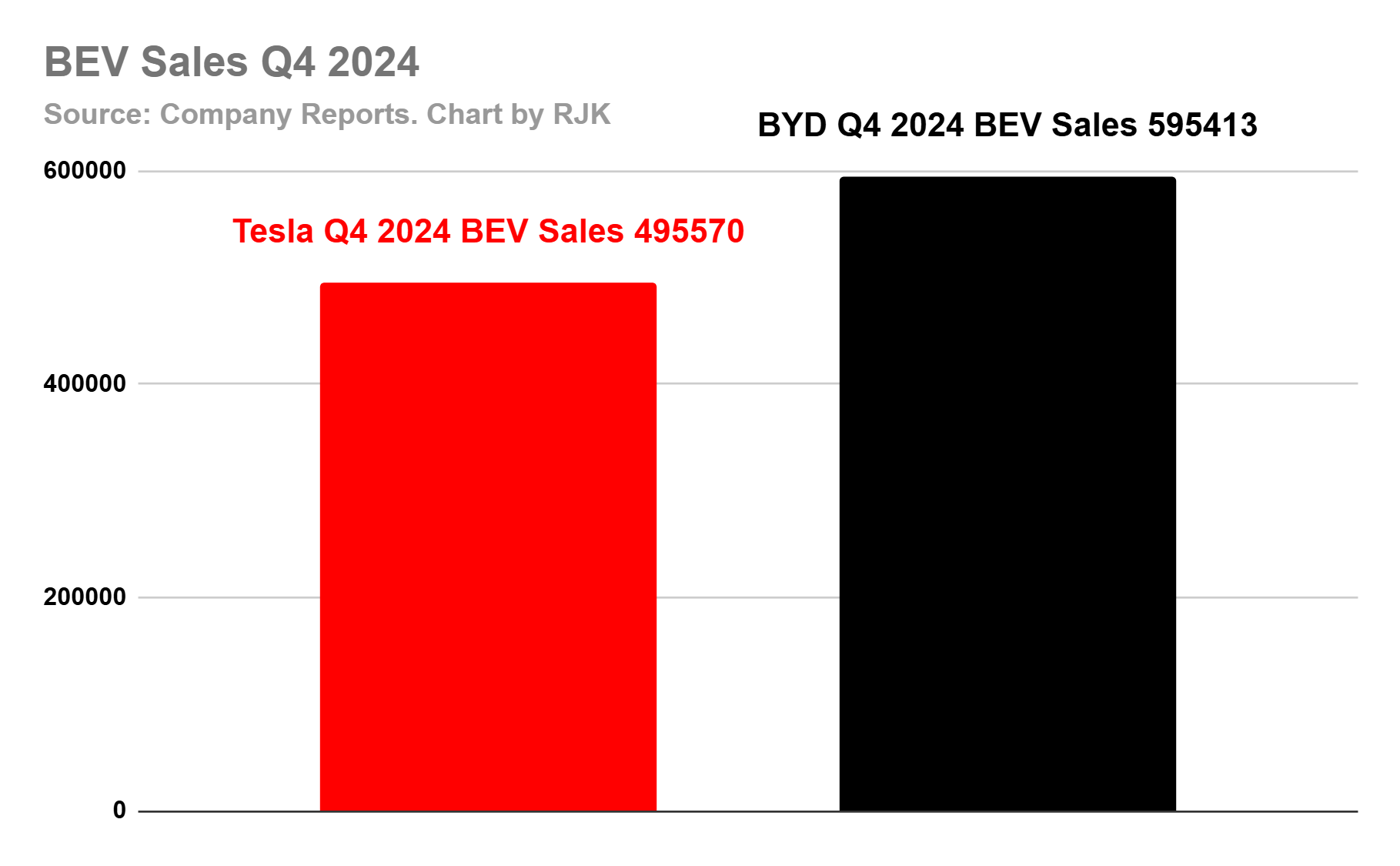

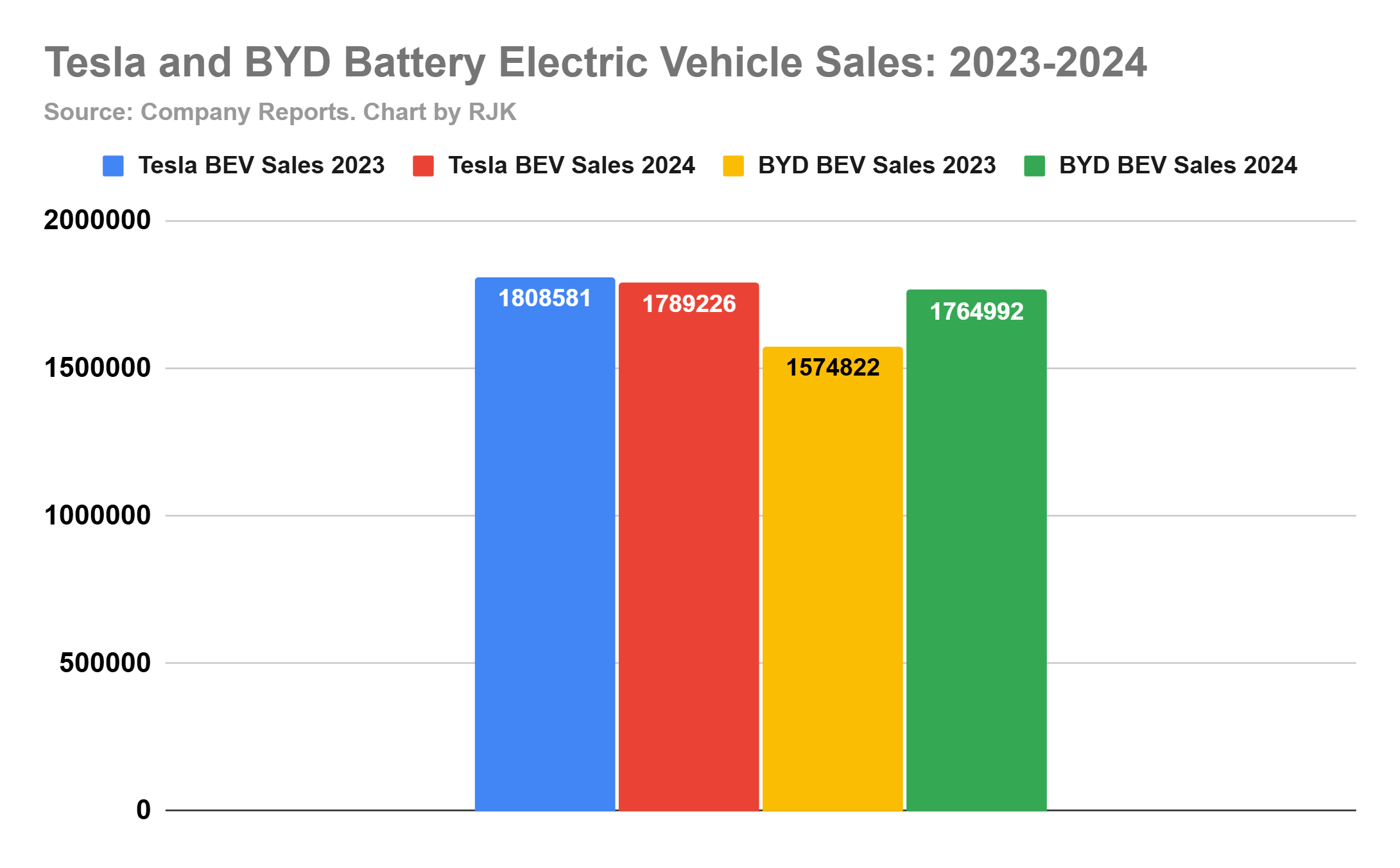

The world’s top two electric vehicle companies, BYD and Tesla, just released their latest annual sales figures, and they make some really interesting reading. Tesla leads the way in terms of battery electric vehicle sales, but it’s getting quite tight, as BYD is now creeping up and getting close to Tesla’s annual sales figures. Thanks to a monster performance in Q4 2024, BYD’s BEV sales figures for 2024 were only 24,234 vehicles behind Tesla. BYD’s 2024 BEV sales were 1,764,992 and Tesla’s were 1,789,226. In Q4, BYD sold close to 600,000 fully electric vehicles. BYD sold 595,413 battery electric vehicles in the last three months of 2024, whilst Tesla delivered 495,570 battery electric vehicles during the same period. Editor’s note: For the record, more than a year ago, I predicted that the end of 2024 is when BYD would surpass Tesla in BEV sales. Boom. —Zach

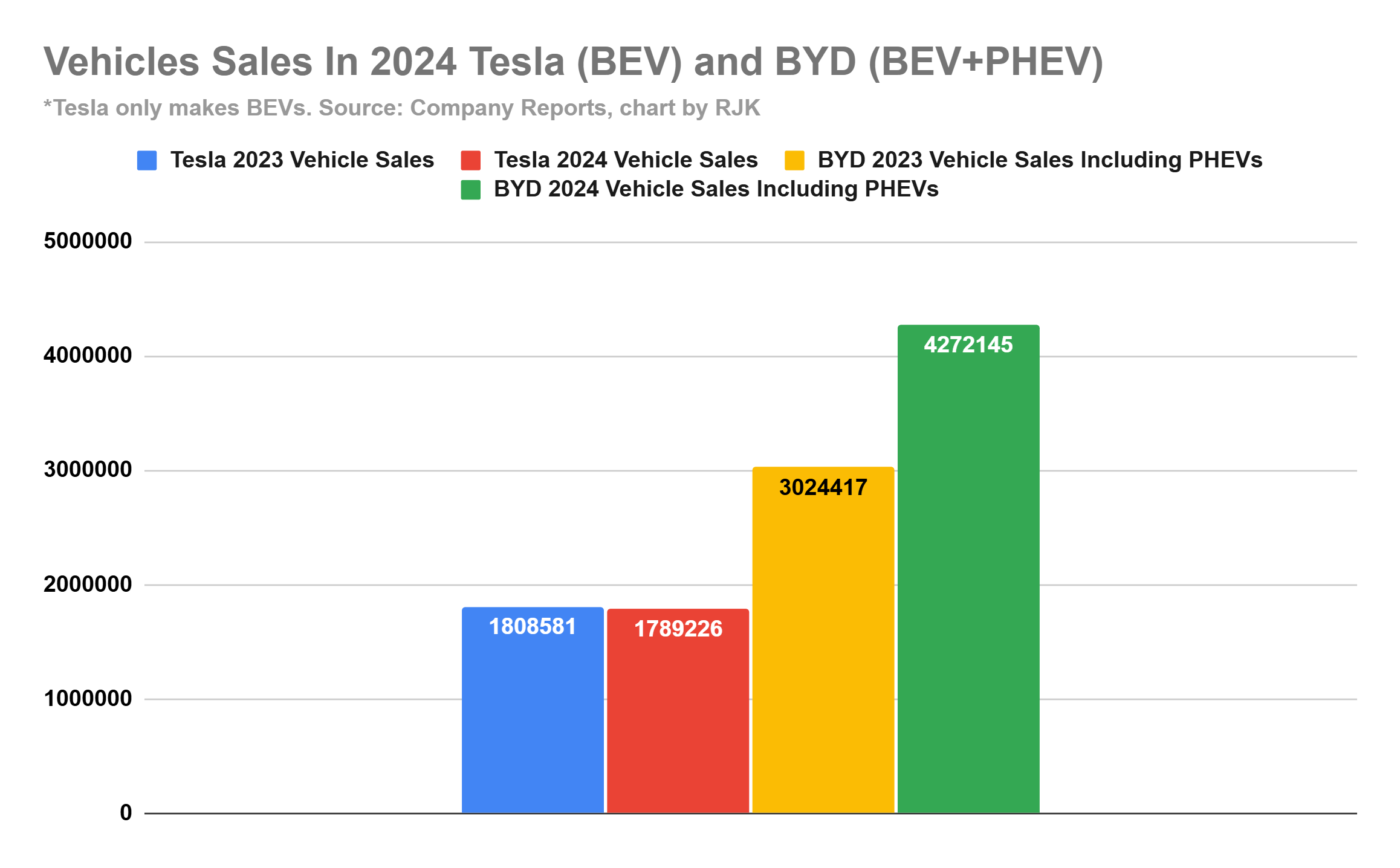

When it comes to plugin vehicle sales, BYD leads the way. In 2024, BYD sold a whopping 4,272,145 vehicles, up 41.1% year on year.

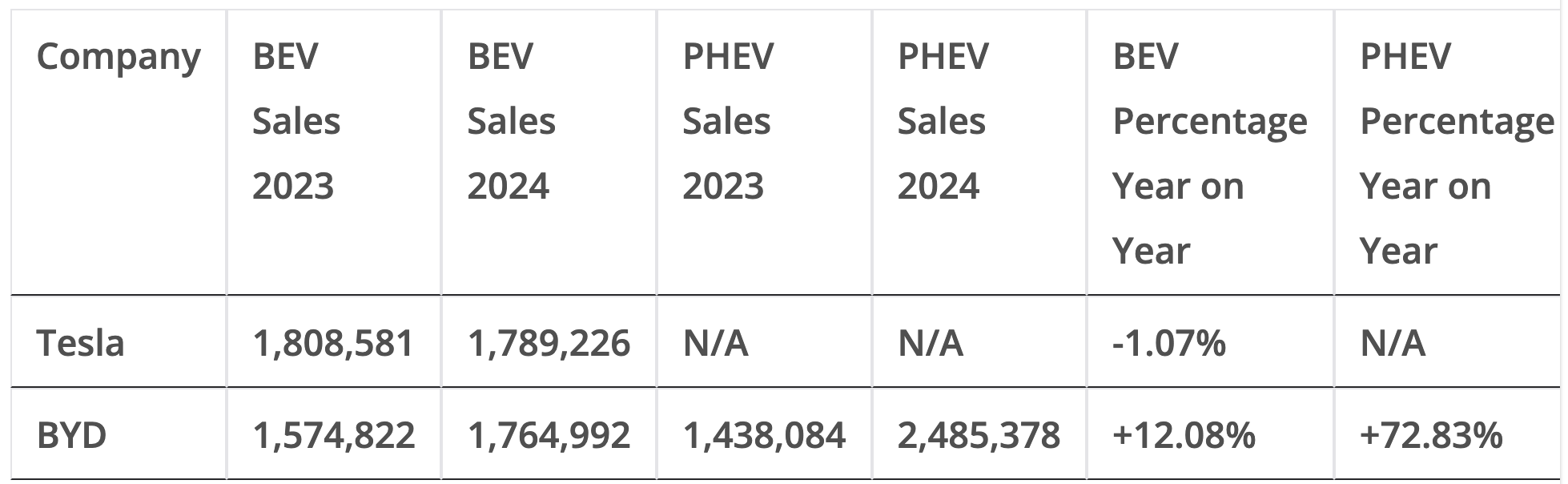

As always, it is important to note that Tesla only sells BEVs whilst BYD also sells plugin hybrids. Here is a summary of how it looked in 2024 for the top two:

BYD and Tesla Vehicle Sales in 2024

From the table above, BEV sales for the world’s top two in 2024 were quite sluggish, with Tesla sales down 1% from 1,808,581 in 2023 to 1,789,226 in 2024 and BYD’s BEV sales up a very modest 12% year on year from 1,574,822 in 2023 to 1,764,992 in 2024. On the other hand, BYD PHEVs were up a whopping 73% from 1,438,084 to 2,485,378. The two companies sell BEVs in a number of common markets, such as China, Australia, New Zealand, and some markets in Europe. However, Tesla has a much larger presence and market in Europe and of course in the USA, where BYD is not yet selling its passenger cars. The end of incentives in key markets such as Germany and a generally tougher economic environment characterised by higher interest rates have previously been cited as some of the reasons for lower than expected growth in some key markets for Tesla. The result is that Tesla’s annual sales did not grow YoY for the first time since it introduced the Model S in 2012. Another factor could be that this year saw a number of newer players start to make significant traction in their EV sales, which could have led to some sales being scooped up by those firms and could have contributed to lower than expected growth in BEV sales for the top two players in the EV game.

Looking at BYD, sales for 2024 saw PHEVs taking 58% of total sales, a big contrast to 2023 when BEVs had a higher share at 52.3%. So, what’s with the sharp increase in PHEV sales? For starters, BYD launched several new PHEV models in 2024 as well as updating its lineup of PHEVs. BYD ran a campaign in China framed as “PHEVs are cheaper than ICE,” highlighting that its upgraded PHEVs are cheaper to buy compared to equivalent full ICE vehicles — from both an upfront purchase perspective as well as an operating or total cost of ownership (TCO) perspective. This appeared to resonate with buyers in 2024. Another factor is the fact that PHEVs in China generally have all-electric ranges of around 100 km, higher than most PHEVs in other parts of the world, where 50 km ranges are more common. This makes PHEVs a bit more attractive compared with other places.

With such a big jump for PHEV sales in 2024, one would probably assume that this trend will continue in the immediate to medium term. This would be due to more new PHEVs models being launched as well as the continuous refreshing of existing PHEV models via the incorporation of updated electric motors, battery packs, and other components. Another factor could be that at the moment, 91% of BYDs’ total vehicle sales are in the local market, with only 9% sold overseas. BYD has generally pushed mostly BEV sales overseas, but with the imminent launch of new PHEVs such as the BYD Shark 06 in several markets, including Australia, New Zealand, South Africa and many other in 2025, the share of PHEVs in BYDs exports may increase. Several PHEV models from BYD’s range are also due to enter new markets in 2025. There are even plans for BYD PHEVs coupled with flex engines using higher levels of ethanol for Brazil.

Outside of BYD, several other automakers are adding more of these longer range PHEVs, and that’s not even counting EREVs. For example, CATL launched its new Freevoy Super Hybrid Battery, the world’s first hybrid vehicle battery to achieve a pure electric range of over 400 km and 4C superfast charging, heralding a new era for high-capacity EREV and PHEV batteries. Quite a number of other firms are releasing PHEVs with electric ranges above 150 km. PHEVs do divide opinion, with many people feeling that with the way BEV tech has advanced in recent times, PHEVs are no longer needed as a transition option to full electric. However, you can see why PHEVs with electric ranges of 200–300 km would appeal to non-early adopters, especially in markets where charging infrastructure is not fully developed. Even in markets like China where EV adoption is one of the highest in the world, charging infrastructure headaches around big holidays are still a major concern, as highlighted in a recent article in the South China Morning Post. This may be one of the factors drawing non-early adopters to these longer range PHEVs.

As Chinese automakers prepare to ramp up exports, will we see an initial bump in PHEV exports to emerging markets — for example, where charging infrastructure is still developing? Let us know what you think in the comments section.

Back to Tesla, the company plans to release some more affordable models this year. This may boost sales to get them back to their previous YoY growth levels. Although, there seems to be a bigger push towards autonomous driving. A more affordable Tesla (say, starting from just under $30,000 before any incentives) would be great for the EV industry and would surely shake things up in the auto sector. With the Model Y set to be the top selling car of any kind globally for the second year running, any compact model priced lower than the Model Y would definitely help accelerate the transition to electric even further. On the other hand, BYD is also ramping up production of its more affordable models, such as the Seagull, which will be launched in Europe and other places later this year. Availing this kind of vehicle in more markets around the world will definitely shake up the auto sector. The future is definitely fully electric. Hopefully BEV sales from the top two EV producers will bounce back big time in 2025.

Chip in a few dollars a month to help support independent cleantech coverage that helps to accelerate the cleantech revolution!

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Sign up for our daily newsletter for 15 new cleantech stories a day. Or sign up for our weekly one if daily is too frequent.

CleanTechnica uses affiliate links. See our policy here.

CleanTechnica’s Comment Policy