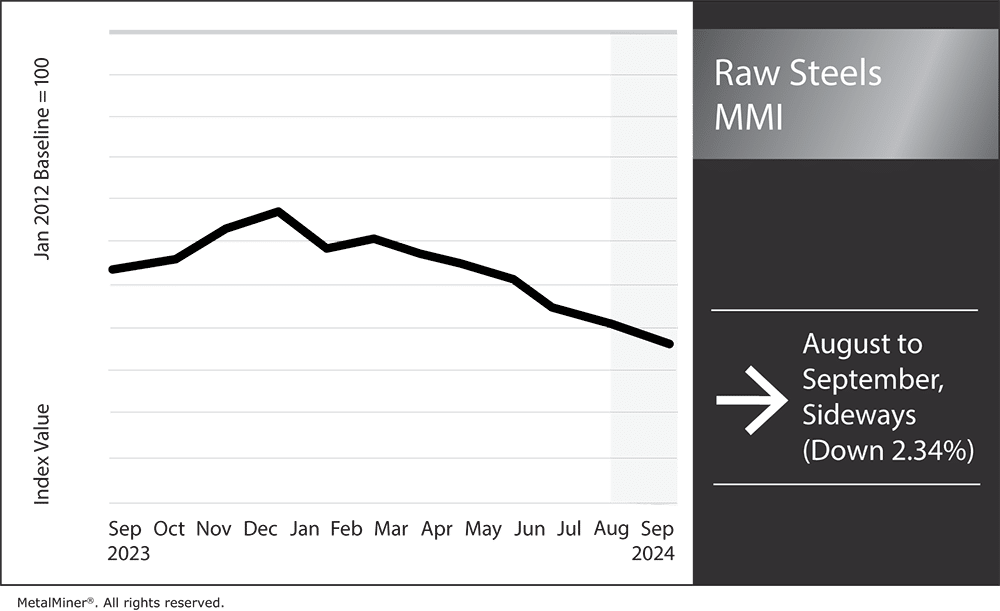

The Raw Steels Monthly Metals Index (MMI) moved sideways, with a 2.34% decline from August to September.

U.S. steel prices trended either sideways or down over recent weeks. HRC and CRC prices appeared to find a bottom in August but did not show enough momentum to the upside to form an uptrend. Meanwhile, HDG prices skipped the sideways trend. As of September 13 they remain in search of a new bottom.

Mills Struggle to Invert Steel Price Downtrend

Markets met warnings of a steel price bottom and widely reported outages over the next few months with a yawn. HRC and CRC prices managed only modest increases in the following weeks, while HDG prices remained in search of a new bottom by mid-September.

Estimates suggest upcoming maintenance-related outages will cut flat rolled capacity by at least 1 million short tons. While that number is nothing to scoff at, demand conditions appear to be getting worse, not better. After months of increasingly short mill lead times and high raw steel production rates in the U.S., this suggests that the upcoming production cuts are more than necessary to curtail the apparent glut of material.

Data from the American Iron and Steel Institute showed the capacity utilization rate stood at 79.8% as of September 7. This is above where it stood at the same point in 2023, at 74.4%. Meanwhile, total domestic steel output during the week reached 1,772,000 tons compared to 1,691,000 tons last year.

Subscribe to MetalMiner’s weekly newsletter and make the most in sideways steel markets with weekly market insights and macroeconomics.

Cliffs Indefinitely Idles Blast Furnace

Most of the upcoming capacity cuts will prove temporary and be concentrated during the month of October. However, the market’s “tepid at best” response to those outages seemed to spook at least one mill into taking a more drastic approach.

In a surprise move, reports indicate Cliffs will turn off its C-6 blast furnace at Ohio’s Cleveland Works facility indefinitely. That said, the plant was already reportedly operating below capacity, so the overall impact on steel prices may prove modest.

Meanwhile, HRC futures, which serve as a leading indicator for HRC steel prices and are often the first to react to such news, remain decidedly sideways. Futures showed no meaningful upside momentum in the days following reports of the idled blast furnace, which will offer little comfort to mills hoping to invert the current price trend.

After edging slightly longer in the weeks following outage reports, mill lead times for HRC, CRC and HDG began to shorten by mid-September. This suggests that it may take more than one furnace going offline to shore up the supply glut accumulated after months of high output levels.

Expert steel sourcing strategies, right at your fingertips. The Monthly Metals Outlook report is your guide to sourcing success no matter what direction steel prices take. Get a free sample copy and then secure a subscription.

Vietnam Dumping Accusations Continue Amid Flood of Steel

Over recent weeks, the HDG market uniquely underperformed its sister markets, HRC and CRC. The correlation between the three remains strong. However, HDG prices remained in search of a new bottom as of mid-September, while HRC and CRC prices consolidated with a slight upside bias.

Meanwhile, the HDG market remains most vulnerable to transhipping efforts and saw the largest influx of imports from leading dumping grounds like Vietnam. Vietnam has faced longstanding accusations of importing cheap, heavily subsidized steel from China, only to process it into materials like HDG to circumvent tariffs on Chinese steel. Census data showed that imports from Vietnam continued at an atypically high rate as of August.

Protectionist Efforts Target HDG in Response

In August, Vietnam remained the second-largest importer of HDG to the U.S. For reference, imports from Canada totaled 83,577.5 metric tons during the month. Figures for Vietnam stood at 62,755.6 metric tons, while Mexico, the third largest source, shipped 20,327.4.

This explains why Vietnam was among the list of countries named in a recent trade petition filed by several U.S. mills and the United Steelworkers Union regarding coated flat rolled steel, better known as hot-dipped galvanized (HDG). While it remains to be seen what will come of the petition, forthcoming trade barriers against places like Vietnam appear more likely than not. If that happens, it will offer support to U.S. prices, potentially making it easier for mills to control the domestic price trend going forward.

Biggest Moves for Raw Material and Steel Prices

Visually see where 2025 steel prices are projected to land with MetalMiner Insights’ comprehensive short and long-term price forecasts.

- U.S. shredded steel scrap prices saw the largest increase of the overall index, with a mere 0.26% increase to $379 per short ton as of September 1.

- Meanwhile, Chinese coking coal prices traded down, with a 3.73% decline to $194 per metric ton.

- Chinese HRC prices remained bearish, falling 5.29% to $431 per short ton.

- Korean pig iron prices dropped 5.76% to $535 per metric ton.

- Chinese steel slab prices experienced the largest decline, sliding 8.47% to $500 per metric ton.