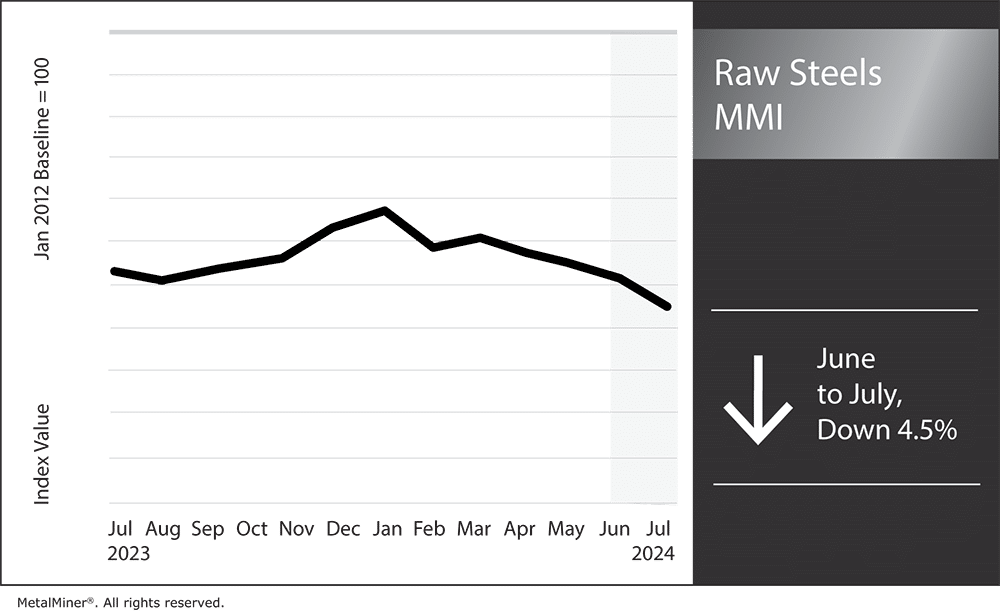

The Raw Steels Monthly Metals Index (MMI) fell 4.5% from June to July.

Although the pace of declines appeared to slow from the previous month, U.S. flat rolled steel prices remained bearish during June. HRC prices fell nearly 7%, followed by an almost 5% decline in HDG prices and a modest 2% drop in CRC prices. Meanwhile, the plate price downtrend picked up speed, with prices falling over 6%. Weak conditions and “ongoing competition” also saw Nucor cut its plate prices by $125/st, which brings them down to an estimated $1,075/st.

Make informed metal purchases. Subscribe to MetalMiner weekly newsletter with important macroeconomic information to negotiate with power.

U.S. Takes Action on Mexican Steel Imports

Following complaints from the U.S. steel industry, the White House recently stepped up protectionist measures on imported steel. To combat the threat of Chinese overcapacity, the U.S. will impose a 25% duty on steel products imported from Mexico unless designations indicate they were “melted and poured” in either the U.S., Canada, or Mexico.

The move intends to block tariff circumvention from China, which has increasingly looked to other markets to dump materials and target investments. According to the Financial Times, during the first quarter of 2024, “at least 41 Chinese manufacturing and logistics projects were announced for Mexico, while at least 39 were scheduled for Vietnam.” This represents the highest number of projects since at least 2003. Thailand, Malaysia, Hungary and Egypt also secured record investments from China.

Meanwhile, direct exports from China to those countries increased substantially over recent years. Moreover, a rising trade surplus between Vietnam and the U.S. suggests that China has increasingly used such markets to reroute exports that eventually end up in the United States.

MetalMiner should-cost models give your organization levers to pull for more price transparency from service centers, producers, and part suppliers. Explore the models now.

Bullish Steel Price Impact: Around 13% of Mexican Steel Imports Subject to Duties

Mexico is the second leading exporter of flat rolled steel products to the U.S., averaging around 10% of total imports since 2018. By comparison, Canada remains the leading supplier, accounting for nearly 42% of total imports. During the 2018 to 2024 period, Mexican imports peaked at over 18%, which occurred during the summer of 2022. However, during the first five months of 2024, the country averaged just over 9%.

U.S. officials estimate roughly 13% of total steel imports from Mexico had been melted and poured outside North America. That portion would now be subject to duties under the latest agreement between the two countries.

The new duties will likely have a modestly bullish impact on domestic steel prices. For buyers, lower steel prices remain the primary benefit of Chinese product. China not only heavily subsidizes its steel sector, but continues to lean on the export market to maintain growth as its property sector continues to flounder.

Despite lackluster Chinese demand and flatlining steel prices, the country showed no signs of slowing steel output. According to data from WorldSteel, production rose to roughly 92.9 million metric tons in May. The Monthly Metals Outlook report covers steel production news and macroeconomic news like this on a monthly basis, providing valuable information and insights on how to save money on steel sourcing.. Check out a free sample copy and secure your subscription.

Mexico Differs From Vietnam Amid Dumping Concerns

Amid accusations of Chinese dumping efforts, import data showed a different picture for Mexico compared to countries like Vietnam. Indeed, flat rolled imports from Vietnam show a bias toward more processed forms of steel. Moreover, CRC and HDG imports far outpace HRC imports into the U.S. The high volume of HRC imports from China to Vietnam suggests that the latter country may be helping China circumvent tariffs by processing HRC into either CRC or HDG. The goal would be to potentially disguise the country of origin before the material hits the export market.

However, flat rolled steel imports from Mexico do not show the same disproportionate bias. Mexican HRC imports averaged around 18,900 metric tons per month since 2018. Meanwhile, CRC and HDG imports averaged roughly 15,900 metric tons and 17,700 metric tons, respectively.

That said, the bias started to shift toward HDG imports at the start of 2024. HDG from Mexico averaged roughly 35% of monthly flat rolled steel imports since 2018. That proportion rose to nearly 49% during the first five months of 2024. Volumes have also shown considerable fluctuation between the three forms of steel over the last six years.

Therefore, it’s difficult to determine if the recent trend echoes a similar phenomenon to what was seen in Vietnam. However, the recent tariffs suggest the U.S. remains vigilant in its ongoing trade war with China.

Biggest Moves for Raw Material and Steel Prices

Start saving on COGS. Explore MetalMiner’s full metal catalog and start getting steel price forecasts customized to your specific types and forms.

- LME primary three-month steel scrap prices saw the only increase of the overall index, rising a mere 0.13% to $390 per metric ton as of July 1.

- Meanwhile, Korean standard steel prices fell 3.86% to $196 per metric ton.

- U.S. shredded scrap prices fell 4.06% to $378 per short ton.

- Comex three month HRC futures fell 6.22% to $780 per short ton.

- Chinese coking coal prices dropped 9.51% to $215 per metric ton.