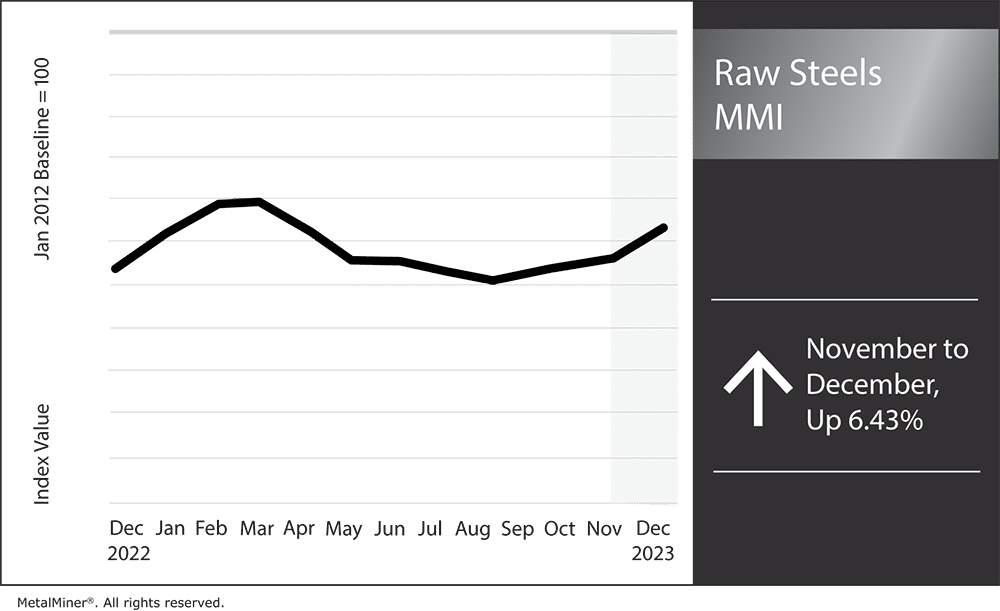

While the Raw Steels Monthly Metals Index (MMI) rose 6.43% from November to December, U.S. flat rolled steel prices remain decidedly bullish. By mid-December, hot rolled coil prices broke above the $1,000 per short ton mark for the first time since June. To date, HRC prices have risen almost 53% this year, outperforming all base metals and other forms of flat rolled steel (get weekly updates on steel market trends in MetalMiner’s weekly newsletter).

Steelmakers Dust Off Old Playbook with Year-End Steel Price Uptrend

For many, the uptrend seemed to come out of nowhere. When HRC prices found a bottom in late September, the manufacturing sector had not posted growth since October 2022, and the since-resolved UAW strikes stymied auto production. Despite this, steelmakers managed to invert the price trend. Now flat rolled steel prices appear poised to enter the new year decidedly bullish.

Irrespective of demand conditions, a year-end uptrend is actually typical of the flat rolled market. In fact, should HRC, CRC, and HDG prices fail to peak by January, it will be the seventh year in a decade where flat rolled prices enter the new year in a bull trend.

The last six of those year-end uptrends peaked an average of 23 weeks after the start of the year. Excluding the historic 2021 uptrend, which owed much of its vigor to the “bull-whip effect” and pandemic-related supply chain disruptions, the average falls to a still-sizable 18 weeks.

MetalMiner’s 2024 Annual Outlook – December update released this month. We provide 3 quarterly updates to this comprehensive steel price forecasting report because metal markets shift constantly and so should forecasting. See a sample copy.

Mills Hold Tight Grip on Steel Production Levels

The nearly three-month steel price uptrend did not happen by accident. The start of the UAW strikes triggered a sharp decline in the domestic raw steel capacity utilization rate. According to data from the American Iron and Steel Institute, the rate dropped to 73.8% in mid-October and stands at 74.6% today. Mills reportedly initiated planned maintenance outages early to mitigate the decline in demand from the auto sector and they continue to maintain capacity discipline.

Data from the Federal Reserve showed auto assemblies began to rebound in November following a sharp drop in October. However, they nonetheless stood at their lowest level since March. The auto sector appeared uniquely reQark, as they currently stand at $1,048/st. That said, Q1 typically sees a boost in ordering activity, which could support prices should it materialize.

Before the pandemic, steel prices breaching the $1,000/st level was seemingly unheard of. However, much has changed within the market in recent years. From tariffs to consolidation among mills, steelmakers continue to find leverage that lets them secure more control over price direction. The fate of the current uptrend will likely depend upon how well demand holds up amid 22-year-high interest rates, as well as how disciplined steelmakers are at keeping supply sufficiently tight.

MetalMiner Insights covers price points, correlation charts and price forecasting for a full suite of steel gauges and forms. See our full metals catalog.

Biggest Moves for Raw Material and Steel Prices

- U.S. Midwest future prices saw the largest increase of the index for the second consecutive month, with a 10.7% rise to $1,076 per short ton as of December 1.

- Chinese coking coal prices rose 9.39% to $368 per metric ton.

- Chinese steel slab prices saw a 6.25% increase to $607 per metric ton.

- Chinese steel billet prices rose 5.84% to $586 per metric ton.

- Meanwhile, Korean standard steel prices saw the only decrease of the index, declining 15.91% to $232 per metric ton.