The Raw Steels Monthly Metals Index (MMI) moved sideways amid bearish steel prices, with a modest 1.75% increase from February to March.

U.S. flat rolled steel prices stayed bearish over the past few weeks. Meanwhile, HRC prices remained 22% beneath their peak at the close of 2023 as they search for a new bottom. However, plate prices continued to diverge from flat rolled steel, remaining sideways. Prices appear to have found enough support to see at least a short-term pause in their slight downside bias since peaking in April 2022. However, this support has also proven too minimal for prices to form an uptrend.

Cliffs, Nucor, ArcelorMittal Raise Flat Rolled Prices

As flat rolled markets began to form a new down cycle in recent months, U.S. steelmakers appeared eager to halt declines. By early March, both Nucor and Cleveland-Cliffs announced price hikes for HRC, CRC, and HDG steel prices. Nucor brought its minimum HRC up to $825/st, while Cliffs topped the market, bringing its minimum HRC price up to $840/st. The following day, ArcelorMittal announced its own price increase, bringing its minimum HRC price in line with Nucor at $825/st.

By the end of the first week of March, the average HRC price stood at $837/st, not far from the newly-announced minimums. However, prices have yet to show any slowdown in their bearish momentum, leaving markets uncertain as to whether or not producers can shift the current trend.

Empower your steel purchasing with the latest market analysis and strategic advice during times of fluctuating demand. Sign up for MetalMiner’s free weekly newsletter here.

Steel Market Shifts from Backwardation to Contango

The price hikes from Cliffs and Nucor came on the heels of a narrowing delta between future and spot prices. HRC prices opened the year in backwardation, with futures falling below spot. This was a clear indication that market participants expected lower prices. By January 11, spot prices carried a $244/st premium, the widest delta since June and well above the historical average premium of $22/st.

However, the ensuing weeks saw that premium narrow as futures prices flattened and spot prices continued to trend lower. Futures then began to rise by early March. This caused the market to flip into contango on March 8, one day after the announced price hikes.

Rising futures prices do not necessarily guarantee that spot prices will follow. However, the two price points boast a longstanding, almost 94% correlation. Beyond that, future price direction typically shifts before any inversion of the spot price trend, making futures a reliable leading indicator of steel price direction.

Shorter Mill Lead Times Drag Steel Prices

Anecdotal reports appear to support a shift in market conditions as mills continue to note an increase in large-volume order inquiries. While the value of those inquiries fell beneath current HRC market pricing, their size would have the potential to shore up the supply glut that has continued to drag steel prices lower throughout Q1.

However, mill lead times showed no evidence of lengthening by the end of February, which suggests those inquiries had not yet translated to actual buying activity. While they remained above their historical average, increasingly shorter mill lead times suggest a still-oversupplied market.

Planned maintenance outages at a number of U.S. mills could also help tighten supply in the coming weeks. However, absent a rise in orders, they appear unlikely to shift market conditions on their own. That said, the steel price uptrend witnessed throughout Q4 2023 was underpinned by an increase in orders as well as suppressed production levels on the part of mills to maintain a tight supply balance.

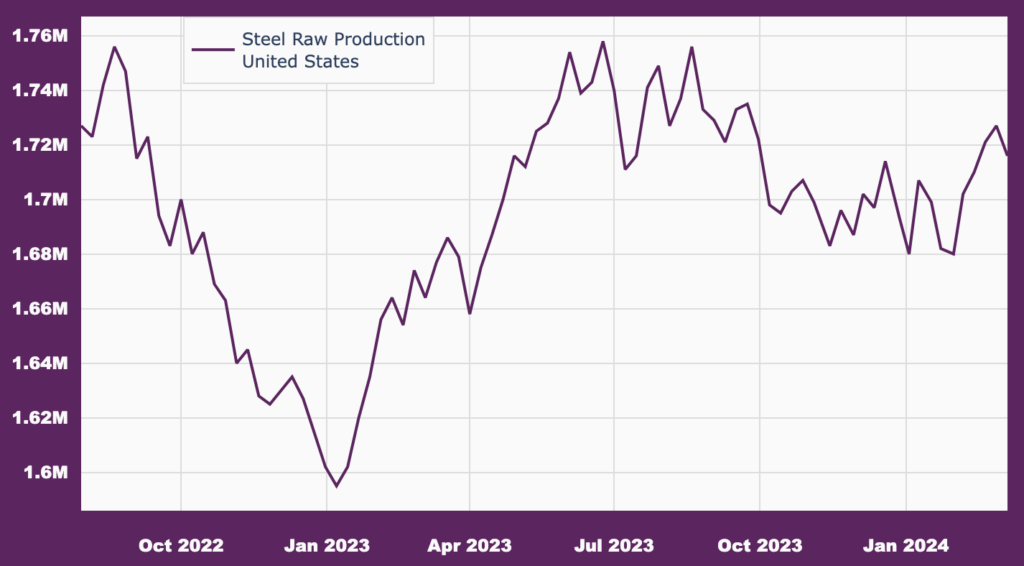

Data from the American Iron and Steel Institute showed that domestic raw steel output remains robust, but that it found at least a temporary peak near the end of February.

Are you on the hook to communicate the company’s steel performance to the executive team? See what should be in that report.

Further Repercussions

If mills cannot stymie the ongoing downtrend in steel prices, they may begin to institute further production cuts despite increasing output throughout February. However, until steel prices show evidence of flattening, the trend will remain down for now. The coming weeks will prove telling as to whether steelmakers can regain control over the trend.

Biggest Moves for Raw Material and Steel Prices

Expert steel sourcing strategies, right at your fingertips. The Monthly Metals Outlook report is your guide to steel sourcing success. Check out a free sample copy.

- Although they started to rebound in early March, U.S. Midwest futures prices fell 0.61% throughout February, reaching $820 per short ton as of March 1.

- Chinese steel slab prices edged lower, with a modest 0.85% decline to $616 per metric ton.

- Chinese coking coal prices also moved sideways, sliding 1.12% to $247 per metric ton.

- LME primary three month steel scrap prices appeared bearish, with a 7.47% drop to $390 per metric ton.

- Chinese HRC prices saw the largest decline of the overall index, with a 10.47% drop to $523 per short ton.