Vietnam finds itself wooed by two large world powers. However, this time, it is not over any geopolitical consideration, but for a resource that the modern world covets: rare earths.

China and the U.S. are locked in a race to court a country that boasts the world’s second-largest rare earth deposits. However, much of Vietnam’s rare earths remain untapped thanks to China’s near-monopoly over global markets. With the West, led by the U.S., no longer wanting to rely on China alone for rare earths supply and processing, Vietnam continues to look like a suitable alternative.

Receive weekly updates and market intelligence on rare earths, helping your company adapt and thrive in the face of changing demand dynamics. Opt into MetalMiner’s free weekly newsletter.

The United States’ Pursuit of Vietnamese Rare Earths

Several recent events serve to underline the Western world’s renewed interest in this Southeast Asia nation. About two months ago, U.S. President Joe Biden visited Hanoi to upgrade bilateral relations. This is ironic, considering that both countries were at war about six decades ago. During his visit, the U.S. President inked an agreement aimed at giving Vietnam a leg up to attract investors for its rare earth deposits.

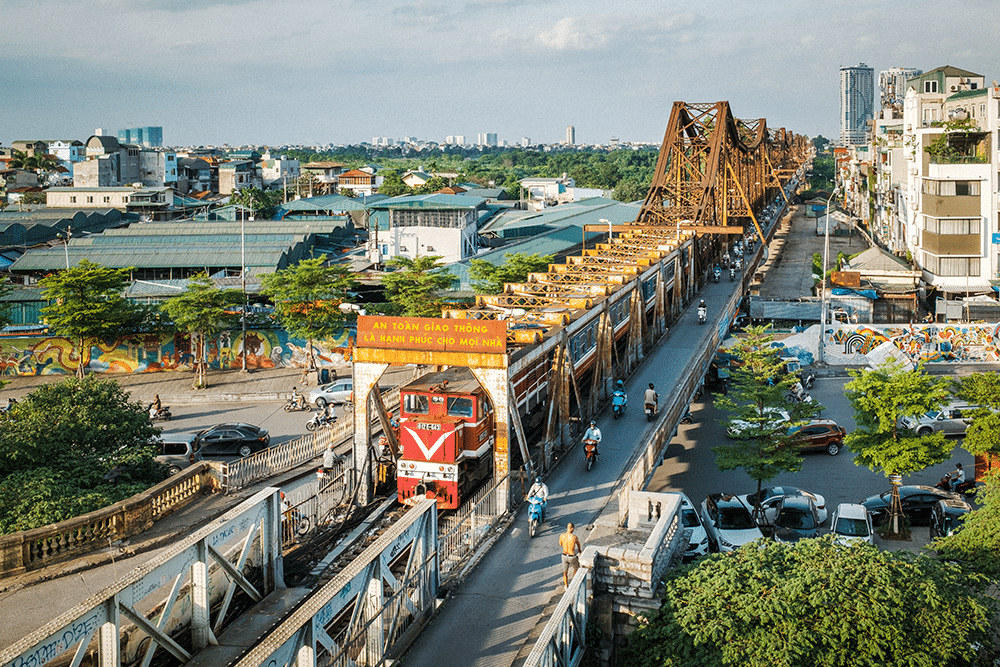

In a bid to keep out the competition, China has also made moves with regard to Vietnam’s extensive deposits of rare earths. Much of these deposits are in North Vietnam, and if all goes well between these two nations, there will be an upgrade of Vietnam’s rail network. This would include a rail line from Kunming in southern China to Vietnam’s port city of Haiphong.

According to media reports, top-ranking officials of Vietnam and China are said to be in talks for a major upgrade of undeveloped rail links. In a recent statement, Vietnam Prime Minister Pham Minh China advocated for enhancing the railway connecting Kunming to Haiphong. The positive outcomes of a recent high-speed rail connection between Kunming and Vientiane could be the reason for this. In fact, that line’s success has also spurred Thailand to expedite the progress on its long-pending high-speed rail project. This line would like Vientiane, cross the Mekong to Nong Khai, and extend to Bangkok.

China’s Bid to Woo Vietnam

A 531-mile-long railway connects the two communist countries of China and Vietnam. However, the current line, built by the French in the early ‘90s, is old and in disrepair.

With much at stake, including Vietnam’s stock of rare earths, China seems to be pulling out all stops to keep Vietnam under its circle of influence. Officials have now indicated that preparations are underway for an upcoming visit to Hanoi by Chinese President Xi Jinping. This visit would further underscore Vietnam’s growing strategic significance in global supply chains, especially with major powers like the U.S. actively seeking regional influence.

A bolstered railway network will also give a fillip to exports from Vietnam to China, increase tourism from China to North Vietnam, and help integrate the manufacturing capacities of the two nations. The fact that the line will run through North Vietnam, a region that’s particularly rich in rare earth deposits, is hardly a coincidence. China remains the #1 refiner of rare earths worldwide.

Moreover, Vietnam now seems to want to go full steam in exploiting it’s extensive rare earth resources. As a first step, it plans to auction some portions of its Dong Pao mine, potentially inviting bids by the end of this month. Meanwhile, production may start as soon as 2024, with Australia’s Blackstone Minerals Ltd said to be quite keen to acquire at least one of these concessions.

MetalMiner covers price points, correlation charts and price forecasting for a full suite of industrial and precious metals. See our full metals catalog.

All Three Countries Face Hurdles

Some circles see this as a move by Vietnam to counter China’s supremacy in this sector. The West is eager to break China’s monopoly and is cozying up to Vietnam to corner a bulk of its rare earth reserves. This will allow them to process ores into metals necessary for magnets in electric vehicles, military equipment, etc. But China seems to have a different take on this. Recently, a report in the China Daily quoted some experts as claiming the U.S. faced “major challenges” in its efforts to diminish China’s dominant position as the primary supplier of rare earths.

The report pointed to the many hurdles Vietnam faces in trying to achieve independent extraction and processing of rare earths. Indeed, China still controls key rare earth processing technologies. Meanwhile, the U.S., which remains a major rare earth importer, does not have local processing plants. Therefore, it must export rare earth ores to China for processing. According to this report, what remains uncertain is whether U.S. companies are willing to invest substantially in developing mines in Vietnam, given the opacity of the country’s rare earth sector.

Whether Vietnam will eventually produce between 5 and 15 % of China’s projected output by the end of this decade remains to be seen.

Make informed rare earth sourcing decisions! Access MetalMiner’s free Monthly Metals Index report to understand economic metal price drivers through metal price charts and expert analysis.