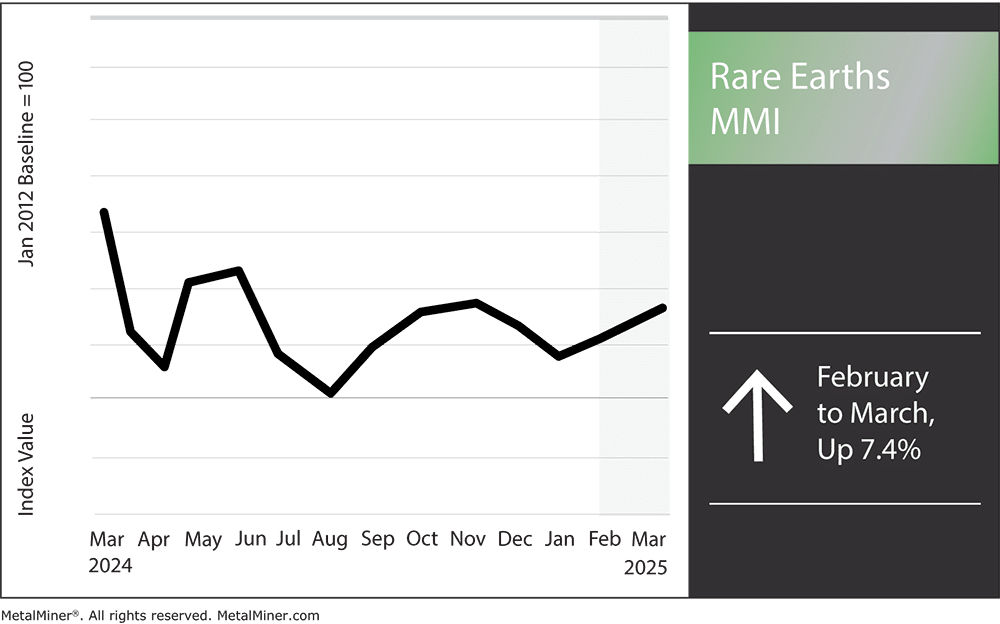

The Rare Earths MMI (Monthly Metals Index) experienced a spike in price action month-over-month, rising by 7.4%. The recent tariffs on China, the top global supplier of rare earths, caused a short-term upward trend for many of the elements in the index. Meanwhile, Ukraine’s mineral reserves have attracted considerable international attention, particularly from President Trump.

Ukraine’s Rare Earth Potential and U.S. Interest

Ukraine possesses abundant mineral resources, including reserves of other valuable resources like lithium, titanium and graphite. These materials play a crucial role in the production of electronics, making Ukraine a potentially significant contributor to the global supply chain.

In February of 2025, a proposed agreement sought to establish a “Reconstruction Investment Fund” through which Ukraine would dedicate 50% of its government-generated mineral revenues to the U.S. in return for support in areas like post-war recovery and economic stability. Proponents designed the fund to strengthen Ukraine’s financial resilience while granting the U.S. access to critical mineral resources.

Don’t lose revenue from tariff induced price increases. Learn how to navigate volatility from tariffs by downloading MetalMiner’s free Comprehensive Steel & Aluminum Tariff Guide.

Oval Office Argument Between President Trump and President Zelensky

Efforts to finalize the minerals rare earths agreement continue to face obstacles. A meeting between U.S. President Donald Trump, Ukrainian President Volodymyr Zelenskyy, and Vice President JD Vance on February 28, 2025, was initially expected to cement the deal. However, it ended abruptly after a heated exchange between the three parties.

The dispute led to Zelenskyy departing Washington, D.C. earlier than planned and without signing the critical minerals agreement. The primary points of contention centered around security guarantees and the distribution of mineral revenues. Despite these challenges, Zelenskyy has states that Ukraine is still willing to move forward with the deal, emphasizing its crucial role in the country’s economic recovery and national security.

Navigating Geopolitical Complexities

The intersection of geopolitics and resource acquisition presents both opportunities and challenges for U.S. buyers. The potential U.S.-Ukraine minerals agreement exemplifies the complexity involved. While access to Ukraine’s mineral wealth could enhance the U.S. supply chain for rare earth elements, the ongoing conflict with Russia and internal political dynamics continue to add layers to the onion of uncertainty.

Get valuable market trends, price alerts and commodity news, supporting your business in mitigating the impact of increasing metal prices, including rare earths. Register for MetalMiner’s free weekly newsletter.

Semiconductor Complications Continue

Meanwhile, the semiconductor industry is undergoing a transformation as trade disputes and shifting U.S. policies reshape global supply chains. Recent actions, such as U.S. tariffs on Chinese imports and China’s restrictions on key minerals like gallium and germanium, have impacted microchip production and raw material availability.

The Trump administration recently escalated tariffs on Chinese imports, which were initially set at 10% and later increased to 20%. More significantly, a 50% tariff on Chinese semiconductors took effect on January 1, 2025.

Industry Reactions

Reactions from industry leaders remain mixed. GlobalFoundries CEO Thomas Caulfield believes the tariffs could strengthen U.S. chip-makers by driving demand for domestically produced semiconductors.

However, businesses reliant on Chinese manufacturing continue to face uncertainty. For instance, Morgan Advanced Materials, a UK-based semiconductor parts supplier with operations across the U.S., Mexico, Canada and China, expects revenue losses due to shifting demand caused by the tariffs.

Rare Earths MMI: Noteworthy Price Shifts

MetalMiner has the solution you need to mitigate price risk from tariff induced price increases. Model the impact of metal price forecasts on your part spend with Insights SV. Learn more.

- Cerium oxide prices rose by 15.5% to $1,299.24 per metric ton.

- Yttria also experience a rise, with prices increasing by 9.92% to $6,314.52.

- Terbium metal prices increased by 9.03% to $1,080.53 per kilogram.

- Lastly, neodymium prices rose by 7.04% to $75,231.26 per metric ton.