Month-on-month, rare earths prices exhibited sharp downward movement. While weaker downstream demand could potentially prove one culprit in the dropping prices, another potential factor is an increase in global rare earth production outside of China. If true, China could find itself bumped down the totem pole in terms of rare earth magnets dominance. Meanwhile, China’s economy continues to waver due to the weakened property sector, which could also potentially impact prices. For now, China continues to hold its spot as the top global rare earths producer.

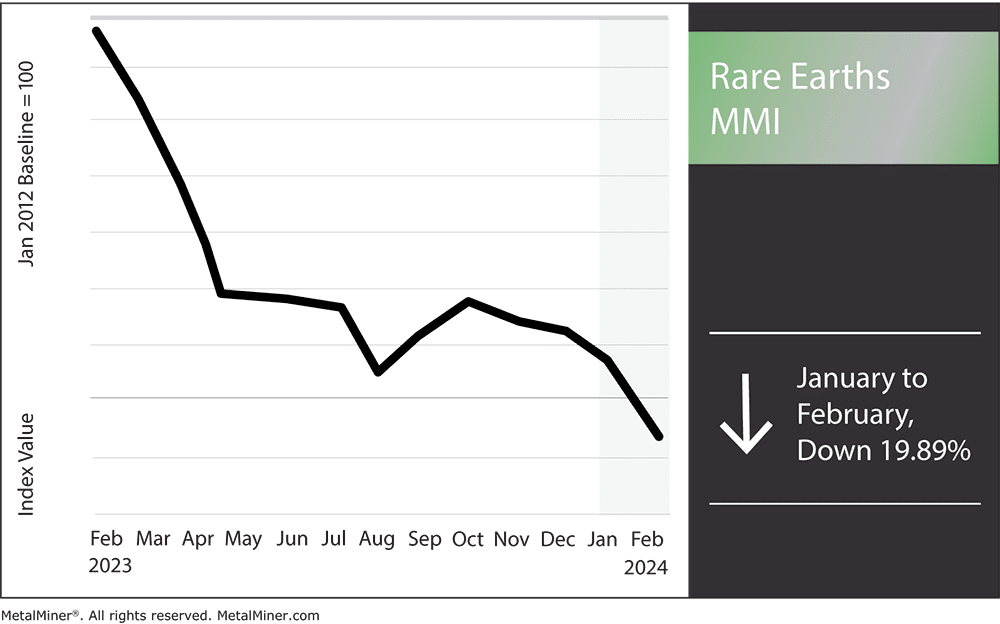

With all of these factors at play, the Rare Earths MMI (Monthly Metals Index) dipped by a total of 19.89%.

Don’t let volatile rare earth markets catch you off guard. Sign up for MetalMiner’s free weekly newsletter and gain access to timely insights on the latest metal market trends and pricing.

Massive Rare Earths Reserve Discovered in Wyoming

A new rare earths find in Wyoming could significantly impact the global rare earth market by lessening the United States’ reliance on China for vital minerals. Several businesses, including American Rare Earths Inc. and Ramaco Resources, recently discovered a large cache of rare earth deposits in the western state. Moreover, current estimates place the reserves’ potential value in the billions. The find is especially noteworthy as rare earth elements are necessary for a number of cutting-edge technologies, including those related to electric cars, wind turbines, and defense.

The United States currently imports a large portion of rare earth magnets and minerals from China. If this recent find proves as bountiful as estimates predict, the U.S. may be able to lessen its reliance on foreign suppliers—especially China while diversifying its rare earth supply chain. In fact, the new deposit could support the country’s energy transition and affect U.S. national security by supporting the domestic manufacturing of technologies that rely on rare earth elements.

Due in part to the Wyoming discovery, it now seems likely that the United States will become a major participant in the international rare earth market. With more research and development, these deposits may help the United States overcome China’s rare earths hegemony by offering a homegrown supply of these vital minerals. It would also lessen the U.S.’s susceptibility to supply chain disruptions and geopolitical unrest.

Maximize your budget and minimize spending risk with MetalMiner’s sourcing/buying solutions. View MetalMiner’s track record on price forecasting.

China’s Rare Earth Magnets Restrictions in Full Swing

China recently placed harsh restrictions on the export of technology for rare earth magnets and the extraction and separation of rare earth minerals. It is a move that could significantly affect the worldwide supply chains and pricing of rare earths. After all, the 17 metals classified as rare earth elements remain essential to many sectors of the global economy, including electronics, clean energy, and defense technology.

China’s restriction on rare earths and technology to manufacture rare earth magnets is a calculated move to maintain its hegemony in the rare earth market, as the nation presently processes around 90% of the rare earths produced worldwide.

2024 Price Predictions

Meanwhile, experts anticipate that this will cause global rare earths prices to experience ongoing uncertainty and possible price volatility throughout 2024. Furthermore, stock prices of firms processing rare earths surged in response to China’s decision. To many, the ban further highlights the necessity of diversifying supply chains for rare earth elements and enhancing local processing capacities abroad. Meanwhile, the United States and its allies continue to work to increase local processing capacity and decrease dependency on Chinese shipments of rare earth elements.

Rare Earths MMI: Notable Price Shifts

Opt into to MetalMiner’s free Monthly Metals Index report and leverage it as a valuable resource for tracking and predicting rare earths price trends.

- Neodymium by 9.33%, which brought prices to $69,284.79 per metric ton.

- Dysprosium oxide fell the most, dropping by 26.88% month-over-month. Prices at month’s start sat at $272.35 per kilogram.

- Terbium metal also fell significantly. Month-on-month, prices dropped 20.81% to $1029.42 per metric ton.

- Lastly, praseodymium oxide dropped by 7.68%, which brought prices to $60,420.49 per metric ton.