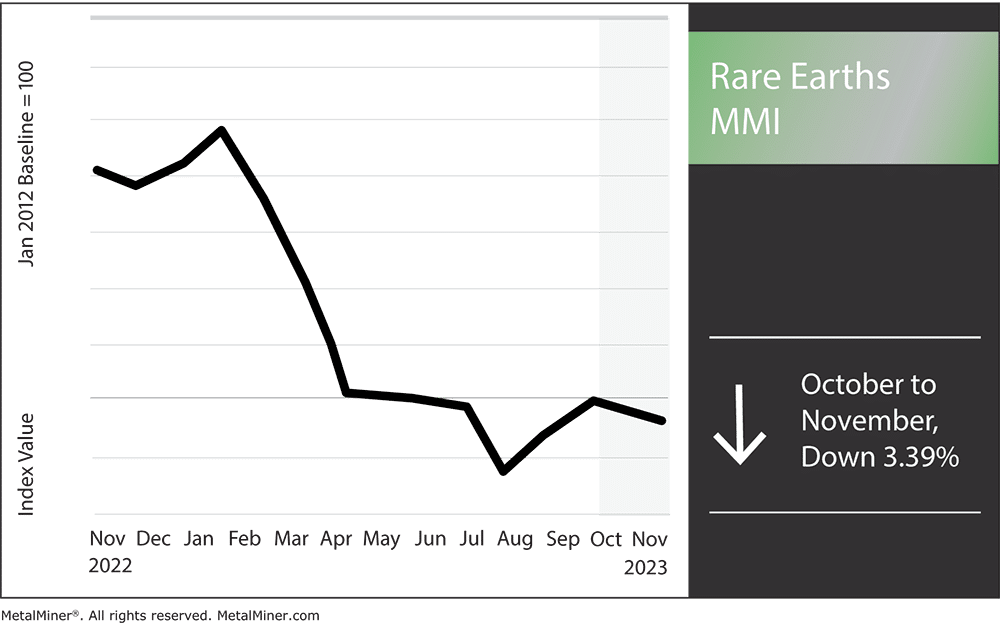

The Rare Earths MMI (Monthly Metals Index) recently began to cool down following two months of bullish momentum. Altogether, the index dropped by about 3.39%. Many components of the index traded sideways, while some others, like praseodymium neodymium oxide, declined. That said, the index still holds the potential to move back up in the remainder of Q4. Meanwhile, the Myanmar mining ban could still cause rare earth buyers to stockpile as other nations, such as Vietnam, plan to step up their rare earth game.

While China, the world’s #1 rare earth producer, saw its economy strengthen over the past couple of months, rare earth prices didn’t continue their heavy upward momentum month-on-month. Still, many factors remain at play in the global rare earths market outside of China, which continues to impact global trade and price dynamics.

Subscribe to MetalMiner’s free MMI report to get monthly rare earth price trends.

Rare Earths Industry Officials Arrested in Vietnam

Vietnam contains the second-largest rare earth mineral reserves in the world after China. To harness the value of those reserves, the nation intends to significantly expand its rare earth sector. This includes plans to increase the yearly production of rare earth oxides from the 4,300 tons seen in 2022 to 60,000 tons by the end of this decade. However, these initiatives recently found themselves derailed after Vietnamese authorities arrested six individuals on suspicion of breaking mining laws. Among them is the chairman of a business leading the charge to develop the rare earth industry in Vietnam. According to some analysts, this one corporation holds the potential to rival China’s lead in the field.

Luu Anh Tuan, the head of Vietnam Rare Earth JSC (VTRE), was taken into custody in late October. The chairman stands accused of fabricating VAT receipts while dealing rare earths with Thai Duong Group. Currently, the corporation runs a mine in the northern Vietnamese province of Yen Bai. Inquiry calls to Tuan on Friday went unanswered, and VTRE’s Hanoi headquarters remained closed for days.

Doan Van Huan, the chairman of Thai Duong Group, was also detained on suspicion of profiting illicitly from the sale of ore taken from the Yen Bai mine his business ran. He’s accused of potentially earning up 632 billion dong ($25.80 million) in illegal funds. Investigators discovered the six men engaging in the illicit mining of iron and rare earth ores in the northern Vietnamese province of Yen Bai. Meanwhile, their activities mainly centered in Yen Phu Commune and Van Yen Districts. Police confiscated approximately 13,700 tons of rare earths and more than 1,400 tons of iron ores at 21 excavation and trading sites in Yen Bai.Bai.

Knowledge is key to navigating rare earth market fluctuations. Don’t miss out on MetalMiner’s expert analysis and up-to-date information. Subscribe to MetalMiner’s free weekly newsletter.

Arrests Throw a Wrench into Vietnamese Rare Earth Mining

By overseeing the illicit extraction of 11,000 tons of rare earth and 152,000 tons of iron ores, Huan and Chinh amassed VND 632 billion (US$25.77 million) in illegal funds. Allegations say the pair conspired with the other two businesses to falsify VAT paperwork related to the rare earth trade, ultimately concealing more than VND 28 billion from the books. Estimates say the coordinated tax evasion cost the Vietnamese government more than VND7.5 billion.

Meanwhile, the government of Vietnam intends to auction off new mining concessions for rare earths later this year. However, officials from at least one company scheduled to bid, VTRE, were among those detained. As a result, the arrests have raised questions about Vietnam’s capacity to challenge China’s global hegemony in the rare earth sector.

Rare Earths MMI: Biggest Price Moves

- Chinese neodymium traded sideways, only increasing by 1%. Prices finally settled at $88,179.80 per metric ton.

- Praseodymium oxide also trended sideways, dropping by 1.71%. This brought prices to $71,481.34 per metric ton.

- Rare earths carbonate followed suit and moved sideways, falling by just 2%. After the drop, prices sat at $5,665.97 per metric ton.

- Chinese terbium oxide moved the most out of all of the other components of the index. Ultimately, prices decreased by 6.09% to $1,101.05 per kilogram.

Don’t gamble with your rare earths purchasing budget. Trust MetalMiner’s track record of forecasting metal price and start saving.