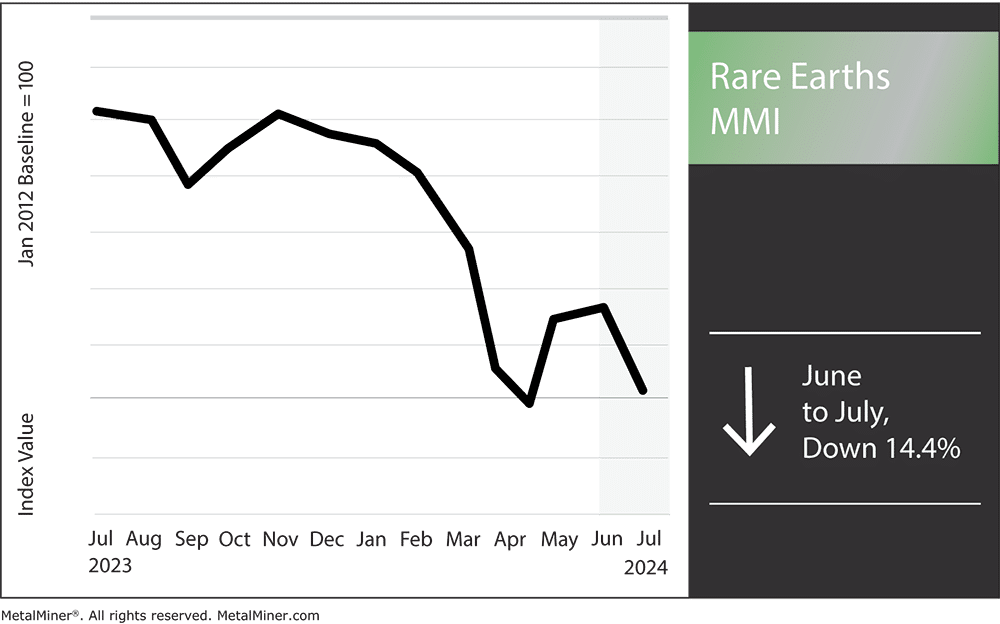

The Rare Earths MMI (Monthly Metals Index) took a steep dive in price action after a month of relative stability, dropping 14.4%. Terbium (both metal and oxide) yanked the index down tremendously, falling more than 16%. However, the rare earths index could yet experience some rebound from now until October, when China’s recent set of brand new rare earth restrictions are set to take effect (stay posted on shifts in the rare earths market due to China’s new export restrictions with MetalMiner’s weekly newsletter).

What Do China’s Revised Rare Earths Restrictions Mean for U.S. Companies?

China recently unveiled a fresh set of restrictions designed to further tighten control over its exports of rare earth elements. The new rules adhere to earlier prohibitions regarding the export of germanium and gallium, which are necessary for the production of microchips.

The implications for the U.S. could prove substantial, as the country is one of the primary users of rare earth elements for high-tech and defense sectors. These new regulations likely mean more supply chain interruptions and expenses. Since China’s domination of the rare earth market creates a bottleneck, many experts expect the new rules to raise prices internationally.

As a result, American businesses will likely need to step up their efforts to boost home production and diversify their supply network of rare earths. The circumstance also emphasizes the urgency of developing other supply networks, recycling technology, and material alternatives.

How Can Rare Earth Sourcing Companies Lighten the Blow?

U.S. businesses should look for suppliers outside of China to deal with this issue. For example, building connections with producers of rare earth elements in nations such as Canada and Australia can help reduce the dangers brought on by China’s new policies. Generally, diversification helps to lessen reliance on a single supplier and guarantees supply continuity.

Additionally, ramping up domestic manufacturing of rare earths continues to gain traction. Therefore, businesses should work with American mining companies to finance the construction of regional rare earth processing and mining facilities. This action can help strengthen the supply chain against interruptions from abroad while also aligning with national interests.

MetalMiner can unlock customizable metal price forecasting for your unique metals, forms, and gauges. View our full metals catalog.

Other Solutions

One sustainable option is recycling rare earths from items that are nearing the end of their lifespan. Investing in cutting-edge recycling methods to recover rare earth elements from discarded electronics and industrial equipment can go a long way toward reducing reliance on imported resources.j

Finding and creating substitutes for rare earth elements can also lead to long-term fixes. Businesses should engage in R&D to find and market alternative materials that can replace rare earths in a variety of applications, thus guaranteeing that technological developments continue uninterrupted.

Enjoying this article? MetalMiner’s monthly MMI report gives you price updates, market trends and industry insight for rare earths and 9 other metal industries. Sign up for free.

Lynas Rare Earths Continues to Battle Chinese Rare Earth Dominance

As the world’s largest producer of rare earths outside of China, Lynas continues to boldly challenge China’s long-standing dominance in this crucial market, taking a strategic approach to leverage Australia’s rich deposits of rare earth elements. By ramping up production and investing heavily in new technologies, Lynas aims to secure a significant global market share.

Among Lynas’s more creative actions was constructing a cutting-edge processing facility in Malaysia. With the help of this facility, Lynas can process rare earths outside of China’s sphere of influence, giving its global clients a more reliable and secure supply chain. Furthermore, Lynas continues to increase its research and development efforts to provide more effective and eco-friendly extraction techniques, establishing a new industry benchmark.

The effects of Lynas’ work could prove significant. Through supply chain diversification, Lynas is lowering the world’s dependency on Chinese rare earths. This change frees nations from geopolitical restrictions, allowing them to pursue their technical achievements while also improving supply chain security. With each step of its expansion, Lynas is challenging China’s hegemony and establishing Australia as a major participant in the global rare earth market.

Rare Earths Prices: Noteworthy Shifts

Join us tomorrow in our July workshop “Secrets to Embedding Deep Price Intelligence” to learn how granular metal price data can save your company large sums of money on metal sourcing.

- Neodymium dropped by 6.15%, which left prices at $61,269.94 per metric ton.

- Dysprosium oxide also dropped. In total, prices fell 8.16% to $252.67 per kilogram.

- Yttria traded flat, remaining at $5941.03 per metric ton.

- Finally, terbium metal had the most significant price drop out of all the components on the index, dropping by 16.94% to $930.62 per kilogram.